Better Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. It serves as a safety net, ensuring that in the event of an untimely demise, the policyholder's beneficiaries receive a financial payout to help them navigate through life's challenges. In today's complex world, it is more crucial than ever to have a comprehensive understanding of life insurance and its various aspects. This expert guide aims to delve into the intricacies of life insurance, offering a comprehensive analysis to help you make informed decisions and secure a better future.

Unveiling the Essentials: Understanding Life Insurance

Life insurance, at its core, is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a monthly or annual basis, and in return, the insurance company promises to pay a sum of money (the death benefit) to the policyholder’s beneficiaries upon their death. This death benefit can be used to cover a wide range of expenses, from funeral costs and outstanding debts to providing long-term financial support for dependents.

The primary objective of life insurance is to mitigate the financial impact of an individual's death on their loved ones. It ensures that the policyholder's family, business partners, or any other designated beneficiaries can maintain their standard of living and meet their financial obligations without the burden of sudden financial strain.

Types of Life Insurance Policies

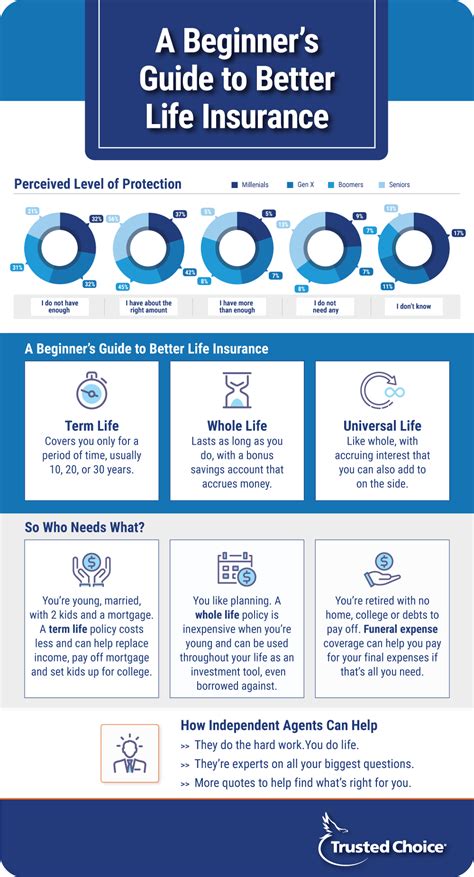

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type serves different needs and comes with its own set of advantages and considerations.

- Term Life Insurance: As the name suggests, term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries only if the policyholder dies during the term of the policy. Term life insurance is often more affordable compared to permanent life insurance, making it an attractive option for individuals seeking coverage during their working years when their financial responsibilities are at their peak.

- Permanent Life Insurance: This type of policy, as the name implies, provides lifelong coverage. Permanent life insurance policies, such as whole life, universal life, and variable life insurance, offer a death benefit along with a cash value component that grows over time. The cash value can be used for various purposes, including paying future premiums or providing a source of income during retirement. Permanent life insurance is often chosen by individuals who seek lifelong coverage and wish to build savings or leave a legacy for their heirs.

| Policy Type | Coverage | Premium | Key Features |

|---|---|---|---|

| Term Life Insurance | Coverage for a specified term | Affordable | Flexibility, option to convert to permanent |

| Permanent Life Insurance | Lifelong coverage | Higher premiums | Cash value accumulation, lifetime protection |

The Benefits of Comprehensive Life Insurance Coverage

Having a comprehensive life insurance policy offers numerous advantages that extend beyond providing a financial safety net for your loved ones. Let’s explore some of the key benefits:

Financial Security for Dependents

The primary purpose of life insurance is to ensure the financial well-being of your dependents. Whether it’s your spouse, children, aging parents, or any other individuals who rely on your income, life insurance provides them with the means to maintain their standard of living and cover essential expenses in your absence.

Debt Repayment and Estate Planning

Life insurance can be used to repay outstanding debts, such as mortgages, personal loans, or credit card balances. This ensures that your loved ones are not burdened with these financial obligations, allowing them to focus on their own financial goals. Additionally, the death benefit can be used to fund estate planning strategies, ensuring a smooth transfer of assets and minimizing tax liabilities.

Educational Expenses and Legacy Building

For many families, education is a top priority. Life insurance can provide the necessary funds to cover tuition fees, books, and other educational expenses, ensuring that your children or grandchildren have access to quality education. Moreover, permanent life insurance policies with cash value accumulation can be used to build a legacy, leaving a financial gift for future generations.

Business Continuity and Key Person Protection

Life insurance is not just for individuals; it plays a crucial role in business continuity as well. Business owners often purchase life insurance policies for key employees or partners to ensure that the business can withstand the loss of a vital individual. The death benefit can be used to cover expenses, hire a replacement, or buy out the deceased’s share in the business, ensuring smooth operations and protecting the business’s future.

Factors to Consider When Choosing a Life Insurance Policy

Selecting the right life insurance policy requires careful consideration of various factors. Here are some key aspects to keep in mind:

Coverage Amount

Determining the appropriate coverage amount is crucial. It should be sufficient to cover your outstanding debts, provide for your dependents’ living expenses, and achieve any other financial goals you may have. Financial advisors and insurance agents can assist in calculating the ideal coverage amount based on your specific circumstances.

