Call State Farm Insurance

State Farm Insurance is a well-known and trusted name in the insurance industry, providing a comprehensive range of insurance products and services to individuals and businesses across the United States. With a rich history spanning over a century, State Farm has established itself as a leading provider, offering tailored coverage solutions and exceptional customer support. In this article, we will delve into the world of State Farm Insurance, exploring its offerings, customer experience, and the reasons why many individuals choose to Call State Farm Insurance for their insurance needs.

A Legacy of Trust and Innovation

State Farm Insurance was founded in 1922 by George J. Mecherle, a former farmer turned insurance entrepreneur. Mecherle’s vision was to create an insurance company that would offer affordable and reliable coverage to farmers and rural communities, who were often overlooked by traditional insurance providers. Over the years, State Farm has evolved and expanded its reach, becoming a prominent player in the insurance market.

One of the key factors contributing to State Farm's success is its commitment to innovation. The company has consistently adapted to changing times, leveraging technology to enhance its services and improve the overall customer experience. From introducing online policy management tools to embracing digital platforms for claims processing, State Farm has embraced the digital age while maintaining its core values of integrity and customer satisfaction.

Comprehensive Insurance Solutions

State Farm Insurance offers a wide array of insurance products to meet the diverse needs of its customers. Whether you’re seeking auto insurance, home insurance, life insurance, or business insurance, State Farm has tailored solutions to provide comprehensive protection. Let’s explore some of the key insurance offerings:

Auto Insurance

State Farm’s auto insurance policies are designed to offer peace of mind to drivers. The company provides coverage options for various vehicle types, including cars, motorcycles, and recreational vehicles. With competitive rates and customizable plans, State Farm ensures that its customers can find the right balance between coverage and affordability. Additionally, State Farm offers a range of discounts and perks, such as safe driver incentives and loyalty rewards, making their auto insurance plans even more attractive.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Auto Insurance | Liability, collision, comprehensive, medical payments, and uninsured motorist coverage. |

| Classic Car Insurance | Specialized coverage for classic and vintage vehicles, including agreed value and limited mileage options. |

| Rideshare Insurance | Tailored coverage for rideshare drivers, providing protection during personal use and rideshare services. |

Home Insurance

Protecting your home is a top priority, and State Farm’s home insurance policies offer a comprehensive approach. Their home insurance plans provide coverage for a wide range of perils, including fire, theft, and natural disasters. State Farm also offers additional endorsements to customize your policy, such as coverage for high-value items, identity restoration, and water backup.

| Coverage Type | Key Features |

|---|---|

| Dwelling Coverage | Protects the structure of your home against damage or destruction. |

| Personal Property Coverage | Covers the contents of your home, including furniture, electronics, and personal belongings. |

| Liability Coverage | Provides protection if someone is injured on your property or if you are held legally responsible for an accident. |

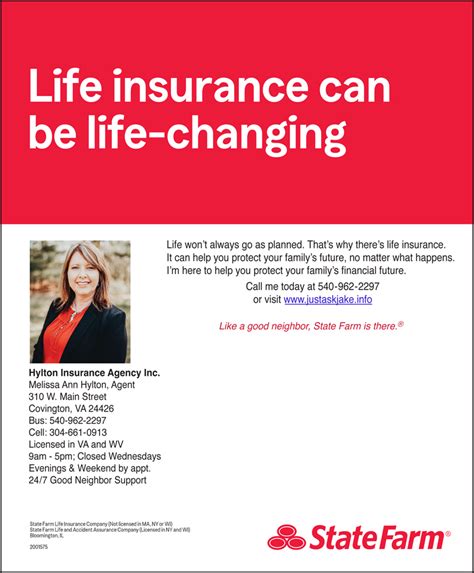

Life Insurance

State Farm understands the importance of financial security and protection for your loved ones. Their life insurance policies offer a range of options to suit different needs and budgets. Whether you’re looking for term life insurance, whole life insurance, or universal life insurance, State Farm can provide tailored solutions. These policies ensure that your beneficiaries receive the financial support they need in the event of your passing.

| Life Insurance Type | Key Benefits |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, often offering higher coverage amounts for a fixed premium. |

| Whole Life Insurance | Permanent coverage that builds cash value over time, providing both financial protection and a savings component. |

| Universal Life Insurance | Flexible coverage with adjustable premiums and the ability to increase or decrease the death benefit. |

Business Insurance

State Farm recognizes the unique needs of small businesses and offers a comprehensive business insurance package. Their business insurance policies provide coverage for property damage, liability claims, business interruption, and more. With State Farm, business owners can rest assured that their operations are protected, allowing them to focus on growth and success.

Exceptional Customer Experience

At the heart of State Farm’s success is its unwavering commitment to delivering an exceptional customer experience. The company prides itself on its network of dedicated agents who are readily available to assist customers with their insurance needs. Whether it’s providing personalized advice, answering queries, or guiding customers through the claims process, State Farm agents ensure a seamless and supportive experience.

