Car Insurance Company Ratings

Welcome to this comprehensive guide on car insurance company ratings. In an industry as vast and diverse as automotive insurance, making informed choices is crucial for drivers seeking the best coverage. This article aims to provide an in-depth analysis of the factors that influence car insurance company ratings, offering valuable insights to help you navigate the complex world of auto insurance.

Understanding Car Insurance Company Ratings

Car insurance company ratings are essential tools for consumers, providing an objective evaluation of an insurer’s performance, financial stability, and overall customer satisfaction. These ratings are typically assigned by independent rating agencies, which conduct thorough assessments to determine an insurer’s reliability and worth.

One of the most renowned rating agencies in the insurance sector is A.M. Best. This agency specializes in evaluating the financial strength and creditworthiness of insurance companies. A.M. Best assigns ratings based on an insurer's ability to meet its ongoing obligations to policyholders and claimants. The ratings range from A++ (Superior) to D (Poor), with an additional F rating indicating a company is under regulatory supervision or in liquidation.

Another leading rating agency, Standard & Poor's (S&P), also assesses insurance companies. S&P focuses on an insurer's financial health and stability, assigning ratings from AAA (the highest) to D (default). These ratings are crucial indicators of an insurer's ability to withstand financial challenges and pay claims.

Key Factors Influencing Car Insurance Company Ratings

Several critical factors contribute to an insurance company’s rating. Understanding these elements is essential for both consumers and industry professionals alike.

Financial Stability

The financial stability of an insurance company is a primary consideration for rating agencies. A strong financial foundation ensures the insurer can honor its commitments, pay claims, and withstand economic fluctuations. Rating agencies analyze an insurer’s financial statements, reserves, and investment strategies to assess its long-term viability.

| Rating Agency | Financial Stability Rating |

|---|---|

| A.M. Best | A++ (Superior) to F (In Liquidation) |

| Standard & Poor's | AAA (Highest) to D (Default) |

Claims Handling and Customer Satisfaction

The efficiency and fairness of an insurance company’s claims handling process are crucial to its rating. Rating agencies examine how promptly and effectively insurers process claims, ensuring policyholders receive fair and timely settlements. Additionally, customer satisfaction surveys and feedback play a significant role in evaluating an insurer’s overall performance.

Risk Management and Underwriting Practices

Rating agencies scrutinize an insurance company’s risk management and underwriting strategies. Effective risk assessment and management ensure the insurer can accurately price policies, minimize losses, and maintain profitability. Sound underwriting practices contribute to an insurer’s long-term success and financial stability.

Regulatory Compliance and Industry Reputation

Compliance with regulatory standards is another critical factor in insurance company ratings. Rating agencies assess an insurer’s adherence to legal and ethical guidelines, including consumer protection laws and industry best practices. A strong industry reputation, built on a history of ethical conduct and fair dealing, also influences an insurer’s rating.

The Impact of Ratings on Consumer Choices

Car insurance company ratings play a pivotal role in shaping consumer decisions. Drivers often rely on these ratings to assess the reliability and trustworthiness of insurers, particularly when comparing different coverage options.

Assessing Financial Security

Financial stability ratings are essential for consumers seeking peace of mind. A high rating from reputable agencies like A.M. Best or Standard & Poor’s assures drivers that their insurance provider is financially sound and unlikely to face insolvency. This confidence is particularly crucial when considering long-term policies or high-value coverage.

Evaluating Claims Handling and Customer Service

Ratings that emphasize claims handling and customer satisfaction are valuable indicators of an insurer’s commitment to its policyholders. Consumers can use these ratings to identify insurers with a proven track record of prompt and fair claims settlement, reducing the stress and uncertainty often associated with filing a claim.

Choosing Insurers with Strong Underwriting Practices

Ratings that reflect an insurer’s underwriting expertise are essential for consumers. Sound underwriting practices ensure that policies are priced fairly and that policyholders are not overcharged. Additionally, strong underwriting can lead to more comprehensive coverage options and better risk management for drivers.

