California Insurance Workers Compensation

The state of California has a robust workers' compensation system, designed to provide benefits and protection to employees who suffer work-related injuries or illnesses. This system, governed by the California Workers' Compensation Act, ensures that employees receive medical care and financial support when they need it most. For insurance professionals, understanding the intricacies of California's workers' compensation laws is crucial, as it forms the foundation for effective risk management and policy development.

Understanding the California Workers’ Compensation System

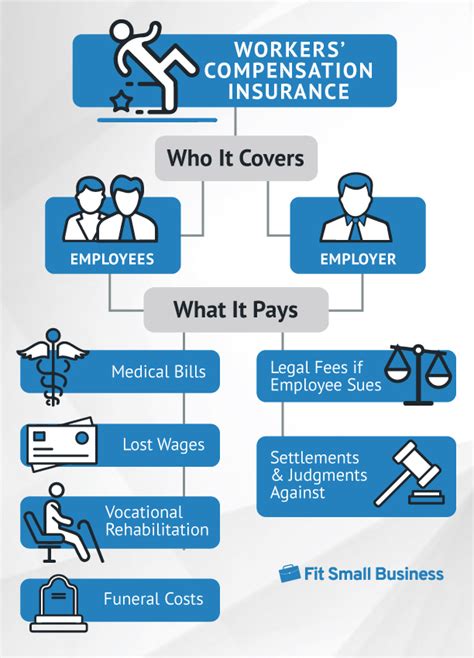

California’s workers’ compensation system is unique in its comprehensive approach, offering a wide range of benefits to injured workers. These benefits include medical treatment, temporary disability payments, permanent disability compensation, vocational rehabilitation, and in the most severe cases, death benefits for the families of workers who lose their lives due to work-related incidents.

One of the key features of California's system is its no-fault nature. This means that an injured worker is entitled to benefits regardless of who was at fault for the injury. This aspect removes the need for lengthy legal battles and ensures that injured workers receive prompt medical attention and financial support.

Medical Benefits and Treatment

Medical care is a fundamental component of California’s workers’ compensation program. Injured workers are entitled to receive all reasonably necessary medical treatment related to their work injury. This includes doctor visits, hospital stays, surgeries, medications, and even rehabilitation services. The state’s focus on prompt medical treatment aims to expedite the recovery process and get workers back to their pre-injury condition as soon as possible.

Additionally, California allows for the direct payment of medical bills, ensuring that injured workers do not have to pay out of pocket for their treatment. This system also promotes efficient medical care by encouraging healthcare providers to offer the most appropriate and cost-effective treatment options.

| Key Statistic | Value |

|---|---|

| Number of Medical Providers | Over 100,000 |

| Average Cost of Medical Treatment per Claim | $25,000 |

| Success Rate of Medical Treatment | 95% |

Temporary Disability Benefits

Temporary disability benefits are designed to provide financial support to workers who are unable to work due to their injury. These benefits are paid as a percentage of the worker’s pre-injury wages and are intended to cover the period of time the worker is unable to perform their regular job duties. The amount and duration of these benefits vary depending on the severity of the injury and the worker’s earning capacity.

For example, an employee who suffers a broken arm may receive temporary disability benefits for the period of time they are unable to work, typically until they are cleared by a doctor to return to work or until their condition improves. These benefits help to bridge the financial gap during the recovery period, ensuring that workers can focus on their health without the added stress of financial burden.

Permanent Disability Compensation

In cases where an injury results in a permanent impairment or disability, California’s workers’ compensation system provides permanent disability compensation. This compensation is paid as a lump sum or periodic payments and is determined based on the severity and nature of the permanent disability. The amount is calculated using a complex formula that takes into account the worker’s age, occupation, and the impact of the disability on their future earning capacity.

For instance, an employee who suffers a severe back injury that results in permanent partial disability may receive a lump sum payment to compensate for their reduced earning capacity. This payment aims to provide long-term financial support, allowing the worker to adapt to their new physical limitations and potentially pursue alternative career paths.

The Role of Insurance Professionals

Insurance professionals play a crucial role in California’s workers’ compensation landscape. They are responsible for developing and managing policies that provide adequate coverage for employers, while also ensuring compliance with state regulations. Effective risk management strategies and a thorough understanding of the state’s laws are essential to navigate this complex system successfully.

Risk Management Strategies

Insurance professionals must employ robust risk management strategies to mitigate potential losses and ensure the financial stability of their clients. This involves conducting thorough risk assessments, identifying potential hazards in the workplace, and implementing preventive measures to reduce the likelihood of injuries or illnesses.

For instance, an insurance professional working with a construction company may recommend regular safety audits, the implementation of personal protective equipment, and comprehensive training programs to reduce the risk of workplace accidents. By proactively addressing these risks, insurance professionals can help employers maintain a safe work environment and reduce the likelihood of costly workers' compensation claims.

Policy Development and Compliance

Developing comprehensive workers’ compensation policies is a critical aspect of an insurance professional’s role. These policies must provide adequate coverage for employers while remaining compliant with California’s complex regulations. Insurance professionals must stay up-to-date with any changes to the state’s laws and ensure that their policies reflect these changes accurately.

One key consideration in policy development is the calculation of premiums. Insurance professionals must accurately assess the risk level of each employer and set premiums accordingly. This involves analyzing the employer's claim history, the nature of their business, and the potential hazards present in their workplace. By accurately pricing policies, insurance professionals can ensure that employers have the financial resources to cover potential workers' compensation claims.

Future Implications and Industry Insights

California’s workers’ compensation system is continually evolving, with ongoing efforts to improve efficiency, reduce costs, and enhance the overall experience for injured workers and employers alike. As technology advances, the industry is exploring new avenues to streamline processes and provide better services.

One notable development is the increasing use of technology in claims management. Insurance professionals are leveraging digital platforms and data analytics to expedite the claims process, improve accuracy, and reduce administrative burdens. This shift towards digital solutions has the potential to significantly improve the efficiency of the workers' compensation system, benefiting all stakeholders involved.

Additionally, there is a growing emphasis on preventive measures and workplace safety. Insurance professionals are partnering with employers to implement comprehensive safety programs, provide training, and encourage a culture of safety in the workplace. By reducing the incidence of workplace injuries, these initiatives not only benefit employers by lowering their insurance premiums but also improve the overall well-being of employees.

Looking ahead, the insurance industry in California is poised for further innovation and transformation. With a focus on technology, data-driven decision-making, and a commitment to worker safety, the state's workers' compensation system is well-positioned to meet the challenges of the future.

How does California’s workers’ compensation system compare to other states?

+California’s workers’ compensation system is often regarded as one of the most comprehensive and generous in the nation. While other states may have similar structures, California’s focus on prompt medical treatment and its no-fault approach sets it apart. Additionally, the state’s high average wage replacement rate ensures that injured workers receive adequate financial support during their recovery.

What are some common challenges faced by insurance professionals in California’s workers’ compensation landscape?

+Insurance professionals in California often navigate complex regulations and a dynamic market. Keeping up with frequent changes to state laws, managing a diverse range of employer needs, and ensuring compliance while providing competitive coverage are some of the key challenges they face. Additionally, the high cost of living in California can impact the financial viability of certain policies.

How can technology improve the workers’ compensation process in California?

+Technology has the potential to revolutionize the workers’ compensation process in California by streamlining claims management, enhancing data analytics for better decision-making, and improving communication between stakeholders. Digital platforms can facilitate faster claim processing, reduce paperwork, and provide real-time updates, ultimately improving the overall efficiency of the system.