Car & Home Insurance Companies

In today's fast-paced world, where accidents and unforeseen circumstances can strike at any moment, having reliable insurance coverage is paramount. For many individuals and families, car and home insurance are essential financial safeguards. These policies provide peace of mind, ensuring that policyholders are protected in the face of unexpected events such as accidents, natural disasters, or property damage. However, with a plethora of insurance companies offering a wide range of policies, choosing the right provider can be a daunting task. In this comprehensive guide, we will delve into the world of car and home insurance companies, exploring their offerings, reputation, and unique features to help you make an informed decision.

Understanding the Landscape: Car and Home Insurance Companies

The insurance industry is vast and diverse, with numerous companies vying for your business. When it comes to car and home insurance, several key players dominate the market. These companies have established themselves as trusted providers, offering comprehensive coverage and tailored policies to meet the diverse needs of policyholders.

Top Car Insurance Companies

Let’s begin by examining some of the leading car insurance providers. These companies have earned a reputation for their excellent customer service, competitive rates, and innovative coverage options.

| Company | Coverage Highlights |

|---|---|

| Allstate | Allstate is renowned for its "Name Your Price" tool, allowing customers to customize their coverage and set a budget. They offer a wide range of discounts, including safe driver and loyalty rewards. |

| State Farm | State Farm has a strong presence across the United States, providing personalized service and comprehensive coverage. They are known for their Drive Safe & Save program, which rewards safe driving habits. |

| GEICO | GEICO stands out for its competitive rates and digital-first approach. They offer a seamless online experience and provide discounts for military members, federal employees, and more. |

| Progressive | Progressive is a pioneer in usage-based insurance, with its Snapshot program. Customers can save by driving safely, and the company offers a variety of coverage options, including rental car reimbursement. |

| Esurance | Esurance focuses on convenience and technology, offering entirely online and mobile services. They provide personalized coverage options and excellent customer support. |

Leading Home Insurance Providers

Home insurance is equally crucial, protecting your dwelling and belongings from various risks. Here are some of the top home insurance companies and their standout features:

| Company | Key Features |

|---|---|

| State Farm | State Farm offers flexible coverage options, including renters, condo, and homeowners insurance. They provide additional protection for high-value items and have an excellent claims process. |

| Allstate | Allstate's home insurance policies include standard coverages like dwelling, personal property, and liability. They also offer optional add-ons for water backup, identity theft, and more. |

| Liberty Mutual | Liberty Mutual provides personalized home insurance plans with customizable coverage limits. They offer discounts for bundling policies and have an easy-to-use mobile app for policy management. |

| Farmers Insurance | Farmers Insurance specializes in home insurance, offering various coverage options and discounts. They provide claims support and have a strong network of local agents. |

| USAA | USAA is a highly rated provider for military members and their families. They offer exclusive benefits like identity theft coverage and a simplified claims process. |

Key Considerations: Finding the Right Insurance Company

With so many options available, selecting the right car or home insurance company can be challenging. Here are some crucial factors to consider during your search:

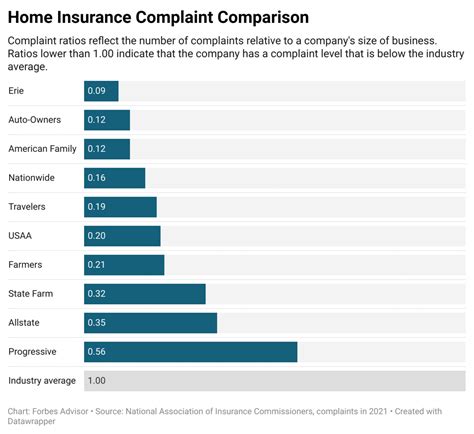

Reputation and Financial Stability

Start by researching the company’s reputation and financial health. Look for reviews and ratings from reputable sources like J.D. Power and AM Best. A stable and well-rated insurance company is more likely to provide reliable coverage and timely claim settlements.

