Boat Insurance Online Quote

Boat insurance is an essential consideration for any boat owner, as it provides crucial financial protection against a range of potential risks and liabilities. With the growing popularity of recreational boating, understanding the importance of adequate insurance coverage has become more critical than ever. This comprehensive guide aims to delve into the world of boat insurance, offering a detailed exploration of the options, benefits, and considerations when seeking an online quote.

Understanding Boat Insurance

Boat insurance is a specialized form of property and liability insurance tailored to the unique needs of boat owners. It covers a wide range of potential risks, including damage to the boat itself, personal liability for accidents or injuries caused by the boat, and even coverage for personal belongings and equipment on board.

The coverage provided by boat insurance policies can vary significantly, depending on the type of boat, its usage, and the specific needs of the owner. For instance, a policy for a small recreational boat used primarily for weekend fishing trips will differ from the coverage required for a large yacht engaged in long-distance cruising or racing.

Key Components of Boat Insurance

Boat insurance typically consists of several key components, each offering specific types of coverage:

- Hull Insurance: This provides coverage for the physical structure of the boat, including the hull, engine, and any attached equipment. It protects against damage caused by accidents, collisions, storms, fire, or vandalism.

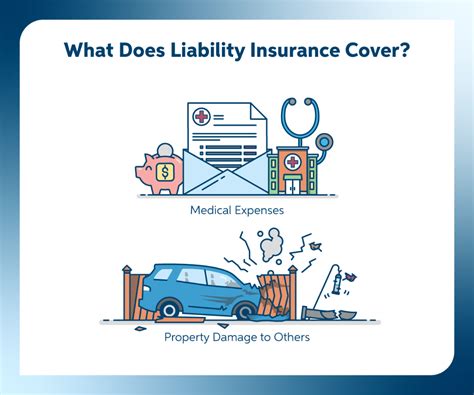

- Liability Insurance: Liability coverage is essential to protect boat owners against claims arising from accidents involving their boat. This can include bodily injury or property damage to others, as well as medical expenses for injured parties.

- Medical Payments Coverage: This coverage pays for the medical expenses of individuals injured in a boating accident, regardless of who is at fault. It provides quick access to funds for necessary medical care, often without the need for a liability claim.

- Uninsured Boater Coverage: Similar to auto insurance, boat insurance can include coverage for accidents involving an uninsured or underinsured boater. This ensures that the policyholder is protected even if the other party involved in the accident lacks sufficient insurance coverage.

- Trailer and Towing Coverage: If the boat is towed by a trailer, this coverage provides protection for the trailer and its contents. It covers damage or loss caused by accidents while towing, as well as certain repairs or replacements needed for the trailer.

- Personal Property Coverage: Boat insurance can also extend to cover personal belongings and equipment on board, such as fishing gear, clothing, and electronics. This coverage is particularly beneficial for ensuring the financial protection of valuable items that may be damaged or lost during a boating trip.

The Process of Obtaining an Online Boat Insurance Quote

Seeking an online quote for boat insurance is a straightforward and efficient process, offering boat owners the convenience of comparing policies and prices without the need for in-person meetings.

Gathering Essential Information

Before initiating the quote process, it’s beneficial to gather some key information about your boat and its usage. This includes the make, model, and year of the boat, its primary use (recreational, commercial, or racing), the horsepower of the engine, and the location where it is typically docked or stored.

Additionally, consider the following factors that can influence the cost and coverage of your boat insurance policy:

- The value of your boat and its equipment.

- The type of watercraft (powerboat, sailboat, yacht, etc.)

- The frequency and duration of your boating trips.

- Any safety equipment or courses you have completed.

- Any existing claims or incidents on your record.

Navigating Online Quote Platforms

Many reputable insurance companies and brokers offer online platforms that guide users through the quote process. These platforms often provide a step-by-step process, allowing you to input the necessary details and select the coverage options that best fit your needs.

Some key considerations when using online quote platforms include:

- Comparing quotes from multiple providers to ensure you get the best value for your specific requirements.

- Reading the fine print and understanding the exclusions and limitations of each policy.

- Considering additional coverage options, such as emergency assistance or coverage for specific events like racing or chartering.

- Reviewing customer reviews and ratings to gauge the reputation and reliability of the insurance provider.

Understanding Coverage Limits and Deductibles

When reviewing online quotes, it’s crucial to understand the coverage limits and deductibles associated with each policy. Coverage limits refer to the maximum amount the insurance company will pay for a covered loss, while deductibles are the portion of the loss that the policyholder must pay out of pocket before the insurance coverage kicks in.

