Best Insurance Prices

When it comes to finding the best insurance prices, it's crucial to understand that insurance policies are tailored to meet specific needs, and the price you pay can vary significantly based on several factors. In this comprehensive guide, we will delve into the world of insurance, offering expert insights and practical tips to help you secure the most competitive rates while ensuring adequate coverage. From understanding the key components of insurance policies to leveraging online tools and comparing quotes, we will cover all the essential aspects to empower you in your search for the best insurance deals.

Understanding Insurance Policies: A Foundation for Affordable Coverage

Insurance policies are complex contracts that provide financial protection against potential risks and uncertainties. To navigate the insurance landscape and find the best prices, it’s essential to grasp the fundamental components of these policies.

Policy Types and Coverage Options

Insurance policies come in various forms, each designed to address specific risks. Common types include:

- Health Insurance: Covers medical expenses and provides access to healthcare services.

- Auto Insurance: Protects vehicle owners from financial losses due to accidents or theft.

- Homeowners/Renters Insurance: Safeguards homes and personal belongings against damage or loss.

- Life Insurance: Provides financial support to beneficiaries upon the policyholder’s death.

- Travel Insurance: Offers coverage for unexpected events during travel, such as medical emergencies or trip cancellations.

Each policy type offers a range of coverage options, allowing individuals to customize their protection based on their unique needs and circumstances. Understanding the specific coverage limits, deductibles, and exclusions is crucial for making informed decisions and finding the best insurance prices.

The Impact of Risk Assessment

Insurance companies assess the level of risk associated with each policyholder to determine appropriate premiums. Factors influencing risk assessment include:

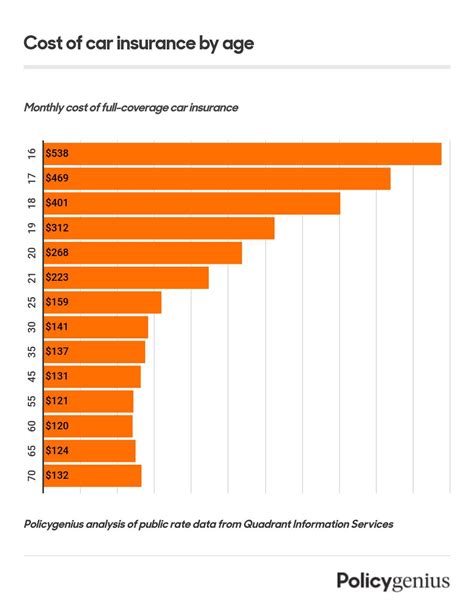

- Age: Younger individuals are generally considered lower risk for certain policies, like auto insurance.

- Health Status: Pre-existing medical conditions can impact health insurance premiums.

- Location: Areas with higher crime rates or natural disaster risks may result in increased homeowners’ insurance costs.

- Driving Record: A history of accidents or traffic violations can affect auto insurance rates.

- Occupation: Certain occupations with higher risk profiles, like construction workers, may face higher insurance premiums.

By understanding how these factors influence risk assessment, you can take steps to mitigate risks and potentially reduce your insurance premiums.

Online Tools and Comparison Shopping: Your Advantage in Finding Affordable Insurance

The digital age has revolutionized the insurance industry, making it easier than ever to compare policies and find the best prices. Online tools and comparison platforms offer a wealth of resources to simplify the insurance shopping process.

Using Insurance Comparison Websites

Insurance comparison websites aggregate policies from multiple providers, allowing you to quickly and easily compare quotes and coverage options. These platforms often provide user-friendly interfaces, making it simple to filter results based on your specific needs and preferences.

When using comparison websites, consider the following:

- Reputation and Trustworthiness: Choose reputable platforms with a track record of providing accurate and unbiased comparisons.

- Comprehensive Coverage Options: Ensure the website covers a wide range of insurance types and providers to offer a diverse selection of choices.

- Personalization: Look for platforms that allow you to input detailed information about your needs, such as coverage limits and deductibles, to receive personalized quotes.

By utilizing comparison websites, you can efficiently explore various insurance options and identify the most cost-effective policies for your circumstances.

Leveraging Insurance Brokers and Agents

Insurance brokers and agents are professionals who work with multiple insurance companies to find the best policies for their clients. While they may charge a fee for their services, their expertise and personalized guidance can be invaluable, especially for complex insurance needs.

Consider the following when working with brokers or agents:

- Experience and Reputation: Seek out professionals with a proven track record of success and positive client reviews.

- Specialization: Choose a broker or agent who specializes in the type of insurance you require, ensuring they have the necessary expertise.

- Communication and Transparency: Opt for individuals who provide clear and transparent communication throughout the process, ensuring you understand all aspects of the policies they present.

Working with a knowledgeable insurance professional can help you navigate the complexities of insurance and secure the best coverage at the most competitive prices.

Maximizing Savings: Strategies for Affordable Insurance Coverage

Finding the best insurance prices goes beyond comparison shopping. By implementing certain strategies and making informed decisions, you can further maximize your savings and ensure you’re getting the most value for your insurance dollar.

Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies with them. For example, you may receive a discounted rate on your auto insurance if you also have your homeowners’ or renters’ insurance with the same provider.

