Business Insurance Prices

Understanding the intricacies of business insurance prices is crucial for any entrepreneur or business owner. The cost of insurance can vary significantly based on numerous factors, making it a complex and often challenging aspect of running a business. In this comprehensive guide, we will delve deep into the world of business insurance prices, providing you with an expert analysis to help navigate this essential aspect of business management.

Factors Influencing Business Insurance Prices

The price of business insurance is influenced by a myriad of factors, each playing a significant role in determining the final cost. These factors can be broadly categorized into two main groups: external and internal.

External Factors

External factors are those that are beyond the control of the business owner. They include:

- Industry and Business Type: Different industries carry varying levels of risk. For instance, construction businesses often face higher insurance costs due to the inherent risks involved in their operations. Similarly, businesses in high-risk sectors like manufacturing or transportation may expect higher insurance premiums.

- Location: The geographic location of your business plays a crucial role. Areas prone to natural disasters or with high crime rates can increase insurance costs. Additionally, the local market conditions and the number of competing businesses in your area can also impact insurance prices.

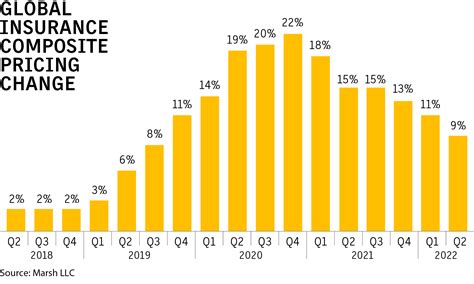

- Economic Climate: The overall economic environment can affect insurance prices. During economic downturns, insurance companies may increase rates to mitigate potential losses. Conversely, a thriving economy might lead to more competitive insurance markets, potentially driving down prices.

Internal Factors

Internal factors are those that business owners can influence or control. These include:

- Business Size and Revenue: Generally, larger businesses with higher revenues tend to have higher insurance costs. This is because they often have more assets and employees, leading to increased potential liabilities.

- Business Operations and Risk Management: The way your business operates can significantly impact insurance prices. Businesses with robust risk management strategies and safety protocols may qualify for lower insurance rates. For instance, implementing employee safety training or investing in security measures can reduce the likelihood of accidents or theft, thereby lowering insurance costs.

- Insurance Claims History: A business’s past claims history is a critical factor in determining insurance prices. Businesses with a history of frequent or costly claims may face higher premiums. Conversely, businesses with a clean claims record might enjoy lower rates.

- Insurance Coverage Selected: The type and level of insurance coverage chosen can greatly affect the price. Comprehensive coverage options that provide broad protection will typically be more expensive than basic coverage plans.

Understanding Insurance Premiums

An insurance premium is the amount a business pays to an insurance company for coverage. It is typically paid monthly, quarterly, or annually. The premium is calculated based on a variety of factors, including those mentioned above. Insurance companies use actuarial science to determine the likelihood of a business making a claim and the potential cost of that claim.

Premiums can be further understood through the concept of deductibles and limits. A deductible is the amount a business must pay out-of-pocket before the insurance coverage kicks in. Higher deductibles can result in lower premiums, as the business assumes more financial risk. Conversely, lower deductibles mean the business pays less upfront but may have higher premiums.

Limits, on the other hand, refer to the maximum amount the insurance company will pay for a covered loss. For instance, a general liability insurance policy might have a limit of $1 million per occurrence. If a business exceeds this limit, it would be responsible for the remaining costs.

| Insurance Type | Average Premium |

|---|---|

| General Liability Insurance | $600 - $1,200 annually |

| Professional Liability Insurance | $500 - $1,500 annually |

| Workers' Compensation Insurance | Varies based on payroll and state laws |

| Commercial Property Insurance | $800 - $1,500 annually |

Impact of Claims on Premiums

A business’s insurance claims history is a significant factor in determining future premiums. Filing multiple claims, especially those that are costly, can lead to increased premiums or even policy cancellation. This is because insurance companies use claims data to assess the risk associated with insuring a particular business.

