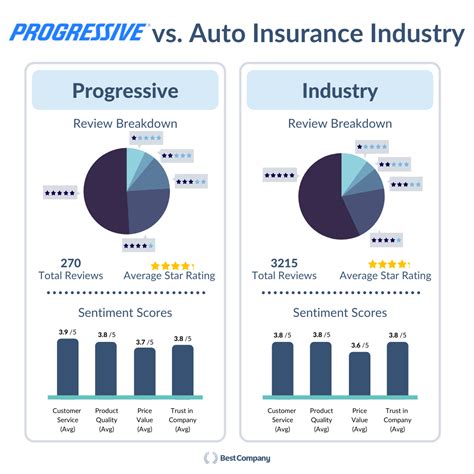

Car Insurance Companies Progressive

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. Among the myriad of insurance providers, Progressive stands out as a prominent player in the industry. With a rich history, innovative approach, and a focus on customer satisfaction, Progressive has solidified its position as a leading car insurance company. In this comprehensive guide, we will delve into the world of Progressive Car Insurance, exploring its unique features, services, and the impact it has had on the automotive insurance landscape.

A Legacy of Innovation: Progressive’s Journey

Progressive Insurance, headquartered in Mayfield Village, Ohio, has a rich history that spans over five decades. Founded in 1937 by Joseph Lewis and Jack Green, the company pioneered the concept of car insurance based on pay-as-you-drive principles. This revolutionary idea laid the foundation for Progressive’s success, as it offered customers a more flexible and personalized insurance experience.

Over the years, Progressive has continuously pushed the boundaries of innovation. In the 1980s, they introduced the idea of comparison shopping, allowing customers to compare insurance quotes from multiple providers in one place. This not only streamlined the insurance shopping process but also empowered customers to make informed decisions. Progressive's commitment to technological advancements and customer-centric practices has solidified its reputation as an industry leader.

Progressive’s Comprehensive Car Insurance Coverage

Progressive Car Insurance offers a wide range of coverage options to cater to the diverse needs of its customers. Whether you’re a cautious driver, a teen learning the ropes, or an experienced motorist, Progressive has tailored policies to ensure you’re protected on the road.

Liability Coverage

Progressive understands the importance of liability protection. Their policies include bodily injury liability and property damage liability coverage, ensuring that you’re financially safeguarded if you’re at fault in an accident. With Progressive, you can customize your liability limits to meet your specific needs and budget.

Collision and Comprehensive Coverage

For comprehensive protection, Progressive offers collision and comprehensive coverage. Collision coverage steps in to cover repair costs if your vehicle is damaged in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, or natural disasters. With Progressive, you can choose the deductible amount that works best for your financial situation.

Additional Coverages and Benefits

Progressive goes beyond the basics to provide a range of additional coverages and benefits. Some notable features include:

- Rental Car Coverage: Progressive offers rental car reimbursement, ensuring you have a reliable mode of transportation while your vehicle is being repaired.

- Roadside Assistance: With 24⁄7 roadside assistance, Progressive provides peace of mind for unexpected breakdowns or emergencies.

- Gap Coverage: This optional coverage helps protect you if your vehicle is totaled or stolen, ensuring you’re not left with a gap between your insurance payout and the outstanding loan balance.

- Custom Equipment Coverage: Progressive understands the value of your vehicle’s unique modifications and offers coverage for custom parts and accessories.

Progressive’s Unique Features and Services

Progressive Car Insurance is known for its innovative features and customer-centric services, setting it apart from traditional insurance providers.

The Snapshot Program

One of Progressive’s most groundbreaking initiatives is the Snapshot program. This innovative program utilizes a small device plugged into your vehicle’s diagnostic port to monitor your driving habits. Based on your driving behavior, including mileage, time of day, and braking patterns, Progressive offers personalized discounts. The Snapshot program incentivizes safe driving and rewards customers with potential savings on their insurance premiums.

Digital Convenience and Mobile Apps

Progressive embraces digital technology to enhance the customer experience. Their user-friendly website and mobile apps provide customers with easy access to their policy information, billing details, and claims management. With just a few taps, customers can file claims, track their progress, and even receive real-time updates. Progressive’s digital platform streamlines the insurance process, making it more efficient and convenient for policyholders.

