Best Medicare Supplemental Insurance

Medicare Supplemental Insurance, also known as Medigap, is an essential aspect of healthcare coverage for many individuals, especially those aged 65 and above. With the complex nature of healthcare plans and the varying needs of individuals, choosing the best Medigap policy can be a daunting task. This article aims to provide a comprehensive guide to understanding Medicare Supplemental Insurance, helping you make an informed decision about your healthcare coverage.

Understanding Medicare Supplemental Insurance (Medigap)

Medicare Supplemental Insurance, or Medigap, is a set of standardized policies designed to fill the gaps in Original Medicare (Parts A and B). These policies, offered by private insurance companies, cover various out-of-pocket costs that Original Medicare doesn’t, such as deductibles, coinsurance, and copayments.

The need for Medigap arises from the limitations of Original Medicare. While Original Medicare provides comprehensive coverage for hospital and medical services, it often leaves beneficiaries with significant out-of-pocket expenses. Medigap policies aim to reduce these expenses, offering a more comprehensive and financially secure healthcare option.

Medigap Policy Types

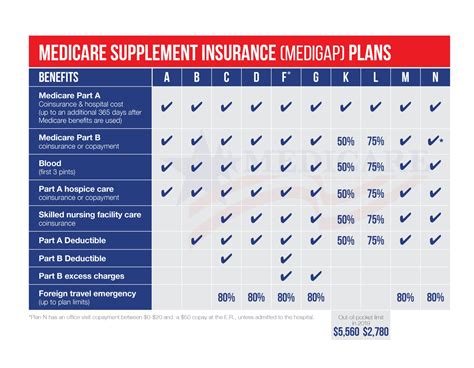

Medigap policies are standardized and labeled with letters A through N, with each offering a different combination of benefits. These policies are regulated by the Centers for Medicare & Medicaid Services (CMS), ensuring that each plan offers the same benefits regardless of the insurance company providing it.

| Medigap Policy | Coverage Highlights |

|---|---|

| Plan A | Basic coverage, including deductibles, coinsurance, and copayments for Part A and Part B. |

| Plan B | Similar to Plan A, but also covers the Part B deductible. |

| Plan C | Offers more comprehensive coverage, including Part A deductible, Part B deductible, and foreign travel emergency care. |

| Plan F | The most comprehensive plan, covering all out-of-pocket costs, including the Part B deductible and excess charges. |

| Plan G | Similar to Plan F, but doesn't cover the Part B deductible. |

| Plan N | Covers most out-of-pocket costs but has certain limitations and cost-sharing provisions. |

It's important to note that not all Medigap policies are available in every state, and some states may offer additional plans. Additionally, Medigap policies don't cover prescription drugs, so individuals may need to enroll in a separate Medicare Part D plan for prescription drug coverage.

Eligibility and Enrollment

Eligibility for Medigap is based on enrollment in Original Medicare. You can enroll in a Medigap policy during your Medicare Initial Enrollment Period, which is the 7-month period that begins 3 months before you turn 65. This period includes the month of your 65th birthday and the 3 months after that.

During this initial enrollment period, you can enroll in any Medigap policy sold in your state without undergoing a medical underwriting process. This means that insurance companies cannot deny you coverage or charge you more due to pre-existing conditions. After this period, you may still be able to purchase Medigap, but you may face medical underwriting and potentially higher premiums.

Choosing the Best Medigap Policy for You

Selecting the best Medigap policy involves considering your specific healthcare needs and financial situation. Here are some factors to help you make an informed decision:

Assess Your Healthcare Needs

Think about your current and potential future healthcare needs. If you have a chronic condition or require frequent medical care, a more comprehensive Medigap plan might be beneficial. On the other hand, if you’re generally healthy and rarely need medical services, a basic plan might suffice.

Evaluate Your Budget

Medigap policies come with monthly premiums, which can vary significantly depending on the plan and the insurance company. Consider your financial situation and choose a plan that fits your budget. Remember that while a more comprehensive plan might have a higher premium, it could save you money in the long run by covering more out-of-pocket expenses.

Compare Multiple Plans

Don’t settle for the first plan you come across. Compare different Medigap policies offered by various insurance companies. Look at the benefits, premiums, and any additional features or discounts they might offer. You can use online comparison tools or consult with an insurance agent or broker who specializes in Medicare plans.

Consider Your Prescription Drug Needs

As mentioned earlier, Medigap policies don’t cover prescription drugs. If you take prescription medications regularly, you’ll need to enroll in a separate Medicare Part D plan. Some insurance companies offer Medigap and Part D plans as a bundle, which can simplify your coverage and potentially save you money.

