Car And Home Insurance Comparison

When it comes to safeguarding our assets and ensuring peace of mind, car and home insurance are essential aspects of financial planning. With numerous options available in the market, it can be challenging to navigate and compare different policies to find the best fit. In this comprehensive guide, we will delve into the world of car and home insurance, exploring the key factors, coverage options, and strategies to secure the right protection for your vehicles and residences.

Understanding Car Insurance: The Essentials

Car insurance is a vital safeguard for vehicle owners, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It plays a crucial role in ensuring your safety and that of other road users. Here’s a breakdown of the fundamental aspects of car insurance:

Types of Car Insurance Coverage

Car insurance policies can be categorized into various types, each offering distinct levels of coverage. The most common types include:

- Liability Coverage: This type of insurance covers the costs associated with bodily injury or property damage caused to others in an accident for which you are at fault. It is often mandatory in many states and serves as a legal requirement.

- Collision Coverage: Collision coverage helps pay for repairs or replacements of your vehicle if it collides with another vehicle or object, regardless of fault. It is particularly beneficial for newer or more valuable cars.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals. It offers a broader range of coverage and is recommended for comprehensive protection.

- Personal Injury Protection (PIP): PIP coverage assists with medical expenses and lost wages resulting from an accident, regardless of fault. It ensures financial support for you and your passengers, even if you are at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It covers medical expenses and damages, ensuring you are not left financially burdened.

Factors Influencing Car Insurance Rates

The cost of car insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially secure more affordable coverage. Some key considerations include:

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as your annual mileage, can impact insurance rates. Sports cars or luxury vehicles may incur higher premiums due to their higher repair costs and potential for theft.

- Driving History: Your driving record plays a crucial role in determining insurance rates. A clean driving history with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher costs.

- Age and Gender: Insurance companies often consider age and gender when calculating rates. Younger drivers, especially males, tend to be associated with higher risk, leading to increased premiums. However, this factor may vary depending on the insurer and state regulations.

- Location and Address: The area where you reside and the location of your vehicle storage can affect insurance rates. High-crime areas or regions with frequent natural disasters may result in higher premiums due to the increased risk of theft or damage.

- Coverage Options and Deductibles: The level of coverage you choose and the corresponding deductibles can impact your insurance costs. Higher deductibles often result in lower premiums, but it’s essential to strike a balance that aligns with your financial comfort.

Home Insurance: Protecting Your Sanctuary

Home insurance is an indispensable tool for safeguarding your residence and its contents against a wide range of potential risks. It provides financial protection and peace of mind, ensuring you can recover from unforeseen events without significant financial strain. Let’s explore the key aspects of home insurance:

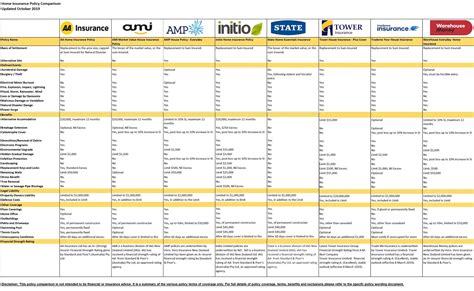

Understanding Home Insurance Coverage

Home insurance policies offer a comprehensive range of coverage options to protect your home and its contents. The primary types of coverage include:

- Dwelling Coverage: This coverage protects the structure of your home, including the walls, roof, and permanent fixtures. It covers damages caused by perils such as fire, wind, hail, or vandalism, ensuring your home can be repaired or rebuilt.

- Personal Property Coverage: Personal property coverage provides protection for your belongings, including furniture, electronics, clothing, and other personal items. It covers losses due to theft, fire, or other covered perils, ensuring you can replace or repair your possessions.

- Liability Coverage: Home insurance includes liability coverage, which protects you against claims arising from injuries or property damage caused to others on your property. It provides financial support to cover medical expenses, legal fees, and potential settlements.

- Additional Living Expenses (ALE): In the event your home becomes uninhabitable due to a covered peril, ALE coverage provides financial assistance for temporary housing, meals, and other necessary expenses until your home is restored.

- Medical Payments Coverage: This coverage assists with medical expenses for guests or visitors who are injured on your property, regardless of fault. It helps cover their medical bills, providing a quick and efficient way to address such situations.