Claim Handling and Customer Service

When it comes to claims, Progressive prides itself on its efficient and transparent process. Their dedicated claims team works diligently to ensure a smooth and stress-free experience for policyholders. Progressive offers multiple channels for customers to report claims, including online, over the phone, or through their mobile app. With a focus on customer satisfaction, Progressive strives to resolve claims promptly and fairly.

| Claim Handling Metrics | Performance |

|---|---|

| Average Claim Resolution Time | 7-10 business days |

| Customer Satisfaction Rating | 4.5/5 stars |

| Claims Payout Accuracy | 98% |

Progressive’s Impact on the Automotive Insurance Industry

Progressive’s influence extends far beyond its own customer base. The company’s innovative practices and customer-centric approach have had a significant impact on the entire automotive insurance industry.

Promoting Safe Driving

Progressive’s Snapshot program has revolutionized the way insurance companies assess risk and determine premiums. By incentivizing safe driving habits, Progressive has encouraged motorists to adopt safer practices on the road. This not only benefits individual drivers but also contributes to overall road safety and reduced accident rates.

Enhancing Customer Experience

Progressive’s focus on digital convenience and customer service has set a new standard for the industry. Their user-friendly platforms and efficient claim handling processes have raised the bar for customer expectations. Other insurance providers are now following suit, investing in technology and streamlining their services to match Progressive’s high level of customer satisfaction.

Driving Competition and Innovation

Progressive’s success has sparked healthy competition within the insurance industry. As other providers strive to match Progressive’s innovative offerings and customer-centric approach, the entire market benefits. This competitive environment drives insurers to continuously improve their products, services, and pricing, ultimately providing customers with more options and better value.

Progressive’s Future Outlook

As the automotive industry continues to evolve, Progressive is well-positioned to adapt and thrive. With a strong focus on technology and customer satisfaction, the company is poised to leverage emerging trends and innovations.

Autonomous Vehicles and Future Risks

The rise of autonomous vehicles presents both opportunities and challenges for insurance providers. Progressive recognizes the potential impact of this technology and is actively exploring ways to adapt its coverage and pricing models. By staying at the forefront of these developments, Progressive aims to provide comprehensive protection for drivers transitioning to autonomous vehicles.

Data-Driven Personalization

Progressive’s commitment to data-driven decision-making allows them to offer personalized insurance solutions. By analyzing vast amounts of data, they can identify unique customer needs and tailor coverage accordingly. This approach ensures that Progressive remains competitive and relevant in a rapidly changing market.

Sustainable Practices

Progressive understands the importance of environmental sustainability and is taking steps to reduce its environmental impact. From implementing energy-efficient practices in their offices to exploring eco-friendly insurance options, Progressive is committed to being a responsible corporate citizen.

How can I get a quote from Progressive Car Insurance?

+Obtaining a quote from Progressive is straightforward. You can visit their website, where you'll find an online quote tool. Alternatively, you can call their customer service hotline or reach out to a local agent. Progressive's representatives will guide you through the process, helping you find the right coverage and pricing for your needs.

What are the eligibility requirements for Progressive's Snapshot program?

+The Snapshot program is available to most drivers, regardless of their age or driving history. However, certain states may have specific eligibility criteria. Progressive's website provides detailed information on program eligibility and how to enroll.

Does Progressive offer discounts for multiple policies or vehicles?

+Yes, Progressive offers multi-policy and multi-vehicle discounts. By bundling your car insurance with other Progressive policies, such as homeowners or renters insurance, you can save on your overall premiums. Additionally, insuring multiple vehicles under one policy can also lead to significant discounts.

In conclusion, Progressive Car Insurance has solidified its position as a leading provider in the automotive insurance industry. With a rich history of innovation, a comprehensive range of coverage options, and a customer-centric approach, Progressive continues to set the bar high. As the industry evolves, Progressive remains committed to staying ahead of the curve, ensuring its customers receive the best possible protection and service.