Consider the following when bundling policies:

- Research Providers: Explore which insurance companies offer bundling discounts and compare their overall pricing and coverage options.

- Review Your Needs: Assess whether bundling makes sense for your specific insurance requirements. Ensure that the bundled policies provide adequate coverage for all your needs.

- Negotiate: Don’t hesitate to negotiate with insurance providers to secure the best possible rates when bundling policies.

Bundling policies can lead to significant savings, so it’s worth considering as a strategy for reducing your insurance expenses.

Explore Discounts and Rewards Programs

Insurance companies often provide discounts and rewards to incentivize certain behaviors or attract specific customer segments. These discounts can significantly impact your overall insurance costs.

Some common discounts and rewards programs include:

- Safe Driving Discounts: Auto insurance providers may offer lower rates to drivers with clean driving records or those who complete defensive driving courses.

- Home Security Discounts : Homeowners’ insurance companies may reduce premiums for homes with advanced security systems or fire protection measures.

- Loyalty Rewards: Some insurance providers reward long-term customers with discounted rates or additional coverage benefits.

- Group or Affiliation Discounts: Certain insurance companies offer discounted rates to members of specific organizations, such as alumni associations or professional groups.

Researching and taking advantage of these discounts can help you lower your insurance costs and make your coverage more affordable.

Review and Adjust Your Coverage Regularly

Insurance needs can change over time, and regularly reviewing your policies ensures that you’re not overpaying for unnecessary coverage or underinsured for new risks.

Consider the following when reviewing your insurance coverage:

- Life Changes: Major life events, such as marriage, divorce, or the purchase of a new home, can impact your insurance needs. Ensure your policies reflect these changes.

- Market Fluctuations: Insurance rates can vary over time due to market conditions. Periodically shop around to ensure you’re still getting the best deals.

- Policy Add-ons: Evaluate whether additional coverage options, like rental car insurance or road assistance, are necessary and worth the added cost.

By staying proactive and regularly reviewing your insurance coverage, you can maintain adequate protection while keeping your costs as low as possible.

The Future of Insurance: Trends and Innovations for Affordable Coverage

The insurance industry is continuously evolving, and technological advancements and changing consumer preferences are shaping the future of insurance. Understanding these trends can help you stay ahead of the curve and make informed decisions when seeking the best insurance prices.

Digital Transformation and InsurTech

The rise of digital technologies and the emergence of InsurTech (insurance technology) startups are revolutionizing the insurance industry. These innovations are making insurance more accessible, efficient, and personalized.

Key InsurTech trends include:

- Digital Onboarding and Claims Processing: InsurTech companies are streamlining the insurance process, allowing for faster and more convenient policy applications and claims submissions.

- Telematics and Usage-Based Insurance: In the auto insurance sector, telematics devices and usage-based insurance models are gaining popularity. These technologies track driving behavior and offer discounts to safe drivers.

- AI and Machine Learning: Artificial intelligence is being utilized to improve risk assessment, fraud detection, and personalized policy recommendations.

- Blockchain Technology: Blockchain is being explored for secure and transparent insurance transactions, potentially reducing administrative costs and improving efficiency.

Staying informed about these digital transformations can help you navigate the evolving insurance landscape and potentially access more affordable and innovative insurance solutions.

The Rise of Microinsurance and On-Demand Coverage

Microinsurance and on-demand coverage models are gaining traction, offering affordable and flexible insurance options for individuals with specific, short-term needs.

Consider the following trends:

- Microinsurance: Microinsurance policies provide coverage for specific events or risks, such as a single trip or a particular medical procedure. These policies are often more affordable and accessible to individuals with limited financial means.

- On-Demand Coverage: On-demand insurance allows individuals to purchase coverage for a specific period, such as a few hours or days. This model is particularly useful for activities like renting a car or attending a special event.

Exploring these alternative insurance models can provide cost-effective solutions for individuals with unique or temporary insurance needs.

Conclusion: Navigating the Path to Affordable Insurance

Finding the best insurance prices requires a combination of understanding insurance policies, leveraging online tools, and implementing strategic approaches to maximize savings. By staying informed about the latest trends and innovations in the insurance industry, you can position yourself to make the most cost-effective decisions for your insurance needs.

Remember, insurance is a vital component of financial security, and taking the time to research and compare options can lead to significant savings without compromising the protection you require. With the right approach and a thorough understanding of the insurance landscape, you can confidently navigate the path to affordable and comprehensive insurance coverage.

What are some common mistakes to avoid when shopping for insurance?

+

Avoid rushing into a decision without thoroughly reviewing policy details and comparing multiple options. Also, be cautious of policies with low premiums but limited coverage. It’s essential to strike a balance between affordability and adequate protection.

How can I save money on health insurance if I’m self-employed or work for a small business?

+

Explore group health insurance plans through professional associations or small business groups, which can offer discounted rates. Additionally, consider high-deductible health plans paired with Health Savings Accounts (HSAs) for potential tax benefits and savings.

What are some tips for getting the best auto insurance rates as a young driver?

+

Maintain a clean driving record, take advantage of good student discounts if applicable, and consider adding a more experienced driver to your policy to potentially lower premiums. Additionally, shop around and compare quotes from multiple providers to find the best deal.