Best Insurance Companies For Health

Health insurance is a crucial aspect of modern life, providing individuals and families with financial protection and access to essential healthcare services. With numerous insurance companies offering various plans and coverage options, choosing the best one can be a daunting task. In this comprehensive guide, we will explore the top insurance companies in the health sector, analyzing their offerings, reputation, and customer satisfaction to help you make an informed decision.

Understanding the Importance of Health Insurance

Health insurance plays a pivotal role in safeguarding your well-being and financial stability. Medical emergencies, chronic illnesses, and even routine check-ups can incur significant costs, often leaving individuals and families burdened with overwhelming expenses. This is where health insurance steps in, acting as a safety net by covering a portion or all of the associated medical expenses.

The benefits of health insurance extend beyond financial protection. It ensures that you have access to a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and specialized treatments. With the right insurance coverage, you can focus on your health and well-being without worrying about the financial implications.

Furthermore, health insurance encourages preventative care and early detection of health issues. Many insurance plans cover annual check-ups, vaccinations, and screenings, allowing for the identification and management of potential health risks before they become more severe and costly to treat.

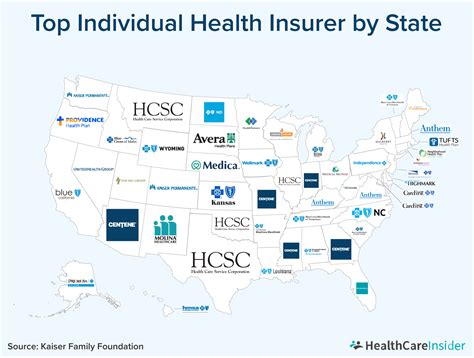

The Top Insurance Companies for Health

When it comes to choosing the best health insurance company, several factors come into play. These include the range of plans offered, the quality of coverage, customer service, and overall reputation in the industry. Here, we delve into the top performers in the health insurance sector, highlighting their unique features and benefits.

UnitedHealthcare

UnitedHealthcare is a leading name in the health insurance industry, offering a comprehensive range of plans to meet diverse needs. With a vast network of healthcare providers and a strong focus on innovation, UnitedHealthcare provides coverage for individuals, families, and employers across the United States.

One of the key strengths of UnitedHealthcare is its commitment to digital health solutions. The company offers a user-friendly mobile app that allows policyholders to access their benefits, find in-network providers, and manage their healthcare expenses with ease. Additionally, UnitedHealthcare's Navigating Cancer Care program provides specialized support for individuals undergoing cancer treatment, offering guidance and resources to navigate the complex journey of cancer care.

UnitedHealthcare's plans often include dental and vision coverage, ensuring that policyholders can maintain their overall oral and eye health. The company's MyDietCoach program also promotes healthy eating habits and weight management, contributing to preventative care and overall well-being.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a well-established and trusted name in health insurance, known for its extensive network of providers and customizable plans. With a history spanning over 80 years, BCBS has a strong presence across the United States, offering coverage to millions of individuals and families.

BCBS stands out for its wide variety of plan options, catering to different needs and budgets. From HMO (Health Maintenance Organization) plans to PPO (Preferred Provider Organization) plans, BCBS offers flexibility and choice. The company's Blue365 program provides policyholders with access to exclusive discounts and savings on health-related products and services, helping to further reduce healthcare costs.

BCBS also emphasizes preventative care and wellness through its Blue Wellness programs. These initiatives promote healthy lifestyles and provide resources for managing chronic conditions, ensuring that policyholders can proactively take charge of their health.

Aetna

Aetna, a subsidiary of CVS Health, is a renowned health insurance provider known for its innovative approach and customer-centric focus. Aetna offers a comprehensive range of plans, including medical, dental, and vision coverage, catering to individuals, families, and employers.

One of Aetna's standout features is its focus on digital health tools. The company's Aetna Navigator platform allows policyholders to manage their healthcare expenses, find in-network providers, and access their benefits with ease. Additionally, Aetna's Teladoc service provides 24/7 access to board-certified doctors for non-emergency medical advice, ensuring convenient and timely healthcare.

Aetna's HealthFund program encourages preventative care by offering rewards and incentives for healthy behaviors. Policyholders can earn rewards for activities such as completing health assessments, participating in wellness programs, and maintaining a healthy lifestyle. These incentives not only promote well-being but also help to reduce healthcare costs over time.

Cigna

Cigna is a global health service company that offers a holistic approach to healthcare, covering medical, dental, and behavioral health services. With a focus on wellness and personalized care, Cigna aims to provide a seamless and integrated healthcare experience.

