Car And Homeowners Insurance Quotes

Protecting your assets and ensuring peace of mind is a top priority for many individuals. Whether it's safeguarding your vehicle or securing your home, having adequate insurance coverage is crucial. In this comprehensive guide, we will delve into the world of car and homeowners insurance, exploring the factors that influence quotes, understanding the coverage options, and providing valuable insights to help you make informed decisions.

Understanding Car Insurance Quotes

When it comes to car insurance, obtaining quotes is an essential step in finding the right coverage for your needs. The process of calculating car insurance quotes involves a meticulous evaluation of various factors that can significantly impact the final premium. Let’s explore some of the key considerations that insurance providers take into account:

Vehicle Type and Usage

The type of vehicle you own plays a pivotal role in determining your insurance quote. Insurance providers assess the make, model, and age of your car, as well as its intended usage. For instance, a sports car may attract higher premiums due to its association with higher speeds and potential risks. On the other hand, a fuel-efficient compact car might be considered less risky and result in lower insurance costs.

Driving History and Record

Your driving history is a critical factor in the insurance quote calculation. Insurance companies carefully examine your record, considering factors such as accidents, traffic violations, and claims made in the past. A clean driving record with no major incidents can lead to more favorable insurance rates, as it indicates a lower risk of future claims.

| Driving Record | Insurance Impact |

|---|---|

| Clean Record | Lower Premiums |

| Minor Violations | Moderate Increase |

| Serious Accidents | Significant Rise |

Additionally, the frequency of driving and the estimated annual mileage can also influence your insurance quote. Long-distance commuters or those with high mileage may face slightly higher premiums due to the increased exposure to potential risks on the road.

Demographic Factors

Insurance providers also consider demographic information when calculating quotes. Factors such as age, gender, and location play a role in assessing the level of risk associated with a particular driver. For example, younger drivers, especially those under 25, are often considered higher-risk due to their lack of driving experience, resulting in higher insurance premiums.

Furthermore, the location where you primarily drive your vehicle can impact your insurance quote. Urban areas with higher population density and a history of frequent accidents or thefts may carry a higher risk profile, leading to increased insurance costs.

Homeowners Insurance: Securing Your Haven

Just as car insurance is vital for protecting your vehicle, homeowners insurance is essential for safeguarding your home and personal belongings. When it comes to obtaining quotes for homeowners insurance, several key factors come into play, each contributing to the overall cost and coverage options available to you.

Property Value and Location

The value of your home is a primary consideration when calculating homeowners insurance quotes. Insurance providers assess the replacement cost of your property, taking into account factors such as the size, construction materials, and any unique features or upgrades. Higher-value homes generally require more extensive coverage and, consequently, result in higher insurance premiums.

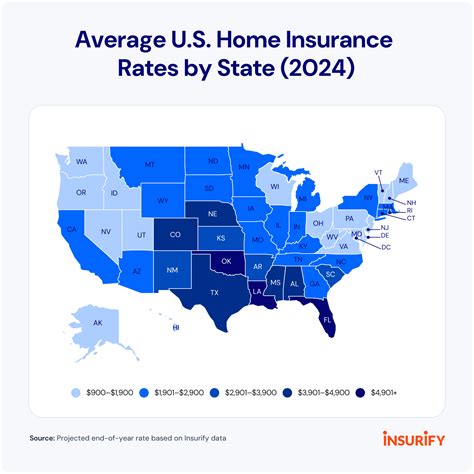

Additionally, the location of your home plays a significant role in determining your insurance quote. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, may pose a higher risk of property damage. As a result, insurance providers may adjust their rates accordingly, reflecting the increased likelihood of claims in those regions.

Coverage Options and Customization

Homeowners insurance offers a range of coverage options to suit different needs and preferences. Standard policies typically include coverage for the structure of your home, personal belongings, and liability protection. However, you have the flexibility to customize your policy by adding additional endorsements or riders to address specific concerns, such as flood insurance or coverage for high-value items like jewelry or artwork.

It's important to carefully review the coverage limits and exclusions outlined in your policy to ensure that you have adequate protection for your unique circumstances. For instance, if you have valuable collectibles or expensive electronics, you may need to increase your coverage limits to fully protect your investments.

Discounts and Savings Opportunities

Insurance providers often offer a variety of discounts to encourage policyholders to take proactive measures to protect their homes. These discounts can significantly reduce your insurance premiums and make coverage more affordable. Some common discounts include:

- Home Security Discounts: Installing a monitored security system, smoke detectors, or fire alarms can qualify you for reduced rates, as these measures help prevent theft and minimize the risk of fire-related incidents.