However, it's important to note that making a claim doesn't always result in higher premiums. If the claim is minor and doesn't significantly impact the insurance company's finances, it may not affect future premiums. Additionally, some insurance companies offer claim forgiveness programs, where one or two claims won't impact your premium rates.

Strategies to Manage Business Insurance Prices

While many factors influencing insurance prices are beyond a business owner’s control, there are strategies that can help manage and potentially reduce these costs.

Risk Management and Safety Protocols

Implementing robust risk management strategies and safety protocols can significantly reduce the likelihood of accidents or incidents that might lead to insurance claims. This could include training employees on safety procedures, regularly inspecting equipment and facilities, and maintaining proper records and documentation.

Bundling Insurance Policies

Bundling multiple insurance policies with the same provider can often lead to cost savings. Many insurance companies offer discounts when businesses purchase multiple policies, such as a combination of general liability, professional liability, and property insurance.

Shopping Around and Negotiating

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from different providers. This will give you a better understanding of the market rates and help you negotiate better terms. Remember, insurance companies want your business, so don’t be afraid to ask for discounts or better rates.

Working with an Insurance Broker

An insurance broker can be a valuable asset in navigating the complex world of business insurance. Brokers have access to a wide range of insurance providers and can help you find the best coverage at the most competitive prices. They can also provide advice on risk management and help you understand the fine print of insurance policies.

The Future of Business Insurance Prices

The business insurance landscape is continually evolving, driven by technological advancements, changing regulatory environments, and shifts in consumer behavior. Here’s a glimpse into what the future might hold for business insurance prices.

Impact of Technology

The insurance industry is embracing technology, and this is expected to have a significant impact on insurance prices. Telematics, for instance, is being used in auto insurance to track driving behavior, which could lead to more personalized insurance rates. Similarly, in commercial insurance, the use of IoT devices and sensors could provide real-time data on business operations, potentially reducing insurance costs for businesses that demonstrate lower risk profiles.

Regulatory Changes

Changes in regulations can also affect insurance prices. For example, if new laws are introduced that increase the liability of businesses, insurance companies may need to adjust their premiums to account for the increased risk. On the other hand, if regulations are relaxed, this could lead to lower insurance costs.

The Rise of Insurtech

Insurtech, the fusion of insurance and technology, is a growing trend. Insurtech companies are leveraging technology to offer more efficient, innovative, and personalized insurance solutions. This could lead to more competitive pricing and a wider range of insurance options for businesses.

Conclusion

Understanding the factors that influence business insurance prices is a critical aspect of effective business management. By recognizing these factors and implementing strategies to manage risk and negotiate better rates, business owners can navigate the complex world of insurance with confidence. As the insurance landscape continues to evolve, staying informed and adaptable will be key to ensuring your business remains adequately protected at a competitive cost.

What is the average cost of business insurance for small businesses?

+The average cost of business insurance for small businesses can vary widely depending on factors such as industry, location, and coverage needs. On average, small businesses can expect to pay anywhere from 500 to 2,000 annually for a basic package of business insurance, which typically includes general liability, professional liability, and property insurance.

Can I negotiate my business insurance premiums?

+Yes, you can negotiate your business insurance premiums. Insurance companies understand that price is a significant factor in a business owner’s decision-making process. By shopping around, comparing quotes, and negotiating with multiple providers, you may be able to secure a better rate or additional coverage for your business.

How can I reduce my business insurance costs?

+There are several strategies you can employ to reduce your business insurance costs. These include implementing robust risk management strategies, bundling insurance policies with the same provider, shopping around for competitive quotes, and working with an insurance broker who can negotiate on your behalf. Additionally, maintaining a clean claims history and improving your business’s overall safety profile can lead to lower insurance premiums over time.