State Farm's customer service extends beyond its agents. The company offers a range of online and mobile tools, allowing customers to manage their policies, make payments, and file claims with ease. Their user-friendly digital platforms ensure that customers can access their insurance information anytime, anywhere, providing convenience and peace of mind.

Claims Process

In the unfortunate event of an accident or loss, State Farm’s claims process is designed to be efficient and stress-free. Customers can report claims online, over the phone, or through their mobile app. State Farm’s claims adjusters work diligently to assess and process claims promptly, ensuring that customers receive the compensation they are entitled to in a timely manner. The company’s focus on customer satisfaction extends to the claims process, aiming to minimize disruption and provide swift resolution.

Why Choose State Farm Insurance

There are several compelling reasons why individuals choose to Call State Farm Insurance for their insurance needs. Here are some key factors that contribute to their popularity:

- Financial Strength and Stability: State Farm is a financially stable company with an excellent credit rating. This ensures that policyholders can have peace of mind, knowing their insurance coverage is backed by a reputable and reliable insurer.

- Personalized Service: State Farm's network of local agents provides a personalized touch. Agents take the time to understand their clients' unique circumstances and tailor insurance plans accordingly. This level of customization ensures that customers receive coverage that aligns with their specific needs.

- Competitive Rates: State Farm is known for offering competitive insurance rates. By leveraging their extensive network and economies of scale, they can provide cost-effective coverage options without compromising on quality or service.

- Customer Satisfaction: State Farm consistently ranks highly in customer satisfaction surveys. Their focus on providing exceptional service, prompt claims processing, and a dedicated agent network contributes to their reputation as a trusted insurer.

- Community Involvement: State Farm is deeply rooted in the communities it serves. The company actively engages in philanthropic initiatives, supporting local causes and giving back to the communities where its customers live and work. This commitment to community involvement fosters a sense of trust and loyalty.

State Farm’s Commitment to Safety and Prevention

State Farm believes in the importance of prevention and safety. They actively promote initiatives and resources aimed at reducing the risk of accidents and losses. Through educational programs, safety campaigns, and partnerships with various organizations, State Farm strives to empower individuals to make informed decisions and take proactive measures to protect themselves and their properties.

Driver Safety Programs

For auto insurance policyholders, State Farm offers a range of driver safety programs. These programs aim to enhance driving skills, promote road safety, and reduce the likelihood of accidents. By encouraging safe driving practices, State Farm not only helps its customers stay safe on the road but also potentially qualifies them for insurance discounts.

Home Safety Resources

State Farm provides valuable resources and tips to help homeowners improve the safety and security of their properties. From fire prevention guides to home security recommendations, State Farm empowers homeowners to take proactive measures to protect their homes and families. By reducing the risk of accidents and losses, homeowners can enjoy peace of mind and potentially benefit from lower insurance premiums.

Conclusion: A Trusted Partner for Your Insurance Needs

In today’s dynamic and often uncertain world, having a reliable insurance partner is invaluable. State Farm Insurance stands as a testament to the power of trust, innovation, and customer-centricity. With a legacy spanning over a century, State Farm has earned its reputation as a leading insurance provider, offering comprehensive coverage solutions and exceptional customer service. Whether you’re seeking auto, home, life, or business insurance, State Farm is dedicated to providing tailored protection and peace of mind.

By Calling State Farm Insurance, you gain access to a vast network of knowledgeable agents, cutting-edge technology, and a commitment to safety and prevention. State Farm's focus on delivering an exceptional customer experience ensures that your insurance needs are met with care and expertise. So, whether you're a first-time insurance buyer or looking to switch providers, State Farm is ready to guide you towards the right coverage, offering the security and support you deserve.

How can I contact State Farm Insurance for quotes or inquiries?

+You can contact State Farm Insurance by visiting their official website, where you can find a convenient online quote form. Additionally, you can call their customer service hotline at 1-800-STATE-FARM (1-800-782-8332) to speak with a representative who can assist you with your insurance needs.

What makes State Farm Insurance unique compared to other insurance providers?

+State Farm Insurance stands out for its personalized service, extensive network of local agents, and commitment to customer satisfaction. Their focus on providing tailored coverage solutions and their dedication to safety and prevention initiatives set them apart from competitors.

Does State Farm Insurance offer discounts on insurance premiums?

+Yes, State Farm Insurance offers a variety of discounts to policyholders. These discounts can include safe driver incentives, loyalty rewards, multi-policy discounts, and more. It’s worth exploring the specific discounts available to you based on your insurance needs and eligibility.

How does State Farm Insurance handle claims and what is their claims satisfaction rate?

+State Farm Insurance is known for its efficient and customer-centric claims process. They offer multiple channels for reporting claims, including online, over the phone, or through their mobile app. State Farm’s claims satisfaction rate consistently ranks among the highest in the industry, reflecting their commitment to providing prompt and fair claim resolutions.

What is the process for switching to State Farm Insurance from another provider?

+Switching to State Farm Insurance is a straightforward process. You can start by requesting a quote online or contacting their customer service team. They will guide you through the process, ensuring a smooth transition and providing you with the necessary information to make an informed decision.