Business Health Insurance Plans

Business health insurance plans are a vital component of any successful organization's benefits package. With the rising costs of healthcare, offering comprehensive and competitive health insurance coverage has become essential to attract and retain top talent. In today's dynamic business landscape, providing accessible and affordable healthcare solutions is not just a legal requirement but a strategic imperative. This article aims to delve into the intricacies of business health insurance plans, exploring their key features, benefits, and the impact they have on both employers and employees.

Understanding the Importance of Business Health Insurance

In the corporate world, health insurance plans are more than just a necessity; they are a strategic tool that can significantly impact an organization’s overall performance and success. Here’s a deeper look at why business health insurance plans are of utmost importance:

Attracting and Retaining Talent

A comprehensive health insurance plan is a powerful magnet for top-tier employees. In a highly competitive job market, businesses that offer robust health benefits stand out. Employees are increasingly aware of the value of good healthcare coverage and often prioritize this aspect when considering job offers. By providing an attractive health insurance package, companies can attract skilled professionals and retain their existing workforce, ensuring a stable and productive environment.

For instance, a study by the National Business Group on Health revealed that 78% of employees consider health benefits to be a crucial factor when evaluating a job offer. This statistic highlights the significant role that health insurance plays in an employee's decision-making process.

Promoting Employee Well-being and Productivity

Health insurance plans are not just about covering medical expenses; they are about fostering a culture of wellness and productivity within the workplace. When employees have access to quality healthcare, they are more likely to prioritize their health, leading to reduced absenteeism and increased productivity. Additionally, comprehensive health coverage can provide early intervention and prevention services, which further reduce long-term healthcare costs for both the employee and the employer.

Mitigating Financial Risk

One of the primary functions of health insurance is to protect individuals from the financial burden of unexpected medical expenses. For businesses, this risk mitigation extends to their entire workforce. By offering health insurance, companies ensure that their employees have access to necessary medical care without facing catastrophic financial consequences. This not only safeguards the financial well-being of employees but also reduces the likelihood of costly lawsuits or compensations due to lack of medical coverage.

Compliance with Legal Requirements

In many regions, offering health insurance to employees is a legal obligation. For instance, in the United States, the Affordable Care Act (ACA) mandates that employers with 50 or more full-time employees offer minimum essential coverage or face penalties. Similarly, in the United Kingdom, the NHS Health Check program encourages employers to provide health assessments for their staff. By complying with these regulations, businesses not only avoid legal repercussions but also demonstrate their commitment to employee welfare.

Key Features of Business Health Insurance Plans

Business health insurance plans come in various forms, each designed to cater to the unique needs of different organizations and their employees. Here’s an overview of some of the key features that define these plans:

Coverage Options

Business health insurance plans offer a range of coverage options to suit the diverse needs of employees. These may include:

- Medical Coverage: Basic medical services such as doctor visits, hospital stays, and prescription drugs are typically covered.

