Best Prices Car Insurance

In the complex world of automotive coverage, finding the best prices for car insurance is a quest that many drivers embark upon. With a myriad of factors influencing premiums, from personal driving records to the make and model of your vehicle, it's essential to navigate this landscape with precision and insight. This comprehensive guide aims to illuminate the path toward securing the most advantageous rates, offering an in-depth exploration of strategies, insights, and the latest trends in the insurance market.

Understanding the Fundamentals of Car Insurance Pricing

At its core, the price of car insurance is a reflection of the perceived risk associated with insuring a specific driver and vehicle. Insurance companies utilize a meticulous process to assess this risk, factoring in elements such as:

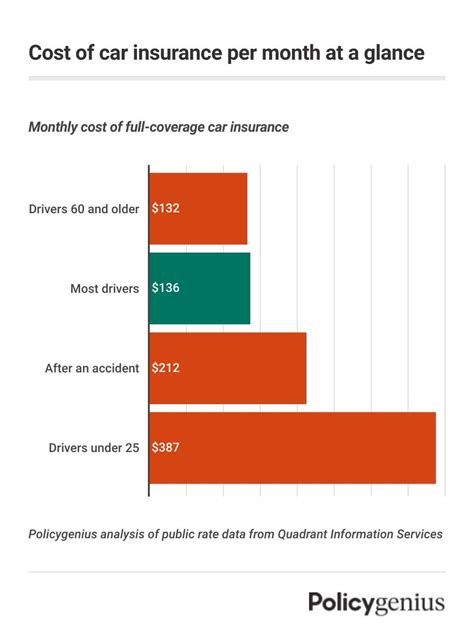

- Driver Profile: Your age, gender, driving history, and even your credit score can significantly impact your insurance rates. Younger drivers, for instance, often face higher premiums due to their statistically higher accident risk.

- Vehicle Details: The make, model, and year of your car matter. Vehicles with higher safety ratings or those less prone to theft may enjoy more competitive rates. Additionally, the primary use of your vehicle (commuting, pleasure, or business) can influence pricing.

- Location: Where you reside and where you typically drive your vehicle play a pivotal role. Urban areas often have higher premiums due to increased traffic congestion and the potential for accidents and theft.

- Coverage Types and Limits: The type and extent of coverage you choose will directly affect your premium. From liability coverage to comprehensive and collision insurance, each adds a layer of protection - and cost.

- Discounts and Bundling: Insurance providers frequently offer discounts for various reasons, such as safe driving, loyalty, or bundling multiple policies (e.g., auto and home insurance) with the same company.

Grasping these fundamentals is the first step toward becoming a savvy consumer in the car insurance market. It empowers you to make informed decisions and potentially negotiate better rates.

Strategies to Secure the Best Prices

Securing the most competitive rates on car insurance requires a strategic approach. Here are some actionable tips to consider:

Shop Around and Compare

The insurance market is highly competitive, and prices can vary significantly between providers. Use online comparison tools or solicit quotes from multiple insurers to identify the most cost-effective option for your needs. Be sure to compare not just the price, but also the coverage offered to ensure you’re getting a comprehensive policy at a competitive rate.

Optimize Your Policy

Review your existing policy to ensure you’re not overinsured or paying for unnecessary coverage. Assess your needs and adjust your policy accordingly. For example, if you have an older vehicle with a low market value, you might consider dropping collision or comprehensive coverage, which could significantly reduce your premiums.

Utilize Discounts and Rewards

Insurance companies offer a range of discounts and rewards to attract and retain customers. These can include safe driving discounts, loyalty rewards, multi-policy discounts, and discounts for vehicle safety features. Ensure you’re taking advantage of all applicable discounts to reduce your premiums.

