Best Insurance Plans For Individuals

Choosing the right insurance plan is a crucial decision, as it provides financial protection and peace of mind in various aspects of life. Whether you're an individual seeking comprehensive coverage or specific protection, there are numerous insurance plans available in the market. This article aims to guide you through the process of selecting the best insurance plans tailored to your needs, ensuring you make informed choices for your future.

Understanding Individual Insurance Needs

Before diving into the world of insurance plans, it's essential to assess your unique circumstances and priorities. Consider factors such as your age, health status, financial stability, and future goals. Are you looking for insurance to protect your income, cover healthcare expenses, or safeguard your assets? Understanding your specific needs will help narrow down the vast array of insurance options.

Health Insurance: A Vital Component

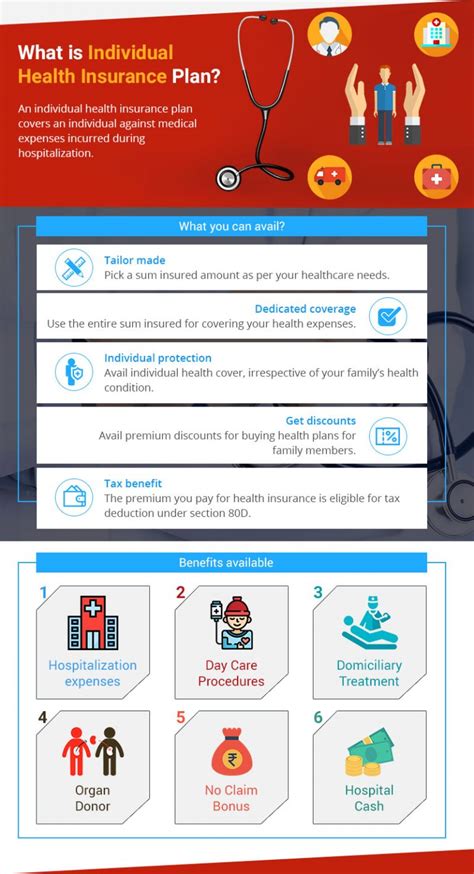

Health insurance is arguably one of the most critical insurance plans for individuals. With rising healthcare costs, having adequate coverage can be a lifesaver, both literally and financially. When selecting a health insurance plan, consider the following:

Coverage and Benefits

Look for plans that offer comprehensive coverage for a wide range of medical services, including hospitalization, doctor visits, prescription drugs, and preventive care. Check for specific benefits like maternity coverage, mental health services, and dental/vision care, depending on your needs.

Network of Providers

Ensure the insurance plan has a robust network of healthcare providers, including hospitals, clinics, and specialists. A strong network ensures you have access to quality care without facing out-of-network charges.

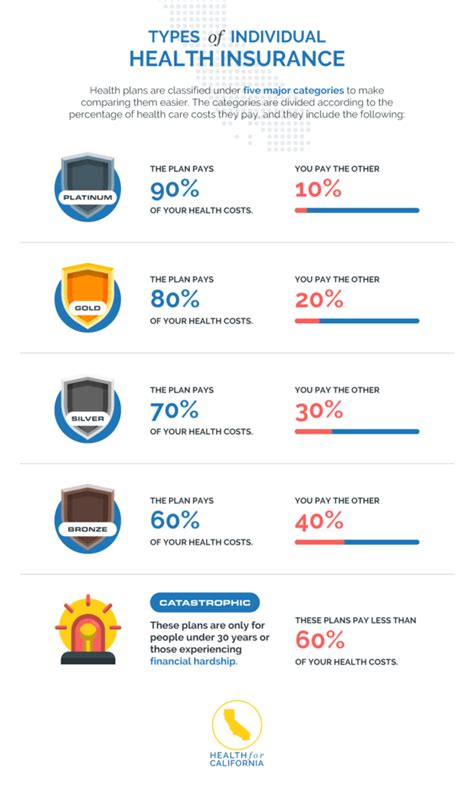

Cost and Deductibles

Health insurance plans come with varying costs and deductibles. Evaluate the premiums, copayments, and deductibles to find a balance between affordability and comprehensive coverage. Remember, cheaper plans may have higher out-of-pocket expenses, so assess your financial situation and choose accordingly.