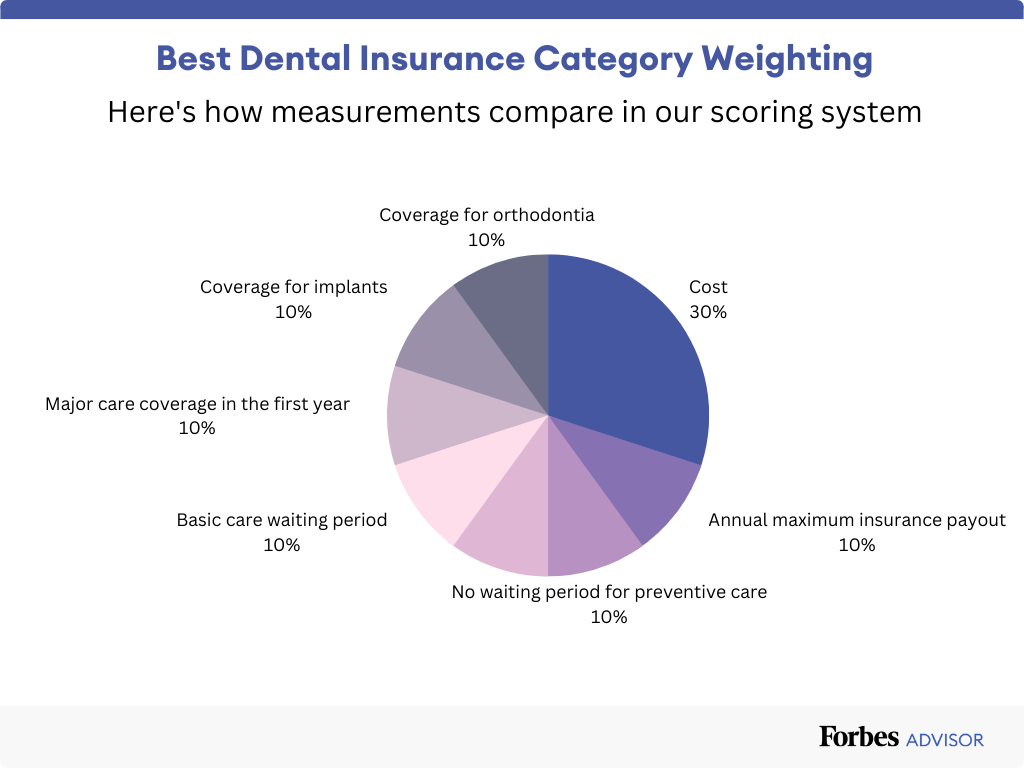

- Dental and Vision Plans: Many businesses offer separate plans for dental and vision care, ensuring employees' oral and eye health needs are met.

- Mental Health Services: With the growing awareness of mental health issues, more employers are including coverage for therapy, counseling, and psychiatric care.

- Preventive Care: Plans often cover preventive services like annual check-ups, immunizations, and screenings to promote early detection and wellness.

- Specialty Services: Depending on the plan, coverage may extend to specialty services like chiropractic care, acupuncture, or fertility treatments.

Plan Types

Business health insurance plans can be categorized into various types, each with its own cost structure and coverage rules. Some common plan types include:

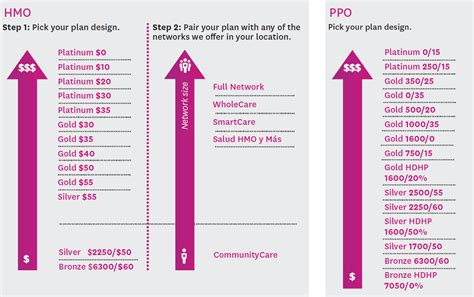

- Health Maintenance Organizations (HMOs): HMOs typically have a lower cost structure but require members to select a primary care physician (PCP) and obtain referrals for specialist care.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility, allowing members to visit any healthcare provider without a referral, although costs may be higher for out-of-network services.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but members must stay within the network for coverage, with no out-of-network benefits.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs, allowing members to choose their preferred level of coverage and cost.

Network Size and Provider Choices

The size and scope of a health insurance plan’s network can significantly impact an employee’s experience. Plans with a larger network offer more provider choices, reducing the likelihood of employees having to travel far for care. On the other hand, plans with a narrower network may have lower costs but may limit provider options.

| Network Size | Pros | Cons |

|---|---|---|

| Large Network | More provider choices, convenient access to care | May have higher costs |

| Narrow Network | Lower costs, focused provider options | Limited choice of providers, potential inconvenience |

Cost-Sharing and Out-of-Pocket Expenses

Health insurance plans often involve cost-sharing between the employer, the employee, and the insurance provider. This cost-sharing can take various forms, including:

- Premiums: The monthly or annual cost of the insurance plan, typically paid by the employer with some contribution from the employee.

- Deductibles: The amount an individual must pay out-of-pocket before the insurance coverage kicks in.

- Co-pays: Fixed amounts paid by the individual at the time of receiving a medical service, such as a doctor's visit or prescription.

- Co-insurance: The percentage of the total cost of a medical service that the individual must pay after the deductible has been met.

Benefits of Business Health Insurance Plans

Implementing comprehensive health insurance plans for businesses brings a multitude of advantages, not only for the employees but also for the organization as a whole. Here’s a closer look at some of the key benefits:

Improved Employee Health and Morale

One of the most significant advantages of business health insurance plans is the positive impact they have on employee health and morale. When employees have access to quality healthcare, they are more likely to take proactive measures to maintain their well-being. This can lead to reduced absenteeism, increased productivity, and a more positive work environment. Additionally, employees who feel valued and supported by their employer’s health benefits are more likely to be engaged and committed to their work.

Cost Savings for Employers

Contrary to the common misconception, offering comprehensive health insurance plans can result in cost savings for employers in the long run. While the initial investment in providing these benefits may seem substantial, several factors contribute to potential cost savings. First, healthy employees are more productive, which can lead to increased efficiency and reduced operational costs. Second, by promoting preventive care and early intervention, employers can avoid the high costs associated with untreated chronic conditions or emergency treatments.

Enhanced Employee Satisfaction and Retention

A competitive health insurance package is a powerful tool for employee satisfaction and retention. When employees feel that their employer cares about their well-being and provides them with access to quality healthcare, it fosters a sense of loyalty and commitment. This, in turn, can lead to reduced turnover rates and a more stable workforce. Additionally, a robust health insurance plan can be a significant factor in attracting top talent, as employees increasingly prioritize health benefits when evaluating job opportunities.

