Best Travel Protection Insurance

Travel protection insurance is an essential consideration for anyone embarking on a journey, offering peace of mind and financial security in case of unforeseen circumstances. In an era where travel plans can be disrupted by a myriad of events, from natural disasters to medical emergencies, having the right insurance coverage is crucial. This comprehensive guide aims to delve into the world of travel protection insurance, exploring the best options available and providing an in-depth analysis to help travelers make informed decisions.

Understanding Travel Protection Insurance

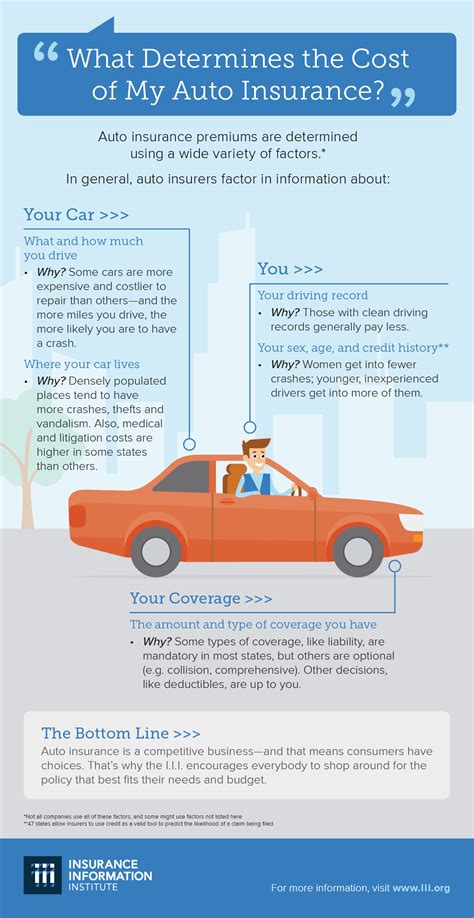

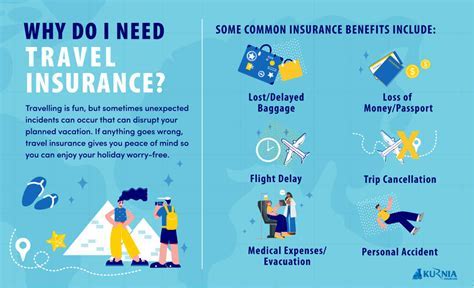

Travel protection insurance, often referred to as travel insurance, is a comprehensive policy designed to safeguard travelers against various risks and unforeseen events that may occur during their trip. It provides coverage for a range of potential issues, including trip cancellations, medical emergencies, lost luggage, and more. This type of insurance is especially valuable given the unpredictable nature of travel, ensuring that travelers can navigate unexpected situations with financial protection and support.

Key Components of Travel Protection Insurance

Travel protection insurance policies typically encompass several key components, each offering specific coverage and benefits. These include:

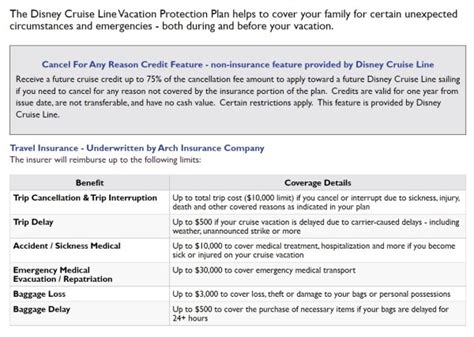

- Trip Cancellation and Interruption: Covers non-refundable trip costs if the journey is canceled or interrupted due to covered reasons, such as illness, injury, or natural disasters.

- Medical and Dental Coverage: Provides assistance for medical emergencies, including transportation to medical facilities, treatment costs, and even dental emergencies.

- Baggage and Personal Effects: Reimburses travelers for lost, stolen, or damaged luggage and personal items.

- Emergency Evacuation: Ensures travelers can be evacuated to a safe location or a medical facility if necessary, covering transportation costs.

- Travel Delay: Offers compensation for expenses incurred due to delays in travel, such as additional accommodation or meals.

- Identity Theft Protection: Aids travelers in resolving identity theft issues that may occur during their trip, providing resources and support.

Top Travel Protection Insurance Providers

When it comes to choosing the best travel protection insurance, several reputable providers offer comprehensive coverage. Here’s an overview of some of the top options in the market:

1. Allianz Travel Insurance

Allianz Travel Insurance is a leading provider known for its extensive coverage options. They offer plans suitable for various types of travelers, from leisure trips to business travels. Allianz’s policies cover a wide range of potential issues, including trip cancellations, medical emergencies, and travel delays. Their plans are customizable, allowing travelers to choose the level of coverage they require.

| Coverage Highlights | Allianz Travel Insurance |

|---|---|

| Trip Cancellation | Covers a broad range of reasons, including illness, injury, and natural disasters. |

| Medical Coverage | Provides up to $50,000 in medical expenses coverage and includes emergency medical evacuation. |

| Baggage Protection | Reimburses travelers for lost or damaged luggage and personal items. |

| Travel Delay | Offers compensation for delays of 6 hours or more, covering additional expenses. |

Expert Tip: Allianz Travel Insurance is an excellent choice for travelers seeking comprehensive coverage, especially those concerned about medical emergencies during their trip.

