Best Insurance For Small Businesses In The Usa

Starting and running a small business in the United States comes with its fair share of challenges, and one of the most critical aspects is ensuring your venture is protected against potential risks. Small businesses face unique exposures, from property damage to liability claims and unexpected expenses. That's where insurance plays a pivotal role in safeguarding your investment and providing peace of mind. However, with countless insurance providers and policies available, choosing the best coverage for your specific needs can be daunting.

In this comprehensive guide, we delve into the world of small business insurance, offering expert insights to help you make informed decisions. By understanding the various coverage options, assessing your unique risks, and leveraging the right tools and resources, you can secure the best insurance for your small business, fostering growth and long-term success.

Understanding the Importance of Insurance for Small Businesses

Insurance is an indispensable component of any small business’s risk management strategy. It provides a safety net, offering financial protection against unforeseen events that could otherwise cripple or even put an end to your entrepreneurial journey.

Here's a breakdown of why insurance is critical for small businesses:

Risk Mitigation

Small businesses face a myriad of risks, including property damage, lawsuits, cyber attacks, and employee injuries. Insurance policies are tailored to address these specific risks, ensuring your business is protected against financial losses arising from such incidents.

Legal Compliance

Certain types of insurance are not just recommended but mandatory under the law. For instance, most states require employers to carry workers’ compensation insurance to cover medical expenses and lost wages for employees injured on the job. Failure to comply can result in severe penalties.

Peace of Mind

Knowing your business is adequately insured can significantly reduce stress and anxiety. It allows business owners to focus on growth and strategy, confident in the knowledge that they have a robust safety net in place.

Enhanced Credibility

Insurance can boost your business’s credibility, especially when dealing with clients, vendors, and partners. It demonstrates a level of professionalism and responsibility, which can be crucial for building trust and fostering long-term relationships.

Assessing Your Small Business’s Insurance Needs

Every small business is unique, with its own set of risks and exposures. Therefore, it’s crucial to conduct a thorough assessment of your specific needs before choosing an insurance policy.

Identify Potential Risks

Start by identifying the risks your business might face. Consider factors such as your industry, location, number of employees, and the nature of your operations. Common risks for small businesses include:

- Property damage or loss due to fire, theft, or natural disasters.

- Liability claims arising from accidents, injuries, or property damage on your premises.

- Cyber attacks or data breaches.

- Business interruption due to unforeseen events.

- Employee injuries or illnesses.

Evaluate Coverage Options

Once you’ve identified the potential risks, evaluate the coverage options available to mitigate those risks. Some of the most common insurance policies for small businesses include:

- General Liability Insurance: Covers third-party bodily injury or property damage claims, as well as advertising injuries and personal injury lawsuits.

- Professional Liability Insurance (aka Errors and Omissions Insurance): Protects against negligence claims arising from your professional services.

- Commercial Property Insurance: Provides coverage for physical damage or loss to your business property, including buildings, inventory, and equipment.

- Business Owner's Policy (BOP): A combination of general liability and commercial property insurance, tailored for small businesses.

- Workers' Compensation Insurance: Required by most states, this policy covers medical expenses and lost wages for employees injured on the job.

- Commercial Auto Insurance: Provides coverage for business-owned vehicles and protects against liability claims arising from accidents.

- Cyber Liability Insurance: Protects against the financial consequences of cyber attacks and data breaches.

- Business Interruption Insurance: Provides income protection in the event your business operations are disrupted by a covered event.

Consider Industry-Specific Risks

Some industries have unique risks that require specialized insurance coverage. For instance, a construction company might need additional coverage for equipment damage, while a tech startup might prioritize cyber liability insurance.

Seek Expert Advice

Consider consulting an insurance broker or agent who specializes in small business insurance. They can provide valuable insights and recommendations based on your specific needs and industry.

Researching and Comparing Insurance Providers

With a clear understanding of your insurance needs, it’s time to research and compare different providers to find the best fit for your small business.

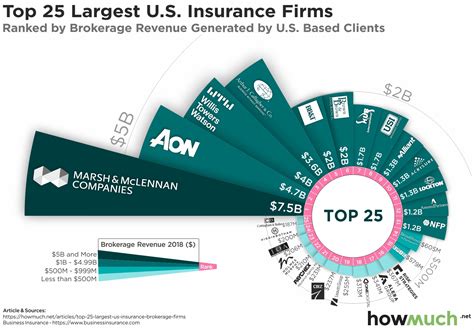

Identify Reputable Insurers

Start by identifying reputable insurance companies that offer small business policies. You can use online resources, industry publications, and recommendations from business owners in your network.

