Car Insurance Check

When it comes to car insurance, staying informed and vigilant about your coverage is crucial. Many drivers might not realize the importance of regular insurance checks, but these simple actions can save you from potential financial and legal headaches down the road. This article aims to delve into the world of car insurance checks, providing a comprehensive guide to help you understand why and how to perform these checks, ensuring you're always protected.

Understanding the Importance of Car Insurance Checks

Car insurance checks are essential to ensure your policy is up-to-date, comprehensive, and aligned with your specific needs. It's not just about having insurance; it's about having the right insurance for your vehicle and circumstances. Here's why these checks are so vital:

- Coverage Adequacy: Over time, your insurance needs might change. Regular checks ensure your coverage is still sufficient for your current vehicle, driving habits, and any personal or professional changes that might impact your insurance requirements.

- Legal Compliance: Different regions have different legal requirements for car insurance. Conducting checks helps you stay compliant with these regulations, avoiding potential fines or legal issues.

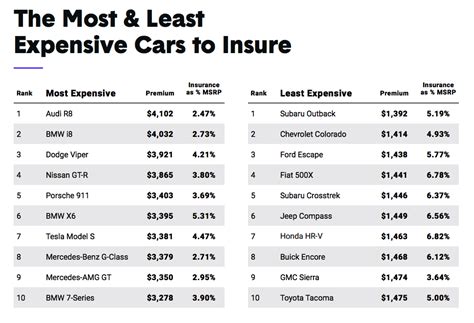

- Cost Savings: Insurance companies often adjust their rates and offer various discounts. By checking your insurance regularly, you can take advantage of these changes and potentially save money on your premiums.

- Peace of Mind: Knowing that your insurance is in order provides a sense of security. It ensures that in the event of an accident or other incident, you're fully covered and prepared.

Steps to Conduct a Comprehensive Car Insurance Check

Performing a car insurance check is a straightforward process, but it requires attention to detail. Here's a step-by-step guide to help you navigate through the process efficiently:

Step 1: Review Your Current Policy

Start by thoroughly reviewing your existing car insurance policy. Pay attention to the following key aspects:

- Policy Type: Understand whether you have liability-only coverage, collision coverage, comprehensive coverage, or a combination of these. Know the specific limits and deductibles for each type of coverage.

- Policy Exclusions: Be aware of any exclusions or limitations in your policy. For example, some policies might exclude coverage for certain types of accidents or specific vehicle uses.

- Policy Add-ons: Review any additional coverage or add-ons you've opted for, such as rental car coverage, roadside assistance, or gap insurance.

- Policy Duration: Confirm the renewal date of your policy and ensure it's not set to lapse.

Step 2: Assess Your Current Needs

Next, evaluate whether your current insurance policy still meets your needs. Consider the following factors:

- Vehicle Changes: If you've recently purchased a new or different type of vehicle, your insurance needs might have changed. Ensure your policy reflects the make, model, and value of your current vehicle.

- Life Changes: Major life events like marriage, divorce, a new job, or a move to a different area can impact your insurance requirements. Update your policy to reflect these changes.

- Driving Habits: Have your driving habits changed? For example, if you now commute less or have added additional drivers to your policy, your insurance needs might have evolved.

- Financial Considerations: Evaluate your current financial situation. You might be able to adjust your coverage to save money or, conversely, you might want to increase your coverage to better protect your assets.

Step 3: Research and Compare Insurance Options

Take the time to research and compare different insurance providers and their offerings. This step is crucial to ensure you're getting the best value and coverage:

- Online Comparison Tools: Utilize online insurance comparison platforms. These tools allow you to input your vehicle and coverage details and receive quotes from multiple insurers, making it easy to compare rates and coverage options.

- Insurance Provider Websites: Visit the websites of reputable insurance companies to learn about their offerings, discounts, and customer reviews. Many providers offer online quotes, providing a quick way to assess their rates.

- Independent Insurance Agents: Consider working with an independent insurance agent who can provide guidance and quotes from multiple insurers. They can offer personalized advice based on your specific needs.

Step 4: Understand Your State's Legal Requirements

Each state has its own set of car insurance laws and minimum coverage requirements. It's essential to understand these regulations to ensure you're complying with the law:

- Liability Coverage: Most states require a minimum amount of liability coverage, which protects you if you're at fault in an accident. Research the specific liability limits required in your state.

- Additional Coverages: Some states might mandate additional coverages, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage.

- SR-22 Insurance: If you've had a DUI or other serious traffic violation, you might be required to carry an SR-22 insurance certificate, which provides proof of financial responsibility.

