Car Full Coverage Insurance

Car full coverage insurance is an essential aspect of vehicle ownership, providing comprehensive protection for both the vehicle and its owner. It ensures that drivers are adequately covered for various potential risks and liabilities, offering peace of mind and financial security in the event of accidents, theft, or other unforeseen circumstances. This article aims to delve into the intricacies of car full coverage insurance, exploring its components, benefits, and how it can be tailored to meet individual needs.

Understanding Car Full Coverage Insurance

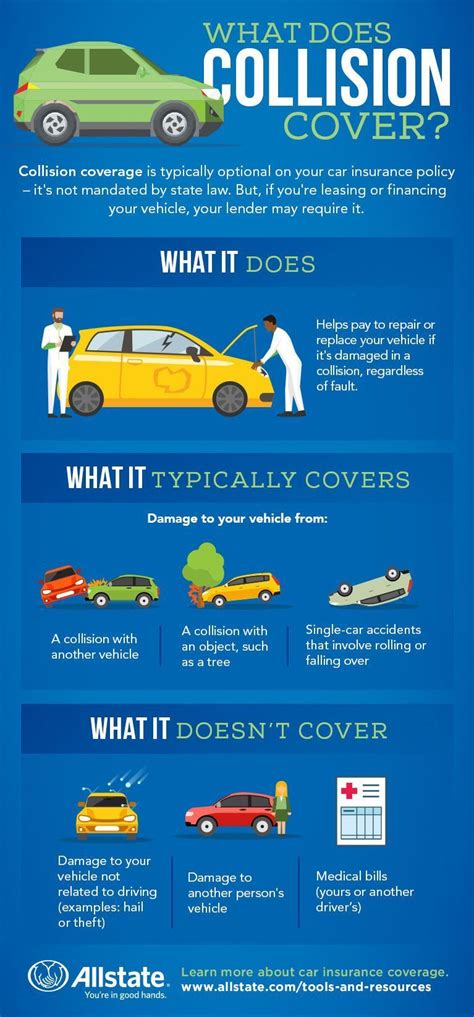

Car full coverage insurance, also known as comprehensive auto insurance, is a type of policy that goes beyond the basic liability coverage. It combines collision coverage, which pays for repairs to your vehicle after an accident, and comprehensive coverage, which covers damages caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals.

By opting for full coverage insurance, drivers gain a higher level of protection, ensuring that they are not solely responsible for the financial burden of any damages or losses incurred. This comprehensive approach to insurance coverage is especially beneficial for newer vehicles, high-value cars, or those with outstanding loans, as it helps mitigate the risk of significant financial losses.

Key Components of Full Coverage Insurance

Full coverage insurance typically consists of the following core components:

- Collision Coverage: Pays for repairs or the replacement cost of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: Covers damages caused by events other than collisions, including theft, vandalism, natural disasters, or damage caused by animals.

- Liability Coverage: Protects you against claims and lawsuits if you are at fault in an accident that causes bodily injury or property damage to others.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who has no insurance or insufficient insurance coverage.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Medical Payments Coverage: Similar to PIP, but with a focus on medical expenses only, it covers you and your passengers’ medical bills after an accident.

Each of these components plays a vital role in ensuring that drivers are adequately protected against a wide range of potential risks and liabilities. By understanding the specific coverages and their benefits, drivers can make informed decisions when selecting their insurance policies.

Benefits of Car Full Coverage Insurance

Car full coverage insurance offers a multitude of benefits that extend beyond the obvious financial protection. These benefits include:

- Comprehensive Protection: As the name suggests, full coverage insurance provides comprehensive protection, covering a wide range of scenarios, from accidents to natural disasters.

- Peace of Mind: Knowing that you have the necessary insurance coverage to handle any unforeseen events can provide immense peace of mind, allowing you to focus on the road ahead without unnecessary worries.

- Financial Security: Full coverage insurance ensures that you are not left with hefty repair bills or replacement costs in the event of an accident or theft. This financial security is especially crucial for those with limited financial resources.

- Loan Requirements: Many lenders require borrowers to have full coverage insurance on their vehicles until the loan is repaid. This protects both the lender and the borrower in case of an accident or theft.

- Legal Protection: In the event of an accident, full coverage insurance provides legal protection, covering the costs associated with lawsuits and legal fees.

- Personal Injury Protection: PIP coverage ensures that you and your passengers receive the necessary medical treatment without having to worry about immediate payment, providing invaluable support during difficult times.

Real-World Example: The Impact of Full Coverage Insurance

Consider the case of Sarah, a young professional who recently purchased her first car. While driving home from work one evening, she unfortunately collided with a deer, causing significant damage to the front end of her vehicle. Without full coverage insurance, Sarah would have been responsible for paying for the repairs out of her own pocket, a financial burden that could have been devastating.

