Can I Change My Health Insurance Plan

Changing your health insurance plan is a significant decision that can impact your healthcare coverage and costs. While the process may vary depending on your location and the specific insurance market, there are generally a few key considerations and steps involved in making a successful switch. This article aims to provide an in-depth guide on how to navigate the process of changing your health insurance plan, ensuring you make informed choices and optimize your healthcare coverage.

Understanding Your Options

The first step in changing your health insurance plan is to understand the various options available to you. Health insurance plans can differ significantly in terms of coverage, cost, and provider networks. Here are some key factors to consider when exploring your options:

Coverage and Benefits

Examine the scope of coverage offered by different plans. Consider your specific healthcare needs, including any ongoing treatments, prescriptions, or chronic conditions. Look for plans that provide comprehensive coverage for your requirements, ensuring you’re not left with unexpected out-of-pocket expenses.

| Plan Type | Coverage Highlights |

|---|---|

| HMO (Health Maintenance Organization) | Typically offers comprehensive coverage with a focus on preventative care. Requires you to choose a primary care physician (PCP) and use in-network providers. |

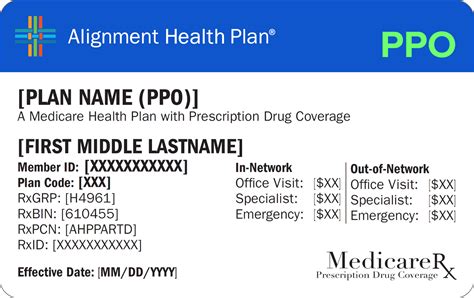

| PPO (Preferred Provider Organization) | Offers more flexibility with a larger network of providers, both in-network and out-of-network. Generally, has higher out-of-pocket costs than HMOs. |

| EPO (Exclusive Provider Organization) | Similar to a PPO, but with a narrower network of providers. You're usually covered only when using in-network providers, except in emergencies. |

| POS (Point of Service) | Combines features of HMOs and PPOs. You choose a PCP and receive comprehensive coverage when using in-network providers, but can also use out-of-network providers with higher out-of-pocket costs. |

Premium and Out-of-Pocket Costs

Compare the premiums (monthly payments) and out-of-pocket costs, such as deductibles, copayments, and coinsurance, for each plan. Remember that a lower premium may result in higher out-of-pocket expenses, so strike a balance that suits your financial situation and healthcare needs.

Provider Networks

Review the provider networks associated with each plan. Ensure that your preferred healthcare providers, such as your primary care physician, specialists, and hospitals, are included in the network. This is crucial to avoid unexpected costs or the hassle of finding new providers.

Additional Benefits and Services

Some plans offer additional benefits, such as vision or dental coverage, prescription drug discounts, or access to wellness programs. Consider whether these added benefits are valuable to you and your family’s health and lifestyle.

Plan Reputation and Customer Satisfaction

Research the reputation and customer satisfaction ratings of the insurance providers you’re considering. Look for reviews and ratings from independent sources to get an unbiased perspective on the quality of service and claims processing.

Open Enrollment Periods and Special Enrollment Events

Health insurance plans typically operate within defined enrollment periods. Understanding these periods is crucial for knowing when you can make changes to your coverage.

Open Enrollment Period

The open enrollment period is a set timeframe each year when you can enroll in a new health insurance plan or make changes to your existing coverage. During this period, anyone can join a plan, regardless of their health status or pre-existing conditions. Missing the open enrollment period may mean you’ll need to wait until the next year to make significant changes to your coverage.

Special Enrollment Events

In certain circumstances, you may be eligible for a special enrollment event, which allows you to change your health insurance plan outside of the open enrollment period. Special enrollment events are typically triggered by specific life events, such as:

- Losing your current health coverage due to a job loss or change in employment.

- Getting married or divorced.

- Having a baby, adopting a child, or gaining legal custody of a child.

- Moving to a new area where your current plan doesn't provide coverage.

- Gaining status as an emancipated minor or becoming eligible for Medicaid.

To take advantage of a special enrollment event, you must act within a specific timeframe (often 60 days) after the qualifying life event occurs. Keep in mind that special enrollment events are not available for all life changes, and you may need to provide documentation to prove your eligibility.