Compare Policies and Coverage

Request quotes and policy details from multiple insurers. Compare the coverage limits, deductibles, exclusions, and additional benefits offered. Ensure the policies align with your identified risks and provide sufficient protection.

Evaluate Customer Service and Claims Handling

Research the insurer’s reputation for customer service and claims handling. Read reviews, ask for referrals, and consider their financial stability and claims-paying ability. Efficient and responsive customer service is crucial when you need to file a claim.

Consider Additional Benefits

Some insurers offer additional benefits or perks that can enhance your coverage. These might include risk management resources, business continuity planning, or access to legal or accounting services.

Leveraging Tools and Resources for Better Insurance Decisions

Making informed insurance decisions for your small business can be made easier with the right tools and resources at your disposal.

Online Insurance Marketplaces

Online insurance marketplaces, like PolicyGenius, Insureon, and BizInsure, provide a convenient way to compare quotes and policies from multiple insurers. These platforms often offer additional resources, such as risk assessment tools and educational content.

Small Business Associations and Chambers of Commerce

These organizations often partner with insurance providers to offer discounted rates or group policies for their members. They can also provide valuable advice and resources to help you make informed insurance decisions.

Insurance Brokers and Agents

Working with an insurance broker or agent who specializes in small business insurance can be beneficial. They can guide you through the process, tailor policies to your needs, and often have access to a wider range of insurers.

Government Resources

Government agencies like the Small Business Administration (SBA) provide valuable resources and guidance on insurance for small businesses. Their website offers comprehensive information on different types of insurance, risk management, and how to choose the right coverage.

The Future of Small Business Insurance: Trends and Innovations

The world of insurance is constantly evolving, and small business owners can benefit from staying abreast of the latest trends and innovations.

Rising Importance of Cyber Insurance

With the increasing reliance on digital technology and the rising threat of cyber attacks, cyber liability insurance is becoming an essential component of small business insurance portfolios. This coverage protects against the financial losses resulting from data breaches, ransomware attacks, and other cyber incidents.

Adoption of Digital Insurance Solutions

Insurance providers are increasingly adopting digital technologies to enhance the customer experience. This includes online quoting tools, digital policy management, and mobile apps for claims reporting and tracking. Small business owners can benefit from these innovations by accessing insurance services more conveniently and efficiently.

Focus on Risk Prevention and Mitigation

Insurers are recognizing the importance of risk prevention and are offering resources and incentives to small businesses to reduce their exposure to potential risks. This includes risk management tools, safety training, and loss prevention resources.

Customized Insurance Solutions

Insurance providers are moving away from one-size-fits-all policies and towards more customized solutions. By leveraging data analytics and advanced risk assessment tools, insurers can tailor policies to the unique needs of each small business, providing more comprehensive and cost-effective coverage.

Conclusion: Securing the Best Insurance for Your Small Business

Choosing the best insurance for your small business is a critical step in safeguarding your entrepreneurial journey. By understanding your unique risks, evaluating coverage options, researching reputable insurers, and leveraging the right tools and resources, you can make informed decisions and secure the protection your business deserves.

Remember, insurance is not a one-time decision but an ongoing process. Regularly review your coverage to ensure it aligns with your business's evolving needs and risks. Stay informed about industry trends and innovations, and don't hesitate to seek expert advice when needed. With the right insurance in place, your small business can thrive with confidence and resilience.

What is the average cost of insurance for a small business in the USA?

+The average cost of insurance for a small business can vary significantly depending on factors such as industry, location, number of employees, and the specific coverage needed. However, according to a report by the Council of Insurance Agents & Brokers, the average small business pays around $5,000 per year for property and liability insurance combined. This figure can range from a few hundred dollars for a very small, low-risk business to tens of thousands of dollars for a larger, more complex business with higher risks.

Are there any government programs or incentives to help small businesses with insurance costs?

+Yes, there are several government programs and incentives that can help small businesses with insurance costs. For instance, the Small Business Administration (SBA) offers resources and guidance on insurance for small businesses. Additionally, some states and local governments offer tax incentives or subsidies for small businesses to help with insurance premiums. It’s worth researching these options to see if your business qualifies.

What are some common mistakes small business owners make when choosing insurance coverage?

+Some common mistakes small business owners make include not understanding their specific risks and needs, choosing the wrong type of insurance (or not enough coverage), and failing to regularly review and update their insurance policies. It’s crucial to conduct a thorough risk assessment, compare quotes from multiple insurers, and seek expert advice to avoid these pitfalls.