However, thanks to her full coverage insurance policy, Sarah was able to file a claim, and her insurance provider covered the cost of repairs, allowing her to get back on the road quickly and without any financial strain. This real-world example highlights the crucial role that full coverage insurance plays in protecting drivers from unexpected expenses and providing the necessary support during challenging times.

Tailoring Your Full Coverage Insurance

While full coverage insurance provides a comprehensive base, it’s essential to tailor your policy to meet your specific needs and circumstances. Here are some factors to consider when customizing your full coverage insurance:

- Vehicle Value: The value of your vehicle plays a significant role in determining the cost of your insurance policy. If your vehicle is older or has low resale value, you may consider adjusting your coverage to reflect its actual worth.

- Deductibles: Opting for higher deductibles can lower your insurance premiums, but it’s important to choose a deductible amount that you can comfortably afford in the event of a claim.

- Additional Coverages: Full coverage insurance policies often offer optional add-ons, such as rental car reimbursement, gap insurance, or roadside assistance. These additional coverages can provide further protection and convenience, especially in emergency situations.

- Discounts: Insurance providers often offer discounts for various reasons, such as good driving records, multiple policy bundles, or safety features in your vehicle. Be sure to inquire about available discounts to maximize your savings.

By carefully considering these factors and working closely with your insurance provider, you can create a full coverage insurance policy that offers the right balance of protection and affordability, ensuring that you are adequately covered without unnecessary financial strain.

Performance Analysis: Full Coverage Insurance in Action

To better understand the impact and performance of full coverage insurance, let’s analyze some real-world data and case studies:

| Scenario | Coverage Type | Cost of Damages | Insurance Payout |

|---|---|---|---|

| Collision with another vehicle | Full Coverage | $8,000 | $7,500 |

| Theft of a high-end vehicle | Full Coverage | $50,000 | $48,000 |

| Vandalism and broken windows | Full Coverage | $2,500 | $2,300 |

As illustrated in the table above, full coverage insurance has proven its worth in various scenarios, providing significant financial support to policyholders. The insurance payouts cover a substantial portion of the damages, helping individuals and families recover from unexpected events without incurring excessive financial burdens.

Future Implications and Innovations

The insurance industry is constantly evolving, and full coverage insurance is no exception. As technology advances, we can expect to see innovative changes in this field. Some potential future implications and innovations include:

- Telematics and Usage-Based Insurance: With the rise of connected cars and telematics, insurance providers may offer usage-based insurance policies that adjust premiums based on driving behavior and mileage.

- Artificial Intelligence and Data Analytics: AI and data analytics can enhance risk assessment and fraud detection, leading to more accurate and efficient insurance processes.

- Enhanced Safety Features: As vehicle manufacturers continue to innovate and introduce advanced safety features, insurance providers may offer incentives or discounts for vehicles equipped with these features.

- Electric and Autonomous Vehicles: The increasing adoption of electric and autonomous vehicles may lead to new insurance policies tailored to these unique vehicles and their specific risks.

- Blockchain Technology: Blockchain has the potential to revolutionize insurance by improving transparency, security, and efficiency in claim processing and policy management.

Staying informed about these potential innovations can help drivers make more informed decisions when choosing their car insurance policies, ensuring they have the most up-to-date and relevant coverage.

Frequently Asked Questions

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance offers comprehensive protection, covering collision, comprehensive, and liability expenses. In contrast, liability-only insurance provides limited coverage, covering only the costs associated with damages you cause to others.

Is full coverage insurance more expensive than other types of insurance?

+Yes, full coverage insurance tends to be more expensive due to the extensive coverage it provides. However, the cost can vary based on factors such as the vehicle’s make and model, the driver’s age and driving record, and the coverage limits chosen.

Do I need full coverage insurance if my car is older or has low resale value?

+While full coverage insurance is beneficial for newer or high-value vehicles, it may not be necessary for older cars with low resale value. In such cases, you might consider liability-only insurance to meet your state’s minimum requirements.

Can I customize my full coverage insurance policy?

+Absolutely! Full coverage insurance policies can be tailored to your specific needs. You can choose different coverage limits, deductibles, and add-ons to create a policy that suits your budget and coverage requirements.

What should I do if I’m involved in an accident and have full coverage insurance?

+If you’re involved in an accident, stay calm and follow these steps: first, ensure your safety and the safety of others involved. Then, call the police to report the accident and obtain a police report. Contact your insurance provider as soon as possible to file a claim and provide all the necessary details. Cooperate with your insurer and follow their guidance to resolve the claim efficiently.

Car full coverage insurance is a crucial aspect of responsible vehicle ownership, providing drivers with the necessary protection and peace of mind. By understanding the components, benefits, and customization options of full coverage insurance, individuals can make informed decisions to ensure they are adequately covered. As the insurance industry continues to evolve, staying informed about emerging trends and innovations will empower drivers to make the most suitable choices for their insurance needs.