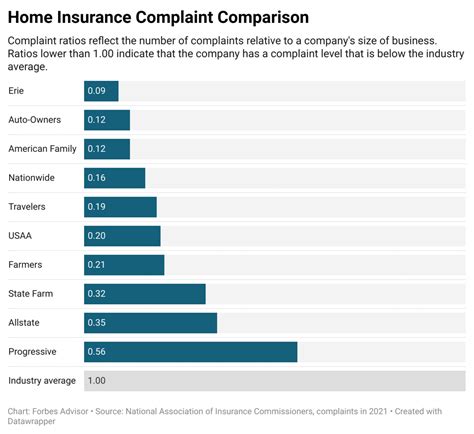

Factors Affecting Home Insurance Rates

Similar to car insurance, various factors influence the cost of home insurance. Understanding these factors can help you make informed decisions and potentially secure more affordable coverage. Key considerations include:

- Location and Address: The area where your home is located plays a significant role in determining insurance rates. Regions prone to natural disasters, such as hurricanes or earthquakes, may have higher premiums due to the increased risk of damage.

- Home Value and Construction: The value and construction type of your home can impact insurance rates. Homes with higher replacement costs or those constructed with materials prone to damage, such as wood, may result in higher premiums.

- Security and Safety Features: Installing security systems, fire alarms, and other safety measures can lead to lower insurance premiums. These features reduce the risk of theft, fire, and other incidents, making your home a safer investment for insurers.

- Coverage Limits and Deductibles: The level of coverage you choose and the corresponding deductibles impact your insurance costs. Higher coverage limits often result in higher premiums, while higher deductibles can lead to lower premiums. It’s crucial to find the right balance for your needs.

- Claim History: Your past claim history can influence insurance rates. Multiple claims, especially for similar incidents, may result in higher premiums. Maintaining a clean claim history can lead to more favorable insurance rates.

Comparing Car and Home Insurance: Strategies for the Savvy Consumer

When it comes to comparing car and home insurance policies, several strategies can help you make informed choices and potentially save money. Here are some key considerations to keep in mind:

Bundle Your Policies

Bundling your car and home insurance policies with the same insurer can often lead to significant discounts. Insurance companies offer multi-policy discounts as an incentive to attract and retain customers. By combining your policies, you can enjoy reduced rates and streamline your insurance management.

Review Coverage Levels

Take the time to carefully review the coverage levels of both your car and home insurance policies. Ensure that the limits and deductibles align with your needs and financial comfort. Consider your assets, liabilities, and potential risks to strike the right balance between coverage and affordability.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurers to find the best combination of coverage and price. Online insurance marketplaces and comparison websites can be valuable tools to quickly gather quotes and assess different options.

Consider Deductibles and Coverage Limits

When comparing policies, pay close attention to deductibles and coverage limits. Higher deductibles often result in lower premiums, but it’s essential to choose a deductible that you can comfortably afford in the event of a claim. Additionally, ensure that the coverage limits adequately protect your assets and liabilities.

Utilize Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract customers. These may include discounts for safe driving records, multi-car policies, loyalty rewards, or even discounts for specific professions or affiliations. Take advantage of these opportunities to reduce your insurance costs.

Seek Expert Advice

If you’re unsure about the best insurance options for your needs, consider seeking advice from insurance professionals or brokers. They can provide valuable insights, answer your questions, and help you navigate the complex world of insurance to find the most suitable coverage at the best price.

Conclusion: Securing Your Peace of Mind

Car and home insurance are essential components of financial planning, providing the necessary protection for your vehicles and residences. By understanding the different coverage options, factors influencing rates, and comparison strategies, you can make informed decisions to secure the right insurance coverage. Remember, it’s crucial to regularly review and update your policies to ensure they align with your changing needs and circumstances.

Frequently Asked Questions

What is the difference between comprehensive and collision coverage in car insurance?

+Comprehensive coverage provides protection against non-collision events such as theft, vandalism, and natural disasters, while collision coverage covers damages resulting from collisions with other vehicles or objects. Comprehensive coverage is broader and often recommended for comprehensive protection.

How do I determine the right coverage limits for my home insurance policy?

+To determine the right coverage limits, consider the replacement cost of your home and the value of your personal belongings. Work with an insurance professional to assess your specific needs and ensure adequate coverage without overpaying.

Can I negotiate car insurance rates with insurers?

+While insurance rates are primarily based on calculated risk factors, it’s worth discussing potential discounts and negotiating terms with insurers. They may offer flexibility in certain situations, such as loyalty rewards or bundle discounts.

Are there any alternative options to traditional home insurance policies?

+Yes, there are alternative insurance options, such as homeowner’s mutual insurance or specialized policies for specific risks. These alternatives may offer more tailored coverage or lower premiums for certain types of homes or locations. It’s essential to research and compare options to find the best fit.