Step 5: Make Necessary Adjustments

Based on your assessment and research, make any necessary adjustments to your car insurance policy:

- Policy Updates: If your current policy no longer aligns with your needs, reach out to your insurer to make the necessary changes. This might include adjusting coverage limits, adding or removing drivers, or updating personal information.

- Switching Insurers: If you find a better deal or more comprehensive coverage with another insurer, consider switching. Ensure a smooth transition by understanding the cancellation policies and any potential fees involved.

- Discounts and Savings: Inquire about any discounts you might be eligible for, such as good driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

Step 6: Maintain Regular Check-Ins

Car insurance checks shouldn't be a one-time event. It's important to make them a regular part of your financial maintenance routine:

- Annual Reviews: Aim to review your insurance policy annually, especially if your circumstances or vehicle details have changed.

- Policy Renewal: When your policy is up for renewal, take the opportunity to reassess your coverage and shop around for the best rates.

- Major Life Events: Whenever a significant life event occurs, such as a marriage, divorce, or a new job, make it a habit to review your insurance needs.

The Impact of Regular Car Insurance Checks

Conducting regular car insurance checks can have a significant impact on your financial well-being and legal compliance. Here's a breakdown of the potential benefits:

- Cost Savings: By comparing rates and coverage options regularly, you can identify opportunities to save money on your insurance premiums. Additionally, you might qualify for new discounts or lower rates based on your driving record or vehicle changes.

- Improved Coverage: Regular checks ensure you're always covered for the right amount and the right situations. This means you won't be underinsured, which can lead to financial hardship in the event of an accident.

- Legal Compliance: Staying updated on your state's insurance requirements helps you avoid legal issues and fines. It also ensures that you're always prepared for any roadside inspections or accident-related claims.

- Peace of Mind: Knowing that your insurance is in order provides a sense of security and peace of mind. You can drive with confidence, knowing that you're protected and prepared for any unexpected incidents.

The Future of Car Insurance Checks

As technology advances and the insurance industry evolves, the process of car insurance checks is likely to become even more streamlined and efficient. Here's a glimpse into the future of car insurance checks:

- Digital Insurance Portals: Insurance providers are increasingly offering digital platforms where policyholders can manage their insurance policies, view coverage details, and make changes in real-time. These portals will likely become the primary tool for conducting insurance checks.

- AI-Assisted Insurance Reviews: Artificial intelligence and machine learning technologies are being used to analyze policy details and provide personalized recommendations for coverage adjustments. These tools can help policyholders quickly identify areas where their coverage might be inadequate or where they can save money.

- Telematics-Based Insurance: With the rise of connected cars and telematics, insurance providers are offering usage-based insurance policies. These policies use data from your vehicle's sensors to assess your driving habits and offer personalized premiums. Regular insurance checks in this scenario might involve reviewing your driving data and understanding how it impacts your premiums.

- Blockchain for Insurance: Blockchain technology has the potential to revolutionize the insurance industry by providing a secure and transparent way to manage and verify insurance policies. In the future, blockchain-based insurance platforms might allow policyholders to easily verify their coverage and make changes, reducing the need for manual checks.

FAQs

How often should I conduct a car insurance check?

+It’s recommended to conduct a car insurance check at least once a year, ideally around the time your policy renews. Additionally, you should perform a check whenever your circumstances change, such as purchasing a new vehicle, moving to a different area, or experiencing a major life event.

What happens if I don’t conduct regular insurance checks?

+Failing to conduct regular insurance checks can lead to several issues. You might find yourself underinsured in the event of an accident, which can result in significant out-of-pocket expenses. Additionally, you might miss out on potential cost savings or better coverage options offered by other insurers. Staying updated on your insurance is crucial for both financial and legal reasons.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, it’s important to understand the cancellation policies and any potential fees involved. Some insurers might charge a fee for canceling mid-term, while others might offer a pro-rated refund. Always review the terms of your current policy and understand the implications before switching.

How can I get the best car insurance rates?

+To get the best car insurance rates, it’s important to shop around and compare quotes from multiple insurers. Additionally, maintain a good driving record, as this can lead to significant discounts. Consider bundling your car insurance with other policies, such as home or renters insurance, as this can often result in substantial savings. Finally, explore the discounts offered by your insurer and ensure you’re taking advantage of any applicable ones.

What should I do if I’m unsure about my insurance coverage?

+If you’re unsure about your insurance coverage, it’s best to reach out to your insurance provider or an independent insurance agent. They can review your policy with you, explain the coverage details, and guide you on any necessary adjustments. It’s always better to seek clarification than to assume your coverage is adequate, especially when it comes to car insurance.