Best Prices On Auto Insurance

In the vast landscape of auto insurance, finding the best prices can be a challenging task. With numerous providers offering a myriad of coverage options, it's essential to navigate this market with an informed approach. This comprehensive guide aims to shed light on the factors that influence auto insurance rates and provide practical strategies to secure the most competitive prices without compromising on coverage quality.

Understanding the Fundamentals of Auto Insurance

Auto insurance is a contract between you and your insurance provider. It provides financial protection against potential physical damage, bodily injury, or liability arising from road accidents. The price of this protection, known as the premium, is determined by a complex interplay of factors, including your personal details, the type of vehicle you drive, and the level of coverage you choose.

Key Factors Influencing Auto Insurance Rates

Several critical factors come into play when insurers calculate your premium. These include:

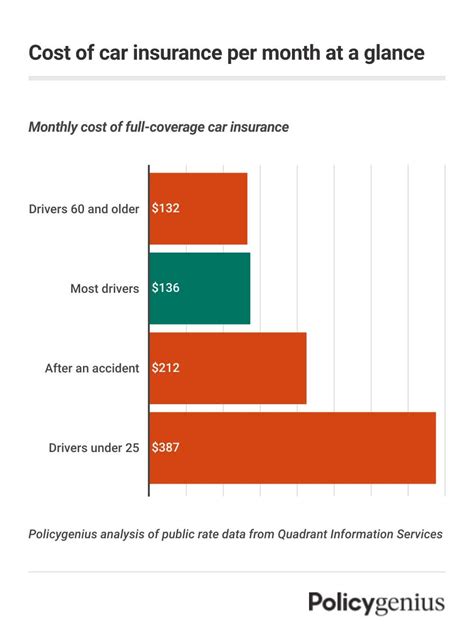

- Your Personal Profile: Age, gender, driving history, and even credit score can significantly impact your premium. Younger drivers, especially males, often face higher rates due to their perceived higher risk of accidents. A clean driving record and a good credit score can work in your favor, potentially lowering your insurance costs.

- Vehicle Type and Usage: The make, model, and year of your vehicle are crucial. High-performance cars or luxury vehicles generally attract higher premiums due to their costlier repairs. Additionally, the primary use of your vehicle (commuting, business, pleasure) and the average annual mileage can affect your rates.

- Coverage Level: The type and extent of coverage you opt for play a pivotal role. Basic liability coverage is mandatory in most states but offers limited protection. Comprehensive and collision coverage, although more expensive, provide broader protection against a range of incidents, from accidents to natural disasters.

- Location: Where you live and where you typically drive your vehicle matters. Urban areas often see higher insurance rates due to increased traffic and potential for accidents. Certain regions might also have higher rates of car theft or natural disasters, impacting insurance costs.

Strategies to Secure the Best Auto Insurance Prices

Navigating the auto insurance market strategically can lead to significant savings. Here are some effective approaches:

- Shop Around: Compare quotes from multiple insurers. Online comparison tools can provide a quick and efficient way to assess various options. Don’t settle for the first quote; explore different providers to find the best deal.

- Bundle Policies: If you have multiple insurance needs, such as home and auto, consider bundling them with the same insurer. Many providers offer substantial discounts for multiple policies, making it a cost-effective choice.

- Utilize Discounts: Insurers offer various discounts, including those for good driving records, safe driving habits, vehicle safety features, and even occupational or educational qualifications. Ensure you understand all the potential discounts and qualify for them.

- Review and Adjust Coverage: Regularly review your insurance policy to ensure it aligns with your current needs. If your circumstances have changed (e.g., you’ve purchased a new car or moved to a different area), adjust your coverage accordingly. Unnecessary coverage can drive up your premiums, so tailor your policy to your specific requirements.

- Consider Usage-Based Insurance: Some insurers offer policies that track your driving habits, such as miles driven, braking patterns, and time of day. If you’re a safe, low-mileage driver, this type of insurance can potentially lower your premiums.

The Impact of Credit Score on Auto Insurance Rates

Your credit score, a reflection of your financial health and reliability, plays an increasingly significant role in determining auto insurance rates. Insurers use credit-based insurance scores, derived from your credit report, to assess your potential risk. The logic is that individuals with higher credit scores are often viewed as more responsible and, consequently, are less likely to file claims.

| Credit Score Range | Potential Impact on Auto Insurance Rates |

|---|---|

| Excellent (720+) | Lower insurance rates due to perceived lower risk |

| Good (680-719) | Competitive rates, potentially with discounts |

| Fair (620-679) | May face higher rates, but discounts might still apply |

| Poor (619 and below) | Substantially higher rates, potentially with limited coverage options |

Improving Your Credit Score for Auto Insurance Savings

If your credit score is impacting your auto insurance rates negatively, taking steps to improve it can be beneficial. Here are some strategies:

- Check Your Credit Report: Start by obtaining a copy of your credit report from reputable sources like Equifax, Experian, or TransUnion. Review it for any errors or discrepancies and dispute any inaccuracies promptly.