Researching and Comparing Plans

Once you understand your options and the enrollment periods, it’s time to dive into the research and comparison process. Here are some steps to guide you:

Utilize Online Tools

Many health insurance providers offer online tools and calculators to help you compare plans. These tools can provide detailed information about coverage, costs, and provider networks, making it easier to find the plan that best suits your needs.

Read Plan Documents

Take the time to read the plan documents, including the Summary of Benefits and Coverage (SBC) and the Plan Brochure. These documents provide comprehensive details about the plan’s coverage, limitations, and exclusions. Pay close attention to the fine print to ensure you fully understand the terms and conditions.

Compare Costs and Coverage

Create a spreadsheet or use a comparison tool to evaluate the costs and coverage of different plans side by side. Consider not just the premium, but also the deductibles, copayments, and coinsurance for various healthcare services. Ensure the plans you’re comparing offer the coverage you need at a price you can afford.

Consider Provider Networks

Check the provider networks of the plans you’re considering. Use the insurance provider’s website or contact their customer service to verify that your preferred healthcare providers are in-network. This step is critical to avoid surprises when seeking medical care.

Seek Expert Advice

If you’re unsure about which plan to choose or have specific healthcare needs, consider consulting with an insurance broker or financial advisor. These professionals can provide unbiased advice and help you navigate the complex world of health insurance, ensuring you make the best decision for your circumstances.

Changing Your Plan: Step-by-Step Guide

Now that you’ve done your research and decided on a new health insurance plan, it’s time to make the switch. Here’s a step-by-step guide to help you through the process:

Step 1: Verify Eligibility

Ensure you’re eligible to change your plan. If it’s during the open enrollment period, you’re generally free to make a change. However, if you’re outside of the open enrollment period, you’ll need to qualify for a special enrollment event. Review the list of qualifying life events and confirm your eligibility with the insurance provider.

Step 2: Gather Necessary Information

Collect all the required information and documents to enroll in your new plan. This may include personal details, such as your social security number, date of birth, and address. You may also need to provide proof of eligibility for the special enrollment event, such as a marriage certificate or a letter confirming a job loss.

Step 3: Choose and Apply for Your New Plan

Decide on the plan that best meets your needs and apply for coverage. You can typically do this online through the insurance provider’s website or by filling out an application form. Ensure you provide accurate and complete information to avoid delays in processing your application.

Step 4: Review and Confirm Your Coverage

Once your application is processed, review the details of your new coverage carefully. Make sure the plan details, effective date, and provider network information are correct. If there are any discrepancies, contact the insurance provider immediately to resolve them.

Step 5: Port Your Medical Records (If Applicable)

If you’re switching from one health insurance plan to another, consider porting your medical records to your new provider. This ensures your new healthcare team has access to your complete medical history, enabling them to provide more effective care.

Transitioning to Your New Plan

After successfully changing your health insurance plan, it’s important to understand how to make the most of your new coverage and navigate any potential challenges.

Understanding Your Coverage

Take the time to thoroughly read and understand your new plan’s coverage details. Familiarize yourself with the provider network, the types of services covered, and any limitations or exclusions. This knowledge will empower you to make informed decisions about your healthcare and avoid unexpected costs.

Choosing a Primary Care Physician (PCP)

If your new plan requires you to choose a primary care physician (PCP), select one who is in-network and aligns with your healthcare needs and preferences. Your PCP will play a crucial role in coordinating your care, so choose someone you feel comfortable with and who has the expertise to manage your health effectively.

Utilizing Preventative Care

Many health insurance plans offer preventative care services at little to no cost. Take advantage of these services to stay on top of your health. This includes regular check-ups, screenings, immunizations, and counseling services. Preventative care can help identify potential health issues early on and save you from more costly treatments down the line.

Managing Chronic Conditions

If you have a chronic condition, ensure your new plan covers the necessary treatments and medications. Work with your healthcare providers to develop a comprehensive care plan that aligns with your insurance coverage. This may involve adjusting your treatment regimen or exploring cost-saving options, such as generic medications or mail-order pharmacies.

