Best Individual Health Insurance Plans

Navigating the complex world of health insurance can be daunting, especially when it comes to finding the best plan for your individual needs. With countless options available, it's crucial to make an informed decision to ensure you receive the coverage you deserve. In this comprehensive guide, we'll delve into the intricacies of individual health insurance plans, exploring key factors, comparing popular options, and providing expert insights to help you make the right choice for your healthcare.

Understanding Individual Health Insurance

Individual health insurance plans are tailored specifically for individuals and their families, offering a range of benefits and coverage options. Unlike group health insurance provided by employers, these plans allow you to customize your coverage based on your unique healthcare requirements. Understanding the different types of individual plans is essential to make an informed decision.

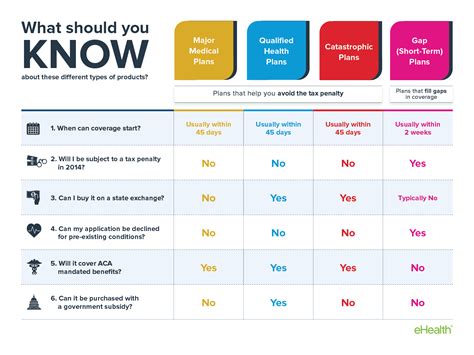

Types of Individual Health Insurance Plans

The landscape of individual health insurance is diverse, with several plan types to choose from. Here’s a breakdown of the most common options:

- Health Maintenance Organization (HMO): HMOs are known for their cost-effectiveness and focus on preventative care. They typically require you to select a primary care physician (PCP) who coordinates your healthcare needs. HMO plans often have lower premiums but may limit your choice of healthcare providers.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility by allowing you to choose from a network of healthcare providers without needing a referral. While PPOs may have higher premiums, they provide greater freedom in selecting doctors and specialists.

- Exclusive Provider Organization (EPO): EPO plans combine elements of both HMOs and PPOs. You have a designated network of providers to choose from, but you won’t need a referral to see specialists. EPOs strike a balance between cost and flexibility.

- Point-of-Service (POS) Plans: POS plans offer a blend of HMO and PPO features. You can choose a primary care physician and receive care within a network, but you also have the option to seek care outside the network for an additional cost.

- High-Deductible Health Plans (HDHP): HDHPs are paired with Health Savings Accounts (HSAs) to offer tax advantages. These plans have higher deductibles, but once you meet the deductible, they provide comprehensive coverage. HDHPs are a popular choice for those who prioritize control over their healthcare expenses.

Each type of plan has its own advantages and considerations. Your choice will depend on factors such as your healthcare needs, preferred level of flexibility, and budget.

Comparing Top Individual Health Insurance Plans

To help you make an informed decision, let’s compare some of the leading individual health insurance plans available in the market. We’ll delve into their key features, coverage options, and unique benefits.

Plan A: Comprehensive Coverage

Plan A is a popular choice for individuals seeking extensive coverage. It offers a wide range of benefits, including:

- Comprehensive medical coverage with low copays and deductibles.

- Extensive network of providers, ensuring easy access to healthcare.

- Specialist referrals are not required, providing flexibility in choosing doctors.

- Vision and dental coverage are included as standard benefits.

- Mental health services are covered, promoting holistic well-being.

Plan A is ideal for individuals with diverse healthcare needs who prioritize convenience and peace of mind. However, its comprehensive coverage comes at a higher premium, making it a more expensive option.

Plan B: Affordable Essentials

Plan B focuses on providing essential coverage at an affordable price point. Key features include:

- Lower premiums and deductibles compared to other plans.

- A basic network of providers for primary and specialty care.

- Limited coverage for prescription drugs, but with the option to add a prescription drug plan.

- Wellness programs and preventative care services are included.

- Telehealth services are available for convenient virtual consultations.

Plan B is a suitable choice for individuals who are generally healthy and prioritize cost-effectiveness. While it offers a more limited network and coverage, it provides essential healthcare services without breaking the bank.

Plan C: Customizable Coverage

Plan C stands out for its flexibility and customization options. Here’s what makes it unique:

- You can choose from a range of coverage levels, from basic to comprehensive.

- Customizable benefits allow you to add or remove coverage for specific healthcare services.

- The plan offers a large network of providers, giving you freedom in choosing healthcare professionals.

- Wellness incentives and discounts are available for maintaining a healthy lifestyle.

- Travel coverage is included, providing peace of mind for frequent travelers.

Plan C is an excellent option for individuals who want control over their healthcare coverage. By tailoring the plan to their specific needs, they can strike a balance between cost and coverage.

Plan D: Wellness-Focused Approach

Plan D takes a holistic approach to healthcare, emphasizing wellness and preventative care. Its key features include:

- Extensive coverage for preventative services, including annual check-ups and screenings.

- Wellness programs and incentives to encourage healthy habits.

- Integrative medicine options, such as acupuncture and chiropractic care.

- Mental health support and resources are readily available.

- Telemedicine services for convenient access to healthcare professionals.

Plan D is ideal for individuals who prioritize their well-being and want a plan that supports their healthy lifestyle. While it may have slightly higher premiums, the focus on wellness and preventative care can lead to long-term cost savings.

Expert Insights and Tips for Choosing the Right Plan

Selecting the best individual health insurance plan requires careful consideration of your unique circumstances. Here are some expert tips to guide you through the process:

Assess Your Healthcare Needs

Take stock of your current and potential future healthcare needs. Consider factors such as chronic conditions, prescription medications, and any specialized care you may require. Understanding your healthcare landscape will help you choose a plan that provides adequate coverage.

