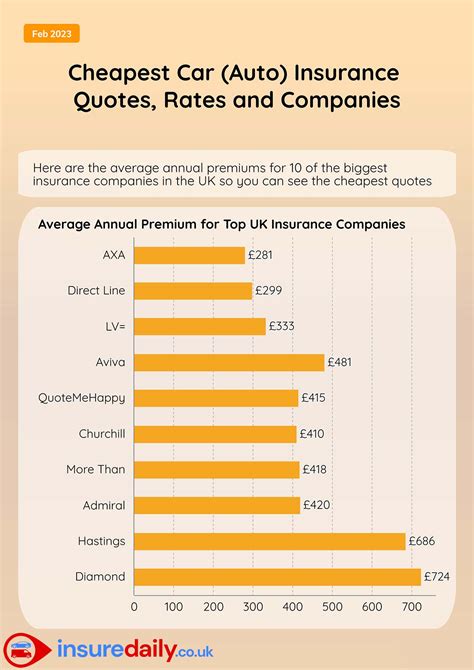

Car Cheap Insurance Quote

When it comes to insuring your vehicle, finding a cheap car insurance quote is a top priority for many drivers. With the right strategy and an understanding of the factors that influence insurance costs, you can secure an affordable policy without compromising on coverage. In this comprehensive guide, we will delve into the world of car insurance, offering expert insights and practical tips to help you navigate the process and obtain the best quote for your specific needs.

Understanding Car Insurance Basics

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It’s essential to grasp the fundamentals before embarking on your quest for a cheap insurance quote. Here’s a breakdown of the key components:

Types of Car Insurance Coverage

Car insurance policies typically encompass various types of coverage, each designed to address different situations. The main categories include:

- Liability Coverage: This covers damages or injuries you cause to others in an accident. It’s mandatory in most states and forms the basis of any car insurance policy.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of fault. It’s an optional coverage but highly recommended.

- Comprehensive Coverage: Comprehensive insurance protects against non-collision incidents like theft, vandalism, natural disasters, and animal collisions. Like collision coverage, it’s optional but valuable for comprehensive protection.

- Medical Payments or Personal Injury Protection (PIP): These coverages pay for medical expenses for you and your passengers, regardless of fault. They vary in availability and coverage limits depending on your state’s regulations.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you’re involved in an accident with a driver who has little or no insurance.

Factors Influencing Car Insurance Rates

Insurance companies assess various factors to determine your insurance premium. Understanding these factors can help you anticipate and potentially mitigate the costs. Key considerations include:

- Driver Profile: Your age, gender, driving history, and location play a significant role. Younger drivers and those with a history of accidents or violations may face higher premiums.

- Vehicle Type: The make, model, and year of your vehicle impact insurance rates. Sports cars and luxury vehicles often attract higher premiums due to their higher repair costs and theft risks.

- Usage and Mileage: How and how often you use your vehicle matters. High-mileage drivers or those who use their cars for business purposes may face higher rates.

- Credit Score: Surprisingly, your credit score can influence your insurance rates. Insurers often use credit-based insurance scores to assess risk, so maintaining a good credit score can lead to lower premiums.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles impact your premium. Higher deductibles can lower your premium, but you’ll pay more out of pocket if you file a claim.

Strategies for Securing a Cheap Car Insurance Quote

Now that we’ve covered the basics, let’s explore some effective strategies to help you find a cheap car insurance quote tailored to your needs:

Shop Around and Compare Quotes

The insurance market is competitive, and rates can vary significantly between providers. Shopping around and comparing quotes is essential to finding the best deal. Utilize online comparison tools and request quotes from multiple insurers to get a clear picture of the market.

Consider factors like the insurer’s financial stability, customer service reputation, and policy features when making your comparison. A comprehensive evaluation will help you identify the insurer that offers the best value for your specific circumstances.

Optimize Your Driving Profile

Your driving profile is a significant determinant of your insurance rates. Here are some tips to optimize it:

- Maintain a Clean Driving Record: Avoid accidents and violations. A clean driving record demonstrates responsible driving behavior and can lead to lower premiums.

- Consider Driver Training Courses: Some insurers offer discounts to drivers who complete defensive driving courses. These courses can improve your skills and potentially reduce your insurance costs.

- Bundle Policies: If you have multiple vehicles or other insurance needs, consider bundling your policies with the same insurer. Bundling can result in substantial savings and simplified management.

Explore Discounts and Savings Opportunities

Insurance companies offer various discounts to attract and retain customers. Be sure to inquire about the following common discounts:

- Safe Driver Discounts: Insurers often reward drivers with clean records and those who’ve completed driver training courses.

- Multi-Policy Discounts: As mentioned, bundling your insurance policies with the same provider can lead to significant savings.

