California Car Insurance

California, the Golden State, is known for its diverse landscapes, vibrant cities, and, of course, its vast network of roads and highways. With millions of vehicles on the roads, understanding the intricacies of car insurance in this state is crucial for every driver. California's insurance landscape is unique, with its own set of regulations and requirements. In this comprehensive guide, we will delve into the world of California car insurance, exploring the key aspects, coverage options, and strategies to ensure you are well-informed and protected.

Understanding California Car Insurance

California’s car insurance market is governed by the California Department of Insurance, which sets the standards and regulations for insurance providers. The state mandates specific coverage limits to ensure drivers are adequately protected in the event of accidents or other incidents. Let’s break down the essential components of California car insurance.

Minimum Coverage Requirements

California requires all drivers to carry liability insurance, which covers damages caused to others in an accident for which you are at fault. The minimum liability limits in California are as follows:

- Bodily Injury Liability: 15,000 per person and 30,000 per accident.

- Property Damage Liability: $5,000 per accident.

While these are the legal minimums, it is often recommended to carry higher limits to provide more robust protection. The cost of medical care and vehicle repairs can quickly exceed these minimums, leaving you financially vulnerable.

Optional Coverage

Beyond the mandatory liability coverage, California drivers have several optional coverage options to consider, depending on their individual needs and preferences.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault. It provides peace of mind for those who wish to protect their vehicle's value.

- Comprehensive Coverage: Comprehensive insurance covers damages to your vehicle caused by non-accident events, such as theft, vandalism, weather-related incidents, or collisions with animals. It offers broader protection.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial, as it protects you if you are involved in an accident with a driver who has little or no insurance. It covers your medical expenses and can prevent financial strain.

- Medical Payments Coverage: MedPay covers the medical expenses of you and your passengers after an accident, regardless of fault. It provides quick access to funds for medical treatment.

- Personal Injury Protection (PIP): PIP coverage is similar to MedPay but typically offers more extensive coverage, including lost wages and funeral expenses.

Factors Influencing Insurance Rates

California car insurance rates can vary significantly based on several factors. Understanding these influences can help you make informed decisions when choosing a policy.

- Location: Insurance rates can vary depending on the city or region you reside in. Urban areas with higher populations and traffic congestion often result in higher rates.

- Vehicle Type: The make, model, and age of your vehicle play a role in insurance costs. Luxury and sports cars tend to be more expensive to insure due to their higher repair and replacement costs.

- Driving History: Your driving record is a significant factor. Tickets, accidents, and claims can increase your insurance premiums. Maintaining a clean driving record is essential for keeping costs down.

- Credit Score: In California, insurance companies are allowed to consider your credit score when determining your rates. A good credit history can lead to lower premiums.

- Age and Gender: Young drivers and those under 25 years old often face higher insurance rates due to their lack of driving experience. Gender can also be a factor, with some insurers charging different rates based on statistical risk assessments.

Choosing the Right Coverage

When selecting car insurance in California, it’s essential to consider your unique circumstances and needs. Here are some tips to help you choose the right coverage:

- Evaluate Your Needs: Assess your financial situation and the value of your vehicle. Consider the potential costs of accidents and choose coverage limits accordingly.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options. Online comparison tools can be a valuable resource.

- Consider Discounts: Many insurers offer discounts for safe driving, multiple vehicles, and other factors. Explore these discounts to potentially lower your premiums.

- Understand Deductibles: Higher deductibles can reduce your premium costs, but they also mean you'll pay more out of pocket in the event of a claim. Choose a deductible that aligns with your financial comfort level.

- Read the Fine Print: Carefully review the policy terms and conditions to ensure you understand the coverage and exclusions. Don't hesitate to ask questions to clarify any uncertainties.

Common Claims and Settlements

California’s roads can present various challenges, from busy urban streets to winding mountain passes. Understanding the types of claims and settlements that are common in the state can help you prepare and ensure you have adequate coverage.

