Car Insurance Agent

In the dynamic world of automotive protection, the role of a Car Insurance Agent stands as a pivotal figure, navigating the complex landscape of policies, risks, and regulations to safeguard drivers and their vehicles. This profession, while often overlooked, is a critical link between the vast array of insurance providers and the diverse needs of vehicle owners, offering personalized guidance and expert advice.

The significance of this role extends beyond mere policy sales; it involves a deep understanding of the unique challenges faced by drivers, from everyday commuters to commercial fleet owners. With an ever-evolving market and an array of coverage options, the Car Insurance Agent is tasked with not only finding the right policy but also educating clients on the nuances of coverage, ensuring they are adequately protected.

The Role and Responsibilities of a Car Insurance Agent

A Car Insurance Agent, often referred to as an Auto Insurance Agent, serves as a trusted advisor, guiding individuals and businesses through the intricate process of selecting suitable automobile insurance. This role demands a comprehensive understanding of the insurance industry, a keen eye for detail, and exceptional interpersonal skills.

Key Responsibilities

- Policy Sales and Advice: Agents are responsible for selling insurance policies, but more importantly, they advise clients on the most suitable coverage for their needs. This involves understanding the client’s circumstances, such as their driving history, vehicle type, and intended usage, to recommend policies that offer the right balance of protection and affordability.

- Policy Management: Beyond sales, agents often assist with ongoing policy management. This includes making changes to existing policies, such as updating vehicle details, adding or removing drivers, or adjusting coverage limits. They also play a crucial role in renewals, ensuring clients have the most up-to-date and competitive coverage.

- Claims Assistance: In the event of an accident or other insured event, agents provide crucial support. They guide clients through the claims process, helping them understand their rights and obligations, and often advocate on their behalf to ensure a fair and timely settlement.

- Client Education: Educating clients about insurance is a fundamental part of the role. Agents explain the different types of coverage, such as liability, collision, comprehensive, and add-ons like rental car reimbursement or roadside assistance. They also clarify complex terms and conditions to ensure clients understand their policies.

- Risk Assessment: Agents are skilled in assessing risk. They evaluate factors like driving records, geographic locations, and vehicle types to determine the likelihood of claims and advise clients on ways to mitigate these risks, such as through defensive driving courses or vehicle modifications.

- Regulatory Compliance: Staying up-to-date with ever-changing insurance regulations is critical. Agents ensure that the policies they sell and the advice they provide are in line with state and federal laws, avoiding potential legal issues for both the insurer and the insured.

The Impact of Technology on the Role

The advent of digital technology has significantly influenced the landscape of car insurance, and consequently, the role of the agent. While it has streamlined many processes and provided new tools for customer engagement, it has also posed challenges and opportunities for the profession.

Digital Tools and Online Platforms

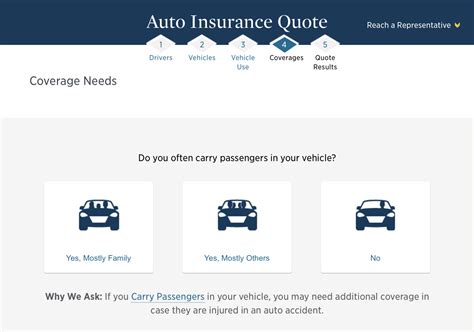

Online platforms and digital tools have revolutionized the way car insurance is sold and managed. Agents now utilize these platforms to quickly compare policies, provide instant quotes, and manage client portfolios. These tools enhance efficiency and provide a more transparent view of the market for clients.

For instance, advanced algorithms can quickly analyze a client's profile and recommend the most suitable policies, while interactive dashboards allow clients to view and manage their policies online, providing real-time updates and notifications.

| Digital Tool | Functionality |

|---|---|

| Comparison Software | Quickly compares policies from various providers, providing side-by-side analysis of coverage and costs. |

| Online Quoting Tools | Generates instant quotes based on client data, offering a fast and accurate estimate of insurance costs. |

| Policy Management Platforms | Enables agents and clients to view and manage policies online, including making changes and renewals. |

Enhanced Customer Engagement

Digital platforms and social media have opened new avenues for customer engagement. Agents can now connect with clients through multiple channels, providing real-time support and advice. This level of accessibility enhances the customer experience and fosters stronger relationships.

