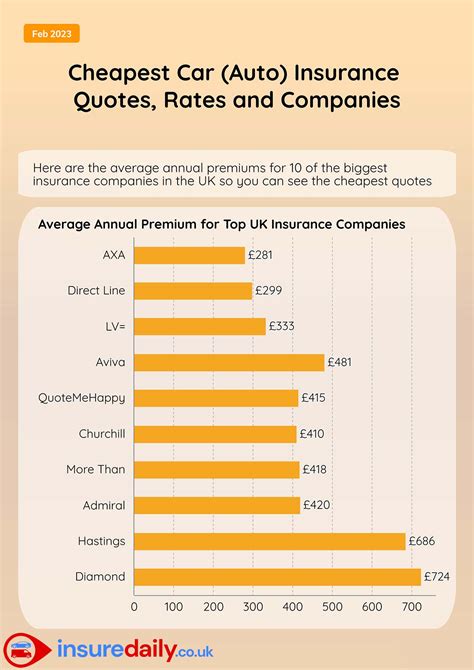

Car Insurance Cheapest Rates

When it comes to car insurance, finding the cheapest rates can be a challenging task, as premiums can vary significantly depending on numerous factors. These factors include your driving history, the type of vehicle you own, your location, and even your personal characteristics. However, by understanding the key aspects that influence insurance costs and employing strategic tactics, you can navigate the complex world of car insurance and secure the most affordable coverage tailored to your specific needs.

Unveiling the Factors Behind Car Insurance Costs

Car insurance premiums are determined by a meticulous analysis of various elements, each playing a crucial role in assessing the risk associated with insuring a particular driver. Here are some of the key factors that insurance companies consider when calculating rates:

Driving Record

Your driving history is a significant determinant of your insurance costs. Insurance providers closely examine your record for any instances of accidents, traffic violations, or claims made in the past. A clean driving record generally leads to lower premiums, as it indicates a reduced risk of future accidents or claims. On the other hand, a history marred by accidents or traffic citations can result in higher insurance rates.

Vehicle Type and Usage

The make, model, and year of your vehicle are crucial factors in determining insurance rates. Cars with advanced safety features or those less prone to theft may attract lower premiums. Additionally, the purpose for which you use your vehicle matters. If you primarily use your car for commuting to work or personal errands, your insurance costs may be lower compared to those who frequently drive long distances or use their vehicles for business purposes.

Location and Mileage

Where you reside and the number of miles you drive annually are also critical considerations. Insurance companies assess the accident and crime rates in your area, as well as the average cost of car repairs in your region. Areas with higher accident rates or a greater prevalence of car theft may result in higher insurance premiums. Furthermore, the number of miles you drive annually can impact your insurance costs, as more miles generally imply a higher risk of accidents or claims.

Demographic Factors

Insurance providers may also consider demographic characteristics such as your age, gender, marital status, and even your occupation. Statistical data suggests that certain demographics tend to be involved in more accidents or claims, which can influence insurance rates. However, it’s important to note that insurance companies are prohibited from discriminating based on certain protected characteristics, such as race or religion.

Strategies for Securing the Cheapest Car Insurance Rates

Now that we’ve explored the key factors influencing car insurance costs, let’s delve into some practical strategies to help you obtain the most affordable coverage:

Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. By obtaining quotes from multiple insurers, you can identify the companies offering the most competitive rates for your specific circumstances. Online comparison tools can be particularly useful for this purpose, allowing you to quickly and conveniently gather quotes from various insurers.

Bundle Your Insurance Policies

If you have multiple insurance needs, such as car, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who consolidate their coverage, as it reduces administrative costs and simplifies policy management. By bundling your policies, you can often achieve substantial savings on your overall insurance expenses.

Utilize Online Tools and Discounts

Insurance companies increasingly offer online tools and resources to help customers save money. These may include safe-driving apps that track your driving habits and reward you with discounts for responsible driving, or telematics devices that monitor your vehicle’s performance and provide insights to improve your driving efficiency. Additionally, many insurers offer discounts for completing defensive driving courses or for having certain safety features installed in your vehicle.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance costs. By adhering to traffic laws, avoiding accidents, and minimizing traffic violations, you can keep your driving record clean and reduce the likelihood of insurance rate increases. Even a single traffic citation or accident can lead to higher premiums, so it’s essential to drive responsibly and practice defensive driving techniques.

Explore Alternative Coverage Options

If you’re a safe and responsible driver with a clean record, you may be eligible for alternative coverage options that can significantly reduce your insurance costs. For instance, usage-based insurance (UBI) programs reward drivers who maintain safe driving habits with lower premiums. These programs use telematics devices or smartphone apps to monitor your driving behavior and calculate your insurance rates based on your actual driving performance. By adopting safe driving practices, you can potentially unlock substantial savings through UBI programs.

Conclusion: Navigating the Path to Affordable Car Insurance

Securing the cheapest car insurance rates requires a comprehensive understanding of the factors that influence insurance costs and a strategic approach to managing your coverage. By shopping around for quotes, bundling your insurance policies, utilizing online tools and discounts, maintaining a clean driving record, and exploring alternative coverage options, you can navigate the complex world of car insurance and find the most affordable protection tailored to your specific needs.

Remember, car insurance is a vital aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. By staying informed, proactive, and mindful of your driving habits, you can strike a balance between affordability and adequate coverage, ensuring peace of mind on the road.

How often should I review my car insurance policy and shop for new quotes?

+It’s a good practice to review your car insurance policy and shop for new quotes annually or whenever you experience a significant life event, such as moving to a new location, buying a new car, or getting married. These changes can impact your insurance rates, and by shopping around, you can ensure you’re getting the most competitive rates for your new circumstances.

Are there any specific tips for young drivers to reduce their car insurance costs?

+Yes, young drivers can take several steps to reduce their insurance costs. Maintaining a clean driving record, completing a defensive driving course, and considering usage-based insurance (UBI) programs can help lower premiums. Additionally, young drivers can explore the option of adding their vehicle to their parents’ policy, as family policies often provide more affordable rates.

What factors should I consider when choosing an insurance provider?

+When selecting an insurance provider, it’s important to consider factors such as their financial stability, customer service reputation, and the range of coverage options they offer. Look for companies with strong financial ratings, positive customer reviews, and a comprehensive suite of insurance products to ensure you receive the best value and service.