2. Travel Guard

Travel Guard is another well-known provider in the travel insurance industry. They offer a wide array of plans, catering to different travel needs and budgets. Travel Guard’s policies provide extensive coverage for trip cancellations, interruptions, and medical emergencies, making them a popular choice among travelers.

| Coverage Highlights | Travel Guard |

|---|---|

| Trip Cancellation | Covers a variety of reasons, including terrorism, natural disasters, and financial default of the travel supplier. |

| Medical Coverage | Offers up to $500,000 in medical expense coverage and includes emergency medical evacuation. |

| Baggage Protection | Reimburses travelers for lost, stolen, or delayed baggage and personal effects. |

| Travel Delay | Provides compensation for delays of 6 hours or more, covering additional expenses such as meals and accommodations. |

Expert Recommendation: Travel Guard is an ideal choice for travelers seeking flexible coverage options and extensive medical protection.

3. World Nomads

World Nomads is a travel insurance provider that caters specifically to adventurous travelers and those embarking on extended trips. Their policies are designed to cover a range of activities, including adventure sports and exploration. World Nomads offers customizable plans, allowing travelers to choose the coverage that aligns with their specific needs.

| Coverage Highlights | World Nomads |

|---|---|

| Trip Cancellation | Covers a variety of reasons, including natural disasters, terrorism, and unforeseen medical issues. |

| Medical Coverage | Provides up to $100,000 in medical expense coverage and includes emergency medical evacuation. |

| Adventure Sports | Covers a wide range of adventure activities, from hiking and scuba diving to bungee jumping and whitewater rafting. |

| Travel Delay | Offers compensation for delays of 12 hours or more, covering additional expenses. |

Traveler's Advantage: World Nomads is an excellent choice for adventurous travelers seeking coverage for their unique activities and extended journeys.

Comparative Analysis: Choosing the Best Travel Protection Insurance

When selecting the best travel protection insurance, it’s essential to consider your specific travel needs and preferences. Here’s a comparative analysis to help you make an informed decision:

Coverage Options

All three providers offer comprehensive coverage, but the specific details vary. Allianz Travel Insurance stands out for its customizable plans and extensive medical coverage, making it ideal for travelers with specific medical concerns. Travel Guard, on the other hand, offers the highest medical expense coverage and caters well to those seeking flexible options. World Nomads is tailored for adventurous travelers, providing coverage for a wide range of activities.

Premium Costs

The cost of travel protection insurance varies depending on the provider, coverage chosen, and the traveler’s destination. Allianz Travel Insurance and Travel Guard typically offer a range of plans with different premium costs, allowing travelers to choose based on their budget. World Nomads tends to be more affordable for extended trips and adventurous activities.

Customer Service and Support

All three providers have a strong reputation for excellent customer service and support. Allianz Travel Insurance and Travel Guard offer 24⁄7 assistance, ensuring travelers can access help whenever needed. World Nomads also provides around-the-clock support, making it convenient for travelers in different time zones.

Claims Process

The claims process can vary slightly between providers. Allianz Travel Insurance and Travel Guard have straightforward online claim processes, with Allianz offering a quick turnaround for approved claims. World Nomads also has an efficient claims process, with the added benefit of providing support in multiple languages.

Conclusion: Empowering Your Travel Experience

Travel protection insurance is an invaluable tool for travelers, offering security and peace of mind during their journeys. By choosing the right insurance provider and understanding the coverage options, travelers can ensure they are prepared for any unforeseen circumstances. Whether it’s medical emergencies, trip cancellations, or lost luggage, having the right travel protection insurance can make a significant difference in how travelers navigate these challenges.

Remember, when selecting travel protection insurance, consider your specific travel needs, budget, and the destinations you plan to visit. By doing so, you can make an informed decision and enjoy your travels with the confidence that you are protected.

What is the difference between travel insurance and travel protection insurance?

+Travel insurance and travel protection insurance are often used interchangeably, referring to the same type of coverage. Travel protection insurance is a more specific term, emphasizing the comprehensive nature of the coverage, which includes trip cancellations, medical emergencies, and other potential issues.

Is travel protection insurance necessary for all trips?

+While travel protection insurance is not mandatory, it is highly recommended, especially for international trips or journeys involving high-risk activities. It provides financial protection and peace of mind in case of unexpected events, ensuring travelers can navigate challenges with support.

How do I choose the right travel protection insurance provider?

+When choosing a travel protection insurance provider, consider your specific travel needs, the destinations you plan to visit, and your budget. Review the coverage options, premium costs, customer service, and claims process to make an informed decision.

Can I purchase travel protection insurance after my trip has started?

+In most cases, travel protection insurance needs to be purchased before your trip starts. Some providers offer limited coverage for existing trips, but it’s best to purchase insurance as early as possible to ensure comprehensive coverage.

What should I do if I need to make a claim while traveling?

+If you need to make a claim while traveling, contact your insurance provider’s 24⁄7 assistance line. They will guide you through the claims process, which typically involves providing documentation and proof of the incident or loss.