Cancel Insurance

In today's world, insurance policies play a crucial role in providing financial protection and security. However, there are instances when individuals or businesses may need to cancel their insurance policies due to various reasons. Understanding the process and implications of canceling insurance is essential to ensure a smooth and informed transition. This comprehensive guide will delve into the intricate details of canceling insurance, exploring the steps, considerations, and potential outcomes associated with this decision.

Understanding the Decision to Cancel Insurance

The decision to cancel an insurance policy is often influenced by a range of factors, including changing personal circumstances, financial considerations, or a shift in insurance needs. It is important to carefully evaluate these factors and assess whether canceling insurance aligns with one’s best interests. This section will provide an in-depth analysis of the common reasons behind policy cancellations and the key considerations to make before proceeding.

Evaluating Personal Circumstances and Insurance Needs

Every individual or business has unique insurance requirements, and these needs can evolve over time. Assessing one’s current and future insurance needs is crucial when considering policy cancellation. This subsection will explore the factors that may trigger a reevaluation of insurance coverage, such as changes in lifestyle, family dynamics, or business operations. By understanding these factors, individuals can make informed decisions about whether canceling insurance is the right choice.

For instance, a young professional who recently purchased a new home may find that their existing renter's insurance policy no longer provides adequate coverage. In this case, canceling the renter's insurance and obtaining a comprehensive homeowner's insurance policy would be a prudent decision. Similarly, a business owner who has successfully diversified their operations may no longer require a specialized insurance policy tailored to a specific industry.

Financial Implications and Alternatives

Canceling an insurance policy can have financial implications, both in the short and long term. It is essential to consider the potential costs and benefits associated with this decision. This subsection will delve into the financial aspects, including potential refunds, penalties, or additional costs that may arise. Additionally, we will explore alternative insurance options and strategies to ensure a seamless transition while maintaining adequate coverage.

Suppose an individual has been paying premiums for a life insurance policy but has recently experienced a significant change in their financial situation, such as a reduction in income. In this scenario, canceling the life insurance policy and exploring more affordable alternatives, such as term life insurance or reducing the coverage amount, could be a viable option. By carefully evaluating their financial situation and exploring alternative coverage options, individuals can make informed choices that align with their current needs and budget.

The Process of Canceling Insurance: A Step-by-Step Guide

Canceling an insurance policy requires a systematic approach to ensure a smooth and legally compliant process. This section will provide a comprehensive step-by-step guide, outlining the necessary actions and considerations at each stage. From initiating the cancellation process to receiving confirmation, we will navigate the entire journey, ensuring clarity and transparency.

Initiating the Cancellation: Contacting the Insurance Provider

The first step in canceling insurance is contacting the insurance provider. This subsection will guide readers through the process of reaching out to their insurance company, either through phone, email, or online portals. We will discuss the importance of clear communication and provide tips on effectively conveying one’s intentions to cancel the policy.

When initiating the cancellation process, it is crucial to have all the necessary information readily available. This includes policy details, such as the policy number, effective dates, and any relevant contact information. Providing accurate and detailed information will streamline the process and ensure a prompt response from the insurance provider.

Understanding Cancellation Policies and Requirements

Insurance providers typically have specific policies and requirements in place for canceling insurance policies. This subsection will delve into the common policies and regulations governing policy cancellations. We will explore factors such as notice periods, potential penalties, and any additional documentation or forms required to complete the cancellation process.

For example, some insurance companies may require a written notice of cancellation, specifying the effective date and reason for cancellation. Others may have specific time frames within which cancellations can be processed, such as a 30-day notice period. By understanding these policies and requirements, individuals can navigate the cancellation process more efficiently and avoid any unexpected delays or complications.

Reviewing Policy Terms and Conditions

Before proceeding with the cancellation, it is essential to thoroughly review the terms and conditions of the insurance policy. This subsection will emphasize the importance of understanding the policy’s fine print, including any cancellation clauses, refund policies, or potential penalties. By familiarizing oneself with these details, individuals can make informed decisions and avoid any unforeseen consequences.

Certain insurance policies may have specific provisions regarding cancellation, such as a minimum notice period or a requirement to provide a reason for cancellation. Additionally, policies may outline the process for obtaining refunds or the calculation of any applicable fees. By carefully reviewing these terms, individuals can ensure they are fully aware of their rights and responsibilities when canceling their insurance policy.

Submitting the Cancellation Request and Documentation

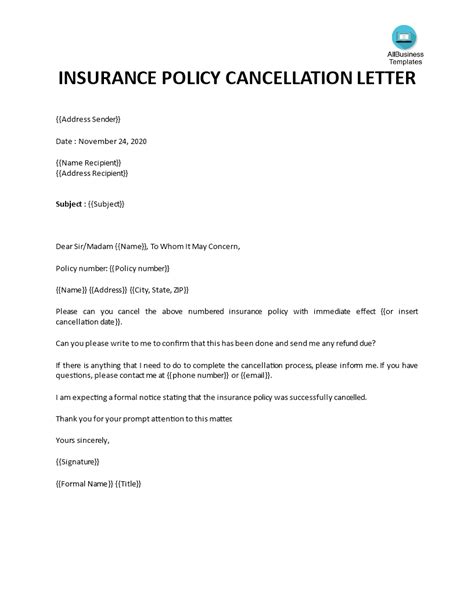

Once the decision to cancel has been made and the necessary research has been conducted, the next step is to formally submit the cancellation request. This subsection will guide readers through the process of submitting the request, including any required documentation or supporting materials. We will emphasize the importance of accuracy and completeness to ensure a swift and hassle-free cancellation.

Depending on the insurance provider and the type of policy, the cancellation request may need to be submitted through a specific channel, such as a dedicated online portal or by mail. It is crucial to follow the instructions provided by the insurance company and ensure that all required information and documentation are included. This may include policy details, identification documents, or any additional forms or statements as requested by the insurance provider.