For example, agents can use social media to share valuable insurance tips, keep clients informed about policy changes, or even offer quick responses to queries, ensuring they are always accessible to their clients.

Challenges and Opportunities

While technology has undoubtedly made the agent’s role more efficient, it has also increased competition. Direct-to-consumer online insurance platforms now offer instant quotes and policy purchases, bypassing the traditional agent-client relationship. This shift has pushed agents to adapt and offer more value-added services.

However, technology also presents opportunities. Agents who embrace digital tools can provide a more personalized and efficient service, leveraging data analytics to offer tailored advice and using online platforms to streamline administrative tasks, freeing up time for more complex client interactions and education.

The Future of Car Insurance Agents

As the insurance industry continues to evolve, the role of the Car Insurance Agent is also undergoing significant transformation. With increasing emphasis on digital platforms and data-driven decision-making, the agent’s role is shifting towards a more consultative and strategic position.

Adapting to Industry Changes

The future of car insurance agents lies in their ability to adapt to emerging trends and technologies. This includes not only keeping abreast of digital tools and platforms but also understanding the implications of new mobility trends, such as ride-sharing and autonomous vehicles, on insurance coverage.

For instance, with the rise of electric vehicles (EVs), agents will need to understand the unique coverage needs associated with these vehicles, including potential battery replacement costs or charging station liability. Similarly, as autonomous vehicles become more prevalent, agents will need to educate clients on the new types of coverage required, such as cyber insurance to protect against potential hacking risks.

Focus on Personalized Service

In an increasingly digital world, the personal touch offered by agents becomes even more valuable. Clients may still prefer to have a human agent guide them through the complex process of choosing the right insurance, especially when it comes to understanding the nuances of different policies and coverage options.

Agents can leverage their expertise to provide personalized advice, taking into account the client's specific circumstances and needs. This level of service cannot be easily replicated by online platforms, and it remains a key differentiator for agents in a competitive market.

Embracing Data Analytics

The use of data analytics is poised to play a pivotal role in the future of car insurance agents. By analyzing large datasets, agents can gain valuable insights into client needs and market trends, allowing them to offer more tailored advice and solutions.

For example, agents could use predictive analytics to identify clients who are likely to face specific risks, such as those living in areas prone to natural disasters, and proactively recommend appropriate coverage. Similarly, data analytics can help agents identify trends in claims, allowing them to advise clients on ways to reduce their premiums through safer driving practices or vehicle modifications.

Conclusion

The role of a Car Insurance Agent is multifaceted and dynamic, requiring a blend of technical knowledge, interpersonal skills, and a keen understanding of the ever-evolving insurance landscape. As technology continues to shape the industry, agents will need to adapt, leveraging digital tools to enhance their services while maintaining the personal touch that clients value.

The future of this profession lies in its ability to embrace change, providing personalized, data-driven advice that meets the unique needs of each client. With a focus on education, risk assessment, and tailored solutions, Car Insurance Agents will continue to play a crucial role in protecting drivers and their vehicles.

What qualifications are needed to become a Car Insurance Agent?

+Becoming a Car Insurance Agent typically requires a high school diploma or equivalent, though some insurers may prefer candidates with a college degree. More importantly, aspiring agents must obtain the necessary insurance licenses, which involve passing state-specific exams that cover insurance laws, regulations, and practices. Ongoing professional development is also crucial to stay updated with industry changes and regulatory requirements.

How do Car Insurance Agents stay updated with industry changes?

+Agents stay current by participating in ongoing professional development programs, attending industry conferences and seminars, and regularly reviewing industry publications and resources. Many insurers also provide internal training and support to ensure their agents are well-equipped to navigate changing market conditions and regulatory landscapes.

What are the common challenges faced by Car Insurance Agents?

+Car Insurance Agents often face challenges such as keeping up with changing regulations, understanding new types of coverage, and staying competitive in a market with increasing online options. Additionally, agents must manage client expectations, especially when it comes to claims, and ensure that clients understand their policies and coverage limitations.