Best Private Insurance Plans

The world of private insurance is vast and varied, offering individuals and families a wide range of options to protect their health and well-being. From comprehensive coverage to specialized plans, choosing the best private insurance plan can be a daunting task. This comprehensive guide aims to delve into the intricacies of private insurance, providing an expert analysis to help you make an informed decision.

Understanding Private Insurance: A Comprehensive Overview

Private insurance plans, distinct from government-funded or employer-sponsored schemes, are an essential component of the healthcare system in many countries. These plans offer individuals the flexibility to choose their coverage, providers, and benefits, catering to diverse healthcare needs and preferences.

The private insurance market is highly competitive, with numerous providers offering a plethora of plans. This diversity allows individuals to tailor their insurance coverage to their specific needs, whether it's comprehensive health insurance, dental care, vision coverage, or specialized plans for specific conditions or treatments.

The Importance of Private Insurance

Private insurance plays a crucial role in ensuring access to quality healthcare. It provides individuals with the financial protection they need to seek medical care without worrying about the associated costs. With the right private insurance plan, individuals can access a wide network of healthcare providers, including specialists and advanced medical facilities, ensuring they receive the best possible care.

Moreover, private insurance often offers additional benefits such as faster appointment times, personalized care, and access to innovative treatments and technologies. It empowers individuals to take control of their health and make informed decisions about their well-being.

Factors to Consider When Choosing a Private Insurance Plan

Selecting the best private insurance plan involves careful consideration of various factors. Here's an in-depth look at the key aspects to guide your decision-making process.

Coverage and Benefits

The coverage and benefits offered by a private insurance plan are arguably the most critical factors. These include:

- Medical Expenses: Comprehensive plans typically cover a wide range of medical expenses, including hospitalization, surgery, outpatient care, and prescription drugs. Look for plans that offer generous coverage limits and minimal out-of-pocket expenses.

- Preventive Care: Private insurance plans often cover preventive services such as vaccinations, annual check-ups, and screenings. Ensure that the plan you choose provides adequate coverage for these essential health maintenance measures.

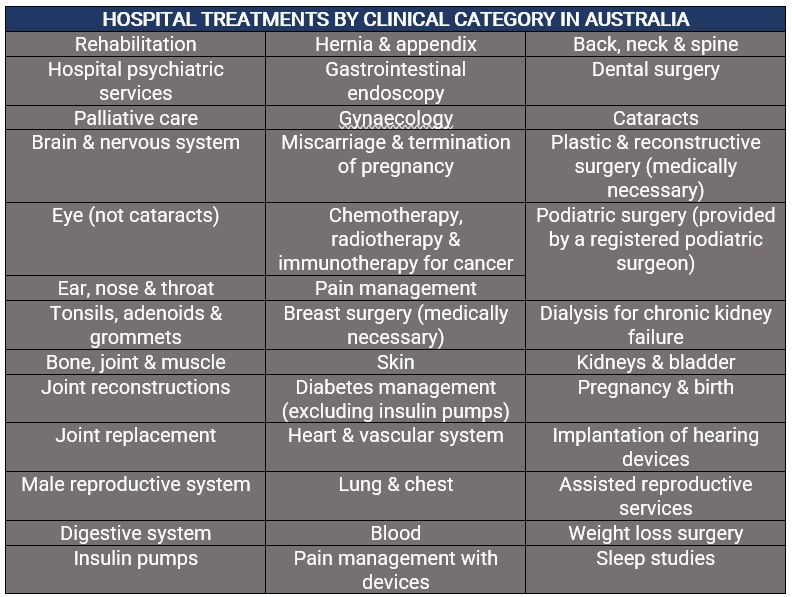

- Specialized Treatments: If you have specific health concerns or require specialized treatments, choose a plan that caters to your needs. This could include coverage for mental health services, maternity care, or specific chronic conditions.

- Dental and Vision: Consider adding dental and vision coverage to your plan. These additional benefits can significantly enhance your overall healthcare experience and ensure comprehensive protection.

Network of Healthcare Providers

The network of healthcare providers associated with a private insurance plan is another crucial factor. Here's what you should look for:

- In-Network Providers: Opt for a plan with a broad network of in-network providers. This ensures that you have access to a wide range of healthcare professionals and facilities without incurring additional costs.

- Out-of-Network Options: While in-network providers are preferred, it's essential to have some flexibility. Look for plans that offer reasonable coverage for out-of-network services, especially if you have a preferred specialist or facility outside the network.

- Specialist Access: Ensure that the plan's network includes specialists relevant to your health needs. This is particularly important if you have specific conditions that require specialized care.

Cost and Financial Considerations

The cost of private insurance is a significant factor, and it's essential to strike a balance between coverage and affordability. Here's how to approach this aspect:

- Premiums: Compare the premiums of different plans. While a lower premium might be attractive, ensure that it doesn't compromise the coverage and benefits you require.

- Deductibles and Co-pays: Understand the deductibles and co-pays associated with the plan. Higher deductibles can lead to lower premiums, but they also mean you'll have to pay more out-of-pocket before the insurance coverage kicks in.

- Out-of-Pocket Limits: Look for plans with reasonable out-of-pocket limits. This ensures that your financial liability is capped, providing peace of mind in case of significant medical expenses.

- Discounts and Subsidies: Explore potential discounts or subsidies you might be eligible for. Some providers offer incentives for healthy lifestyles or loyalty, which can significantly reduce your overall costs.

