Best Price Auto Insurance

When it comes to finding the best price for auto insurance, it's essential to understand the factors that influence rates and the strategies to secure the most affordable coverage. With the vast array of insurance providers and policies available, it can be a daunting task to navigate the market and make an informed decision. This comprehensive guide will delve into the world of auto insurance, providing valuable insights and practical tips to help you secure the best price while ensuring adequate coverage for your vehicle.

Understanding Auto Insurance: The Fundamentals

Auto insurance is a contract between you and an insurance provider that offers financial protection against potential losses or damages caused by vehicle-related incidents. It’s a crucial aspect of responsible car ownership, providing peace of mind and ensuring that you’re not left financially devastated in the event of an accident. However, with the myriad of coverage options and add-ons available, it’s easy to get overwhelmed and end up paying more than necessary.

The first step towards securing the best price for your auto insurance is to grasp the fundamental concepts and the key factors that influence rates. By understanding these elements, you can make informed decisions and negotiate with insurance providers to get the most competitive rates.

Key Factors Influencing Auto Insurance Rates

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role in determining your insurance rates. Additionally, the purpose for which you use your vehicle (e.g., personal, business, or pleasure) can impact the premium.

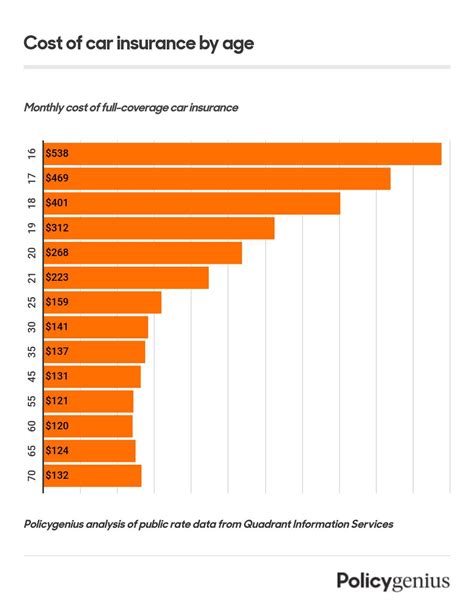

- Driver’s Profile: Your age, gender, driving history, and even your credit score can affect your insurance rates. Younger drivers, for instance, often pay higher premiums due to their perceived higher risk on the road.

- Location and Address: The area where you live and where your vehicle is typically parked can influence rates. Urban areas with higher traffic volumes and crime rates may result in higher insurance costs.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles can greatly impact your premium. Higher coverage limits and lower deductibles typically lead to higher premiums.

- Insurance Provider and Policy Type: Different insurance companies offer varying rates and policy options. The type of policy you select, such as comprehensive, collision, or liability-only, will also affect your overall cost.

Comparing and Negotiating: Strategies for the Best Price

Now that we’ve established the key factors influencing auto insurance rates, let’s explore some practical strategies to help you secure the best price.

Research and Compare

Before committing to a specific insurance provider, take the time to research and compare different companies and their offerings. Online comparison tools and insurance aggregators can be incredibly useful in this regard, allowing you to quickly assess a range of providers and their rates.

When comparing insurance quotes, pay attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Ensure that you're comparing apples to apples, considering similar coverage levels and policy types to make an accurate assessment.

Understand Your Options

Auto insurance policies come in various forms, and understanding the different options available can help you make more informed choices. Here’s a breakdown of some common policy types:

- Liability Coverage: This is the most basic form of auto insurance, covering damages or injuries you cause to others in an accident. It's required by law in most states, but the minimum coverage limits can vary.

- Collision Coverage: This type of insurance covers damage to your vehicle in the event of a collision, regardless of who is at fault. It's an optional coverage but is often recommended, especially for newer vehicles.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal-related incidents. Like collision coverage, it's optional but can be valuable for comprehensive protection.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It's an important consideration, especially in areas with a high prevalence of uninsured drivers.

Utilize Discounts and Savings

Insurance providers often offer a variety of discounts and savings opportunities to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

- Safe Driver Discounts: Insurance companies reward safe driving habits by offering discounts to drivers with clean records and no recent accidents or violations.

- Student Discounts: Many providers offer discounts to students with good academic standing, as well as to young drivers who complete approved driver training courses.

- Payment Method Discounts: Some insurance companies offer discounts for paying your premium in full or using automatic payment methods.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can lead to loyalty discounts, rewarding your long-term commitment.

Negotiate and Ask for Better Rates

Don’t be afraid to negotiate with insurance providers. Many companies are willing to work with you to secure your business, especially if you have a strong driving record and a history of safe driving.

When negotiating, highlight your positive driving history, any safety features on your vehicle, and any other factors that might reduce your risk profile. Additionally, ask about any available discounts and how you can qualify for them. Remember, insurance providers want your business, so leverage this to your advantage and aim for the best possible rate.

Maximizing Savings: Additional Tips and Tricks

Beyond comparing rates and negotiating with providers, there are several additional strategies you can employ to maximize your savings on auto insurance.

Improve Your Driving Record

A clean driving record is one of the most effective ways to reduce your insurance premiums. Avoid speeding tickets, maintain a safe driving distance, and always follow traffic laws. By demonstrating responsible driving behavior, you’ll be seen as a lower-risk driver, which can lead to significant savings.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept that rewards safe driving habits. These policies use a device or app to track your driving behavior, including mileage, speed, and braking habits. If you drive safely and limit your mileage, you can potentially qualify for lower premiums.

Raise Your Deductibles

Opting for higher deductibles can lead to lower premiums. However, it’s important to ensure that you can afford the higher deductible in the event of an accident. Raising your deductible is a strategy that works best for responsible drivers who are confident in their ability to avoid accidents.

Review Your Coverage Annually

Insurance needs can change over time, so it’s important to review your coverage annually. As your life circumstances change, your insurance requirements may also change. For instance, if you’ve paid off your car loan, you may no longer need collision or comprehensive coverage. Regularly reviewing your coverage ensures that you’re not overpaying for unnecessary coverage.

Shop Around Regularly

Insurance rates can fluctuate, and new providers may enter the market with competitive offers. It’s a good practice to shop around for auto insurance every few years to ensure you’re still getting the best deal. Don’t be afraid to switch providers if you find a better offer elsewhere.

FAQs

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and you’re not overpaying for unnecessary features.

Can I get auto insurance without a credit check?

+Some insurance providers offer policies without requiring a credit check. However, it’s important to note that your credit score is often a significant factor in determining your insurance rates. Policies without a credit check may come with higher premiums.

What is the average cost of auto insurance per year?

+The average cost of auto insurance can vary significantly depending on your location, driving record, and the type of coverage you choose. According to recent data, the national average for auto insurance premiums is around $1,674 per year. However, this can range from a few hundred dollars to several thousand dollars, so it’s crucial to shop around and compare rates.

By understanding the fundamentals of auto insurance and employing strategic approaches to comparison and negotiation, you can secure the best price for your coverage. Remember, auto insurance is an essential investment to protect yourself and your vehicle, so take the time to find the right policy at the right price.