Car Insurance Best Prices

When it comes to car insurance, finding the best prices can be a challenging task. With numerous insurance providers offering a wide range of policies, it's essential to navigate the market wisely to secure the most cost-effective coverage for your vehicle. This comprehensive guide will delve into the factors that influence car insurance rates, offer practical tips for securing the best deals, and provide a detailed analysis of the top insurance providers and their offerings.

Understanding Car Insurance Rates

Car insurance rates are determined by a multitude of factors, including the make and model of your vehicle, your driving history, and the coverage options you choose. Insurance companies assess these factors to calculate the risk associated with insuring your vehicle and set their premiums accordingly. Understanding these factors is crucial to identifying areas where you can negotiate better rates.

Vehicle Factors

The type of vehicle you drive plays a significant role in determining your insurance rates. High-performance cars, sports cars, and luxury vehicles are generally more expensive to insure due to their higher repair costs and increased likelihood of theft. On the other hand, compact cars and family sedans often attract lower premiums. Additionally, newer models may command higher rates due to their advanced technology and potential for higher repair costs.

Here's a table showcasing the average insurance rates for different vehicle categories:

| Vehicle Type | Average Annual Premium |

|---|---|

| Sports Cars | $2,500 - $3,000 |

| Luxury Vehicles | $2,000 - $2,500 |

| Compact Cars | $1,500 - $2,000 |

| Family Sedans | $1,200 - $1,800 |

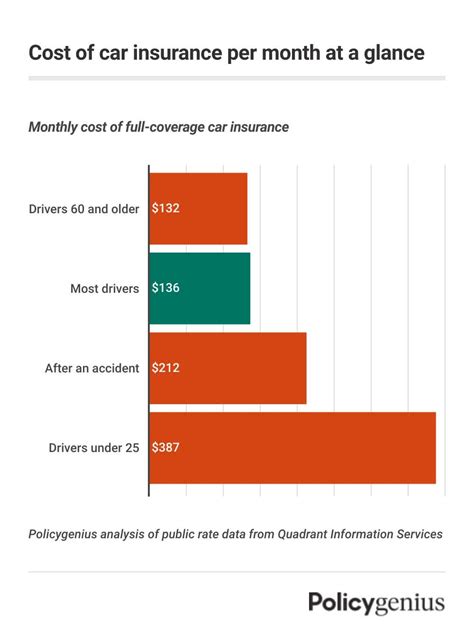

Driver Factors

Your driving history is a key determinant of your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, as it indicates a lower risk profile. On the contrary, a history of accidents or moving violations may result in higher insurance costs. Insurance companies also consider your age, gender, and marital status, as these factors are statistically linked to driving behavior and accident rates.

Coverage Options

The level of coverage you choose significantly impacts your insurance rates. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, typically costs more than liability-only coverage, which only covers damages you cause to others. However, it’s essential to strike a balance between cost and adequate protection to ensure you’re not underinsured.

Tips for Securing the Best Car Insurance Prices

Now that we’ve explored the factors influencing car insurance rates, let’s dive into some practical strategies to help you secure the best prices.

Shop Around and Compare

One of the most effective ways to find the best car insurance prices is to shop around and compare quotes from multiple providers. Insurance companies have different rate structures and policies, so getting quotes from at least three to five providers can help you identify the most competitive rates. Online comparison tools and insurance brokerages can streamline this process and provide a comprehensive overview of the market.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, if you have home insurance and car insurance, consider getting quotes from providers who offer both. By bundling these policies, you may be eligible for a multi-policy discount, which can significantly reduce your overall insurance costs.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible, you’re essentially sharing more of the financial risk with your insurance company, which can lead to lower monthly premiums. However, it’s important to ensure that you can afford the higher deductible in the event of an accident or claim.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to attract and retain customers. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Be sure to inquire about these discounts when getting quotes, as they can significantly reduce your insurance costs.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance rates. Insurance companies use credit-based insurance scores to assess your financial responsibility and predict your likelihood of filing a claim. Maintaining a good credit score can help you secure more favorable insurance rates. If you’re looking to improve your credit score, consider paying your bills on time, reducing your credit card balances, and monitoring your credit report for any errors.

Top Car Insurance Providers and Their Offerings

Now, let’s take a closer look at some of the top car insurance providers in the market and the unique features and benefits they offer.

