Best Price For Car Insurance

Finding the best price for car insurance is a priority for many drivers, and it's an important aspect of financial planning and responsible vehicle ownership. With the multitude of insurance providers and policies available, navigating the market to secure the most cost-effective coverage can be a complex task. This article aims to provide a comprehensive guide to help you understand the factors that influence car insurance rates and offer strategies to identify the best deals, ensuring you receive the coverage you need at a price that suits your budget.

Understanding the Factors that Affect Car Insurance Rates

The cost of car insurance is influenced by a variety of factors, and recognizing these elements is key to making informed decisions about your coverage. Here are some of the primary considerations that impact insurance rates:

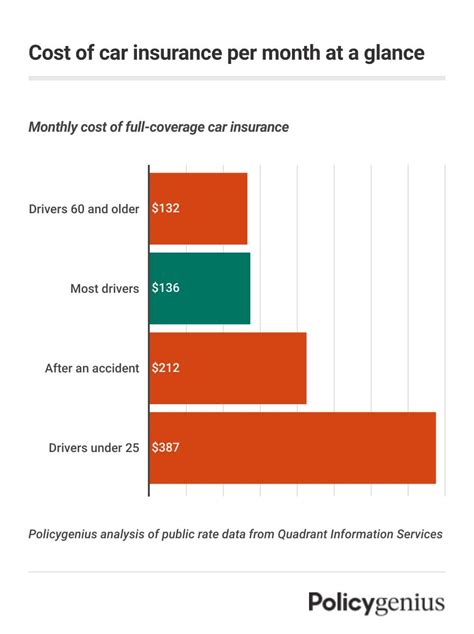

- Driver Profile: Your age, gender, driving record, and credit score all play a role in determining your insurance rates. Young drivers, for instance, are often considered higher risk and may face higher premiums. Similarly, a history of traffic violations or accidents can lead to increased costs.

- Vehicle Type: The make, model, and year of your vehicle can significantly affect your insurance rates. Sports cars and luxury vehicles typically attract higher premiums due to their expensive repair costs and higher likelihood of theft. On the other hand, sedans and compact cars are often more affordable to insure.

- Coverage Options: The level of coverage you choose will directly impact your insurance costs. Comprehensive and collision coverage, while offering more protection, will increase your premiums. Conversely, opting for higher deductibles can lower your monthly payments.

- Location: Insurance rates vary widely depending on your geographical location. Urban areas often have higher rates due to increased traffic and the risk of accidents. Additionally, regions with a history of natural disasters or high crime rates may also see elevated insurance costs.

- Insurance Provider: Different insurance companies have varying pricing structures and policy offerings. Some providers may specialize in certain types of coverage or offer discounts for specific groups of drivers. It's important to shop around and compare quotes to find the best deal.

Strategies to Find the Best Car Insurance Prices

With a solid understanding of the factors that influence car insurance rates, you can employ effective strategies to locate the best prices. Here are some practical tips to help you in your search:

Compare Multiple Quotes

One of the most effective ways to find affordable car insurance is to compare quotes from various providers. Online comparison tools can simplify this process by allowing you to quickly gather multiple quotes based on your specific needs and circumstances. Take advantage of these tools to get a clear picture of the market and identify the most competitive rates.

Research Discounts

Insurance providers often offer a range of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include those for safe driving records, loyalty, bundling multiple policies, and vehicle safety features. Research the discounts offered by different providers and ensure you’re taking advantage of all applicable opportunities.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This not only simplifies your insurance management but can also result in substantial savings. By bundling your policies, you may be eligible for reduced rates on all your insurance needs.

Shop Around Regularly

Car insurance rates can change over time, so it’s important to regularly review your options. Even if you’re happy with your current provider, shopping around at least once a year can help you stay informed about market rates and ensure you’re not overpaying. Keep an eye out for new providers entering the market or changes in existing providers’ offerings.

Negotiate Your Rates

Don’t be afraid to negotiate with your insurance provider. If you’ve been a loyal customer or have a strong safety record, you may be able to secure a better rate. Contact your provider and discuss your options, highlighting any changes in your circumstances or improvements in your driving record that could justify a lower premium.

Review Your Coverage Regularly

Regularly reviewing your insurance coverage can help you identify areas where you may be overinsured or where you could benefit from additional protection. As your life circumstances change, so might your insurance needs. Ensure your coverage remains aligned with your current requirements to avoid paying for unnecessary features.

Conclusion: Securing the Best Value in Car Insurance

Finding the best price for car insurance requires a thoughtful approach that considers a range of factors and employs strategic tactics. By understanding the elements that influence insurance rates and utilizing effective comparison and negotiation techniques, you can secure the coverage you need at a price that fits your budget. Remember, the key to successful car insurance management is staying informed, regularly reviewing your options, and making informed decisions based on your unique circumstances.

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not paying for unnecessary features.

Can I switch insurance providers mid-policy term?

+

Yes, you can switch insurance providers at any time, although you may incur a cancellation fee if you cancel your policy before its renewal date. It’s important to ensure your new policy is in place before canceling your old one to avoid a lapse in coverage.

What factors can I control to lower my car insurance rates?

+

You can control several factors to lower your car insurance rates, including maintaining a clean driving record, improving your credit score, choosing a vehicle with lower repair and maintenance costs, and shopping around for the best deals.