Policy Terms and Conditions

Read the fine print! Understand the policy's terms and conditions, including any exclusions or limitations. Some plans may have waiting periods for certain conditions or pre-existing condition clauses. Ensure you're aware of these details to avoid any surprises.

Example: Blue Cross Blue Shield's PPO Plan

The Blue Cross Blue Shield PPO plan offers a wide range of benefits, including coverage for doctor visits, specialist care, and prescription drugs. With a large network of providers, this plan ensures access to quality healthcare across the country. While the premiums may be higher compared to other plans, the comprehensive coverage and flexible provider choices make it a popular choice for individuals seeking robust health insurance.

| Plan | Coverage Highlights | Network Size | Premiums |

|---|---|---|---|

| Blue Cross Blue Shield PPO | Comprehensive medical, prescription, and specialist care | Over 1 million healthcare professionals | $450 - $600/month |

| UnitedHealthcare HMO | Focus on preventive care and lower premiums | Limited to in-network providers | $350 - $450/month |

| Aetna EPO | Balance of cost and coverage, with some out-of-network options | Over 1.2 million providers | $400 - $550/month |

Life Insurance: Securing Your Legacy

Life insurance is a crucial aspect of financial planning, ensuring your loved ones are protected in the event of your untimely demise. When selecting a life insurance plan, consider the following:

Term vs. Permanent Life Insurance

Term life insurance offers coverage for a specific period, typically 10-30 years. It is affordable and suitable for individuals seeking coverage during their working years. Permanent life insurance, on the other hand, provides lifetime coverage and accumulates cash value over time. It's a more comprehensive option but comes with higher premiums.

Coverage Amount and Beneficiaries

Determine the coverage amount based on your financial responsibilities and goals. Consider factors like outstanding debts, future education costs for children, and income replacement needs. Additionally, choose beneficiaries wisely, ensuring they receive the benefits as intended.

Rider Options

Life insurance plans often offer rider options, which are additional benefits or protections. Common riders include waiver of premium (waiving payments if you become disabled), accelerated death benefit (access to a portion of the benefit if diagnosed with a terminal illness), and spousal coverage.

Example: Prudential's Term Life Insurance

Prudential's Term Life Insurance plan offers affordable coverage for individuals seeking short-term protection. With flexible terms ranging from 10 to 30 years, it provides financial security for families during their working years. The plan offers a range of coverage amounts, starting at $100,000, and allows for easy conversion to permanent life insurance if needed.

| Insurer | Plan Type | Coverage Period | Premiums |

|---|---|---|---|

| Prudential | Term Life Insurance | 10-30 years | $20 - $40/month for $100,000 coverage |

| New York Life | Whole Life Insurance | Lifetime coverage | $100 - $200/month for $250,000 coverage |

| State Farm | Universal Life Insurance | Flexible coverage period | $50 - $150/month for $150,000 coverage |

Disability Insurance: Protecting Your Income

Disability insurance is often overlooked but plays a vital role in safeguarding your income in case of an accident or illness that prevents you from working. Here's what to consider when choosing a disability insurance plan:

Short-Term vs. Long-Term Disability

Short-term disability insurance provides coverage for a limited period, typically a few months, to cover expenses during temporary disabilities. Long-term disability insurance, on the other hand, offers coverage for extended periods, often up to retirement age.

Benefit Amount and Elimination Period

Choose a benefit amount that replaces a significant portion of your income. The elimination period is the time you must wait before benefits kick in. Consider your financial situation and choose an appropriate elimination period, balancing affordability and immediate needs.

Own Occupation vs. Any Occupation

Own occupation disability insurance provides benefits if you're unable to perform your specific job. Any occupation insurance, on the other hand, pays out if you're unable to work in any occupation for which you're suited. The former offers more comprehensive coverage but is typically more expensive.

Example: MetLife's Short-Term Disability Insurance

MetLife's Short-Term Disability Insurance plan offers coverage for up to 26 weeks, providing financial support during temporary disabilities. With a 14-day elimination period, it ensures benefits kick in promptly. The plan offers flexible benefit amounts, allowing individuals to choose coverage that suits their income replacement needs.

| Insurer | Plan Type | Benefit Period | Elimination Period |

|---|---|---|---|

| MetLife | Short-Term Disability | Up to 26 weeks | 14 days |

| Principal | Long-Term Disability | Up to age 65 | 90 days |

| Unum | Own Occupation Disability | Up to age 65 | 30 days |

Homeowners and Renters Insurance: Protecting Your Assets

Whether you own a home or rent, insurance is essential to protect your assets and liability. Here's what to consider:

Homeowners Insurance

Homeowners insurance provides coverage for your home's structure, personal belongings, and liability. When choosing a plan, consider the replacement cost of your home and the value of your belongings. Additionally, ensure the plan covers specific risks like fire, theft, and natural disasters.

