California State Health Insurance

In the vast landscape of healthcare, understanding the intricacies of insurance plans is crucial, especially when it comes to state-specific programs like the California State Health Insurance. This comprehensive guide aims to demystify this essential aspect of healthcare, offering a detailed exploration of its features, benefits, and impact on the lives of Californians.

California State Health Insurance: A Lifeline for Millions

The California State Health Insurance, often referred to as Covered California, is a pivotal program designed to provide affordable healthcare coverage to residents of the Golden State. With a population of over 39 million people, California’s healthcare landscape is diverse and complex, making the role of Covered California even more critical.

Covered California was established in 2014 as part of the Patient Protection and Affordable Care Act, commonly known as the ACA or Obamacare. It serves as the state's health insurance marketplace, offering a range of insurance plans from various carriers, tailored to meet the diverse needs of Californians.

The Need for State-Specific Insurance

California’s unique demographic and geographic diversity present a challenge when it comes to healthcare. With a vast range of income levels, varying degrees of healthcare needs, and a large uninsured population, the state required a tailored solution. Covered California was developed to address these specific needs, ensuring that all residents, regardless of their circumstances, have access to quality healthcare.

One of the key strengths of Covered California is its ability to negotiate with insurance carriers, resulting in more affordable premiums and a wider range of coverage options. This state-based approach has been instrumental in reducing the number of uninsured individuals in California, providing peace of mind and financial security to millions.

Eligibility and Enrollment

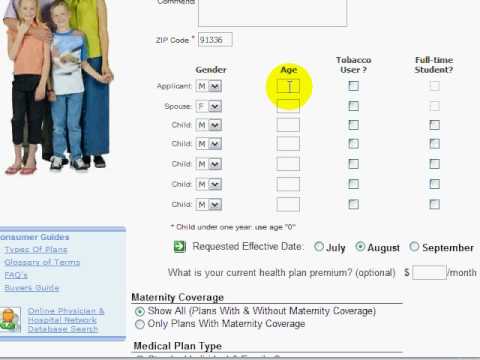

Covered California is open to all California residents who are not eligible for Medicare or other government-funded health programs. Eligibility is based on a combination of factors, including income, family size, and age. The program offers financial assistance in the form of premium tax credits and cost-sharing reductions to make healthcare more affordable for those who need it most.

The enrollment process is straightforward, with individuals able to apply online, by phone, or in-person with the help of certified enrollers. The annual Open Enrollment Period typically runs from November to January, allowing residents to review and select plans for the upcoming year. However, those who experience a qualifying life event, such as a change in employment or family status, can enroll outside of this period.

Plan Options and Benefits

Covered California offers a diverse range of health insurance plans, categorized into four main tiers: Bronze, Silver, Gold, and Platinum. Each tier represents a different level of coverage and cost-sharing, with Bronze plans typically having lower premiums and higher deductibles, and Platinum plans offering the opposite.

Within these tiers, individuals can choose from a variety of plan types, including:

- Health Maintenance Organizations (HMOs): These plans typically provide coverage for a specific network of healthcare providers, offering comprehensive care at a lower cost.

- Preferred Provider Organizations (PPOs): PPO plans offer more flexibility, allowing individuals to choose any healthcare provider, although costs may be lower when using in-network providers.

- Exclusive Provider Organizations (EPOs): Similar to PPOs, EPOs have a network of preferred providers, but individuals are not covered outside of this network unless it's an emergency.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs, offering a primary care network with the option to seek care outside of the network for an additional cost.

All plans offered through Covered California must meet certain standards, including providing essential health benefits such as:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services, including dental and vision care

Understanding Cost-Sharing

Cost-sharing refers to the out-of-pocket expenses that individuals pay for their healthcare, including deductibles, copayments, and coinsurance. These costs can vary significantly depending on the plan chosen. Covered California aims to make these costs more manageable through financial assistance, ensuring that healthcare remains accessible to all.

| Cost-Sharing Feature | Description |

|---|---|

| Deductible | The amount an individual pays out of pocket before the insurance plan begins to cover costs. Deductibles can range from a few hundred to several thousand dollars. |

| Copayment | A fixed amount paid for a covered service, such as a doctor's visit or prescription medication. Copayments are typically lower for in-network providers. |

| Coinsurance | The percentage of costs an individual pays after the deductible has been met. For example, a plan with 80/20 coinsurance means the insurance covers 80% of costs, while the individual pays the remaining 20%. |

