Car Insurance By Mile

In the dynamic world of automotive insurance, the concept of pay-per-mile car insurance has emerged as a revolutionary idea, offering a fresh perspective on how we insure our vehicles. This innovative approach is not just a clever marketing tactic; it's a game-changer that addresses some of the fundamental challenges associated with traditional insurance models.

For years, car insurance has been predominantly based on factors like the driver's age, gender, and driving record, with a standard mileage estimate often applied across the board. However, this one-size-fits-all approach fails to consider the diverse realities of modern life. With more people embracing remote work, urban living, and sustainable transportation options, the traditional insurance model can be seen as outdated and inefficient.

Enter pay-per-mile car insurance, a concept that is rapidly gaining traction and disrupting the status quo. This insurance model charges drivers based on the actual number of miles driven, providing a more accurate and fair pricing structure. It's an idea that aligns perfectly with the modern, eco-conscious, and flexible lifestyles many people lead today.

Understanding the Pay-Per-Mile Model

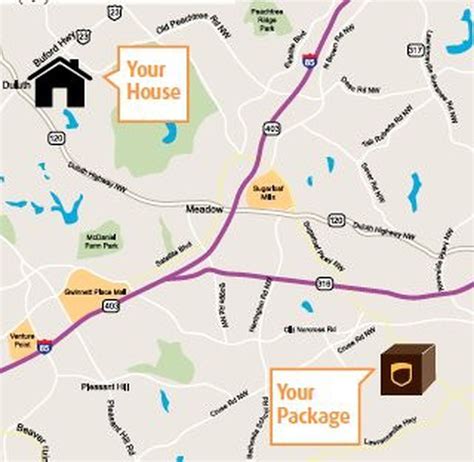

At its core, pay-per-mile insurance is a simple yet effective concept. Instead of charging a flat rate or calculating premiums based on traditional risk factors, this model leverages modern technology to track the number of miles driven. Typically, this is achieved through the use of telematics devices or smartphone apps, which accurately record the distance traveled.

For instance, Metromile, a leading provider of pay-per-mile insurance, offers a small telematics device that plugs into the diagnostic port of your car. This device, called a Metromile Pulse, tracks your mileage and sends the data to the company. Similarly, other insurers might use smartphone apps that utilize GPS to monitor your driving distance.

The beauty of this model is its fairness. Drivers who opt for this insurance pay for what they use, just like with pay-as-you-go phone plans or electricity metering. This means that if you lead a low-mileage lifestyle or have a car that sits idle for extended periods, you can significantly reduce your insurance costs. Conversely, high-mileage drivers can benefit from traditional insurance models that offer a more fixed rate structure.

The Advantages of Pay-Per-Mile Insurance

Cost Savings for Low-Mileage Drivers

One of the most appealing aspects of pay-per-mile insurance is the potential for substantial cost savings, particularly for those who don't drive frequently. With this model, drivers can reduce their insurance expenses by a significant margin. For instance, if you live in an urban area and primarily rely on public transport, bike sharing, or ride-hailing services, the miles you put on your car could be minimal. In such cases, pay-per-mile insurance can offer a more affordable alternative to traditional insurance plans.

Consider a scenario where you drive only a few thousand miles annually. With a standard insurance policy, you might be paying for coverage you don't need, especially for the months when your car is rarely used. However, with pay-per-mile insurance, you only pay for the miles you drive, making it a more economical choice.

Incentivizing Eco-Friendly Choices

In today's environmentally conscious world, pay-per-mile insurance aligns perfectly with sustainable living. By encouraging drivers to reduce their mileage, this model indirectly promotes eco-friendly behaviors. The less you drive, the less impact you have on the environment, and the more you save on insurance costs. This is a win-win situation for both the planet and your wallet.

Additionally, pay-per-mile insurance can be especially beneficial for those who own electric vehicles (EVs). Since EV owners tend to drive fewer miles due to the limited range of most EVs, this insurance model can offer significant savings. It's a brilliant way to reward drivers who make the switch to more sustainable transportation options.

