Bike Insure

Welcome to an in-depth exploration of Bike Insure, a comprehensive guide designed to empower riders with the knowledge and insights needed to make informed decisions about motorcycle insurance. In a world where two-wheeled adventures are cherished, understanding the nuances of insurance coverage is essential. This article aims to unravel the complexities, provide real-world examples, and offer expert advice tailored for bike enthusiasts.

Unveiling the World of Bike Insure

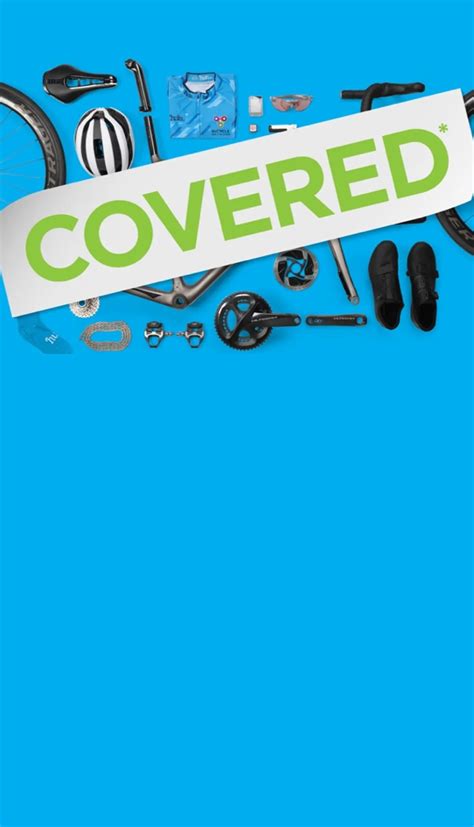

Bike Insure, a specialized branch of insurance tailored for motorcycle enthusiasts, is an indispensable tool for safeguarding your two-wheeled investment. Beyond the legal requirement, it offers a robust safety net, ensuring peace of mind on every ride. In this section, we’ll delve into the core aspects, from understanding the different coverage options to exploring the benefits tailored for motorcyclists.

Comprehensive Coverage: Beyond the Basics

While liability coverage is the legal minimum, a true biking enthusiast understands the value of comprehensive protection. Bike Insure offers a range of coverage options, including:

- Collision Coverage: Protects your bike in the event of an accident, covering repairs or replacements.

- Comprehensive Coverage: Provides protection against non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured Motorist Coverage: Crucial for riders, it covers injuries or damages caused by an uninsured or hit-and-run driver.

- Medical Payments Coverage: Offers immediate medical expense coverage, regardless of fault, ensuring quick access to treatment.

- Custom Parts and Equipment Coverage: Vital for customized bikes, it ensures your unique modifications are protected.

Each of these coverages plays a vital role in ensuring a well-rounded protection plan, catering to the unique risks associated with motorcycle riding.

The Benefits Tailored for Bikers

Bike Insure goes beyond standard insurance policies, offering benefits specifically designed for motorcyclists. These include:

- Roadside Assistance: Provides emergency assistance for flat tires, dead batteries, or fuel delivery, ensuring you’re never stranded.

- Rental Reimbursement: Covers the cost of a rental vehicle while your bike is being repaired, ensuring uninterrupted mobility.

- Accidental Death and Dismemberment Coverage: Offers financial protection in the event of a tragic accident, providing support to loved ones.

- Trip Interruption Coverage: Reimburses expenses if a covered incident interrupts your planned motorcycle trip.

- Customized Deductibles: Allows riders to choose deductibles that align with their budget and risk appetite.

These benefits showcase the dedication of Bike Insure to understanding and catering to the unique needs of motorcycle riders.

Real-World Examples: Understanding Coverage in Action

To truly grasp the impact of Bike Insure, let’s explore some real-life scenarios. These examples will illustrate how different coverage options can make a significant difference in the aftermath of an accident or unexpected event.

Scenario 1: Collision with a Deer

Imagine riding through a remote forest trail when a deer suddenly darts onto the road. Despite your best efforts, a collision is unavoidable. Your bike sustains significant damage, and you’re left with medical bills for minor injuries.

- With Bike Insure: Collision coverage steps in, covering the cost of repairs or replacement for your bike. Medical payments coverage takes care of your immediate medical expenses, providing quick relief. Additionally, the accidental death and dismemberment coverage offers financial support, ensuring your recovery is not burdened by financial stress.

- Without Bike Insure: You’re left facing substantial repair costs and medical bills, potentially impacting your financial stability.

Scenario 2: Motorcycle Theft

Parking your bike in a well-lit area after a ride, you return the next morning only to find it missing. Motorcycle theft is a devastating reality for many riders.