- Bundling Discounts: Insuring multiple policies with the same provider, such as combining your homeowners and auto insurance, can result in substantial savings. Insurance companies often offer bundle discounts to reward loyal customers.

- Loyalty Discounts: Maintaining a long-standing relationship with an insurance provider can lead to loyalty discounts. The longer you've been a customer, the more likely you are to qualify for reduced rates.

Tips for Obtaining Accurate Quotes

When seeking car or homeowners insurance quotes, it’s essential to take a strategic approach to ensure you receive accurate and competitive offers. Here are some valuable tips to consider:

Compare Multiple Providers

Don’t settle for the first insurance quote you receive. It’s crucial to shop around and compare quotes from multiple providers. Each insurance company has its own rating system and considerations, so exploring various options can help you identify the most suitable coverage at the best price.

Understand Your Coverage Needs

Before requesting quotes, take the time to assess your specific coverage needs. Consider factors such as the value of your vehicle or home, any unique risks or vulnerabilities, and the level of protection you desire. By understanding your needs, you can effectively communicate them to insurance providers and receive more accurate quotes.

Provide Accurate Information

When requesting quotes, ensure that you provide accurate and detailed information about your vehicle, home, driving history, or any other relevant factors. Inaccurate or incomplete information can lead to discrepancies in quotes and potentially result in unexpected surprises when it comes to filing claims.

Explore Customization Options

Both car and homeowners insurance offer customization options to tailor coverage to your specific needs. Take advantage of these opportunities to enhance your protection. For instance, you might consider adding rental car coverage to your car insurance policy or increasing your liability limits in your homeowners insurance to ensure comprehensive protection.

Utilize Online Resources

In today’s digital age, numerous online tools and resources are available to assist you in obtaining insurance quotes. Online quote comparison platforms can provide a convenient way to compare multiple providers and policies in one place. Additionally, many insurance companies offer online quote calculators that allow you to input your information and receive personalized quotes instantly.

Future Trends and Innovations

The insurance industry is constantly evolving, and several emerging trends and innovations are shaping the future of car and homeowners insurance. Staying informed about these developments can help you make more informed decisions and potentially benefit from new opportunities.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of data-tracking devices or smartphone apps, is revolutionizing the way insurance companies assess risk and calculate premiums. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, allows insurance providers to monitor driving behavior and reward safe driving practices with discounted rates. This technology provides a more accurate assessment of individual risk and encourages safer driving habits.

Smart Home Technology

The integration of smart home technology is becoming increasingly common, and insurance providers are taking notice. Smart home devices, such as security cameras, smart locks, and leak detectors, can enhance home security and reduce the risk of theft or water damage. Insurance companies may offer discounts or tailored coverage options for policyholders who invest in these technologies, recognizing the added layer of protection they provide.

Data Analytics and Personalized Pricing

Advanced data analytics and machine learning algorithms are transforming the way insurance companies assess risk and price policies. By analyzing vast amounts of data, including historical claims data, driving behavior patterns, and demographic information, insurance providers can more accurately predict the likelihood of future claims and adjust premiums accordingly. This personalized pricing approach ensures that policyholders pay rates that are fair and reflective of their individual risk profiles.

Digital Claims Processing

The insurance industry is embracing digital transformation, and this extends to the claims process as well. Insurance providers are implementing streamlined digital claims systems that allow policyholders to submit and track their claims online or through mobile apps. This not only enhances convenience and efficiency but also reduces the administrative burden on both the insurer and the policyholder, leading to faster claim resolutions.

How do insurance companies determine car insurance quotes?

+Insurance companies use a variety of factors to determine car insurance quotes, including vehicle type and usage, driving history and record, demographic factors, and location. These factors help assess the level of risk associated with a particular driver and determine the appropriate insurance premium.

What are some common discounts available for homeowners insurance?

+Common discounts for homeowners insurance include home security discounts for installing monitored security systems or smoke detectors, bundling discounts when insuring multiple policies with the same provider, and loyalty discounts for long-standing customers.

Can I customize my insurance coverage to suit my specific needs?

+Yes, both car and homeowners insurance offer customization options. You can add endorsements or riders to address specific concerns, such as flood insurance or coverage for high-value items. Understanding your unique needs and communicating them to insurance providers can help ensure you receive tailored coverage.