California Insurance Rates

Understanding the intricate world of insurance rates in California is a complex task, one that many individuals and businesses face when navigating the state's unique insurance landscape. With a diverse range of factors influencing these rates, from geographic location to personal history, it's a challenging yet critical aspect of financial planning. This comprehensive guide aims to shed light on the specific factors that determine insurance rates in California, providing a detailed analysis to help readers make informed decisions.

The Complexity of California Insurance Rates

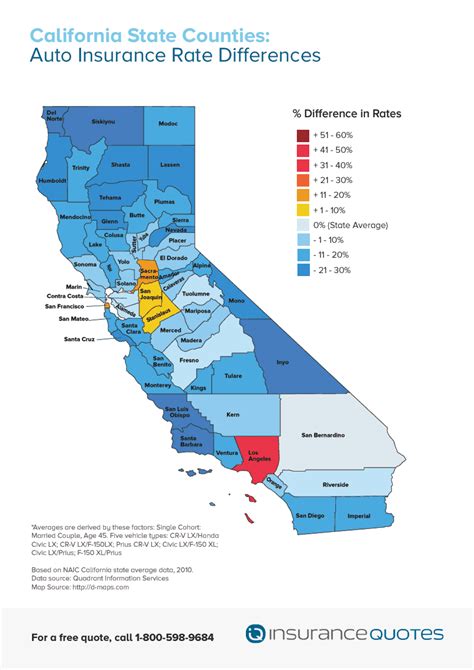

California, with its diverse geography, bustling cities, and varied demographics, presents a unique challenge when it comes to insurance rates. The state’s insurance landscape is shaped by a multitude of factors, each playing a significant role in determining the cost of insurance coverage. From the coastal regions to the inland valleys, and from the bustling cities to the rural areas, insurance rates can vary drastically, making it a complex puzzle to decipher.

Key Factors Influencing Insurance Rates

One of the primary factors influencing insurance rates in California is the geographic location of the insured. The state’s diverse geography, with its varying weather patterns, natural hazards, and crime rates, can significantly impact insurance costs. For instance, coastal regions prone to earthquakes and floods often see higher insurance rates due to the increased risk of natural disasters.

Additionally, the personal history of the insured plays a crucial role. Insurance companies consider an individual's or business's claims history, credit score, and driving record when determining rates. A history of frequent claims or a low credit score can lead to higher insurance premiums, as these factors are seen as indicators of potential future risks.

The type of insurance being sought also significantly influences rates. Whether it's auto insurance, homeowners insurance, health insurance, or business insurance, each type comes with its own set of risks and considerations, impacting the final cost.

| Insurance Type | Average Premium in California |

|---|---|

| Auto Insurance | $1,244 annually |

| Homeowners Insurance | $1,154 annually |

| Health Insurance | Varies based on plan and coverage |

| Business Insurance | Varies based on industry and coverage needs |

The Role of Data and Analytics

Insurance companies in California heavily rely on data analytics to determine insurance rates. They analyze vast amounts of data, including historical claims data, weather patterns, crime statistics, and demographic information, to assess the risk associated with insuring a particular individual or business. This data-driven approach allows insurance companies to set rates that accurately reflect the level of risk they’re assuming.

For instance, if an area has a high rate of car accidents or thefts, insurance companies will likely set higher auto insurance rates for that region. Similarly, if a particular demographic group has a history of making frequent insurance claims, insurance rates for that group may be adjusted accordingly.

Regulation and Oversight

The insurance industry in California is heavily regulated to ensure fair practices and consumer protection. The California Department of Insurance (CDI) is responsible for overseeing the industry, ensuring that insurance companies operate ethically and comply with state laws. The CDI also plays a role in reviewing and approving insurance rates, providing an additional layer of protection for consumers.

However, it's important to note that while the CDI approves insurance rates, it does not set them. Insurance companies determine their rates based on the factors mentioned earlier, and these rates must be filed with and approved by the CDI before they can be implemented.

Navigating California’s Insurance Landscape

Given the complexity of California’s insurance rates, it’s essential to approach the process of obtaining insurance coverage with careful consideration. Here are some tips to help navigate this landscape effectively:

- Shop Around: Don't settle for the first insurance quote you receive. Compare rates from multiple insurance companies to ensure you're getting the best deal.

- Understand Your Risks: Be aware of the risks associated with your location, occupation, and personal history. This knowledge can help you negotiate better rates or choose the right coverage.

- Improve Your Credit Score: A good credit score can significantly impact your insurance rates. Take steps to improve your credit if needed, as this can lead to lower premiums.

- Review Your Coverage Regularly: Insurance needs can change over time. Regularly review your coverage to ensure it aligns with your current situation and that you're not overpaying for unnecessary features.

- Consider Bundling: Many insurance companies offer discounts when you bundle multiple types of insurance (e.g., auto and home insurance) with them. This can be a cost-effective way to save on your premiums.

The Future of Insurance in California

The insurance landscape in California is constantly evolving, driven by advancements in technology, changing regulatory environments, and shifts in consumer behavior. As we move forward, several key trends are likely to shape the future of insurance rates in the state:

- Increased Use of Telematics: With the rise of telematics, insurance companies are gaining access to more detailed data about driving behavior. This technology has the potential to revolutionize auto insurance rates, offering discounts to safe drivers and adjusting rates based on real-time data.

- Data-Driven Personalization: As insurance companies continue to refine their data analytics capabilities, we can expect more personalized insurance rates. This means rates will be tailored to an individual's unique risk profile, potentially leading to more accurate and fair pricing.

- Focus on Prevention: There's a growing trend among insurance companies to offer incentives for preventive measures. For example, health insurance companies may offer discounts for maintaining a healthy lifestyle, while homeowners insurance companies may provide discounts for installing safety features in the home.

- Regulatory Changes: The regulatory environment in California is subject to change, which can significantly impact insurance rates. Any shifts in state laws or regulations regarding insurance could lead to adjustments in rates.

Conclusion

Understanding the factors that influence insurance rates in California is a crucial step towards making informed decisions about your insurance coverage. By staying informed about these factors and keeping an eye on emerging trends, you can navigate the complex world of insurance with confidence and ensure you’re getting the best value for your insurance premiums.

FAQ

How do I find the best insurance rates in California?

+Finding the best insurance rates in California requires a comprehensive approach. Start by comparing quotes from multiple insurance companies to understand the market rate for your specific needs. Consider factors like your geographic location, credit score, and claims history, as these can significantly impact your rates. Additionally, explore the option of bundling multiple types of insurance with the same provider, as this can often lead to substantial savings.

Are insurance rates in California higher than other states?

+Insurance rates in California can be higher compared to some other states, primarily due to the state’s diverse geography, high population density, and frequent natural disasters. However, it’s important to note that rates can vary significantly within California itself, with certain areas having much higher premiums than others. It’s crucial to obtain quotes specific to your location to understand the exact rates you may face.

How often should I review my insurance coverage and rates?

+It’s recommended to review your insurance coverage and rates at least once a year. This allows you to stay updated on any changes in your personal circumstances or the insurance market that may impact your coverage or rates. Additionally, reviewing your coverage annually can help ensure you’re not overpaying for unnecessary features and that your coverage remains adequate for your current needs.

What factors can I control to potentially lower my insurance rates?

+While certain factors like geographic location and claims history are beyond your control, there are several factors you can influence to potentially lower your insurance rates. These include maintaining a good credit score, practicing safe driving habits (for auto insurance), implementing safety measures in your home (for homeowners insurance), and adopting a healthy lifestyle (for health insurance). Additionally, shopping around for the best rates and exploring bundling options can also help lower your insurance costs.