Coverage Options and Customization

Examine the range of coverage options offered by the insurance company. Ensure they provide comprehensive plans that align with your specific needs. Look for customization options to tailor the policy to your circumstances, whether it’s additional coverage for high-value items or unique circumstances like water backup or identity theft.

Discounts and Savings Opportunities

Insurance companies often provide various discounts to attract customers. Explore the savings opportunities available, such as multi-policy discounts, safe driver rewards, or loyalty bonuses. These discounts can significantly reduce your insurance premiums over time.

Customer Service and Claims Process

Excellent customer service is a hallmark of a good insurance company. Look for providers with responsive and knowledgeable customer support teams. Additionally, research their claims process to ensure it is efficient and fair. Prompt and fair claim settlements are crucial when you need them the most.

Technology and Digital Offerings

In today’s digital age, insurance companies are increasingly offering online and mobile services. Consider whether the provider has a user-friendly website and mobile app for policy management and claim reporting. Digital tools can simplify the insurance process and provide added convenience.

The Benefits of Bundling Car and Home Insurance

For many individuals, bundling car and home insurance policies with the same provider can offer significant advantages. Here’s why bundling is a smart choice:

Discounts and Savings

Insurance companies often reward customers who bundle their policies by offering substantial discounts. These savings can add up over time, reducing your overall insurance expenses.

Simplified Policy Management

Bundling simplifies policy management. You’ll have a single provider and a single renewal date for both your car and home insurance. This convenience streamlines your insurance experience and reduces the hassle of dealing with multiple companies.

Consistent Coverage and Service

When you bundle your policies, you can expect consistent coverage and service from a single insurance company. This uniformity ensures that you receive the same level of protection and support across all your insurance needs.

Enhanced Customer Experience

Bundling often comes with additional perks, such as dedicated customer service representatives and personalized attention. Insurance companies value loyal customers, and bundling can lead to a more positive and rewarding customer experience.

Expert Tips for Choosing the Right Insurance Company

As an insurance expert, I’d like to share some valuable insights to help you make an informed decision:

- Compare Quotes: Obtain multiple quotes from different insurance companies to find the best rates and coverage options.

- Read the Fine Print: Carefully review the policy details and exclusions to ensure you understand the coverage provided.

- Consider Local Providers: Explore local insurance companies, as they may offer specialized coverage for unique regional risks.

- Seek Referrals: Ask friends, family, and colleagues for recommendations based on their positive experiences with insurance providers.

- Review Claims Handling: Research the company's claims process and reputation for timely and fair claim settlements.

Conclusion: Your Path to Secure and Informed Insurance Coverage

Choosing the right car and home insurance company is a crucial decision that impacts your financial security and peace of mind. By understanding the landscape, considering key factors, and following expert tips, you can make an informed choice. Remember, the right insurance provider should offer comprehensive coverage, competitive rates, and exceptional customer service. Take the time to research and compare options to find the perfect fit for your needs. With the right insurance coverage, you can protect your assets and enjoy the confidence that comes with being prepared for life’s unexpected twists and turns.

How do I know if an insurance company is reputable?

+Reputable insurance companies are typically well-established, have a strong financial rating from agencies like AM Best, and maintain a positive reputation among customers and industry experts. Researching online reviews, ratings, and financial stability is essential to assess a company’s reputation.

What should I look for in a car insurance policy?

+When choosing a car insurance policy, consider factors like liability coverage, comprehensive and collision coverage, personal injury protection, and uninsured/underinsured motorist coverage. Look for customization options and discounts to tailor the policy to your needs and budget.

How can I save money on home insurance?

+To save on home insurance, consider increasing your deductible, bundling policies with the same provider, and taking advantage of discounts for security systems, fire protection, and other safety measures. Regularly review your coverage to ensure it aligns with your needs and doesn’t include unnecessary add-ons.