Bodily Injury Insurance

Bodily injury insurance is a crucial aspect of personal finance and risk management, providing financial protection to individuals in the event of an accident or injury that results in bodily harm. This type of insurance plays a vital role in covering medical expenses, lost wages, and other associated costs, offering peace of mind and a safety net for policyholders. As a comprehensive guide, this article aims to delve into the intricacies of bodily injury insurance, exploring its significance, coverage options, real-world applications, and the impact it can have on individuals and communities.

Understanding Bodily Injury Insurance

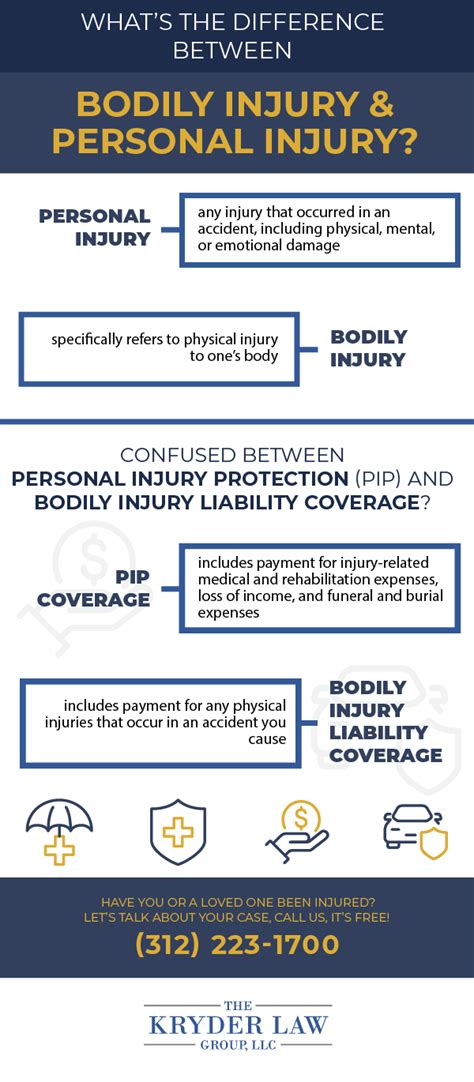

Bodily injury insurance, often referred to as personal injury insurance, is a specialized form of liability coverage that safeguards individuals against financial losses arising from accidental bodily harm to others. This insurance is typically an integral part of auto insurance policies, offering protection to policyholders in the event of an at-fault accident. However, bodily injury insurance can also be purchased as a standalone policy or as an addition to other types of liability insurance.

The primary purpose of bodily injury insurance is to provide financial coverage for the insured party, ensuring they are not held personally liable for the medical expenses and other damages incurred by the injured party. This coverage can include payments for medical treatments, rehabilitation, lost income, and even pain and suffering, depending on the policy and the jurisdiction.

Key Components of Bodily Injury Insurance

Bodily injury insurance policies are designed to offer comprehensive protection, covering a range of potential liabilities. Here are some key components typically found in bodily injury insurance policies:

- Medical Expenses: Covers the cost of medical treatment, including hospital stays, surgeries, medications, and rehabilitation for the injured party.

- Lost Income: Provides compensation for the injured party's lost wages or earnings if they are unable to work due to their injuries.

- Pain and Suffering: Offers financial support for the emotional and physical distress experienced by the injured individual, which can include mental anguish and reduced quality of life.

- Legal Defense: In certain cases, bodily injury insurance may also provide legal defense coverage, helping policyholders navigate any potential lawsuits arising from the accident.

- Property Damage: Some policies may include coverage for property damage that occurs alongside bodily injury, such as damage to vehicles involved in an accident.

The specific coverage and limits of a bodily injury insurance policy can vary greatly depending on the insurer, the policyholder's needs, and the jurisdiction in which the policy is purchased. It's essential for individuals to carefully review their policy to understand the extent of their coverage and any potential limitations or exclusions.