Cigna's My Cigna Digital Tools platform empowers policyholders to take control of their healthcare journey. The platform offers a range of features, including the ability to view and manage claims, find in-network providers, and access personalized health information. Cigna's Wellbeing Program also provides resources and support for managing stress, improving sleep, and enhancing overall well-being.

Additionally, Cigna's behavioral health coverage is a standout feature, offering access to mental health services and resources. The company's Behavioral Health Network connects policyholders with a wide range of behavioral health providers, ensuring that individuals can receive the care they need for their mental and emotional well-being.

Kaiser Permanente

Kaiser Permanente is a unique healthcare organization that operates as an integrated healthcare system, combining insurance coverage with direct provision of medical services. With a strong presence in several states, Kaiser Permanente offers a comprehensive and coordinated approach to healthcare.

Kaiser Permanente's member-centric model ensures that policyholders have a dedicated team of healthcare professionals, including doctors, specialists, and support staff. This integrated approach simplifies the healthcare experience, as members can access a wide range of services within the Kaiser Permanente network.

The company's My Health Manager platform allows members to view their medical records, schedule appointments, and communicate with their healthcare team online. Kaiser Permanente also emphasizes preventative care and wellness, offering a range of health education programs and resources to promote healthy lifestyles.

Key Considerations for Choosing the Right Health Insurance

When selecting a health insurance company, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

- Coverage Options: Evaluate the range of plans offered by each insurance company, ensuring that they provide the necessary coverage for your healthcare needs.

- Network of Providers: Assess the size and quality of the insurance company's network of healthcare providers. A robust network ensures that you have access to a wide range of medical professionals and facilities.

- Customer Service: Look for insurance companies with a strong track record of excellent customer service. Responsive and knowledgeable support can make a significant difference in resolving any issues or concerns.

- Digital Tools and Resources: In today's digital age, insurance companies that offer user-friendly digital platforms and tools can enhance your overall experience. These tools can simplify the management of your healthcare expenses and provide valuable health-related information.

- Preventative Care and Wellness Programs: Choose an insurance company that places emphasis on preventative care and wellness. These programs can help you maintain your health and potentially reduce long-term healthcare costs.

The Future of Health Insurance

The health insurance landscape is continuously evolving, driven by technological advancements, changing consumer preferences, and the need for more accessible and affordable healthcare. Here’s a glimpse into the future of health insurance:

Digital Transformation

Insurance companies are increasingly investing in digital transformation to enhance the customer experience. We can expect to see more user-friendly mobile apps, online portals, and digital tools that streamline the management of healthcare expenses and provide personalized health recommendations.

Focus on Wellness and Prevention

The industry is shifting towards a greater emphasis on preventative care and wellness. Insurance companies are developing programs and incentives to encourage healthy lifestyles, manage chronic conditions, and promote early detection of health issues. This shift aims to reduce long-term healthcare costs and improve overall population health.

Integration of Telehealth Services

Telehealth services, such as virtual doctor visits and remote monitoring, are becoming increasingly popular. Insurance companies are expanding their coverage of these services, recognizing their potential to improve access to healthcare, especially in rural or underserved areas. Telehealth can also reduce the need for in-person visits, providing convenience and cost savings.

Personalized Medicine and Genetic Testing

Advancements in genetic testing and personalized medicine are transforming the healthcare industry. Insurance companies may begin to incorporate genetic testing into their coverage, allowing for more tailored treatment plans and disease prevention strategies. This shift towards personalized medicine could revolutionize the way healthcare is delivered and improve patient outcomes.

What factors should I consider when comparing health insurance plans?

+When comparing health insurance plans, it’s important to evaluate factors such as coverage limits, deductibles, copayments, and out-of-pocket maximums. Consider your healthcare needs and budget to find a plan that provides adequate coverage without straining your finances.

How can I ensure that my insurance company has a strong network of providers?

+Research the insurance company’s provider network by checking their website or contacting their customer service. Look for a diverse network of healthcare professionals and facilities that are conveniently located for your needs. You can also ask for recommendations from your primary care physician or other trusted healthcare providers.

What should I do if I encounter issues with my health insurance provider?

+If you face any challenges or have concerns regarding your health insurance coverage, it’s important to reach out to the insurance company’s customer service department. They can assist you in resolving any issues, answering questions, or providing guidance on the claims process. If necessary, you can also seek assistance from consumer advocacy groups or regulatory bodies.

How can I maximize the benefits of my health insurance plan?

+To maximize the benefits of your health insurance plan, take advantage of the preventative care services and wellness programs offered by your insurance company. Stay informed about your coverage limits and utilize the digital tools provided to manage your healthcare expenses effectively. Additionally, maintain open communication with your healthcare providers to ensure that your care aligns with your insurance coverage.