Research Insurance Company Reputation

When choosing a Medigap policy, it’s essential to consider the reputation and financial stability of the insurance company. Look for companies with a strong track record of customer satisfaction and timely claim payments. You can check ratings and reviews from independent sources to get an idea of the company’s performance.

The Benefits of Medigap

Medigap policies offer several advantages that make them an attractive option for individuals seeking comprehensive healthcare coverage:

Comprehensive Coverage

Medigap policies fill the gaps in Original Medicare, providing coverage for deductibles, coinsurance, and copayments. This means you won’t be faced with unexpected out-of-pocket expenses, making your healthcare more predictable and financially manageable.

Flexibility and Choice

With Medigap, you have the flexibility to choose from a range of standardized plans. This allows you to select a plan that best fits your healthcare needs and budget. Additionally, you can choose to purchase Medigap from any private insurance company authorized to sell these policies in your state, giving you a wide range of options.

Portability

If you move or switch insurance companies, your Medigap coverage remains the same. This portability ensures that your healthcare coverage is not affected by changes in your geographical location or insurance provider.

No Network Restrictions

Medigap policies don’t have networks, which means you can visit any doctor or hospital that accepts Medicare. This provides you with a wide range of healthcare providers to choose from, ensuring you have access to the care you need when you need it.

Potential Drawbacks of Medigap

While Medigap policies offer numerous advantages, there are some potential drawbacks to consider:

Limited Enrollment Periods

As mentioned earlier, you have a limited window of opportunity to enroll in Medigap without medical underwriting. After this initial enrollment period, you may face challenges in obtaining coverage or higher premiums due to pre-existing conditions.

Premiums and Cost Sharing

Medigap policies come with monthly premiums, which can be costly, especially for comprehensive plans. Additionally, some plans have cost-sharing provisions, meaning you’ll still have out-of-pocket expenses, albeit reduced compared to Original Medicare.

No Prescription Drug Coverage

Medigap policies don’t cover prescription drugs, so you’ll need to enroll in a separate Medicare Part D plan if you require prescription medication coverage.

Medigap vs. Medicare Advantage

When considering your Medicare options, you might also come across Medicare Advantage plans. These plans, also known as Part C, are an alternative to Original Medicare and Medigap. Here’s a comparison to help you understand the differences:

| Aspect | Medigap | Medicare Advantage |

|---|---|---|

| Coverage | Supplements Original Medicare, covering deductibles, coinsurance, and copayments. | Provides all Medicare-covered services and often includes additional benefits like prescription drug coverage and vision/dental care. |

| Flexibility | Offers flexibility in choosing doctors and hospitals, as it doesn't have networks. | Typically has a network of providers, and you may need to stay within that network to avoid additional costs. |

| Premiums | Monthly premiums vary depending on the plan and insurance company, but can be costly for comprehensive coverage. | Premiums can be lower than Original Medicare, but may have additional costs for out-of-network services. |

| Enrollment | Enrollment is during specific periods, and you may face medical underwriting outside these periods. | Enrollment is during the Medicare Annual Enrollment Period, and you can switch plans during this time. |

The choice between Medigap and Medicare Advantage depends on your specific needs and preferences. Medigap provides more flexibility and comprehensive coverage, while Medicare Advantage often includes additional benefits and potentially lower premiums. It's essential to evaluate both options thoroughly before making a decision.

Conclusion

Medicare Supplemental Insurance, or Medigap, is a valuable tool for individuals seeking comprehensive healthcare coverage. By understanding the different Medigap policies, assessing your needs, and evaluating your options, you can make an informed decision about your healthcare coverage. Remember to consider your healthcare needs, budget, and the reputation of the insurance company when choosing a Medigap plan.

As you navigate the complex world of Medicare coverage, it's essential to stay informed and seek professional advice when needed. With the right Medigap policy, you can ensure that your healthcare needs are met and that you have the financial protection you deserve.

What is the difference between Medigap and Medicare Advantage plans?

+

Medigap is a supplemental insurance plan that fills the gaps in Original Medicare, while Medicare Advantage plans are an alternative to Original Medicare, offering all Medicare-covered services and sometimes additional benefits like prescription drug coverage.

When is the best time to enroll in a Medigap policy?

+

The best time to enroll in a Medigap policy is during your Medicare Initial Enrollment Period, which is the 7-month period that includes the month of your 65th birthday. During this time, you can enroll without undergoing medical underwriting.

Do all Medigap policies cover prescription drugs?

+

No, Medigap policies do not cover prescription drugs. If you require prescription medication coverage, you’ll need to enroll in a separate Medicare Part D plan.

Can I switch Medigap policies after my initial enrollment period?

+

Yes, you can switch Medigap policies after your initial enrollment period, but you may face medical underwriting and potentially higher premiums. It’s best to consult with an insurance professional before making any changes.