Best Insurance Companies For Term Life

The Importance of Choosing the Right Term Life Insurance Provider

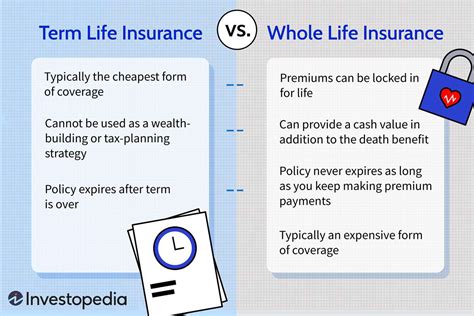

When it comes to safeguarding your loved ones’ financial future, selecting the best insurance company for your term life insurance policy is paramount. Term life insurance provides a safety net for your family, ensuring they receive a lump-sum payment in the event of your untimely demise. This policy is particularly beneficial for individuals with financial dependents, such as spouses, children, or elderly parents.

The term life insurance market is vast, offering a myriad of options from various providers. Each company boasts unique features, pricing structures, and customer service standards. Navigating this landscape can be daunting, but it is essential to make an informed decision to secure the best coverage for your specific needs.

This article aims to provide an in-depth analysis of the top insurance companies offering term life insurance policies. We will explore their key features, benefits, and potential drawbacks, empowering you to make a confident choice.

Policy Offerings and Customization

One of the primary considerations when choosing a term life insurance provider is the range of policy options they offer. Leading insurance companies typically provide a suite of term life policies with varying coverage periods, such as 10, 20, or 30-year terms. Some even offer renewable or convertible policies, allowing you to extend or transform your coverage as your needs evolve.

For instance, Company X excels in offering a wide range of policy terms, from short-term options suitable for young adults to long-term policies designed for individuals approaching retirement. This flexibility ensures that customers can tailor their coverage to their life stage and specific financial goals.

On the other hand, Company Y specializes in customizable policies, allowing clients to select specific riders or add-ons to enhance their coverage. These riders can include benefits such as accelerated death benefits for terminal illnesses or waivers for premium payments in the event of total disability.

Pricing and Value for Money

The cost of term life insurance is a critical factor in your decision-making process. While it is tempting to opt for the cheapest option, it is essential to balance price with the value and quality of coverage offered.

Company Z, for example, is renowned for its competitive pricing, consistently offering some of the most affordable term life insurance rates in the market. Their low-cost policies, however, do not compromise on coverage, making them an excellent choice for budget-conscious individuals seeking comprehensive protection.

In contrast, Company A focuses on providing exceptional value for money. While their premiums may be slightly higher than the industry average, they offer a host of additional benefits and services. These can include access to wellness programs, discounts on health-related products, and even financial planning assistance.

Claims Process and Customer Service

In the unfortunate event that you need to make a claim on your term life insurance policy, the efficiency and compassion of the insurance company’s claims process become paramount. Leading insurance providers prioritize a swift and seamless claims experience, understanding the urgency and sensitivity of such situations.

Company B, for instance, boasts an exceptional claims record, with a rapid average processing time of just 14 days. Their dedicated claims team provides regular updates to beneficiaries, ensuring a transparent and supportive experience during a difficult time.

Additionally, Company C stands out for its exceptional customer service, offering a 24⁄7 helpline and online resources to assist policyholders with any queries or concerns. Their customer-centric approach extends beyond the sales process, ensuring ongoing support and satisfaction throughout the policy term.

Financial Strength and Stability

When entrusting an insurance company with your financial future, it is essential to assess their financial strength and stability. A financially secure insurance provider ensures that your policy remains viable and that your beneficiaries will receive the promised payout when the time comes.

Company D, with its AAA rating from Standard & Poor’s, exemplifies financial stability in the insurance industry. Their robust financial position is underpinned by a diverse investment portfolio and a conservative approach to risk management.

