Car Cheap Insurance Michigan

Finding affordable car insurance in Michigan can be a daunting task, as the state has some of the highest auto insurance rates in the nation. However, with the right approach and an understanding of the factors that impact insurance costs, it's possible to secure a competitive rate. This comprehensive guide will delve into the intricacies of obtaining cheap car insurance in Michigan, offering practical tips and insights to help drivers make informed decisions.

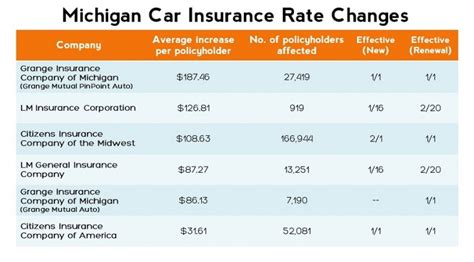

Understanding the Michigan Insurance Market

Michigan’s insurance landscape is unique due to its no-fault system, which mandates that drivers carry Personal Injury Protection (PIP) coverage to cover medical expenses and lost wages in the event of an accident, regardless of fault. This system, while offering comprehensive protection, also contributes to the state’s high insurance premiums. Understanding this system is crucial for Michigan drivers seeking affordable coverage.

Key Factors Influencing Michigan Car Insurance Rates

Several factors play a significant role in determining car insurance rates in Michigan, including:

- Driver’s Age and Gender: Younger drivers, particularly males, often face higher premiums due to their perceived higher risk profile.

- Vehicle Type and Usage: The make, model, and purpose of the vehicle (e.g., personal use, commercial use) can impact insurance costs.

- Location: Insurance rates vary significantly across Michigan’s cities and counties, with urban areas generally having higher rates.

- Driving Record: A clean driving history can lead to substantial savings, while violations and accidents can significantly increase premiums.

- Credit Score: In Michigan, insurers are allowed to consider a driver’s credit score when determining rates, so maintaining a good credit score is beneficial.

| Factor | Impact on Rates |

|---|---|

| Age and Gender | High (Young Males) |

| Vehicle Type and Usage | Moderate |

| Location | Varies Widely |

| Driving Record | Significant |

| Credit Score | Considerable |

Tips for Securing Cheap Car Insurance in Michigan

Navigating the Michigan insurance market can be challenging, but by following these strategies, drivers can optimize their insurance coverage and potentially reduce costs:

Compare Multiple Quotes

Obtaining quotes from various insurance providers is essential to finding the best rate. Michigan drivers should consider getting quotes from both large national insurers and smaller, local carriers that may offer more competitive rates.

Explore Discounts

Insurers often offer a range of discounts that can significantly reduce premiums. These may include discounts for safe driving, multiple policies (e.g., bundling car and home insurance), good student status, and loyalty.

Consider Higher Deductibles

Opting for a higher deductible can lower monthly premiums. However, drivers should ensure they have the financial means to cover the deductible in the event of a claim.

Maintain a Clean Driving Record

A clean driving history is crucial for keeping insurance costs down. Avoid traffic violations and accidents to prevent increases in premiums.

Shop Around Regularly

Insurance rates can change over time, so it’s beneficial to review and compare quotes annually or whenever significant life changes occur, such as moving to a new location or purchasing a new vehicle.

Understand Coverage Options

Michigan drivers should carefully review their coverage options to ensure they have the right balance of protection and affordability. While the state mandates PIP coverage, other optional coverages like collision and comprehensive can add to the cost but may provide valuable protection.

The Role of Technology in Affordable Insurance

Advancements in technology have introduced new opportunities for Michigan drivers to save on insurance. Telematics, or usage-based insurance (UBI), is one such innovation. With UBI, drivers can enroll in programs that monitor their driving behavior, with safer driving often resulting in lower premiums.

Usage-Based Insurance (UBI) Programs

Several insurance providers in Michigan offer UBI programs. These programs typically involve installing a device in the vehicle or using a smartphone app to track driving habits, such as mileage, braking, acceleration, and time of day driving. Drivers who exhibit safe driving behaviors may be rewarded with discounted rates.

For example, State Farm's Drive Safe & Save program utilizes a mobile app to track driving behavior, with eligible customers receiving a discount of up to 50% on their liability and comprehensive coverages.

The Future of Affordable Car Insurance in Michigan

The insurance landscape in Michigan is evolving, with ongoing efforts to reform the state’s no-fault system and reduce insurance costs. These reforms, if successful, could significantly impact the affordability of car insurance for Michigan drivers.

Potential Reforms and Their Impact

Proposed reforms include capping PIP benefits, introducing fault-based liability systems, and limiting the use of credit scores in rate determination. If implemented, these changes could lead to more competitive insurance rates and greater affordability for Michigan drivers.

Conclusion

Obtaining cheap car insurance in Michigan requires a combination of understanding the unique insurance landscape, exploring available discounts and coverage options, and leveraging technology to one’s advantage. By staying informed and proactive, Michigan drivers can navigate the state’s insurance market and secure affordable coverage that meets their needs.

What is the average cost of car insurance in Michigan?

+The average cost of car insurance in Michigan is approximately $2,500 per year, but rates can vary widely based on individual factors such as driving history, vehicle type, and location.

Are there any ways to lower my insurance rates if I have a poor driving record?

+Yes, while a poor driving record can significantly increase insurance rates, you can take steps to mitigate these increases. This includes enrolling in a defensive driving course, which may result in a discount, and shopping around for insurers that offer accident forgiveness programs.

Can I get car insurance without a credit check in Michigan?

+In Michigan, insurers are permitted to consider credit scores when determining rates. However, there are insurers that offer non-standard insurance policies for drivers with poor credit or no credit history. These policies may have higher premiums, but they can provide coverage without a credit check.