Best Supplemental Insurance Medicare

Medicare, the federal health insurance program in the United States, provides comprehensive coverage for millions of seniors and individuals with disabilities. However, original Medicare (Parts A and B) has its limitations, including gaps in coverage for certain services and out-of-pocket expenses. This is where supplemental insurance, also known as Medicare Supplement or Medigap plans, steps in to offer additional protection and financial security.

Supplemental insurance for Medicare is designed to cover the "gaps" left by original Medicare, ensuring that beneficiaries have more comprehensive coverage and reduced out-of-pocket costs. These plans are particularly valuable for those who require ongoing medical care or wish to avoid unexpected medical bills. With a wide range of Medigap plans available, it's essential to understand the options to make an informed decision about the best supplemental insurance for your specific needs.

Understanding Medicare Supplemental Insurance

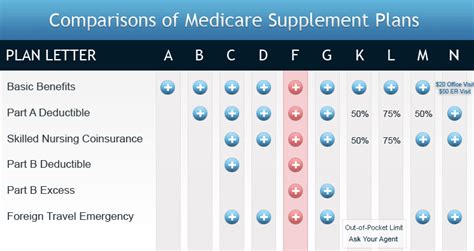

Medicare Supplement plans, often referred to as Medigap, are private insurance policies that cover the costs that original Medicare doesn't, such as copayments, coinsurance, and deductibles. These plans are standardized, meaning that Plan A in one insurance company will offer the same benefits as Plan A in another company. The key difference lies in the pricing and the additional perks that some companies may offer.

There are ten standardized Medigap plans, labeled A through N, with each plan offering a unique set of benefits. These plans are regulated by the federal government and are available to purchase from private insurance companies. It's important to note that not all Medigap plans are available in every state, and some insurance companies may offer only a select few plans.

Top Medigap Plans for 2023

When it comes to choosing the best supplemental insurance for Medicare, the decision largely depends on your individual needs and preferences. Here are some of the top Medigap plans for 2023, along with their key benefits and considerations.

Medigap Plan G

Plan G is one of the most comprehensive and popular Medigap plans available. It covers all Medicare Part A and Part B deductibles and copayments, except for the Medicare Part B deductible. Here's a breakdown of its coverage:

| Coverage | Plan G |

|---|---|

| Part A Deductible | ✔️ |

| Part B Deductible | ✖️ |

| Part A Coinsurance or Copayment | ✔️ |

| Part B Coinsurance or Copayment | ✔️ |

| Blood Deductible | ✔️ |

| Skilled Nursing Care Coinsurance | ✔️ |

| Foreign Travel Emergency | ✔️ |

Key Benefits: Plan G offers extensive coverage, ensuring that beneficiaries have minimal out-of-pocket expenses. It's an excellent choice for those who anticipate frequent medical visits and want comprehensive protection.

Considerations: While Plan G provides comprehensive coverage, it doesn't cover the Medicare Part B deductible, which is currently $233. This means you'll be responsible for this amount annually for Part B services.

Medigap Plan F

Plan F is another highly popular Medigap plan, known for its all-inclusive coverage. It covers all Medicare Part A and Part B deductibles and copayments, including the Medicare Part B deductible. Here's a breakdown of its coverage:

| Coverage | Plan F |

|---|---|

| Part A Deductible | ✔️ |

| Part B Deductible | ✔️ |

| Part A Coinsurance or Copayment | ✔️ |

| Part B Coinsurance or Copayment | ✔️ |

| Blood Deductible | ✔️ |

| Skilled Nursing Care Coinsurance | ✔️ |

| Foreign Travel Emergency | ✔️ |

Key Benefits: Plan F is ideal for individuals who want complete peace of mind and don't want to worry about any out-of-pocket expenses. It covers all the gaps in original Medicare, including the Part B deductible.

Considerations: Plan F is no longer available for newly eligible Medicare beneficiaries, which means you must have been eligible for Medicare before January 1, 2020, to enroll in this plan. Additionally, Plan F tends to be more expensive than other Medigap plans due to its comprehensive coverage.

Medigap Plan N

Plan N is a cost-effective Medigap plan that provides substantial coverage while keeping premiums lower than some other plans. It covers most of the gaps in original Medicare, with a few exceptions. Here's a breakdown of its coverage:

| Coverage | Plan N |

|---|---|

| Part A Deductible | ✔️ |

| Part B Deductible | ✖️ |

| Part A Coinsurance or Copayment | ✔️ |

| Part B Coinsurance or Copayment | ✖️ (up to $20 per visit) |

| Blood Deductible | ✔️ (up to 3 pints per year) |

| Skilled Nursing Care Coinsurance | ✔️ (days 21–100) |

| Foreign Travel Emergency | ✔️ |

Key Benefits: Plan N is an affordable option for those seeking good coverage without breaking the bank. It covers most of the significant gaps in original Medicare while keeping premiums relatively low.

Considerations: Plan N does not cover the Medicare Part B deductible, and you'll be responsible for a small copayment for certain Part B services. Additionally, it covers only a portion of skilled nursing care coinsurance and blood deductibles.

