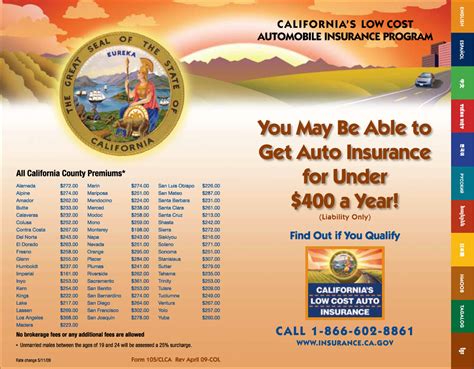

California Insurance Auto

Welcome to a comprehensive guide on California's Auto Insurance Landscape, a vital aspect of vehicle ownership in the Golden State. This article will delve into the intricacies of auto insurance in California, providing valuable insights for both residents and visitors alike. From understanding the state's unique regulations to choosing the right coverage, we'll cover it all. So, buckle up as we navigate the highways of insurance knowledge together!

Understanding California’s Auto Insurance Requirements

California is known for its stringent auto insurance laws, designed to protect drivers and ensure financial security in the event of accidents. The state mandates that all drivers carry a minimum amount of liability insurance, which covers bodily injury and property damage caused to others in an at-fault accident.

The minimum liability limits in California are as follows:

- Bodily Injury Liability: $15,000 per person / $30,000 per accident

- Property Damage Liability: $5,000 per accident

While these are the legal minimums, it's important to note that many experts recommend carrying higher limits to provide adequate protection. After all, the costs associated with severe accidents can quickly exceed these amounts.

In addition to liability insurance, California also requires drivers to carry Uninsured Motorist Coverage. This ensures that drivers are protected if they are involved in an accident with an uninsured or underinsured driver. Uninsured Motorist Coverage typically includes coverage for bodily injury and property damage.

Optional Coverages in California

While the above coverages are mandatory, California drivers have the option to enhance their insurance policies with additional protections. These include:

- Collision Coverage: Pays for damages to your vehicle when you’re at fault in an accident, or when your car is damaged by a non-collision event like a fallen tree.

- Comprehensive Coverage: Covers a wide range of incidents, including theft, vandalism, weather damage, and more.

- Medical Payments Coverage: Provides additional medical coverage for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

It's important to carefully consider your coverage options, as different policies and additional coverages can significantly impact your premium.

California’s Insurance Rates and Factors

Insurance rates in California can vary widely depending on several factors. These include the type of vehicle, the driver’s age and driving history, the location, and even the credit score of the policyholder. Here’s a closer look at some of these variables:

Vehicle Factors

The make, model, and year of your vehicle can significantly impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher premiums due to their higher replacement costs and tendency to be targeted by thieves. Additionally, newer vehicles with advanced safety features may qualify for discounts.

Driver Factors

Your driving history is a key factor in determining your insurance rates. A clean driving record with no at-fault accidents or moving violations can lead to lower premiums. On the other hand, a history of accidents or traffic violations can significantly increase your insurance costs.

Age is another important consideration. Young drivers (typically under 25) and senior drivers (over 65) often face higher premiums due to their perceived higher risk levels. However, some insurers offer discounts for young drivers who maintain good grades or complete approved driver education courses.

Location and Usage Factors

The area where you live and work can impact your insurance rates. Urban areas with higher populations and denser traffic tend to have higher rates due to increased accident risks. Similarly, if you primarily drive in high-risk areas or during rush hour, your rates may be higher.

Credit Score and Other Factors

Believe it or not, your credit score can play a role in your insurance rates. Many insurers use credit-based insurance scores to assess risk, and a higher credit score can often lead to lower premiums. Additionally, factors like your marital status, the number of miles you drive annually, and the type of commute you have can all influence your rates.

Navigating California’s Insurance Market: Tips and Tricks

With so many variables at play, finding the right auto insurance policy in California can be a challenge. Here are some tips to help you navigate the process and secure the best coverage at the most competitive rates:

Shop Around

Don’t settle for the first insurance quote you receive. Take the time to compare rates and coverage options from multiple insurers. Online comparison tools can be a great starting point, but be sure to also seek quotes from local insurance agents who can provide personalized advice.

Understand Your Coverage Needs

Assess your specific coverage needs based on your vehicle, driving habits, and financial situation. While it’s important to have adequate liability coverage, you may also want to consider additional protections like collision and comprehensive coverage, especially if your vehicle is still being financed or leased.

Explore Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. Common discounts include those for safe driving records, loyalty, multi-policy coverage, and safety features in your vehicle. Some insurers also offer discounts for completing defensive driving courses or for being a member of certain professional organizations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to track your driving behavior and adjust your premiums accordingly. This can be a great option for safe drivers who don’t log many miles annually, as it rewards good driving habits with lower rates.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with one insurer. Many insurers offer substantial discounts for bundling multiple policies, which can save you a significant amount over time.

Regularly Review and Adjust Your Policy

Insurance needs can change over time, so it’s important to regularly review your policy and make adjustments as necessary. This might include increasing your liability limits, adding or removing drivers from your policy, or adjusting your coverage levels to reflect changes in your vehicle or driving habits.

Conclusion: California’s Auto Insurance Scene

California’s auto insurance landscape is diverse and dynamic, offering a range of options to suit the unique needs of its drivers. By understanding the state’s insurance requirements, exploring your coverage options, and leveraging strategies like shopping around and bundling policies, you can find the right coverage at the best possible rate.

Remember, auto insurance is a vital component of responsible vehicle ownership. By staying informed and proactive, you can ensure you have the protection you need on the roads of the Golden State.

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California varies widely depending on various factors. According to recent data, the average annual premium for a minimum liability policy in California is around 700, while the average for a full coverage policy (including collision and comprehensive) is closer to 1,800. However, these averages can vary significantly based on individual circumstances.

Can I get auto insurance without a driver’s license in California?

+No, California law requires that all registered vehicles be insured, and insurers typically require a valid driver’s license to issue a policy. However, if you’re a non-driver or have a restricted license, you may still be able to obtain insurance for your vehicle, but the process can be more complex and may require additional documentation.

What are some common discounts offered by auto insurers in California?

+Common discounts offered by auto insurers in California include safe driver discounts, multi-policy discounts (for bundling auto insurance with other types of insurance), loyalty discounts, good student discounts, and discounts for completing defensive driving courses. Additionally, some insurers offer discounts for vehicles equipped with certain safety features or for those who drive low mileage annually.