Evaluate Your Budget

Health insurance is a significant expense, so it’s essential to consider your financial situation. Evaluate your budget and determine how much you can comfortably allocate for premiums, deductibles, and out-of-pocket costs. Balancing coverage and affordability is crucial.

Research Network Providers

Explore the network of healthcare providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are included in the network. This will save you from unexpected costs and provide convenience in accessing care.

Consider Long-Term Goals

Think about your long-term healthcare goals and plans. If you anticipate significant medical expenses in the future, choosing a plan with higher coverage limits and lower out-of-pocket costs may be beneficial. Conversely, if you’re generally healthy, a more cost-effective plan might suit your needs.

Compare Benefits and Exclusions

Review the fine print of each plan’s benefits and exclusions. Pay attention to the coverage limits, copays, and deductibles. Ensure that the plan covers essential services like maternity care, mental health services, and prescription drugs, as these can be costly without adequate coverage.

Explore Wellness Programs

Many health insurance plans offer wellness programs and incentives to encourage healthy lifestyles. These programs can provide additional benefits and savings. Look for plans that align with your wellness goals and offer resources to support your journey towards better health.

Utilize Online Tools and Resources

Take advantage of online tools and resources provided by insurance companies and independent websites. These tools can help you compare plans, estimate costs, and make informed decisions based on your specific needs and budget.

The Future of Individual Health Insurance

The individual health insurance market is continually evolving, influenced by technological advancements, changing consumer preferences, and policy reforms. Here’s a glimpse into the future of individual health insurance:

Digital Health Solutions

The integration of digital health solutions is transforming the way healthcare is delivered and accessed. Telemedicine services, mobile health apps, and wearable devices are becoming increasingly popular. Insurance companies are adapting to this trend by offering plans that incorporate digital health benefits, providing convenient and accessible healthcare options.

Personalized Medicine

Advancements in genetic testing and precision medicine are paving the way for personalized healthcare. Insurance plans of the future may offer coverage for genetic testing and tailored treatment plans based on individual genetic profiles. This approach can lead to more effective and targeted healthcare interventions.

Value-Based Care

The focus on value-based care is shifting towards outcomes and patient satisfaction. Insurance companies are incentivizing healthcare providers to deliver high-quality care by linking payments to patient outcomes. This model aims to improve healthcare quality while controlling costs, benefiting both patients and providers.

Wellness-Incentivized Plans

Incentivizing healthy behaviors through wellness-focused plans is gaining traction. Insurance companies are offering discounts, rebates, and other incentives to policyholders who engage in healthy activities and maintain a healthy lifestyle. These plans promote preventive care and can lead to long-term cost savings.

Increased Consumer Empowerment

With the availability of comprehensive online resources and comparison tools, consumers are becoming more empowered in their health insurance choices. Insurance companies are adapting to this trend by offering transparent pricing, simplified plan options, and personalized recommendations to meet individual needs.

Frequently Asked Questions (FAQ)

How do I know if an individual health insurance plan is right for me?

+Choosing the right individual health insurance plan depends on your unique circumstances. Consider factors such as your healthcare needs, budget, and preferred level of flexibility. Assess your current and potential future healthcare expenses, evaluate plan coverage and costs, and ensure the plan aligns with your lifestyle and wellness goals.

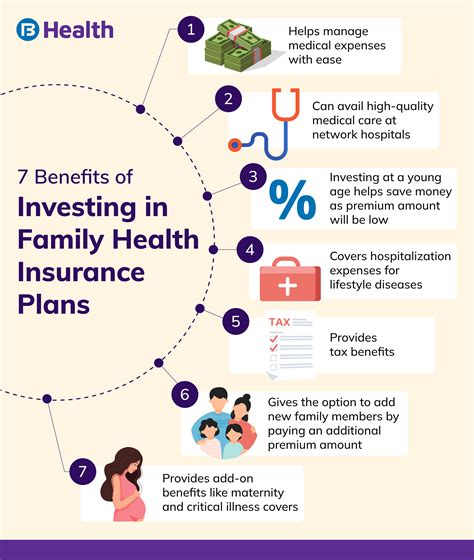

What are the benefits of having individual health insurance?

+Individual health insurance offers several benefits, including personalized coverage tailored to your needs, the ability to choose your healthcare providers, and access to a wide range of healthcare services. It provides financial protection against unexpected medical expenses and ensures you receive the care you need when you need it.

How can I save money on individual health insurance plans?

+To save money on individual health insurance plans, consider factors such as plan type, network providers, and coverage levels. Explore options like High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) for tax advantages. Compare quotes from different insurers and negotiate rates if possible. Additionally, maintain a healthy lifestyle to qualify for wellness incentives and discounts.

Can I switch individual health insurance plans during the year?

+In most cases, you can only switch individual health insurance plans during the annual open enrollment period or if you experience a qualifying life event, such as marriage, divorce, or the birth of a child. It’s important to review your plan’s terms and conditions to understand when and how you can make changes to your coverage.

What happens if I don’t have health insurance?

+Going without health insurance can have significant financial and health consequences. In the United States, you may face penalties or fines for not having coverage, and unexpected medical expenses can quickly become unaffordable. It’s essential to prioritize obtaining health insurance to protect yourself and your finances.

As you navigate the world of individual health insurance, remember that your choice should align with your specific healthcare needs and budget. By carefully considering your options and staying informed about the latest trends and innovations, you can make a confident decision to secure the best coverage for your well-being.