Best Term Life Insurance Providers

Term life insurance is a popular and cost-effective way for individuals and families to secure financial protection for a specified period, typically ranging from 10 to 30 years. It provides a death benefit to beneficiaries if the insured person passes away during the policy term. This type of insurance is ideal for those seeking coverage for a defined period, such as during their working years when they have financial obligations and dependents to support.

Understanding Term Life Insurance

Term life insurance offers coverage for a set period, after which the policy expires. It is distinct from permanent life insurance, which provides lifelong coverage and often includes a cash value component. Term life insurance is designed to offer affordable protection during specific life stages, such as raising a family or paying off a mortgage.

The key advantage of term life insurance is its affordability. Premiums for term life insurance are generally lower compared to permanent life insurance, making it an accessible option for many. The death benefit paid out upon the insured's death can provide significant financial support to beneficiaries, helping them cover expenses like funeral costs, outstanding debts, or ongoing living expenses.

Choosing the Best Term Life Insurance Provider

Selecting the best term life insurance provider involves considering various factors to ensure you get the coverage that suits your needs and provides the best value. Here are some key considerations and leading providers to help guide your decision.

Factors to Consider

- Financial Strength and Stability: Opt for providers with a strong financial rating, ensuring they can honor claims even in challenging economic times. Ratings from reputable agencies like AM Best, Moody’s, and Standard & Poor’s provide valuable insights.

- Coverage Options and Flexibility: Choose a provider offering term lengths and coverage amounts that align with your needs. Some insurers offer terms of 10, 15, 20, or 30 years, while others provide more flexibility with annual renewable terms.

- Renewability and Convertibility: Look for policies that offer the option to renew or convert to permanent life insurance, providing ongoing coverage beyond the initial term.

- Rider Options: Riders are additional benefits that can enhance your policy. Common riders include accelerated death benefits, waiver of premium, and accidental death benefits. Ensure the provider offers riders that align with your specific needs.

- Customer Service and Claims Process: A responsive and efficient customer service team can make a significant difference, especially during times of need. Research providers’ reputations for timely claim processing and customer satisfaction.

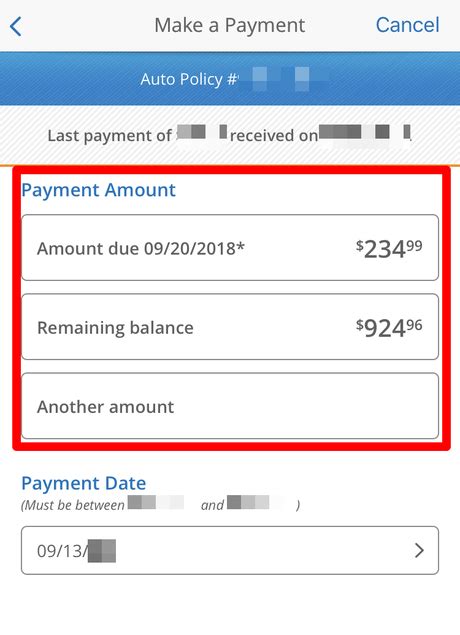

- Technology and Digital Tools: Many insurers now offer online applications, policy management, and claims filing. Consider providers with user-friendly digital platforms for a seamless experience.

- Pricing and Discounts: Compare quotes from different providers to find the most competitive rates. Some insurers offer discounts for healthy lifestyles, multiple policies, or membership in certain organizations.

Top Term Life Insurance Providers

Here are some of the leading term life insurance providers, along with their unique features and offerings:

Haven Life

Haven Life, a subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual), is known for its innovative approach to life insurance. They offer term life insurance policies with coverage amounts ranging from 100,000 to 3 million and terms of 10, 15, 20, or 30 years. Haven Life stands out for its simple and fast online application process, often providing coverage within minutes.

Key Features:

- Haven Term: A traditional term life insurance policy with coverage options up to $3 million.

- Simplified Issue: An accelerated underwriting process that may not require a medical exam for applicants under 50.