Analyzing Real-World Performance: Case Studies

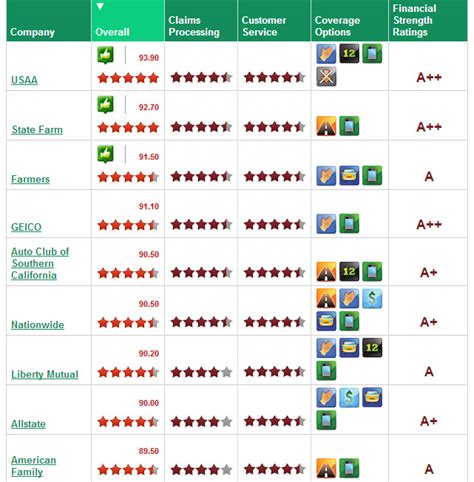

To illustrate the impact of car insurance company ratings, let’s explore two case studies of highly rated insurers.

Case Study: State Farm - A Leading Insurer with Superior Ratings

State Farm is a well-known and highly regarded insurer, consistently earning top ratings from A.M. Best and Standard & Poor’s. With an A++ (Superior) rating from A.M. Best and an AA+ (Very Strong) rating from S&P, State Farm demonstrates exceptional financial stability and customer satisfaction.

State Farm's success can be attributed to its strong financial foundation, built on a history of conservative investment strategies and a focus on long-term growth. The insurer's commitment to ethical practices and customer service has also contributed to its excellent reputation in the industry.

Case Study: USAA - Highly Rated Insurer for Military Families

USAA is a highly specialized insurer, serving military personnel and their families. Despite its niche market, USAA has consistently earned top ratings, including an A++ (Superior) from A.M. Best and an AA (Very Strong) from S&P.

USAA's success lies in its dedication to its unique customer base. The insurer offers tailored coverage options and a strong focus on customer service, earning it high praise from policyholders. USAA's financial stability is also impressive, with a conservative investment approach and a commitment to long-term financial security.

Future Implications and Industry Trends

The world of car insurance is continually evolving, and rating agencies must adapt to emerging trends and challenges.

Adapting to Technological Advances

The insurance industry is increasingly embracing technology, from telematics and usage-based insurance to digital claims processing. Rating agencies must stay abreast of these innovations to accurately assess insurers’ abilities to adapt and innovate.

Addressing Climate Change and Natural Disasters

Climate change is posing new risks to the insurance industry, with increased frequency and severity of natural disasters. Rating agencies are now factoring in insurers’ resilience and preparedness for climate-related events, ensuring they can manage these risks effectively.

Focus on Data Analytics and Risk Assessment

The use of advanced data analytics is transforming the insurance industry. Rating agencies are increasingly evaluating insurers’ ability to leverage data for more accurate risk assessment and pricing. This shift towards data-driven decision-making is expected to continue, shaping the future of the industry.

Conclusion: Making Informed Choices

Car insurance company ratings are invaluable tools for consumers and industry professionals. By understanding the factors that influence these ratings and the impact they have on the market, drivers can make more informed choices when selecting an insurance provider. Whether it’s assessing financial stability, claims handling, or underwriting practices, ratings provide a comprehensive snapshot of an insurer’s performance and reliability.

As the insurance landscape continues to evolve, staying informed about the latest trends and industry developments is essential. By keeping abreast of changes and utilizing the insights provided by rating agencies, consumers can navigate the complex world of car insurance with confidence and peace of mind.

How often are insurance company ratings updated?

+Insurance company ratings are typically updated annually by leading rating agencies. However, in response to significant events or changes in an insurer’s financial performance, ratings may be revised more frequently. It’s important to check for the most recent ratings when making insurance decisions.

What happens if an insurance company’s rating is downgraded?

+A downgrade in an insurance company’s rating can be a cause for concern. It often indicates financial instability or other issues within the insurer. Policyholders may experience changes in their coverage or premiums, and in extreme cases, the insurer may face regulatory intervention or liquidation. It’s advisable to monitor the rating of your insurance provider and consider alternative options if necessary.

Are there any disadvantages to choosing a highly rated insurance company?

+While highly rated insurance companies offer many advantages, there can be some potential drawbacks. These insurers may have a larger customer base, leading to longer processing times for claims or customer service inquiries. Additionally, their premiums might be slightly higher due to their financial stability and market reputation. However, the benefits of choosing a highly rated insurer often outweigh these minor inconveniences.