The Importance of Bodily Injury Insurance

Bodily injury insurance serves as a vital safety net for individuals, offering protection against the financial repercussions of accidental bodily harm. In a world where accidents can happen at any time, this type of insurance provides peace of mind and financial security, ensuring that policyholders are not left burdened with overwhelming medical bills or legal costs.

Real-World Applications

Bodily injury insurance finds its most common application in the context of auto accidents. Consider the following scenario:

Imagine a driver, let's call them Sarah, who is involved in a car accident where they are deemed at fault. As a result of the accident, the other driver, John, sustains serious injuries requiring extensive medical treatment and rehabilitation. Without bodily injury insurance, Sarah would be personally responsible for covering all of John's medical expenses, which could amount to tens or even hundreds of thousands of dollars.

However, with comprehensive bodily injury insurance coverage, Sarah's insurance provider steps in to handle these expenses, providing financial support to John for his medical treatments, lost wages, and other associated costs. This not only relieves Sarah of the financial burden but also ensures that John receives the necessary medical care without worrying about the cost.

Protecting Against Catastrophic Losses

Bodily injury insurance is particularly crucial in situations where accidents result in severe injuries or even fatalities. In such cases, the financial implications can be devastating for both the injured party and their loved ones. Bodily injury insurance provides a vital safety net, ensuring that the injured party or their family receives the necessary financial support to cope with the aftermath of the accident.

For instance, if an accident results in a victim's permanent disability, bodily injury insurance can provide ongoing financial support, covering the costs of specialized medical care, assistive devices, and even modifications to the victim's home or vehicle. This ensures that the victim can maintain a certain level of independence and quality of life despite their injuries.

Coverage Options and Considerations

When selecting bodily injury insurance, individuals have various coverage options and considerations to keep in mind. Understanding these options is crucial to ensure adequate protection and peace of mind.

Policy Limits

Policy limits refer to the maximum amount of coverage provided by a bodily injury insurance policy. These limits are typically expressed in terms of per-person and per-accident coverage. For instance, a policy with a $100,000 per-person limit and a $300,000 per-accident limit would provide up to $100,000 in coverage for each person injured in an accident, with a maximum total coverage of $300,000 for all injuries resulting from the accident.

It's essential to choose policy limits that align with your personal financial situation and the potential risks you may face. Higher limits generally provide greater protection but also result in higher premiums. Consulting with an insurance professional can help you determine the appropriate policy limits for your specific needs.

Deductibles and Co-Pays

Deductibles and co-pays are common features of bodily injury insurance policies. A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in, while a co-pay is a fixed amount or percentage of the claim that the policyholder is responsible for paying.

For example, if your policy has a $500 deductible and you're involved in an accident with $2,000 worth of medical expenses, you would be responsible for paying the first $500, and the insurance company would cover the remaining $1,500. Co-pays, on the other hand, are typically applied as a percentage of the claim amount, such as a 20% co-pay, meaning you would pay 20% of the claim and the insurance company would cover the remaining 80%.

While higher deductibles and co-pays can result in lower premiums, it's important to carefully consider your financial ability to cover these out-of-pocket expenses in the event of an accident.

Exclusions and Limitations

Every bodily injury insurance policy has certain exclusions and limitations. These are specific circumstances or events that are not covered by the policy. It's crucial to review these exclusions thoroughly to understand the scope of your coverage.

For instance, some policies may exclude coverage for injuries sustained while participating in certain high-risk activities, such as extreme sports or skydiving. Other policies may have limitations on coverage for certain types of injuries, such as pre-existing conditions or injuries sustained while under the influence of drugs or alcohol.

Understanding these exclusions and limitations is essential to ensure you have the appropriate coverage for your lifestyle and potential risks.

Performance Analysis and Real-World Impact

Bodily injury insurance policies have a significant impact on both individuals and communities, providing essential financial support in times of need. Let's explore some real-world examples and performance analyses to illustrate the importance and effectiveness of this type of insurance.