Exploring Additional Benefits

Review the additional benefits and services offered by your new plan. These may include wellness programs, fitness incentives, or discounts on vision or dental care. Take advantage of these benefits to improve your overall health and well-being.

Common Challenges and Solutions

Changing your health insurance plan can come with its fair share of challenges. Here are some common issues you may encounter and strategies to overcome them:

Provider Network Changes

When switching plans, it’s common for provider networks to change. If your preferred healthcare providers are no longer in-network, consider the following options:

- Negotiate with your providers: Discuss the change in network status and see if they're willing to accept your new plan's reimbursement rates.

- Explore out-of-network options: While it may be more expensive, you can still receive care from your preferred providers as an out-of-network patient.

- Find in-network alternatives: Research and identify new providers who are in-network and have the expertise to meet your healthcare needs.

Cost Concerns

If you’re concerned about the cost of your new plan, consider these strategies:

- Review your budget: Assess your financial situation and determine how much you can afford to spend on healthcare. Adjust your spending habits or seek financial assistance if needed.

- Shop around for better rates: Compare prices for similar plans from different providers. You may find a plan with a lower premium and similar coverage.

- Explore government assistance programs: Depending on your income and family size, you may qualify for government-subsidized health insurance plans, such as Medicaid or CHIP.

Coverage Limitations

If you discover that your new plan has limitations or exclusions that impact your healthcare needs, consider the following steps:

- Advocate for yourself: Discuss your concerns with your healthcare providers and insurance company. Sometimes, plans can be adjusted or exceptions made for specific circumstances.

- Seek alternative treatments: Explore other treatment options or therapies that may be covered by your plan. Work with your healthcare team to find cost-effective solutions.

- Consider a different plan: If the limitations are significant and cannot be resolved, you may need to switch to a different plan that better meets your needs.

FAQs

Can I change my health insurance plan anytime I want?

+

No, you typically need to wait for the open enrollment period or qualify for a special enrollment event to change your health insurance plan. The open enrollment period is a set timeframe each year when anyone can join a plan or make changes to their coverage, regardless of their health status. Special enrollment events, on the other hand, allow you to change your plan outside of the open enrollment period due to specific life events, such as losing your job or getting married.

What happens if I miss the open enrollment period and don’t qualify for a special enrollment event?

+

If you miss the open enrollment period and don’t qualify for a special enrollment event, you generally have to wait until the next open enrollment period to make significant changes to your health insurance plan. However, you may still be able to make certain adjustments to your coverage, such as updating your personal information or adding a dependent, outside of these enrollment periods.

How do I know if a health insurance plan is right for me?

+

To determine if a health insurance plan is right for you, consider your specific healthcare needs, including any ongoing treatments, prescriptions, or chronic conditions. Compare the coverage, costs, and provider networks of different plans. Look for plans that offer comprehensive coverage for your requirements, ensuring you’re not burdened with unexpected out-of-pocket expenses. Additionally, consider the reputation and customer satisfaction ratings of the insurance providers you’re evaluating.

Can I switch health insurance plans if I don’t like my current provider network?

+

Yes, you can switch health insurance plans if you’re unhappy with your current provider network. During the open enrollment period or when qualifying for a special enrollment event, you can explore different plans and choose one with a provider network that better suits your needs. Just ensure you thoroughly research and compare the new plan’s coverage, costs, and provider network before making the switch.

What should I do if I encounter challenges with my new health insurance plan?

+

If you face challenges with your new health insurance plan, such as provider network changes, cost concerns, or coverage limitations, don’t hesitate to reach out for support. Contact your insurance provider’s customer service team to discuss your concerns and explore potential solutions. They may be able to provide guidance, negotiate with providers, or assist you in finding cost-effective alternatives. Additionally, seek advice from healthcare professionals or financial advisors who can offer personalized recommendations based on your specific situation.

Conclusion

Changing your health insurance plan is a complex process, but with the right information and guidance, you can make informed choices to optimize your healthcare coverage. Remember to research your options, understand enrollment periods, and seek expert advice when needed. By taking a proactive approach to managing your health insurance, you can ensure you have the coverage you need to protect your health and financial well-being.