- Riders: Offers riders like the Child Rider, which provides a death benefit for minor children, and the Waiver of Premium Rider, which waives premiums if the insured becomes disabled.

State Farm

State Farm is a well-established insurance provider offering a range of insurance products, including term life insurance. They provide flexible term lengths of 10, 15, 20, or 30 years and coverage amounts up to $5 million. State Farm's term life insurance policies are known for their competitive pricing and comprehensive coverage options.

Key Features:

- Level Term: Provides a guaranteed death benefit and premium throughout the policy term.

- Increasing Term: Offers a death benefit that increases over time to keep pace with inflation and changing needs.

- Riders: Includes options like the Waiver of Premium Rider and the Accidental Death Benefit Rider.

Prudential

Prudential, also known as Pru, is a leading provider of life insurance and financial services. Their term life insurance policies offer coverage amounts up to $5 million and term lengths of 10, 15, 20, or 30 years. Prudential is known for its strong financial stability and innovative product offerings.

Key Features:

- Term Essentials: A basic term life insurance policy with affordable premiums.

- Custom Term: Allows customization of coverage amounts and term lengths to suit individual needs.

- Riders: Provides options like the Long-Term Care Rider, which offers a benefit for long-term care expenses, and the Accidental Death Benefit Rider.

Mutual of Omaha

Mutual of Omaha is a trusted provider of life insurance and other financial products. Their term life insurance policies offer coverage amounts up to $1 million and term lengths of 10, 20, or 30 years. Mutual of Omaha is known for its commitment to customer service and community involvement.

Key Features:

- Term Life Insurance: A traditional term life policy with guaranteed level premiums.

- Guaranteed Issue Life Insurance: A simplified issue policy that guarantees coverage regardless of health status, with limited coverage options.

- Riders: Includes the Child Rider and the Waiver of Premium Rider.

New York Life

New York Life is one of the largest mutual life insurance companies in the United States. They offer term life insurance policies with coverage amounts up to $10 million and term lengths of 10, 15, 20, or 30 years. New York Life is known for its financial strength and comprehensive product offerings.

Key Features:

- Level Term: Provides guaranteed level premiums and a death benefit throughout the policy term.

- Annual Renewable Term: Offers the flexibility to renew coverage annually, with premiums increasing each year.

- Riders: Includes options like the Accelerated Benefits Rider, which provides access to a portion of the death benefit if the insured is diagnosed with a terminal illness.

| Provider | Coverage Amount | Term Lengths | Key Features |

|---|---|---|---|

| Haven Life | $100,000 - $3 million | 10, 15, 20, 30 years | Fast online application, simplified issue option |

| State Farm | $500,000 - $5 million | 10, 15, 20, 30 years | Competitive pricing, increasing term option |

| Prudential | $500,000 - $5 million | 10, 15, 20, 30 years | Financial stability, custom term option |

| Mutual of Omaha | $100,000 - $1 million | 10, 20, 30 years | Community involvement, guaranteed issue option |

| New York Life | $1 million - $10 million | 10, 15, 20, 30 years | Financial strength, accelerated benefits rider |

How do I determine how much term life insurance coverage I need?

+

Determining the right amount of term life insurance coverage involves considering your financial obligations and the needs of your loved ones. A general rule of thumb is to have enough coverage to replace your income for at least 10 years, but it’s essential to tailor this amount to your specific circumstances. Factors to consider include outstanding debts, mortgage payments, education expenses for children, and any other financial responsibilities.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage simply expires, and you no longer have protection. However, many providers offer the option to renew or convert your policy to a permanent life insurance plan, ensuring ongoing coverage. It’s essential to review your policy’s terms and understand your options as the policy term approaches.

Can I add riders to my term life insurance policy to enhance coverage?

+

Yes, many term life insurance providers offer riders that allow you to customize your policy and enhance coverage. Common riders include waiver of premium, accidental death benefit, and long-term care benefits. These riders can provide additional protection for specific situations, so it’s worth exploring the options with your provider.