- Loyalty Discounts: Some insurers offer discounts to long-term customers, so it’s worth inquiring about loyalty programs.

- Occupational and Alumni Discounts: Certain occupations and alumni associations may be eligible for discounts, so check with your insurer.

- Low-Mileage Discounts: If you drive less than average, you may qualify for a low-mileage discount.

Consider Telematics or Usage-Based Insurance

Telematics insurance, also known as usage-based insurance, is an innovative approach that assesses your driving behavior in real-time. Insurers install a device in your vehicle or use a smartphone app to monitor factors like speeding, braking, and mileage. Based on your driving habits, you may qualify for discounted rates.

Telematics insurance is an excellent option for safe drivers who want to demonstrate their responsible behavior and potentially save on insurance costs.

Evaluate Coverage Levels and Deductibles

The level of coverage you choose and the associated deductibles have a direct impact on your insurance premium. Consider your financial situation and risk tolerance when making these decisions.

Higher deductibles can lead to lower premiums, but remember that you’ll need to pay this amount out of pocket if you file a claim. On the other hand, lower deductibles offer more financial protection but result in higher premiums.

Assess your coverage needs and strike a balance that provides adequate protection without straining your finances.

Maintain a Good Credit Score

As mentioned earlier, your credit score can influence your insurance rates. A good credit score demonstrates financial responsibility and can lead to lower premiums. Focus on maintaining a healthy credit profile by paying your bills on time, reducing debt, and regularly monitoring your credit report.

Making an Informed Decision

With the strategies outlined above, you’re well-equipped to secure a cheap car insurance quote. However, it’s essential to make an informed decision that considers not only the cost but also the quality of coverage and the insurer’s reputation.

Here are some key considerations when choosing an insurance provider:

- Financial Stability: Ensure the insurer is financially stable and has the resources to pay claims promptly.

- Customer Service: Look for an insurer with a strong reputation for customer service and claim handling.

- Policy Features: Compare the features and benefits of different policies to ensure you’re getting the coverage you need.

- Reviews and Ratings: Read customer reviews and industry ratings to gauge the insurer’s performance and satisfaction levels.

- Claim Process: Understand the insurer’s claim process and response times to ensure you’ll receive prompt assistance when needed.

Conclusion: Finding the Right Balance

Securing a cheap car insurance quote is a balance between cost and coverage. By understanding the factors that influence rates, shopping around, optimizing your driving profile, and exploring discounts, you can find an affordable policy that provides the protection you need.

Remember, car insurance is a critical investment in your financial security and peace of mind. Take the time to research and compare options, and don’t hesitate to seek expert advice if needed. With the right approach, you can drive confidently knowing you’ve made an informed decision.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the US varies depending on several factors, including the state you reside in, your driving record, and the coverage you choose. As of 2023, the national average for car insurance is approximately 1,674 per year or 139 per month. However, rates can range from as low as 500 to over 3,000 annually, so it’s crucial to shop around and compare quotes to find the best deal for your specific circumstances.

How can I lower my car insurance rates if I have a poor driving record?

+Improving your driving record is essential to lowering your insurance rates. Consider taking a defensive driving course, as some insurers offer discounts for completing such courses. Additionally, maintain a clean driving record going forward to demonstrate responsible behavior. Over time, a positive driving history can lead to reduced premiums. However, it’s important to note that serious violations or multiple accidents may require specialized high-risk insurance, which tends to be more expensive.

Are there any car insurance providers that specialize in offering cheap quotes to high-risk drivers?

+Yes, there are insurance providers that cater specifically to high-risk drivers, including those with a history of accidents, violations, or even DUI convictions. These insurers, often referred to as non-standard or high-risk insurers, offer specialized policies with higher premiums. While they may be more expensive, they provide coverage for drivers who may have difficulty obtaining insurance through traditional means. It’s worth shopping around and comparing quotes from these providers to find the most affordable option for your situation.

Can I get car insurance if I don’t own a car, but occasionally rent or borrow vehicles?

+Yes, you can purchase non-owner car insurance, which provides liability coverage for you as a driver, regardless of the vehicle you’re operating. This type of insurance is ideal for individuals who don’t own a car but still need protection when renting or borrowing vehicles. Non-owner car insurance typically offers lower premiums compared to standard policies since it doesn’t include comprehensive or collision coverage for a specific vehicle. It’s a cost-effective solution for occasional drivers.

What are some common mistakes to avoid when shopping for cheap car insurance quotes?

+When searching for cheap car insurance, it’s crucial to avoid common pitfalls. Firstly, don’t assume that the cheapest quote is the best option; always compare coverage levels and policy features. Additionally, avoid providing incomplete or inaccurate information during the quote process, as this can lead to unexpected surprises later. Finally, be cautious of insurers offering excessively low rates without proper research and verification.