Access to a Wider Talent Pool

By offering comprehensive health insurance benefits, businesses can expand their talent pool and attract a diverse range of skilled professionals. In today’s competitive job market, health insurance is a key differentiator for employers. By providing competitive health benefits, businesses can position themselves as attractive destinations for job seekers, especially those with specific healthcare needs or those who prioritize health and wellness.

Case Studies: Real-World Impact of Business Health Insurance

To understand the practical implications of business health insurance plans, let’s explore a couple of real-world case studies:

Company X: A Small Business Success Story

Company X, a small tech startup with a team of 25 employees, implemented a comprehensive health insurance plan as a key component of its employee benefits package. The plan included coverage for medical, dental, and vision services, as well as mental health support. As a result, the company experienced a significant improvement in employee morale and engagement. Absenteeism rates dropped, and the team’s overall productivity increased. Additionally, the company was able to attract and retain top talent, contributing to its rapid growth and success.

Company Y: A Large Corporation’s Transformation

Company Y, a well-established multinational corporation, recognized the need to enhance its health insurance offerings to stay competitive in the job market. They revamped their health benefits package to include a broader range of services, such as fertility treatments and expanded mental health coverage. This move not only improved employee satisfaction but also led to a noticeable reduction in stress-related absences. Furthermore, the company saw a boost in its diversity and inclusion efforts, as the new health benefits appealed to a wider range of potential employees, including those with specific healthcare needs.

Future Trends and Innovations in Business Health Insurance

The landscape of business health insurance is continually evolving, with new trends and innovations shaping the industry. Here’s a glimpse into some of the future developments that are likely to impact business health insurance plans:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Telehealth offers a convenient and accessible way for employees to receive medical care, particularly for non-emergency issues. By integrating telehealth into health insurance plans, businesses can enhance the efficiency and reach of their healthcare offerings.

Wellness Programs and Incentives

Wellness programs are becoming increasingly popular as employers recognize the value of promoting healthy lifestyles among their workforce. These programs can include incentives for employees to engage in activities like exercise, nutrition counseling, stress management, and smoking cessation. By incorporating wellness initiatives into health insurance plans, businesses can encourage employees to take an active role in their health, leading to improved overall well-being.

Data-Driven Personalized Care

With advancements in technology and the availability of health data, personalized care is becoming more feasible. Health insurance plans of the future may leverage data analytics to offer customized care plans based on individual health needs and risk factors. This approach can lead to more efficient and effective healthcare delivery, potentially reducing costs for both employers and employees.

Expanded Mental Health Coverage

Mental health issues are gaining more attention and recognition in the workplace. As a result, health insurance plans are likely to expand their coverage for mental health services. This may include increased access to therapy, counseling, and support groups, as well as initiatives to reduce the stigma surrounding mental health. By prioritizing mental health, businesses can create a more supportive and productive work environment.

Flexibility and Choice

The future of business health insurance plans may lean towards providing employees with more flexibility and choice. This could involve offering a range of plan options, including traditional health insurance plans, health savings accounts (HSAs), or even direct primary care (DPC) arrangements. By empowering employees to make informed choices about their healthcare, businesses can foster a sense of ownership and engagement.

Conclusion

Business health insurance plans are a cornerstone of any comprehensive employee benefits package. They not only provide essential healthcare coverage but also contribute to a healthier, more productive, and happier workforce. By understanding the key features, benefits, and future trends in business health insurance, employers can make informed decisions to attract and retain top talent while fostering a culture of wellness and success.

How do business health insurance plans impact small businesses with limited resources?

+Small businesses can face unique challenges when it comes to offering health insurance. However, there are strategies they can employ. For instance, small businesses can explore group purchasing cooperatives or partner with local chambers of commerce to negotiate better rates. Additionally, they can consider offering health savings accounts (HSAs) to help employees manage their healthcare costs.

What are some common challenges employers face when implementing health insurance plans?

+Employers often face challenges such as rising healthcare costs, complex regulatory requirements, and the need to balance employee needs with budget constraints. To address these, employers can work with insurance brokers or consult with healthcare experts to find cost-effective solutions and stay compliant with regulations.

How can employees make the most of their health insurance benefits?

+Employees can maximize their health insurance benefits by staying informed about their plan’s coverage and cost-sharing structures. They should take advantage of preventive care services and explore the various resources offered by their insurance provider, such as wellness programs or online health tools. Additionally, employees should feel empowered to ask questions and seek clarification to ensure they are utilizing their benefits effectively.