Capital One Venture Card Rental Car Insurance

Exploring Capital One Venture Card's Rental Car Insurance Coverage: A Comprehensive Guide

When it comes to travel rewards credit cards, the Capital One Venture Card is a popular choice among frequent travelers. One of its standout features is the comprehensive rental car insurance coverage it offers. This article delves into the specifics of the Capital One Venture Card's rental car insurance, helping you understand its benefits, limitations, and how to maximize its value.

Understanding the Capital One Venture Card's Rental Car Insurance

The Capital One Venture Card provides an automatic secondary coverage for collision damage and theft when you rent a car using the card. This means that your personal auto insurance or the rental company's insurance will be the primary coverage, and the Venture Card's insurance will step in as a secondary layer of protection.

This secondary coverage can be a valuable safety net, especially for travelers who may not have extensive personal auto insurance coverage or those who want to avoid the often costly rental car insurance offered by rental companies. The Venture Card's rental car insurance is automatically included with your card membership, so there's no need to enroll or activate it separately.

Coverage Details

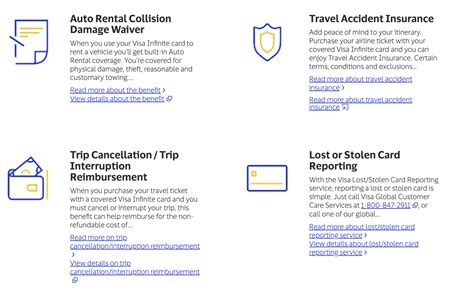

The Capital One Venture Card's rental car insurance covers collision damage waiver (CDW) and theft protection for rental vehicles. CDW provides coverage for damage to the rental car itself, while theft protection covers the vehicle if it's stolen. This coverage extends to most rental cars in the U.S. and abroad, including cars, motorcycles, and other types of vehicles.

| Coverage Type | Coverage Limits |

|---|---|

| Collision Damage Waiver (CDW) | $50,000 per rental |

| Theft Protection | $50,000 per rental |

It's important to note that the Venture Card's rental car insurance does not cover liability, personal injury, or damage to personal belongings. Additionally, there are some exclusions and limitations, such as coverage not being valid for certain high-risk vehicles or if the rental period exceeds 31 consecutive days.

Maximizing the Benefits of Venture Card's Rental Car Insurance

Planning Your Rental

To make the most of the Venture Card's rental car insurance, it's essential to plan your rental strategically. Here are some tips:

- Choose the Right Rental Company: Not all rental car companies accept credit card insurance. Ensure the company you're renting from accepts the Venture Card's coverage before finalizing your reservation.

- Review Rental Terms: Carefully read the rental agreement to understand the company's policies, especially regarding insurance and damage liability. This will help you avoid any unexpected charges or issues.

- Inspect the Vehicle: Before driving off, thoroughly inspect the rental car for any existing damage. Note these on the rental agreement and take photos as evidence. This step can save you from being charged for pre-existing damage.

Utilizing the Coverage Effectively

When an incident occurs, it's crucial to follow the proper procedures to ensure your claim is processed smoothly:

- Report the Incident: Immediately notify the rental company and Capital One about the collision or theft. Prompt reporting is essential for a successful claim.

- Collect Documentation: Gather all relevant documentation, including the rental agreement, police reports, photos of the damage, and any other evidence that can support your claim.

- File a Claim: Contact Capital One's insurance provider to initiate a claim. Provide all the necessary documentation and follow their instructions for a timely resolution.

Comparing Venture Card's Rental Car Insurance to Other Options

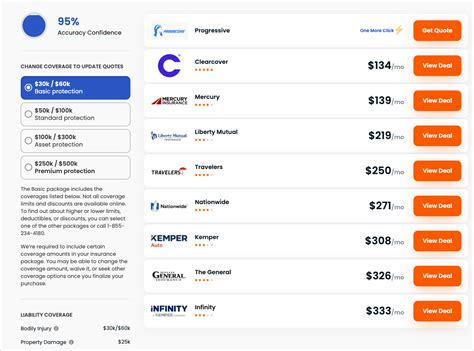

While the Capital One Venture Card's rental car insurance is a valuable benefit, it's worth exploring how it compares to other options:

Primary vs. Secondary Coverage

The Venture Card's rental car insurance is a secondary coverage, which means it kicks in after your primary insurance (personal auto or rental company's insurance) has been utilized. This can be beneficial if you want to minimize the impact on your personal insurance rates or avoid the high costs of rental company insurance.

On the other hand, some credit cards offer primary coverage, which can be more comprehensive and provide more peace of mind. However, these cards often come with higher annual fees or other requirements, so it's essential to weigh the benefits against the costs.

Rental Car Insurance from Rental Companies

Rental car companies typically offer their own insurance packages, which can be quite expensive. These packages often include CDW, liability insurance, and other coverages. While they provide primary coverage, they can significantly increase the cost of your rental.

By using the Venture Card's rental car insurance, you can save on these additional costs, especially if you already have adequate personal auto insurance coverage.

Conclusion

The Capital One Venture Card's rental car insurance is a valuable benefit for travelers, offering a secondary layer of protection for collision damage and theft. By understanding the coverage's specifics and utilizing it effectively, you can maximize its benefits and enjoy a more secure rental car experience. Remember to always review the full terms and conditions and plan your rentals carefully to make the most of this advantageous perk.

Can I use the Venture Card’s rental car insurance for any rental car company?

+

Yes, the Venture Card’s rental car insurance is accepted by most major rental car companies worldwide. However, it’s always a good idea to confirm with the specific rental company and review their terms and conditions before renting.

What if I have an accident while using the Venture Card’s rental car insurance? How do I file a claim?

+

In the event of an accident, you should immediately report it to the rental company and Capital One. Collect all relevant documentation, including photos and police reports, if applicable. Contact Capital One’s insurance provider to initiate a claim and provide them with the necessary information and documents.

Are there any exclusions or limitations to the Venture Card’s rental car insurance coverage?

+

Yes, there are some exclusions and limitations. For example, the coverage does not apply to certain high-risk vehicles, such as luxury cars, SUVs, and off-road vehicles. Additionally, the rental period must not exceed 31 consecutive days. It’s crucial to review the full terms and conditions to understand all the exclusions and limitations.