State Farm

State Farm is one of the largest car insurance providers in the United States, known for its comprehensive coverage options and excellent customer service. They offer a wide range of discounts, including a good student discount, safe driver discount, and multi-policy discount. State Farm also provides a unique feature called Drive Safe & Save, which uses telematics technology to monitor your driving habits and offer personalized discounts based on your safe driving behavior.

Geico

Geico, short for Government Employees Insurance Company, is another prominent player in the car insurance market. They offer competitive rates and a user-friendly online platform for managing your policy. Geico provides a range of discounts, such as the Military Service Member discount, Federal Employee discount, and Good Student discount. They also offer a unique feature called Emergency Deployment Coverage, which provides additional coverage for military members who are deployed.

Progressive

Progressive is known for its innovative approach to car insurance, offering a wide range of coverage options and personalized policies. They provide a unique feature called Name Your Price®, which allows you to choose your desired coverage level and then presents you with available policy options that match your budget. Progressive also offers a Snapshot® program, which uses telematics to monitor your driving behavior and provides discounts based on your safe driving habits.

Allstate

Allstate is a leading car insurance provider with a strong focus on customer satisfaction. They offer a range of coverage options, including standard liability coverage, collision coverage, and comprehensive coverage. Allstate’s unique feature is their Drivewise® program, which uses telematics to track your driving behavior and offers discounts based on your safe driving practices. They also provide a range of discounts, including the Safe Driving Bonus Check®, which rewards you for maintaining a safe driving record.

USAA

USAA is a highly regarded insurance provider exclusively serving military members, veterans, and their families. They offer competitive rates and excellent customer service tailored to the unique needs of the military community. USAA provides a range of discounts, including the Loyalty Discount, Safe Driver Discount, and Multi-Policy Discount. They also offer unique features such as the Accident Forgiveness program, which waives rate increases after an at-fault accident.

Future Trends and Innovations in Car Insurance

The car insurance industry is continuously evolving, with new technologies and innovations shaping the way insurance is provided and accessed. Here are some key trends and innovations to watch out for in the future:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices to track driving behavior, is expected to play a significant role in the future of car insurance. Usage-based insurance, where premiums are calculated based on real-time driving data, is gaining popularity. This trend allows insurance companies to offer more personalized and fair pricing, rewarding safe drivers with lower premiums.

Connected Car Technology

With the rise of connected car technology, insurance companies are exploring ways to leverage vehicle data for improved risk assessment and pricing. Connected cars generate a wealth of data, including driving behavior, vehicle diagnostics, and location information. This data can be used to offer more accurate and tailored insurance coverage, as well as provide real-time alerts and assistance in the event of an accident or breakdown.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being utilized by insurance companies to enhance their operations and provide better customer experiences. These technologies can analyze vast amounts of data to identify patterns and trends, enabling insurance providers to offer more precise risk assessments and personalized coverage options. AI-powered chatbots and virtual assistants are also being employed to streamline customer interactions and provide quick assistance.

Pay-as-You-Drive Insurance

Pay-as-you-drive insurance, also known as Pay-per-Mile insurance, is gaining traction as a more flexible and cost-effective alternative to traditional insurance models. With this approach, insurance premiums are calculated based on the number of miles driven, rather than a fixed annual rate. This model is particularly beneficial for low-mileage drivers, as it allows them to pay only for the coverage they actually need.

Conclusion

Securing the best car insurance prices requires a thoughtful approach and a good understanding of the factors that influence rates. By shopping around, comparing quotes, and taking advantage of discounts and innovative coverage options, you can find the most cost-effective insurance policy for your needs. As the car insurance industry evolves, staying informed about the latest trends and innovations will help you make informed decisions and secure the best coverage at the most competitive prices.

How do I know if I’m getting a good car insurance deal?

+

A good car insurance deal should offer comprehensive coverage at a competitive price. Compare quotes from multiple providers, and consider factors like the provider’s reputation, customer service, and the range of discounts and benefits they offer. Also, ensure that the policy provides adequate coverage for your specific needs.

What are some common car insurance discounts I should look for?

+

Common car insurance discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Some providers also offer discounts for bundling multiple policies or for specific professions or affiliations.

How can I lower my car insurance premiums if I have a poor driving record?

+

If you have a poor driving record, consider taking a defensive driving course to improve your driving skills and potentially reduce your insurance premiums. Additionally, focus on maintaining a clean driving record moving forward, as this can help improve your insurance rates over time. You can also explore usage-based insurance options, which may offer more favorable rates based on your current driving behavior.