Choosing the right coverage limits and deductibles involves balancing the cost of the policy with the level of protection it provides. Higher coverage limits and lower deductibles generally result in more comprehensive protection but also lead to higher premium costs. It's essential to find a balance that aligns with your financial capabilities and the level of risk you're comfortable assuming.

Benefits of Online Boat Insurance Quotes

Seeking boat insurance quotes online offers several distinct advantages to boat owners, including:

- Convenience: Online quotes can be obtained from the comfort of your home or office, eliminating the need for in-person meetings with insurance agents.

- Speed: The quote process is often streamlined and efficient, providing quick access to multiple quotes and allowing for swift comparisons.

- Transparency: Online platforms typically provide clear and detailed information about coverage options, policy terms, and pricing, ensuring boat owners have a comprehensive understanding of their insurance choices.

- Competition: By comparing quotes from multiple providers, boat owners can leverage competition to find the best value and coverage for their specific needs.

- Flexibility: Online quote platforms often offer a wide range of coverage options, allowing boat owners to customize their policies to align with their unique requirements and preferences.

The Importance of Customizing Your Boat Insurance Policy

While obtaining an online quote is a critical first step, it’s essential to recognize that boat insurance is not a one-size-fits-all proposition. Every boat owner has unique needs and preferences that should be reflected in their insurance coverage.

Factors to Consider for Customization

When customizing your boat insurance policy, consider the following factors:

- The value of your boat and the potential financial impact of a total loss or significant damage.

- The geographical locations where you typically operate your boat, as certain regions may pose higher risks of accidents or theft.

- The activities you engage in while boating, such as fishing, water sports, or racing, as these can influence the types of coverage you require.

- Any specialized equipment or accessories on your boat that may require additional coverage.

- Your personal preferences and budget, as these will dictate the balance between coverage and cost that you're comfortable with.

Working with Insurance Professionals

While online quotes provide a convenient starting point, it’s often beneficial to consult with insurance professionals who can offer personalized advice and guidance based on your specific circumstances. These professionals can help you understand the nuances of boat insurance, clarify any doubts or concerns, and ensure that your policy aligns with your unique needs.

When working with insurance professionals, be prepared to provide detailed information about your boat, its usage, and your personal preferences. This will enable them to offer tailored recommendations and assist you in selecting the most suitable coverage options.

Conclusion

Boat insurance is an essential aspect of boat ownership, providing crucial financial protection and peace of mind. By understanding the various components of boat insurance, the process of obtaining online quotes, and the importance of customizing your policy, you can make informed decisions to ensure adequate coverage for your specific needs.

Remember, while convenience and efficiency are key benefits of online quotes, it's equally important to seek professional advice and thoroughly review the fine print of any policy before making a decision. With the right approach, you can navigate the world of boat insurance with confidence, ensuring your boating experiences are both enjoyable and well-protected.

Frequently Asked Questions

What factors influence the cost of boat insurance?

+

The cost of boat insurance can be influenced by several factors, including the type and value of your boat, its age and condition, the location where it is stored or operated, the frequency and duration of your boating trips, your personal boating experience and safety record, and any additional coverage options you select.

Do I need boat insurance if I only use my boat occasionally?

+

Even if you only use your boat occasionally, boat insurance is still highly recommended. It provides financial protection against a range of risks, including accidents, theft, vandalism, and liability claims. Regardless of usage frequency, unexpected incidents can occur, and having insurance ensures you’re prepared for such situations.

What happens if I have an accident and my boat insurance policy doesn’t cover the full cost of repairs?

+

If your boat insurance policy doesn’t cover the full cost of repairs after an accident, you’ll be responsible for paying the remaining amount out of pocket. This is where understanding the coverage limits and deductibles of your policy becomes crucial. Choosing appropriate coverage limits and deductibles can help ensure you’re adequately protected without incurring excessive costs.

Can I add coverage for specific events or activities, like fishing tournaments or water sports?

+

Yes, many boat insurance policies offer the option to add coverage for specific events or activities. For instance, if you regularly participate in fishing tournaments or engage in water sports like waterskiing or wakeboarding, you can typically add coverage to protect against the unique risks associated with these activities. It’s important to discuss these options with your insurance provider to ensure you have the necessary coverage.

How often should I review and update my boat insurance policy?

+

It’s a good practice to review your boat insurance policy annually or whenever significant changes occur in your boating activities or circumstances. This ensures that your coverage remains aligned with your current needs. For example, if you upgrade your boat, add new equipment, or start engaging in different boating activities, your insurance policy should reflect these changes.