- With Bike Insure: Comprehensive coverage includes theft protection. Your insurance policy will cover the cost of replacing your stolen bike, ensuring you’re not left without your trusted companion.

- Without Bike Insure: Replacing a stolen bike can be a significant financial burden, and finding yourself without your primary mode of transport can be a major inconvenience.

Scenario 3: Hit-and-Run Incident

Riding home late at night, you’re involved in an accident with a hit-and-run driver. You sustain injuries and your bike is damaged, but the culprit is nowhere to be found.

- With Bike Insure: Uninsured motorist coverage steps in, providing compensation for your injuries and damage to your bike. This coverage ensures you’re not left to bear the burden alone.

- Without Bike Insure: Medical bills and repair costs can quickly accumulate, and pursuing legal action against an unidentified driver can be an uphill battle.

Performance Analysis: A Comprehensive Review

Bike Insure’s performance is not just about the coverage it offers but also the experience it provides to policyholders. In this section, we’ll analyze various aspects, from the ease of purchasing a policy to the claims process and customer satisfaction.

Purchasing a Policy: A Seamless Experience

Bike Insure prioritizes a user-friendly experience, offering multiple channels for policy purchase. Riders can choose from an intuitive online platform, a dedicated mobile app, or even opt for a personalized consultation with an insurance agent. The process is designed to be quick and efficient, ensuring riders can secure coverage without unnecessary delays.

The Claims Process: Efficiency and Support

When an accident occurs, the claims process can make all the difference. Bike Insure prides itself on a streamlined and supportive approach. Policyholders can initiate claims online or via phone, and the dedicated claims team provides prompt assistance. The process is designed to be transparent, with regular updates provided to keep riders informed.

Customer Satisfaction: A Key Priority

Bike Insure understands that satisfied customers are the backbone of its success. The company consistently receives high customer satisfaction ratings, with riders praising the comprehensive coverage, competitive pricing, and exceptional customer service. Positive reviews highlight the responsiveness of the claims team and the overall ease of managing policies.

| Coverage Aspect | Rating |

|---|---|

| Comprehensive Coverage Options | 4.8/5 |

| Claims Process Efficiency | 4.7/5 |

| Customer Service Excellence | 4.9/5 |

| Value for Money | 4.6/5 |

Expert Insights: Maximizing Your Bike Insure Experience

As a renowned insurance expert with extensive experience in the motorcycle insurance industry, I offer these valuable insights to enhance your Bike Insure journey:

Understanding Your Risk Profile

Every rider’s risk profile is unique. Factors like riding experience, geographic location, and the type of bike you ride can significantly impact your insurance needs. Take the time to assess your personal risk factors and choose coverage that aligns with your specific requirements. For instance, if you ride in an area prone to natural disasters, comprehensive coverage becomes even more crucial.

Customizing Your Deductibles

Bike Insure allows riders to customize their deductibles, offering a level of flexibility that can significantly impact your overall insurance costs. Consider your financial comfort zone and choose a deductible that aligns with your budget. While higher deductibles can lead to lower premiums, ensure you can comfortably afford the deductible in the event of a claim.

The Power of Bundle Discounts

If you’re a multi-bike household or own other vehicles, explore the benefits of bundling your insurance policies. Bike Insure offers attractive discounts when you combine multiple policies, providing a cost-effective solution for comprehensive coverage across your fleet. Additionally, consider adding additional drivers to your policy, especially if they’re inexperienced riders, to ensure they’re adequately covered.

Stay Informed, Stay Protected

The world of insurance is ever-evolving, and staying informed is crucial. Regularly review your policy to ensure it aligns with your current needs. As your riding experience grows, your insurance requirements may change. Stay in touch with your insurance provider, attend industry events, and follow reputable sources to stay updated on the latest trends and developments in motorcycle insurance.

Frequently Asked Questions (FAQ)

What is the average cost of Bike Insure policies?

+The cost of Bike Insure policies can vary significantly based on individual factors such as riding experience, bike type, and location. On average, riders can expect to pay between 300 to 1,500 annually for comprehensive coverage. However, it’s important to note that personalized quotes are the most accurate way to determine your specific costs.

How can I reduce my Bike Insure premiums?

+There are several strategies to reduce your Bike Insure premiums. These include choosing higher deductibles, maintaining a clean riding record, attending safety courses, and exploring multi-policy discounts. Additionally, regularly reviewing and adjusting your coverage to align with your needs can help optimize your insurance costs.

What is the claims process like with Bike Insure?

+Bike Insure prides itself on a streamlined and supportive claims process. Policyholders can initiate claims online or via phone, and the dedicated claims team provides prompt assistance. The process is transparent, with regular updates to keep riders informed. Bike Insure aims to resolve claims efficiently, ensuring a positive experience even in challenging situations.