Plan Flexibility and Customization

The best private insurance plans offer flexibility and customization to meet individual needs. Consider the following aspects:

- Customizable Benefits: Choose a plan that allows you to tailor the benefits to your specific needs. This could include adding optional riders for specific conditions or increasing coverage limits for certain services.

- Plan Renewal and Changes: Understand the renewal process and any potential changes to the plan. Some providers offer flexible renewal options, allowing you to adjust your coverage as your needs evolve.

- Add-on Services: Look for plans that offer additional services or perks, such as wellness programs, travel insurance, or access to health and wellness apps. These add-ons can enhance your overall healthcare experience.

Top Private Insurance Plans: A Comparative Analysis

With a clear understanding of the factors to consider, let's delve into a comparative analysis of some of the top private insurance plans available in the market.

Plan A: Comprehensive Health Insurance

Coverage and Benefits: Plan A offers a comprehensive range of benefits, including hospitalization, surgery, and outpatient care. It provides generous coverage limits, ensuring minimal out-of-pocket expenses. Additionally, it covers a wide range of preventive services and includes dental and vision coverage.

Network: Plan A boasts an extensive network of healthcare providers, including top-rated hospitals and specialists. With over 10,000 in-network providers, you can access quality care across the country.

Cost: The premium for Plan A is slightly higher than average, but it offers significant value with its comprehensive coverage and minimal deductibles. The out-of-pocket limit is capped at $5,000, providing financial protection in case of major medical expenses.

Flexibility: Plan A allows for customization, enabling you to add optional riders for specific conditions. It also offers a wellness program with discounts on gym memberships and healthy lifestyle choices.

Plan B: Specialized Coverage

Coverage and Benefits: Plan B is designed for individuals with specific health needs. It offers specialized coverage for chronic conditions, including diabetes, heart disease, and mental health disorders. The plan provides access to a dedicated team of specialists and innovative treatments.

Network: Plan B has a focused network of healthcare providers, ensuring that you receive specialized care from leading experts in the field. While the network is smaller, it includes some of the best facilities for specialized treatments.

Cost: The premium for Plan B is higher due to its specialized nature, but it offers significant peace of mind for individuals with specific health concerns. The plan has a lower deductible and a capped out-of-pocket limit, ensuring financial protection.

Flexibility: Plan B allows for customization based on individual needs. You can increase coverage limits for specific treatments or add additional benefits for travel or home healthcare.

Plan C: Affordable Essentials

Coverage and Benefits: Plan C is designed for individuals seeking essential coverage at an affordable price. It covers hospitalization, surgery, and basic outpatient care. While it has lower coverage limits, it still provides adequate protection for common medical needs.

Network: Plan C has a smaller network of providers, but it includes a range of reputable hospitals and clinics. While the network is more limited, it offers good coverage in major metropolitan areas.

Cost: The premium for Plan C is significantly lower than other plans, making it an attractive option for those on a tight budget. However, it has higher deductibles and out-of-pocket limits, which means you'll pay more if you require extensive medical care.

Flexibility: While Plan C doesn't offer extensive customization, it does provide the option to add dental and vision coverage for an additional cost. This allows you to enhance your coverage based on your specific needs.

Frequently Asked Questions

How do I choose the right private insurance plan for my family?

+When selecting a private insurance plan for your family, consider your family's healthcare needs and priorities. Assess the coverage requirements for each family member, including any specialized needs or pre-existing conditions. Evaluate the plan's network of providers to ensure accessibility to quality healthcare services. Compare the financial aspects, including premiums, deductibles, and out-of-pocket limits, to find a balance between coverage and affordability. Lastly, consider any additional benefits or perks that align with your family's well-being, such as wellness programs or travel insurance.

Can I switch private insurance plans if I'm not satisfied with my current coverage?

+Yes, you have the option to switch private insurance plans if you're dissatisfied with your current coverage. However, it's important to understand the renewal process and any potential restrictions or penalties associated with changing plans. Some providers offer flexible renewal options, allowing you to switch plans annually or semi-annually. Research and compare different plans to find one that better aligns with your needs and preferences.

What happens if I require medical treatment while traveling internationally with my private insurance plan?

+If you require medical treatment while traveling internationally, the extent of coverage provided by your private insurance plan may vary. Some plans offer international coverage, ensuring you receive medical care and assistance during your travels. However, it's crucial to review your plan's terms and conditions to understand the specific coverage limits, network of providers, and any potential out-of-pocket expenses. Consider adding travel insurance to your plan to enhance your protection while abroad.

Are there any tax benefits associated with private insurance plans?

+Yes, there are tax benefits associated with private insurance plans in certain countries. These benefits can vary depending on your jurisdiction and the specific plan you choose. Some plans may qualify for tax deductions or credits, reducing your overall tax liability. It's advisable to consult with a tax professional or financial advisor to understand the potential tax advantages of your private insurance plan and how to maximize your savings.

Choosing the best private insurance plan is a crucial decision that impacts your health and financial well-being. By understanding the factors to consider and comparing the top plans available, you can make an informed choice that aligns with your needs and priorities. Remember, private insurance is a personalized journey, and the right plan for you may differ from others. Take the time to evaluate your options, seek expert advice if needed, and make a decision that provides you with the peace of mind and protection you deserve.