- Pay Bills on Time: A proven track record of timely bill payments can boost your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: Aim to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your score.

- Build a Long Credit History: A longer credit history is generally viewed more favorably. If you have a limited credit history, consider adding accounts or using credit responsibly over a longer period.

Navigating Auto Insurance Claims

When an accident occurs, knowing how to navigate the claims process can impact both your financial and legal well-being. Here’s a step-by-step guide to help you through this process:

- Stay Calm and Safe: Ensure your safety and the safety of others involved. If possible, move your vehicle to a safe location away from traffic.

- Assess the Situation: Determine the extent of the damage and injuries. If necessary, call emergency services immediately.

- Gather Information: Collect the necessary details from the other party or parties involved, including their name, contact information, insurance details, and vehicle information. Take photos of the accident scene and any damage to vehicles.

- Contact Your Insurer: Notify your insurance provider as soon as possible. Provide them with all the relevant details and any documentation you’ve gathered. They will guide you through the claims process, including any necessary repairs or medical attention.

- Understand Your Coverage: Review your policy to understand the extent of your coverage. This will help you manage your expectations and ensure you receive the benefits you’re entitled to.

- Cooperate with Investigations: If an insurance adjuster or investigator needs to assess the accident, cooperate fully. Provide all necessary information and documentation to support your claim.

- Seek Legal Advice: If the accident was severe, resulting in significant injuries or property damage, consider consulting a personal injury lawyer. They can advise you on your rights and potential compensation.

Common Auto Insurance Claims Mistakes to Avoid

Navigating the claims process can be daunting, and making mistakes can potentially harm your case. Here are some common pitfalls to steer clear of:

- Delaying the Claims Process: Don’t delay reporting your claim. Prompt action can help speed up the process and potentially reduce the complexity of your case.

- Admitting Fault: Avoid admitting fault or discussing the accident details with anyone other than your insurer or legal representative. Let the insurance company or legal professionals handle the liability determination.

- Failing to Document Evidence: Take photos, videos, or detailed notes of the accident scene and any injuries. This evidence can be crucial in supporting your claim.

- Neglecting Medical Attention: If you’ve sustained injuries, seek medical attention promptly. Delaying medical care can complicate your claim, especially if the insurer argues that your injuries weren’t severe.

The Future of Auto Insurance: Emerging Trends

The auto insurance landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics, the technology that tracks and analyzes vehicle data, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, utilizes telematics to offer more personalized insurance rates based on an individual’s actual driving behavior. This data-driven approach provides a more accurate assessment of risk, potentially benefiting safe drivers with lower premiums.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are revolutionizing the way insurance claims are processed. These advanced tools can quickly analyze vast amounts of data, including accident reports, repair estimates, and even social media posts, to streamline the claims process and improve accuracy. By leveraging AI, insurers can offer faster, more efficient service to their policyholders.

Electric and Autonomous Vehicles

The rise of electric vehicles (EVs) and the impending advent of autonomous vehicles are set to disrupt the auto insurance market. EVs, with their lower maintenance and repair costs, could potentially lead to reduced insurance premiums. Autonomous vehicles, although still in their infancy, promise even greater safety, which could further drive down insurance costs in the long term.

Conclusion

Finding the best prices on auto insurance involves a comprehensive understanding of the market, your personal circumstances, and the evolving nature of the industry. By staying informed, comparing quotes, and making strategic choices, you can secure the coverage you need at a price that suits your budget. Remember, auto insurance is not just about cost; it’s about ensuring your safety and financial protection on the road.

How often should I review my auto insurance policy?

+

It’s a good practice to review your auto insurance policy annually, especially during your renewal period. This allows you to assess if your coverage still meets your needs and if you’re getting the best rates. Major life changes, such as purchasing a new vehicle, moving to a different area, or getting married, are also good times to review your policy.

Can I negotiate my auto insurance rates with my insurer?

+

While auto insurance rates are largely standardized, you can negotiate certain aspects with your insurer. For example, you might be able to negotiate the terms of your policy, the coverage limits, or the payment schedule. Additionally, if you’ve had a long-standing relationship with your insurer and have a good claims history, they might be willing to offer you a loyalty discount or other incentives.

What are some common exclusions in auto insurance policies?

+

Auto insurance policies typically exclude coverage for certain types of damage or incidents. Common exclusions include damage caused by normal wear and tear, intentional acts, or mechanical breakdowns not related to an accident. It’s important to review your policy carefully to understand what is and isn’t covered, as exclusions can vary significantly between providers.