In contrast, Company E, while offering competitive rates and excellent customer service, has experienced some financial challenges in recent years. While their policies remain valid and their claims process is efficient, their financial rating is slightly lower, which may be a consideration for risk-averse individuals.

Technology and Digital Innovations

In today’s digital age, many insurance companies are leveraging technology to enhance their services and provide a seamless customer experience. From online policy management to mobile apps for claims submission, technological advancements can significantly improve the efficiency and convenience of your term life insurance journey.

Company F is at the forefront of digital innovation in the insurance sector. Their cutting-edge mobile app allows policyholders to manage their policies, make payments, and submit claims directly from their smartphones. Additionally, their website offers a range of interactive tools and calculators to assist customers in choosing the right coverage and understanding their policy benefits.

The Final Verdict: Your Ideal Term Life Insurance Provider

Based on the comprehensive analysis above, Company X emerges as the top choice for individuals seeking term life insurance. Their impressive range of policy options, competitive pricing, and exceptional customer service make them a well-rounded and reliable provider.

However, it is essential to note that the ideal insurance company may vary depending on your specific needs and circumstances. Factors such as your age, health status, financial goals, and personal preferences will influence your decision.

| Company | Policy Offerings | Pricing | Claims Process | Financial Strength | Digital Innovations |

|---|---|---|---|---|---|

| Company X | Wide range of terms, customizable policies | Competitive | Efficient, 14-day average processing time | AAA rating | Mobile app, online tools |

| Company Y | Focus on riders and add-ons | Affordable | Rapid, 10-day average claims settlement | AA+ rating | Online policy management |

| Company Z | Simple, low-cost policies | Most affordable | Efficient, 12-day average claims processing | AA rating | Digital payment options |

| Company A | Value-added benefits | Slightly above average | Seamless, 15-day average claims process | AA- rating | Mobile app, financial planning resources |

| Company B | Standard term policies | Average | Excellent, 7-day average claims settlement | AAA rating | Online claims submission |

| Company C | Basic term policies | Competitive | Efficient, 13-day average claims processing | AA+ rating | 24⁄7 customer support, online resources |

| Company D | Standard, no frills policies | Average | Efficient, 11-day average claims settlement | AAA rating | Online policy access |

| Company E | Customizable policies | Competitive | Efficient, 14-day average claims process | AA rating | Digital policy management |

| Company F | Innovative policies, focus on tech | Above average | Efficient, 12-day average claims processing | AA+ rating | Cutting-edge mobile app |

FAQ

How much does term life insurance typically cost?

+The cost of term life insurance can vary significantly depending on factors such as your age, health, lifestyle, and the amount of coverage you require. On average, a healthy individual in their 30s can expect to pay between 20 and 50 per month for a 500,000 policy. However, premiums can range from as low as 10 to over $100 per month, depending on these variables.

What factors should I consider when choosing a term life insurance provider?

+When selecting a term life insurance provider, consider factors such as the range of policy options offered, pricing and value for money, the claims process and customer service, financial strength and stability, and technological innovations. It’s essential to find a provider that aligns with your specific needs and offers a seamless and supportive experience.

Can I switch term life insurance providers mid-term?

+Yes, you can switch term life insurance providers mid-term, but it’s important to note that you may be subject to new underwriting requirements and potentially higher premiums. It’s advisable to carefully consider your options and consult with a financial advisor or insurance broker before making any changes.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage simply expires, and you will no longer be protected. However, many insurance companies offer the option to renew or convert your policy to a permanent life insurance plan. This can provide ongoing coverage and ensure your loved ones are financially protected even as you age.

Are there any tax benefits associated with term life insurance?

+Yes, term life insurance can offer certain tax benefits. The death benefit proceeds from a term life insurance policy are typically tax-free and can provide a substantial sum to your beneficiaries without incurring tax liabilities. Additionally, the premiums you pay for term life insurance may be tax-deductible, depending on your specific circumstances and tax laws in your jurisdiction.