Best Insurance For Home

Securing the right insurance coverage for your home is a critical aspect of financial planning and risk management. With a wide range of insurance providers and policies available, finding the best option can be a daunting task. This article aims to provide an in-depth guide to help you navigate the complex world of home insurance, offering expert insights and comprehensive analysis to assist you in making an informed decision.

Understanding the Basics of Home Insurance

Home insurance, also known as homeowners insurance, is a policy that provides financial protection for homeowners against various risks and liabilities. It covers a range of potential losses, including damage to the structure of the home, its contents, and additional living expenses if the home becomes uninhabitable due to an insured event.

The primary purpose of home insurance is to safeguard homeowners from financial ruin in the event of unforeseen circumstances, such as natural disasters, theft, or accidents. By paying an annual premium, policyholders gain peace of mind knowing that they are protected against potential losses that could be financially devastating.

Key Components of a Home Insurance Policy

A typical home insurance policy consists of several essential coverages:

- Dwelling Coverage: This protects the physical structure of the home, including the walls, roof, and permanent fixtures.

- Personal Property Coverage: Covers the cost of replacing or repairing personal belongings, such as furniture, clothing, and electronics, in the event of a covered loss.

- Liability Coverage: Provides protection against lawsuits and medical bills if someone is injured on the insured property.

- Additional Living Expenses: If a home is damaged and becomes unlivable, this coverage pays for temporary living expenses until the home is repaired or rebuilt.

- Loss of Use Coverage: Similar to additional living expenses, this coverage pays for additional costs incurred when a home is damaged and the residents need to find alternative accommodations.

It's important to note that the specific coverages and limits offered can vary widely between insurance providers and policy types. Understanding these components is crucial when comparing different home insurance options and ensuring you have adequate protection.

Factors to Consider When Choosing the Best Home Insurance

Selecting the best home insurance policy involves considering various factors that align with your specific needs and circumstances. Here are some key aspects to keep in mind:

1. Coverage Options and Limits

Different insurance providers offer a range of coverage options and limits. Ensure that the policy you choose provides adequate coverage for your home’s structure, personal belongings, and potential liabilities. Consider the replacement cost of your home and the value of your possessions when determining the appropriate coverage limits.

For example, if you live in an area prone to natural disasters like hurricanes or earthquakes, you'll want to ensure your policy includes coverage for these specific risks. Some providers offer specialized policies for high-risk areas, providing more comprehensive protection.

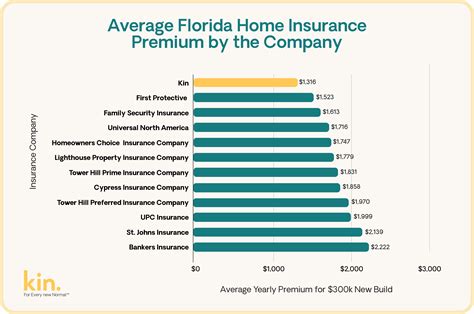

2. Cost of Premiums

The cost of home insurance premiums can vary significantly between providers and policies. While it’s essential to find a policy with a competitive premium, it’s equally important not to sacrifice coverage for a lower price. Compare quotes from multiple insurers to find the best balance between coverage and cost.

Additionally, consider the potential for discounts. Many insurers offer discounts for factors such as having multiple policies with the same company (e.g., auto and home insurance), installing security systems or fire alarms, or being a loyal customer for an extended period.

3. Reputation and Financial Stability of the Insurer

It’s crucial to choose an insurance provider with a solid reputation and financial stability. A reputable insurer is more likely to have a track record of prompt and fair claim settlements. Financial stability ensures that the company will be able to pay out claims even in the event of widespread disasters affecting many policyholders.

Researching an insurer's financial strength and customer satisfaction ratings can provide valuable insights. Organizations like AM Best and J.D. Power rate insurance companies based on their financial health and customer service, respectively. These ratings can be a helpful guide when assessing an insurer's reliability.

4. Claim Handling Process and Customer Service

In the event of a claim, you’ll want an insurer that provides efficient and responsive service. Research the claim handling process of potential insurers, including how quickly they respond to claims, their average settlement time, and the overall customer satisfaction with the claims process.

Consider reading reviews and testimonials from current and former policyholders to get a sense of the insurer's customer service and claim handling capabilities. A company with a reputation for excellent customer service is likely to provide a more positive experience during what can be a stressful time.

5. Policy Add-ons and Customization

Different homeowners have unique needs and risks. Look for an insurer that offers policy add-ons or customization options to tailor the coverage to your specific circumstances. For instance, if you have valuable jewelry or artwork, you may want to add a personal articles policy to ensure these items are adequately covered.

Additionally, consider any unique risks associated with your home's location or construction. For example, if you live in a flood-prone area, you may need to purchase separate flood insurance, as most standard home insurance policies do not cover flood damage.

Comparing Home Insurance Policies: A Step-by-Step Guide

Now that we’ve covered the key factors to consider, let’s delve into a step-by-step process for comparing home insurance policies:

Step 1: Identify Your Coverage Needs

Start by assessing your specific coverage needs. Consider the value of your home, its contents, and any potential liabilities. Determine the coverage limits and types of coverage you require. This initial assessment will help you narrow down your options and focus on policies that meet your unique requirements.