Accident Claims

Vehicle accidents are the most common type of insurance claim in California. Whether it’s a fender bender or a more severe collision, understanding the claims process is crucial.

- Reporting an Accident: After an accident, promptly report it to your insurance company. Provide detailed information about the incident, including the date, time, location, and any injuries or property damage.

- Filing a Claim: Your insurance provider will guide you through the claims process. They may assign an adjuster to investigate the claim and determine fault and damages.

- Settlements: Settlements can vary depending on the circumstances of the accident and the coverage involved. It's important to understand your policy's limits and any applicable deductibles when discussing settlements.

Weather-Related Claims

California experiences a range of weather conditions, from droughts to wildfires and earthquakes. These events can lead to insurance claims for property damage.

- Wildfires: California's wildfire season poses a significant risk to vehicles and properties. Comprehensive insurance typically covers damages caused by wildfires, but it's essential to review your policy's exclusions.

- Earthquakes: While earthquakes are less frequent, they can cause extensive damage. Standard car insurance policies do not cover earthquake damage, so drivers may need to consider additional coverage options.

Vandalism and Theft

Unfortunately, vehicle vandalism and theft are common issues in California. Comprehensive insurance typically covers these incidents, providing financial protection for repairs or replacement.

Future Trends and Considerations

The world of car insurance is constantly evolving, and California is no exception. Here are some future trends and considerations to keep in mind when planning your insurance strategy.

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining popularity. These programs use data from your driving behavior to determine your insurance rates. If you’re a safe and cautious driver, you may benefit from lower premiums.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is transforming the automotive industry. As these vehicles become more prevalent, insurance providers will need to adapt their coverage options and pricing structures.

Technology and Claims Processing

Advancements in technology are streamlining the claims process. From mobile apps for reporting claims to drone technology for assessing damage, the future of insurance claims processing looks efficient and innovative.

Climate Change and Natural Disasters

California’s susceptibility to natural disasters, such as wildfires and earthquakes, highlights the importance of comprehensive coverage. As climate change continues to impact the state, insurance providers may adjust their policies and rates to account for these risks.

Conclusion

Navigating the world of California car insurance requires a thorough understanding of the state’s regulations, coverage options, and potential risks. By staying informed and choosing the right coverage, you can ensure you’re protected on California’s roads. Remember, insurance is a vital aspect of responsible driving, and by making informed decisions, you can drive with confidence and peace of mind.

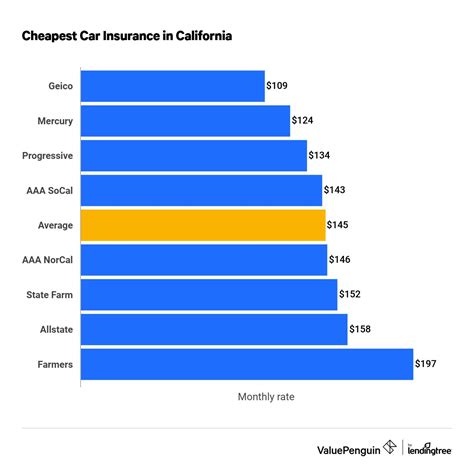

What is the average cost of car insurance in California?

+The average cost of car insurance in California can vary significantly based on factors such as location, driving history, and the type of coverage chosen. As of [current year], the average annual premium in California is approximately $1,500. However, it’s important to obtain personalized quotes to get an accurate estimate for your specific situation.

Are there any discounts available for car insurance in California?

+Yes, California insurance providers offer various discounts to policyholders. These can include safe driver discounts, multi-policy discounts (bundling car and home insurance), loyalty discounts, and even discounts for taking defensive driving courses. It’s worth exploring these options to potentially lower your insurance premiums.

How can I lower my car insurance premiums in California?

+There are several strategies to reduce your car insurance premiums in California. Some effective methods include maintaining a clean driving record, increasing your deductible, exploring usage-based insurance programs, and shopping around for the best rates. Additionally, consider adding safety features to your vehicle, as some insurers offer discounts for advanced safety systems.