Renters Insurance

Renters insurance is crucial for individuals who rent. It provides coverage for your personal belongings and liability, protecting you from financial loss in case of theft, fire, or accidents. Choose a plan that offers adequate coverage for your belongings and ensures peace of mind.

Example: State Farm's Homeowners Insurance

State Farm's Homeowners Insurance plan offers comprehensive coverage for homes, including protection against fire, theft, and liability. With customizable options, individuals can choose coverage limits that suit their needs. The plan also offers additional benefits like identity restoration coverage and home systems protection.

| Insurer | Plan Type | Coverage Highlights |

|---|---|---|

| State Farm | Homeowners Insurance | Comprehensive coverage, identity restoration, home systems protection |

| Allstate | Renters Insurance | Personal property coverage, liability protection, flexible add-ons |

| Liberty Mutual | Condo Insurance | Coverage for condo unit, personal belongings, and liability |

Auto Insurance: Protecting Your Vehicle and Liability

Auto insurance is mandatory in most states, providing coverage for your vehicle and liability in case of accidents. When selecting an auto insurance plan, consider the following:

Liability Coverage

Liability coverage is essential to protect you financially in case you're at fault in an accident. Choose limits that align with your financial responsibilities and state requirements.

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle in case of an accident, while comprehensive coverage protects against non-accident-related incidents like theft, vandalism, and natural disasters. Consider these coverages based on your vehicle's value and your financial situation.

Additional Coverages

Look for additional coverages like rental car reimbursement, roadside assistance, or gap insurance, which can provide extra protection and peace of mind.

Example: Geico's Auto Insurance

Geico's Auto Insurance plan offers a range of coverage options, including liability, collision, and comprehensive coverage. With customizable limits and additional coverages, individuals can tailor their plan to their needs. Geico's digital platform also provides easy access to policy management and claims processing.

| Insurer | Plan Type | Coverage Highlights |

|---|---|---|

| Geico | Auto Insurance | Customizable coverage, digital platform, additional coverages |

| Progressive | Auto Insurance | Snapshot program for usage-based discounts, flexible payment options |

| State Farm | Auto Insurance | Multi-policy discounts, accident forgiveness, rental car coverage |

Other Insurance Considerations

In addition to the above, individuals may also consider other insurance plans based on their specific needs and circumstances. These could include:

- Travel Insurance: Protects against trip cancellations, medical emergencies, and lost luggage.

- Pet Insurance: Covers veterinary costs and provides financial support for pet-related emergencies.

- Umbrella Insurance: Provides additional liability coverage beyond your existing policies.

- Long-Term Care Insurance: Offers financial support for extended care needs, such as nursing home stays.

FAQ

What are the key factors to consider when choosing an insurance plan?

+

When selecting an insurance plan, key factors to consider include your specific needs (health, financial, asset protection), the coverage and benefits offered by the plan, the network of providers (for health insurance), cost and affordability, and any exclusions or limitations in the policy.

How do I choose between term and permanent life insurance?

+

The choice between term and permanent life insurance depends on your financial goals and needs. Term life insurance is more affordable and suitable for short-term protection, while permanent life insurance offers lifetime coverage and accumulates cash value. Consider your financial responsibilities, future goals, and the need for long-term financial protection.

What is the importance of disability insurance, and who needs it?

+

Disability insurance is crucial as it protects your income in case of an accident or illness that prevents you from working. Anyone who relies on their income to meet financial obligations should consider disability insurance. It provides financial support during temporary or long-term disabilities, ensuring you can continue to meet your financial commitments.

Are there any tax benefits associated with insurance plans?

+

Yes, certain insurance plans offer tax benefits. For example, premiums paid for health insurance plans may be tax-deductible, and life insurance proceeds are typically tax-free. It’s important to consult with a tax professional to understand the specific tax advantages associated with your insurance plans.