Improve Your Driving Record

A clean driving record is one of the most effective ways to lower your insurance premiums. Avoid traffic violations and at-fault accidents, as these can significantly increase your rates. Additionally, consider enrolling in a defensive driving course, which can often lead to reduced premiums and a better understanding of safe driving practices.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses data from a device installed in your vehicle to monitor your driving habits. This data is then used to adjust your premiums accordingly. If you’re a safe and cautious driver, this type of insurance can lead to significant savings.

Review and Negotiate Regularly

Insurance rates can fluctuate over time due to various factors, including changes in your personal circumstances, market conditions, and insurer policies. Regularly review your policy and compare it with other providers to ensure you’re still getting the best deal. Don’t hesitate to negotiate with your insurer, especially if you’ve been a loyal customer or your circumstances have changed significantly.

The Impact of Technological Advances

The insurance industry is rapidly evolving with the advent of new technologies. Here’s how some key advancements are shaping the car insurance landscape:

Telematics and Usage-Based Insurance

As mentioned earlier, telematics technology is transforming the way insurance is priced. By providing real-time data on driving behavior, insurers can offer more accurate and personalized premiums. This technology also encourages safer driving habits, leading to reduced accidents and lower insurance costs over time.

AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are being leveraged by insurers to analyze vast amounts of data and identify patterns that can predict risk more accurately. These technologies can consider a broader range of factors, such as weather conditions, traffic patterns, and even individual driving behavior, to offer more precise and competitive pricing.

Digital Transformation

The shift towards digital insurance is another significant trend. With the rise of online platforms and mobile apps, consumers can now easily compare policies, purchase coverage, and manage their insurance needs with just a few clicks. This increased accessibility and convenience have made it simpler for consumers to shop around and find the best prices.

Future Trends and Implications

Looking ahead, several emerging trends are set to shape the car insurance market and influence pricing strategies. Here are some key developments to watch:

Autonomous Vehicles

The advent of self-driving cars is expected to significantly reduce the number of accidents, leading to lower insurance premiums over time. However, the initial introduction of autonomous vehicles may cause a surge in premiums as insurers grapple with the new risks and liability issues associated with this technology.

Data-Driven Insurance

With the continued advancement of data analytics and AI, insurers will increasingly rely on data-driven models to assess risk and price policies. This shift towards data-driven insurance will likely lead to more precise and personalized pricing, ensuring that consumers pay rates that accurately reflect their risk profile.

Emerging Technologies

The insurance industry is also exploring the potential of emerging technologies such as blockchain and Internet of Things (IoT) devices. Blockchain can enhance data security and streamline claims processes, while IoT devices can provide real-time data on vehicle performance and driver behavior, leading to more accurate risk assessment and potentially lower premiums.

Regulatory Changes

Changes in government regulations and laws can significantly impact the car insurance market. For example, shifts in liability laws or the introduction of new safety standards can influence insurance premiums. It’s essential to stay informed about these changes to understand how they might affect your insurance costs.

Conclusion

Securing the best prices for car insurance is a multifaceted task that requires a combination of knowledge, strategy, and adaptability. By understanding the factors that influence pricing, adopting a proactive approach to shopping around and comparing policies, and staying abreast of the latest technological and regulatory developments, you can position yourself to secure the most competitive rates. Remember, the car insurance market is dynamic, and by staying informed and engaged, you can make the most of the opportunities it presents.

How often should I review my car insurance policy to ensure I’m getting the best price?

+It’s recommended to review your policy annually, or whenever your circumstances change significantly. This ensures you’re always aware of any new discounts or policy changes that could impact your premiums.

What are some common discounts offered by car insurance providers?

+Common discounts include safe driving, loyalty, multi-policy, vehicle safety features, and defensive driving course completion. Each insurer may offer a unique set of discounts, so it’s worth exploring these options when comparing policies.

How can I improve my driving record to lower my insurance premiums?

+To improve your driving record, avoid traffic violations and at-fault accidents. Consider taking a defensive driving course, which can often lead to reduced premiums and a better understanding of safe driving practices. Additionally, maintain a clean driving record by regularly checking for any errors or discrepancies in your driving history.