Policy Duration

Consider the duration of coverage you require. Term life insurance policies are ideal for covering short-term financial obligations, such as providing for children until they become financially independent. Permanent life insurance, on the other hand, offers lifelong coverage and can be especially beneficial for individuals seeking long-term financial protection and savings.

Premium Affordability

Life insurance premiums can vary significantly based on the type of policy, coverage amount, and your personal health and lifestyle factors. It’s essential to choose a policy that fits within your budget. Term life insurance is generally more affordable, making it a popular choice for those on a tighter budget. However, permanent life insurance can offer flexibility in premium payments and provide long-term savings opportunities.

Rider Options

Riders are optional additions to your life insurance policy that can enhance its benefits. Common riders include accelerated death benefit, waiver of premium, and long-term care coverage. These riders can provide additional protection and peace of mind, especially if you have specific health concerns or caregiving needs.

Maximizing Your Life Insurance Policy

Once you have secured a life insurance policy, there are several strategies you can employ to maximize its benefits and ensure it aligns with your evolving financial goals.

Regular Policy Review

Life insurance policies should be reviewed periodically to ensure they remain aligned with your changing needs and circumstances. Major life events, such as marriage, the birth of a child, a career change, or the purchase of a new home, can impact your insurance requirements. Regular reviews allow you to adjust coverage amounts, add riders, or switch policies as necessary.

Utilizing Cash Value Accumulation

If you have a permanent life insurance policy with a cash value component, you can leverage this accumulation for various purposes. The cash value can be used to pay premiums, especially during times of financial hardship. Additionally, you can borrow against the cash value or withdraw a portion of it to meet short-term financial needs, such as funding a child’s education or covering medical expenses.

Estate Planning Integration

Life insurance can be an integral part of your estate planning strategy. By naming a trust as the beneficiary of your life insurance policy, you can ensure that the death benefit is distributed according to your wishes and minimize potential tax liabilities. Consult with an estate planning attorney to explore the best options for integrating your life insurance into your overall estate plan.

The Future of Life Insurance: Technological Innovations

The life insurance industry is evolving, and technological advancements are playing a significant role in shaping its future. Here’s a glimpse into some of the innovations that are transforming the way life insurance is purchased and managed.

Digital Underwriting and Instant Coverage

Traditional life insurance applications often require extensive medical examinations and a lengthy approval process. However, with the advent of digital underwriting, applicants can now provide health and lifestyle information online, and in some cases, receive instant coverage decisions. This streamlines the application process, making it more efficient and convenient for policyholders.

Wearable Technology and Health Monitoring

Wearable devices, such as fitness trackers and smartwatches, are increasingly being used to monitor an individual’s health and fitness levels. Insurance companies are exploring ways to integrate this data into their underwriting processes, offering incentives and discounts to policyholders who maintain healthy lifestyles. This shift towards health-conscious insurance policies may lead to more affordable coverage for individuals committed to their well-being.

Blockchain and Smart Contracts

Blockchain technology is revolutionizing various industries, and life insurance is no exception. By utilizing smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, the insurance process can become more efficient and transparent. Smart contracts can automate certain aspects of the insurance process, such as claim settlement, ensuring faster payouts and reducing administrative burdens.

Artificial Intelligence and Personalized Coverage

Artificial intelligence (AI) is being employed to analyze vast amounts of data and provide personalized insurance coverage recommendations. AI algorithms can assess an individual’s health, lifestyle, and financial situation to suggest the most suitable life insurance policy. This level of personalization ensures that policyholders receive coverage tailored to their unique needs, enhancing the overall customer experience.

Conclusion: Empowering Your Future with Life Insurance

Life insurance is a powerful financial tool that offers protection, security, and peace of mind. By understanding the different types of policies, their benefits, and the factors to consider, you can make informed decisions to secure your future and the future of your loved ones. Whether you opt for term life insurance for short-term financial obligations or permanent life insurance for lifelong protection and savings, having a comprehensive life insurance policy is a responsible step towards achieving financial stability.

As the life insurance industry continues to evolve with technological advancements, policyholders can expect more efficient processes, personalized coverage, and innovative solutions. By staying informed and actively managing your life insurance policy, you can ensure that it remains an essential component of your financial plan, empowering you to face life's challenges with confidence.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your financial obligations, debts, and the financial goals you wish to achieve. A common rule of thumb is to aim for coverage that is 10-15 times your annual income. However, it’s best to consult with a financial advisor or insurance agent to calculate the ideal coverage amount based on your specific circumstances.

Is term life insurance better than permanent life insurance?

+The choice between term and permanent life insurance depends on your individual needs and financial goals. Term life insurance is often more affordable and suitable for covering short-term financial obligations. Permanent life insurance, on the other hand, provides lifelong coverage and offers savings opportunities through its cash value accumulation. Consider your financial situation, the duration of coverage required, and your budget when making this decision.

Can I switch from term life insurance to permanent life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy within a certain timeframe, often without the need for additional medical examinations. This provides flexibility and the opportunity to transition from short-term coverage to lifelong protection.

What are some common riders available with life insurance policies?

+Common riders include the accelerated death benefit, which allows you to access a portion of your death benefit while still alive if you are diagnosed with a terminal illness. Other riders may include a waiver of premium, which waives your premium payments if you become disabled, and long-term care coverage, which provides benefits to cover the costs of long-term care services.