California Homeowners Insurance

California is known for its diverse landscapes, from the sunny beaches of Southern California to the lush forests and towering mountains of the north. However, this golden state also presents a unique set of challenges for homeowners, making homeowners insurance an essential consideration.

With its susceptibility to natural disasters like earthquakes, wildfires, and floods, as well as its high-risk coastal areas, California demands a tailored approach to home insurance. Understanding the specific risks and coverage options is crucial for every Californian homeowner. This comprehensive guide aims to provide an in-depth analysis of California homeowners insurance, covering everything from the essential policies to the unique risks and factors that influence premiums.

Understanding California Homeowners Insurance

Homeowners insurance in California, as in any state, serves as a financial safety net for homeowners. It provides protection against a range of perils that could potentially damage or destroy a home, and it also covers liabilities related to the property. The specific coverage and premiums can vary significantly depending on the insurer, the policy type, and the location and characteristics of the home.

Key Coverage Components

California homeowners insurance policies typically include the following core coverages:

- Dwelling Coverage: This is the cornerstone of any homeowners insurance policy. It provides financial protection for the physical structure of the home, covering damages caused by perils such as fire, windstorms, and vandalism. However, it's important to note that earthquakes and floods are typically excluded and require separate policies.

- Personal Property Coverage: This coverage reimburses homeowners for the cost of replacing or repairing their belongings, such as furniture, electronics, and clothing, if they are damaged or destroyed by a covered peril.

- Liability Coverage: Liability insurance protects homeowners against claims arising from accidents or injuries that occur on their property. It covers medical expenses and legal fees if a guest or passerby is injured on the homeowner's premises.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to a covered peril, this coverage reimburses the homeowner for additional living expenses, such as hotel stays and restaurant meals, until the home is repaired or rebuilt.

Additional Endorsements and Riders

Beyond the standard coverage, California homeowners may want to consider additional endorsements or riders to tailor their policy to their specific needs. These can include:

- Earthquake Insurance: Given California's seismic activity, many homeowners choose to add earthquake insurance to their policy. This provides coverage for damage caused by earthquakes, which is typically excluded from standard homeowners insurance.

- Flood Insurance: While coastal properties may be at risk of storm surges and flooding, flood insurance is not typically included in standard homeowners policies. The National Flood Insurance Program (NFIP) offers flood insurance policies to homeowners, renters, and business owners.

- Personal Property Endorsements: Homeowners can add endorsements to their policy to increase coverage limits for valuable items like jewelry, artwork, or musical instruments. These endorsements provide additional protection for items that may exceed the standard coverage limits.

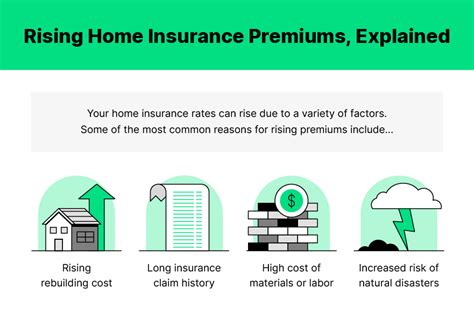

Factors Influencing California Homeowners Insurance Premiums

The cost of homeowners insurance in California can vary significantly depending on several factors. Understanding these factors can help homeowners make informed decisions when choosing a policy and potentially negotiate better rates.

Location and Natural Disaster Risks

California’s diverse geography means that different regions face unique natural disaster risks. Insurers consider these risks when calculating premiums. For example, homes located in high-risk areas for wildfires, earthquakes, or floods will likely face higher premiums due to the increased likelihood of claims.

Home Construction and Age

The construction materials and age of a home can also impact insurance premiums. Homes built with fire-resistant materials or those that have been retrofitted with earthquake-resistant features may qualify for lower rates. Additionally, newer homes are generally considered less risky than older homes, as they may be built to more stringent codes and standards.

Home Value and Coverage Limits

The value of the home and the chosen coverage limits can significantly influence premiums. Homeowners should ensure that their dwelling coverage limit reflects the cost to rebuild their home, not the market value. Overestimating or underestimating this value can lead to insufficient coverage or unnecessary expenses.

Claims History

Insurer’s consider a homeowner’s claims history when determining premiums. Frequent claims can signal higher risk to insurers and may result in increased premiums or even non-renewal of the policy. On the other hand, a clean claims history can lead to discounts and more favorable rates.

Deductibles and Coverage Options

The choice of deductibles and coverage options can also affect premiums. Higher deductibles generally result in lower premiums, as the homeowner assumes more of the financial risk. Additionally, selecting comprehensive coverage options, such as additional endorsements or higher liability limits, can increase premiums.

Comparing California Homeowners Insurance Policies

With the wide range of insurance providers and policy options available in California, it’s essential to compare policies to find the best fit for your needs and budget. Here are some key considerations when comparing California homeowners insurance policies:

Coverage Options and Limits

Review the coverage options and limits offered by each policy. Ensure that the dwelling coverage limit is sufficient to rebuild your home, and consider adding endorsements for valuable possessions or increased liability limits if needed.

Premium Costs and Discounts

Compare the annual premiums offered by different insurers. Keep in mind that the cheapest policy may not always provide the best value. Look for insurers that offer discounts for multiple policies (e.g., bundling home and auto insurance), safety features (such as smoke detectors or security systems), or loyalty.

Reputation and Financial Stability

Research the reputation and financial stability of the insurance providers you’re considering. Check ratings from independent agencies like AM Best or J.D. Power to ensure the insurer is financially sound and has a good track record of paying claims.

Customer Service and Claims Handling

Consider the insurer’s customer service reputation and claims handling process. Look for insurers with responsive customer service, efficient claims processing, and a history of fair and prompt claim settlements.

Policy Exclusions and Fine Print

Read the policy documents carefully, paying close attention to exclusions and fine print. Understand what perils are covered and which are excluded, and ensure you’re comfortable with the terms and conditions before purchasing the policy.

| Insurers | Premium Cost | Coverage Limits | Discounts |

|---|---|---|---|

| State Farm | $1,200 annually | Dwelling: $500,000 Personal Property: $250,000 Liability: $100,000 |

Multi-policy, safe driver, good student |

| Allstate | $1,350 annually | Dwelling: $600,000 Personal Property: $300,000 Liability: $300,000 |

Bundled policies, safe home, new home |

| USAA | $1,100 annually | Dwelling: $400,000 Personal Property: $200,000 Liability: $100,000 |

Loyalty, multi-policy, automatic payments |

Conclusion

California homeowners insurance is a vital investment for protecting your home and possessions. By understanding the key coverage components, the factors that influence premiums, and how to compare policies, you can make an informed decision and choose a policy that provides the right coverage at a competitive price. Remember, it’s crucial to review your policy regularly and adjust it as your needs and circumstances change.

Frequently Asked Questions

What is the average cost of homeowners insurance in California?

+The average cost of homeowners insurance in California is approximately 1,000 to 1,500 annually. However, this can vary significantly based on factors like location, home value, and coverage limits.

Are earthquakes covered by standard homeowners insurance policies in California?

+No, earthquakes are typically excluded from standard homeowners insurance policies in California. Homeowners can purchase separate earthquake insurance policies to cover damages caused by seismic activity.

How can I reduce my homeowners insurance premiums in California?

+You can reduce your homeowners insurance premiums by increasing your deductibles, maintaining a clean claims history, installing safety features like smoke detectors and security systems, and bundling your home and auto insurance policies.