Tailored Coverage for Diverse Lifestyles

Not everyone leads the same lifestyle or has the same driving habits. Pay-per-mile insurance acknowledges this diversity and offers a more personalized approach to insurance. Whether you're a city dweller who rarely drives, a rural resident who covers long distances, or a suburban parent who primarily uses the car for school runs and errands, this model allows you to tailor your insurance coverage to your unique needs.

For instance, if you're a student who only uses the car during the summer break or a retired individual who travels extensively but rarely drives locally, pay-per-mile insurance can provide coverage that suits your specific situation. This level of customization is often lacking in traditional insurance plans, making this model a more attractive option for many.

The Future of Car Insurance

As the automotive industry continues to evolve, so too will the landscape of car insurance. Pay-per-mile insurance is just one example of how technology and changing consumer behaviors are reshaping this industry. With the advent of autonomous vehicles and shared mobility services, the way we use and insure our cars is set to undergo further significant transformations.

In the coming years, we can expect to see more innovative insurance models that leverage advanced technologies like artificial intelligence and machine learning. These models will likely offer even more precise and personalized coverage, further blurring the lines between insurance and technology.

Data-Driven Insurance

The pay-per-mile model is just the tip of the iceberg when it comes to data-driven insurance. Insurers are increasingly utilizing vast amounts of data to understand consumer behaviors and offer more tailored products. This data can include not just mileage, but also driving habits, road conditions, and even weather patterns. By analyzing this data, insurers can offer more accurate pricing and coverage, ensuring a better fit for individual consumers.

For instance, some insurers are already using telematics data to offer bonuses or discounts to drivers who exhibit safe driving behaviors. This incentivizes safer driving practices and can lead to reduced premiums for responsible drivers.

The Rise of Usage-Based Insurance

Usage-based insurance (UBI) is another concept that is gaining traction alongside pay-per-mile insurance. UBI goes beyond just tracking mileage and takes into account a range of factors, including driving behavior, time of day, and even the type of roads traveled. By offering real-time feedback and incentives, UBI aims to encourage safer driving and provide more accurate insurance pricing.

For instance, some UBI programs offer discounts for driving during off-peak hours when roads are less congested and the risk of accidents is lower. Others might offer rewards for avoiding high-risk roads or for maintaining a consistent, safe driving speed.

Conclusion: Embracing a New Era of Car Insurance

Pay-per-mile car insurance represents a significant shift in the automotive insurance landscape, offering a more equitable and personalized approach to coverage. As we move towards a more sustainable and tech-driven future, this model, along with other innovative insurance concepts, will play a pivotal role in shaping the industry.

For consumers, this means having more choices and the ability to select an insurance plan that aligns with their unique lifestyle and driving habits. It's a move towards a more transparent and consumer-centric insurance market, where the power is in the hands of the driver.

As we look ahead, the future of car insurance promises to be exciting, with new technologies and innovative models continually pushing the boundaries of what's possible. Pay-per-mile insurance is just the beginning of this transformative journey.

How does pay-per-mile insurance work in practice?

+In practice, pay-per-mile insurance typically involves installing a small device, often called a telematics device, into your car. This device tracks your mileage and sends the data to the insurance company. Alternatively, some insurers use smartphone apps that utilize GPS to monitor your driving distance. The insurance company then calculates your premium based on the number of miles driven, often with a base rate for coverage included.

Are there any drawbacks to pay-per-mile insurance?

+One potential drawback is that pay-per-mile insurance may not be as cost-effective for high-mileage drivers. Since the premium is directly tied to the number of miles driven, those who cover a lot of ground might find that traditional insurance plans offer a better value. Additionally, there may be concerns about privacy, as the telematics device or smartphone app tracks your location and driving habits.

What types of vehicles are suitable for pay-per-mile insurance?

+Pay-per-mile insurance can be suitable for a wide range of vehicles, from everyday commuter cars to specialty vehicles like classic cars or recreational vehicles. It’s especially beneficial for those who don’t drive frequently, such as urban dwellers who primarily use public transport or ride-sharing services, or individuals with seasonal vehicles like snowmobiles or boats.