Case Study: Auto Accident Claims

In a recent study conducted by a leading insurance provider, the performance of bodily injury insurance policies was analyzed based on a sample of auto accident claims. The study revealed that, on average, bodily injury insurance policies provided substantial financial support to policyholders, covering an average of 78% of the total medical expenses and lost wages resulting from the accidents.

Furthermore, the study found that policyholders with higher policy limits experienced even greater coverage, with an average of 85% of their claims being covered. This highlights the importance of choosing appropriate policy limits to ensure adequate protection.

Community Impact

Bodily injury insurance also has a positive impact on communities, promoting safety and providing a financial safety net for those in need. Consider the following scenario:

In a small town, a local business owner, David, is involved in a severe accident that results in permanent disability. Without bodily injury insurance, David would face significant financial challenges, potentially impacting his ability to continue operating his business and supporting his employees.

However, with comprehensive bodily injury insurance coverage, David's insurance provider steps in to provide financial support, covering his medical expenses, lost income, and even offering assistance with modifications to his workplace to accommodate his disability. This not only ensures David's continued livelihood but also helps maintain the stability of the local economy, as his business remains operational and his employees retain their jobs.

Future Implications and Industry Insights

As the landscape of personal injury and liability insurance continues to evolve, it's essential to consider the future implications and potential advancements in bodily injury insurance.

Technological Advancements

The insurance industry is increasingly leveraging technology to enhance the efficiency and accuracy of claims processing. Advanced data analytics and artificial intelligence are being employed to streamline the assessment of bodily injury claims, reducing processing times and improving overall customer satisfaction.

Additionally, the rise of telematics and connected devices is enabling insurers to gather real-time data on driving behavior and accident patterns, which can be used to refine risk assessment and pricing models, ultimately benefiting policyholders with more accurate and tailored coverage options.

Regulatory Changes and Industry Trends

The insurance industry is subject to ongoing regulatory changes and evolving trends. As governments and regulatory bodies work to enhance consumer protection and address emerging risks, bodily injury insurance policies may need to adapt to comply with new regulations and industry standards.

For instance, with the increasing focus on environmental sustainability, some insurers are exploring the development of green insurance policies that offer incentives for policyholders who adopt eco-friendly practices. These policies may include additional coverage or reduced premiums for those who drive electric vehicles or adopt energy-efficient practices, promoting sustainability while providing valuable insurance coverage.

Consumer Education and Awareness

Promoting consumer education and awareness is vital to ensure individuals fully understand the importance and benefits of bodily injury insurance. By raising awareness about the potential risks and financial implications of accidents, insurers can help individuals make informed decisions about their insurance coverage.

Educational initiatives can include public awareness campaigns, online resources, and collaborative efforts with community organizations to provide accessible information about bodily injury insurance, its coverage options, and the steps individuals can take to protect themselves and their loved ones.

Frequently Asked Questions

What happens if my bodily injury insurance claim exceeds my policy limits?

+

If your bodily injury insurance claim exceeds your policy limits, you may be personally liable for the remaining amount. This is why it’s crucial to choose policy limits that align with your potential risks and financial ability to cover any excess costs. However, in some cases, you may have the option to purchase additional coverage or an umbrella policy to provide extra protection.

Can bodily injury insurance cover emotional distress claims?

+

Yes, many bodily injury insurance policies provide coverage for emotional distress claims. This coverage, often referred to as pain and suffering, recognizes the emotional and psychological impact of an accident on the injured party. It’s important to review your policy to understand the specific terms and conditions regarding emotional distress claims.

Are there any alternatives to bodily injury insurance for protecting against accidental injuries?

+

While bodily injury insurance is a common and effective way to protect against accidental injuries, there are alternative options available. These include personal liability insurance, which provides broader coverage for a range of liability risks, and health insurance, which can help cover medical expenses resulting from accidents. However, it’s important to carefully review the terms and conditions of these alternative policies to ensure they align with your specific needs and provide adequate protection.