Step 2: Research Insurance Providers

Research a variety of insurance providers, both major national carriers and smaller regional or local insurers. Look for providers with a strong financial rating and a solid reputation for customer service and claim handling. Read reviews and seek recommendations from trusted sources to identify potential insurers that align with your needs.

Step 3: Obtain Quotes and Compare Coverage

Contact the insurers you’ve shortlisted and request quotes for home insurance policies. Compare the quotes based on the coverage they offer, the limits, and any additional benefits or perks included. Ensure that you’re comparing apples to apples by looking at policies with similar coverage levels.

When comparing quotes, pay attention to the fine print. Look for any exclusions or limitations that may impact your coverage. For instance, some policies may have restrictions on coverage for certain types of natural disasters or may require you to purchase additional riders for specific risks.

Step 4: Assess the Insurer’s Claim Handling Process

Research the claim handling process of the insurers you’re considering. Look for information on their average response time, the steps involved in filing a claim, and their reputation for fair and prompt settlements. Consider factors like whether they offer 24⁄7 claims reporting and whether they have a dedicated claims team or a centralized call center.

Step 5: Evaluate Customer Service and Online Tools

Assess the customer service capabilities of the insurers. Check their website and mobile app for ease of use and functionality. Look for features like online policy management, digital claim filing, and the ability to make payments or update personal information online. Excellent customer service and user-friendly digital tools can significantly enhance your experience as a policyholder.

Step 6: Consider Discounts and Policy Add-ons

Explore the discounts and policy add-ons offered by each insurer. Compare the potential savings you can achieve through discounts for factors like multiple policies, security systems, or loyalty. Additionally, evaluate the customization options and policy add-ons to ensure you can tailor the coverage to your specific needs.

Best Home Insurance Companies: A Comprehensive List

While the best home insurance company will vary based on individual needs and circumstances, here’s a list of top-rated insurers known for their comprehensive coverage, competitive pricing, and excellent customer service:

- State Farm: Offers a wide range of coverage options and is known for its strong financial stability and extensive agent network.

- Allstate: Provides customizable policies and innovative tools like the Allstate Digital Locker for organizing and storing important documents.

- USAA: Highly rated for its excellent customer service and tailored policies for military members and their families.

- Amica Mutual: Known for its exceptional customer satisfaction and personalized approach to insurance.

- Erie Insurance: Offers competitive rates and a wide range of coverage options, including unique add-ons like the Rate Lock feature, which guarantees your premium won't increase based on changes to your policy, except for a few specific reasons.

- Farmers Insurance: Provides comprehensive coverage and a 24/7 claims reporting service.

- Liberty Mutual: Offers a variety of policy options and discounts, as well as an online platform for managing your policy and filing claims.

- Travelers: Known for its robust coverage options and specialized policies for high-value homes.

- Progressive: Provides customizable policies and excellent digital tools for policy management and claims filing.

- Nationwide: Offers a wide range of coverage options and discounts, including a unique SmartRider program that rewards policyholders for maintaining a safe home.

Conclusion: Making an Informed Decision

Choosing the best home insurance policy involves a careful evaluation of your coverage needs, a comprehensive comparison of insurers, and a deep understanding of the factors that impact your decision. By considering the key components of a home insurance policy, assessing the reputation and financial stability of insurers, and comparing quotes and coverage options, you can make an informed decision that provides the right balance of protection and value.

Remember, home insurance is an essential aspect of protecting your financial well-being and ensuring the security of your home and belongings. Take the time to research and compare options to find the policy that best fits your needs. With the right coverage in place, you can have peace of mind knowing that you're prepared for whatever life throws your way.

Frequently Asked Questions

What is the average cost of home insurance in the United States?

+The average cost of home insurance varies depending on factors like location, the value of the home, and the coverage limits. According to the Insurance Information Institute, the average annual premium for homeowners insurance in the U.S. was $1,312 in 2021. However, this can range significantly, with some states having much higher or lower average premiums.

Can I bundle my home and auto insurance policies to save money?

+Yes, many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. This is known as a “multi-policy” or “package” discount. By bundling your policies, you can often save a significant amount on your premiums.

How often should I review and update my home insurance policy?

+It’s a good practice to review your home insurance policy annually, especially if you’ve made significant changes to your home or its contents. This ensures that your coverage limits and deductibles are still adequate and that you haven’t missed out on any new discounts or coverage options that may be available.

What should I do if I’m not satisfied with my current home insurance provider?

+If you’re unhappy with your current home insurance provider, it’s within your rights to shop around for a new insurer. Compare quotes and coverage options from multiple providers to find a policy that better meets your needs and provides better value. Make sure to carefully review the new policy to ensure it offers the coverage you require.

Can I negotiate the price of my home insurance policy?

+While insurance rates are generally set based on a variety of factors, you may have some room for negotiation, especially if you’ve been a loyal customer for an extended period. Contact your insurer and explain your situation. They may be willing to offer a discount or provide a better rate to retain your business.