Medigap Plan K and Plan L

Plan K and Plan L are known as the "high-deductible" Medigap plans. They provide comprehensive coverage but require beneficiaries to pay a higher deductible before the insurance kicks in. Here's a breakdown of their coverage:

| Plan K | Plan L | |

|---|---|---|

| Part A Deductible | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Part B Deductible | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Part A Coinsurance or Copayment | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Part B Coinsurance or Copayment | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Blood Deductible | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Skilled Nursing Care Coinsurance | ✔️ (50% coverage) | ✔️ (75% coverage) |

| Foreign Travel Emergency | ✔️ (50% coverage) | ✔️ (75% coverage) |

Key Benefits: Plan K and Plan L are excellent options for those who are generally healthy and anticipate minimal medical expenses. They offer comprehensive coverage with lower premiums compared to other plans.

Considerations: These plans have a high deductible, which means you'll need to pay a significant amount out-of-pocket before the insurance coverage begins. Additionally, you'll be responsible for a higher percentage of certain costs compared to other Medigap plans.

Choosing the Right Medigap Plan

Selecting the best supplemental insurance for Medicare involves considering your health needs, budget, and preferences. Here are some key factors to keep in mind when choosing a Medigap plan:

- Coverage Needs: Assess your medical history and anticipate your future healthcare requirements. If you have chronic conditions or require frequent medical visits, a more comprehensive plan like Plan G or Plan F might be ideal. For those with fewer healthcare needs, Plan N or the high-deductible plans could be suitable.

- Budget: Medigap plans have varying premiums, and it's essential to choose a plan that aligns with your financial capabilities. Consider your overall financial situation and choose a plan that offers the right balance between coverage and affordability.

- Insurance Company Reputation: Research and select an insurance company with a solid reputation for customer service and claim handling. Check reviews and ratings to ensure you're choosing a reliable provider.

- Plan Availability: Not all Medigap plans are available in every state or from every insurance company. Check the availability of your preferred plan in your area and compare options from multiple companies.

Remember, you can only enroll in a Medigap plan during specific enrollment periods, so it's crucial to plan ahead and research your options well in advance.

Medigap vs. Medicare Advantage

It's essential to distinguish between Medigap plans and Medicare Advantage plans (Part C) when considering supplemental insurance. Medicare Advantage plans are an alternative to original Medicare and often include additional benefits like prescription drug coverage and vision care. These plans are administered by private insurance companies and may have networks of providers, unlike Medigap plans, which simply supplement original Medicare.

While Medicare Advantage plans can offer more comprehensive coverage, they may have limitations on provider choice and require you to receive care within their network. Medigap plans, on the other hand, provide more flexibility in choosing healthcare providers and are a good option for those who want to stick with original Medicare but need additional financial protection.

Future of Medicare Supplemental Insurance

The landscape of Medicare Supplemental Insurance is constantly evolving, with new plans and regulations being introduced periodically. As healthcare costs continue to rise, the need for comprehensive supplemental coverage becomes increasingly evident. Here are some key trends and developments to watch out for in the future of Medigap plans:

- Plan F Phase-Out: As mentioned earlier, Plan F is no longer available for newly eligible Medicare beneficiaries. This trend is likely to continue, with more emphasis on cost-sharing plans like Plan G and Plan N.

- High-Deductible Plans: The popularity of high-deductible plans, such as Plan K and Plan L, is expected to grow among those who prefer lower premiums and are comfortable with higher out-of-pocket expenses.

- Digital Innovation: Insurance companies are embracing digital technologies to enhance the Medigap experience. This includes online enrollment, digital claim submissions, and the use of mobile apps for policy management.

- Part D Integration: There may be increased efforts to integrate Medicare Part D prescription drug coverage with Medigap plans, providing a more comprehensive and convenient package for beneficiaries.

- Regulatory Changes: The federal government and state regulators may introduce new rules and regulations to ensure the stability and affordability of Medigap plans, particularly in response to changing healthcare dynamics.

Frequently Asked Questions

What is the difference between Medigap and Medicare Advantage plans?

+Medigap plans supplement original Medicare (Parts A and B), covering gaps in coverage and reducing out-of-pocket expenses. Medicare Advantage plans, on the other hand, are an alternative to original Medicare and often include additional benefits like prescription drug coverage and vision care. They may have provider networks and additional rules, unlike Medigap plans, which simply supplement Medicare without restrictions on providers.

Can I have both a Medigap plan and a Medicare Advantage plan?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. Medigap plans are designed to work with original Medicare, and having a Medicare Advantage plan means you are no longer covered by original Medicare. Therefore, you cannot have a Medigap plan if you are enrolled in a Medicare Advantage plan.

When can I enroll in a Medigap plan?

+The best time to enroll in a Medigap plan is during your Initial Enrollment Period, which starts when you turn 65 and are enrolled in Medicare Part B. This period typically lasts for six months, and enrolling during this time ensures that you can choose any Medigap plan available in your area without undergoing medical underwriting. Outside of this period, you may have limited options and face higher premiums or medical underwriting.

What is medical underwriting for Medigap plans?

+Medical underwriting is a process where insurance companies evaluate your health status before offering you a Medigap plan. They may review your medical history, current health conditions, and even prescription drug usage. Based on this evaluation, they may charge you higher premiums or even deny your application for coverage. Medical underwriting is typically not required during your Initial Enrollment Period or certain other special enrollment periods.

Are there any restrictions on switching Medigap plans?

+Yes, there are some restrictions on switching Medigap plans. You may have the opportunity to switch plans during specific enrollment periods, such as your Initial Enrollment Period or during certain special enrollment periods. However, you may face medical underwriting when switching plans outside of these periods, and your new plan may not offer the same benefits as your current plan. It’s essential to understand the rules and timing of enrollment periods to make informed decisions about switching Medigap plans.