Additional Benefits and Services

Beyond the essential health benefits, Covered California plans often include additional services and benefits, such as:

- Dental and vision coverage for children

- Access to a 24/7 nurse advice line

- Wellness programs and incentives

- Prescription drug coverage, including specialty medications

- Mental health and substance abuse treatment

The Impact on Californians

The introduction of Covered California has had a profound impact on the lives of Californians, particularly those who were previously uninsured or underinsured. By providing affordable, comprehensive healthcare coverage, the program has improved access to essential services and reduced financial barriers to healthcare.

Improved Health Outcomes

With better access to healthcare, Californians are experiencing improved health outcomes. Regular check-ups, preventive care, and timely treatment for illnesses and injuries have become more accessible, leading to earlier detection and better management of health conditions. This, in turn, has reduced the burden of chronic diseases and improved overall quality of life.

Financial Security and Peace of Mind

The financial protection offered by Covered California is a significant benefit. Individuals and families no longer face the fear of unaffordable medical bills, as the insurance plans cover a substantial portion of healthcare costs. This financial security allows Californians to plan for the future with confidence, knowing that unexpected health issues won’t lead to devastating financial consequences.

Community Benefits

The positive impact of Covered California extends beyond individual health and financial security. The program has contributed to the overall well-being of communities across the state. With more residents having access to healthcare, there is a reduction in the spread of communicable diseases, improved management of chronic conditions, and an increase in overall health literacy.

Future Prospects and Innovations

Covered California continues to evolve and adapt to meet the changing needs of Californians. The program is committed to innovation and has implemented several initiatives to enhance its services and benefits.

Digital Transformation

Recognizing the importance of technology in healthcare, Covered California has invested in digital transformation. The program now offers a user-friendly online platform, making it easier for individuals to research, compare, and enroll in plans. This digital approach has streamlined the enrollment process, providing a more efficient and convenient experience for users.

Expanded Coverage Options

Covered California is constantly working to expand its network of insurance carriers and providers, offering more choice and competition in the marketplace. This expansion ensures that residents have access to a diverse range of plans, catering to different needs and preferences.

Enhanced Financial Assistance

The program has increased its efforts to reach those who are eligible for financial assistance but may not be aware of their options. By partnering with community organizations and leveraging digital marketing, Covered California is raising awareness and ensuring that more residents can access the support they need to afford healthcare.

Focus on Prevention and Wellness

In line with the growing emphasis on preventive care, Covered California is promoting wellness initiatives and incentives. This includes providing access to health and wellness programs, offering discounts on healthy lifestyle products, and incentivizing regular check-ups and screenings.

Conclusion

The California State Health Insurance, or Covered California, stands as a testament to the state’s commitment to ensuring accessible and affordable healthcare for all residents. Through its comprehensive approach, tailored plan options, and focus on financial assistance, the program has transformed the lives of millions, improving health outcomes and providing much-needed peace of mind.

As Covered California continues to innovate and adapt, it remains a crucial component of California's healthcare landscape, shaping a healthier and more prosperous future for the state.

What is Covered California’s role in the ACA (Obamacare)?

+

Covered California is the state’s health insurance marketplace, established as part of the ACA. It offers a range of insurance plans, providing Californians with affordable healthcare options and financial assistance.

How can I enroll in Covered California outside of the Open Enrollment Period?

+

You can enroll outside of the Open Enrollment Period if you experience a qualifying life event, such as a change in employment or family status. Simply contact Covered California to discuss your options and start the enrollment process.

What are the essential health benefits covered by Covered California plans?

+

Covered California plans must provide essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health services, prescription drugs, and more.

How can I compare different plan options and choose the right one for me?

+

Covered California provides a user-friendly online platform where you can research and compare different plans based on factors like cost, coverage, and provider network. You can also speak with a certified enroller for personalized guidance.

What is the difference between HMOs, PPOs, EPOs, and POS plans?

+

These are different types of health insurance plans. HMOs typically cover a specific network of providers, while PPOs and EPOs offer more flexibility. POS plans combine features of both HMOs and PPOs.