Receiving Confirmation and Understanding the Effective Date

Upon submitting the cancellation request, individuals can expect to receive confirmation from the insurance provider. This subsection will discuss the importance of obtaining written confirmation and understanding the effective date of the cancellation. We will also explore any potential follow-up actions or additional steps required to finalize the cancellation process.

Insurance providers typically send a formal confirmation of cancellation, which serves as a record of the transaction. This confirmation should clearly state the effective date of the cancellation, which is the date from which the policy will no longer be in force. It is essential to review this confirmation carefully and ensure that it aligns with the intended cancellation date. If any discrepancies are identified, individuals should promptly contact the insurance provider to resolve the issue.

Potential Outcomes and Considerations After Cancellation

Canceling an insurance policy can have various outcomes and implications. This section will explore the potential consequences, including any financial adjustments, coverage gaps, or future insurance considerations. We will provide valuable insights to help individuals navigate the post-cancellation landscape and make informed decisions regarding their insurance needs.

Financial Adjustments and Refunds

One of the immediate outcomes of canceling an insurance policy is the financial adjustment associated with the cancellation. This subsection will delve into the potential refunds or credits individuals may receive upon canceling their policy. We will discuss the factors influencing these adjustments and provide guidance on managing and utilizing these funds effectively.

The amount of refund or credit an individual receives can depend on various factors, such as the policy's cancellation provisions, the timing of the cancellation, and any outstanding premiums. In some cases, individuals may be entitled to a full refund of the premium paid, especially if the cancellation occurs within a specified grace period. However, it is important to note that certain policies may have non-refundable components, such as administrative fees or coverage for a specific period, which can impact the amount of refund received.

Coverage Gaps and Alternative Options

Canceling an insurance policy may create coverage gaps, leaving individuals or businesses vulnerable to unforeseen risks. This subsection will explore the potential risks associated with coverage gaps and provide guidance on identifying and addressing these gaps. We will discuss alternative insurance options and strategies to ensure continuous coverage and mitigate potential financial losses.

For instance, if an individual cancels their health insurance policy, they may face challenges in obtaining coverage for pre-existing conditions or finding an affordable plan in the future. In such cases, exploring alternative options, such as short-term health insurance plans or high-deductible health plans, can help bridge the coverage gap until a more suitable long-term solution is found. Similarly, businesses that cancel their commercial insurance policies may need to reassess their risk exposure and explore specialized insurance products to protect their operations.

Future Insurance Considerations and Strategies

Canceling an insurance policy may impact future insurance considerations, such as obtaining new coverage or maintaining existing policies. This subsection will provide insights into the potential challenges and strategies to navigate these considerations effectively. We will discuss factors such as insurance history, claims records, and any potential implications for future insurance applications.

Individuals who have canceled an insurance policy may encounter challenges when applying for new coverage, especially if the cancellation was due to non-payment of premiums or other negative factors. In such cases, it is crucial to be transparent and provide a clear explanation for the cancellation. Additionally, maintaining a positive insurance history, such as timely premium payments and a clean claims record, can enhance one's chances of obtaining favorable terms and rates when applying for future insurance policies.

Conclusion: Empowering Informed Decisions

Canceling an insurance policy is a significant decision that requires careful consideration and understanding of the process and potential outcomes. Throughout this comprehensive guide, we have explored the various aspects of canceling insurance, from evaluating personal circumstances and financial implications to navigating the cancellation process and addressing post-cancellation considerations. By providing detailed insights and practical guidance, we aim to empower individuals and businesses to make informed decisions regarding their insurance needs.

Remember, insurance is a vital tool for managing risks and protecting one's financial well-being. While canceling insurance may be necessary in certain situations, it is essential to approach this decision with caution and thorough research. By staying informed, individuals can ensure they are making choices that align with their best interests and maintain adequate coverage to safeguard their assets, livelihoods, and future financial stability.

What are the common reasons for canceling an insurance policy?

+There are several common reasons why individuals may choose to cancel their insurance policies. These include changing personal circumstances, such as relocation or marriage, financial considerations, a shift in insurance needs, or dissatisfaction with the insurance provider. It is important to carefully evaluate these reasons and assess whether canceling the policy is the best course of action.

Are there any penalties or fees associated with canceling insurance?

+The presence of penalties or fees for canceling insurance depends on the specific policy and insurance provider. Some policies may have cancellation fees or require a minimum notice period before cancellation can take effect. It is crucial to review the terms and conditions of your insurance policy and consult with your insurance provider to understand any potential penalties or fees associated with canceling your policy.

How long does it typically take to cancel an insurance policy?

+The time it takes to cancel an insurance policy can vary depending on the insurance provider and the complexity of the policy. In most cases, the cancellation process can be completed within a few business days once the necessary documentation and requests have been submitted. However, it is important to allow sufficient time for the cancellation to be processed and to receive confirmation from the insurance provider.

Can I receive a refund after canceling my insurance policy?

+Whether you are eligible for a refund after canceling your insurance policy depends on the terms and conditions of your specific policy. Some policies may provide a refund for the unused portion of the premium, especially if the cancellation occurs within a certain timeframe. However, it is important to review your policy documents and consult with your insurance provider to understand the refund policies and any potential conditions or limitations.

What should I consider when evaluating alternative insurance options after canceling my policy?

+When evaluating alternative insurance options after canceling your policy, it is crucial to assess your current insurance needs and future risks. Consider factors such as the type of coverage required, the level of protection desired, and any specific requirements or regulations applicable to your situation. Research different insurance providers, compare policies, and seek professional advice to ensure you find suitable coverage that aligns with your needs and budget.