Car Insurance Contact Number

In the world of car ownership, having reliable and comprehensive insurance is crucial. Whether it's for peace of mind, legal compliance, or financial protection, car insurance is an essential aspect of responsible driving. However, finding the right insurance provider and navigating the often-complex process can be daunting. That's where the Car Insurance Contact Number comes into play, offering a direct line of communication to expert assistance.

Understanding the Importance of Car Insurance

Car insurance is a contractual agreement between an individual and an insurance company, designed to provide financial protection against potential risks and liabilities associated with vehicle ownership and operation. These risks can range from accidents and collisions to theft, vandalism, and even natural disasters. By having car insurance, drivers can safeguard themselves and their vehicles, ensuring they are prepared for unforeseen circumstances.

The benefits of car insurance are twofold: it provides financial coverage for repairs or replacements in case of damage, and it also offers liability protection, which is crucial in case of accidents where the insured driver is at fault. This protection extends to cover any medical expenses, property damage, or legal fees that may arise from an accident. Additionally, car insurance can also include optional add-ons such as roadside assistance, rental car coverage, and personalized support services.

The Role of the Car Insurance Contact Number

The Car Insurance Contact Number serves as a vital link between policyholders and their insurance providers. It is a dedicated support line that offers assistance and guidance throughout the entire insurance journey, from initial inquiries to claims processing and beyond.

When faced with a query, concern, or an unfortunate incident, having direct access to an insurance expert can make a significant difference. The Car Insurance Contact Number ensures that policyholders receive timely and accurate information, personalized to their specific needs and circumstances. Whether it's understanding policy details, seeking clarification on coverage, or reporting an accident, this contact number provides a seamless and efficient channel of communication.

Key Features and Benefits

- 24⁄7 Availability: The Car Insurance Contact Number operates around the clock, ensuring that policyholders can reach out for assistance at any time, day or night. This is particularly valuable in emergency situations where prompt action is required.

- Expertise and Experience: The representatives assigned to this contact number are highly trained professionals with extensive knowledge of the insurance industry. They are equipped to handle a wide range of inquiries, providing accurate and reliable information.

- Personalized Service: Each call is treated with care and attention, allowing policyholders to receive tailored advice and guidance based on their unique circumstances. This personalized approach ensures that individuals receive the support they need, when they need it.

- Claims Assistance: In the event of an accident or incident, the Car Insurance Contact Number becomes a vital resource. Representatives can guide policyholders through the claims process, offering step-by-step instructions and ensuring a smooth and efficient resolution.

Navigating the Insurance Landscape

The insurance market is vast and diverse, with numerous providers offering a range of policies and coverage options. Navigating this landscape can be challenging, especially for those new to car insurance or seeking better value for their needs.

Choosing the Right Provider

When selecting a car insurance provider, it’s essential to consider various factors. These include the reputation and financial stability of the company, the range of coverage options offered, and the level of customer service and support provided. Additionally, policyholders should assess their own specific needs and priorities, such as the level of coverage required, any additional benefits desired, and the affordability of the insurance plan.

The Car Insurance Contact Number can be a valuable tool in this decision-making process. By reaching out to different providers and engaging in conversations with their representatives, prospective policyholders can gain insights into the company's offerings, clarify any doubts, and make an informed choice. The expertise and guidance provided can help individuals navigate the complexities of insurance and find the best fit for their circumstances.

Comparing Policies and Premiums

Comparing car insurance policies is crucial to ensure one is getting the best value for their money. Policyholders should carefully evaluate the coverage limits, deductibles, and any additional benefits included in the policy. It’s also important to consider the reputation and financial stability of the insurance provider, as well as the ease of claims processing and customer satisfaction ratings.

The Car Insurance Contact Number can facilitate this comparison process. By contacting multiple providers and seeking detailed information on their policies, individuals can gather the necessary data to make an informed decision. Representatives can provide insights into the specific coverage options, explain any potential exclusions, and offer guidance on choosing the right policy based on individual needs and budget constraints.

Maximizing Your Car Insurance Experience

Car insurance is more than just a contractual agreement; it’s a partnership between the policyholder and the insurance provider. By actively engaging with their insurance company and utilizing the resources available, policyholders can maximize the benefits and value of their car insurance experience.

Understanding Your Policy

One of the most important aspects of car insurance is understanding the policy itself. Policyholders should take the time to thoroughly review their insurance documents, ensuring they have a clear grasp of the coverage limits, deductibles, and any exclusions or limitations. By understanding their policy inside and out, individuals can make informed decisions and take advantage of the full range of benefits available.

The Car Insurance Contact Number can be a valuable resource in this process. Representatives can provide clarification on any confusing terms or provisions, explain the implications of different coverage options, and offer guidance on how to optimize the policy to best suit the policyholder's needs. By leveraging this expertise, individuals can ensure they are making the most of their car insurance investment.

Utilizing Additional Benefits

Car insurance policies often come with a range of additional benefits and services that can enhance the overall experience. These may include roadside assistance, rental car coverage, accident forgiveness, or even discounts for safe driving or loyalty. By understanding and utilizing these benefits, policyholders can further protect themselves and their vehicles, while also enjoying added convenience and peace of mind.

The Car Insurance Contact Number can provide valuable insights into these additional benefits. Representatives can explain the specific features and eligibility criteria, as well as guide policyholders on how to access and make the most of these perks. By taking advantage of these benefits, individuals can not only improve their insurance experience but also potentially save money and reduce stress in the event of an unexpected situation.

The Future of Car Insurance

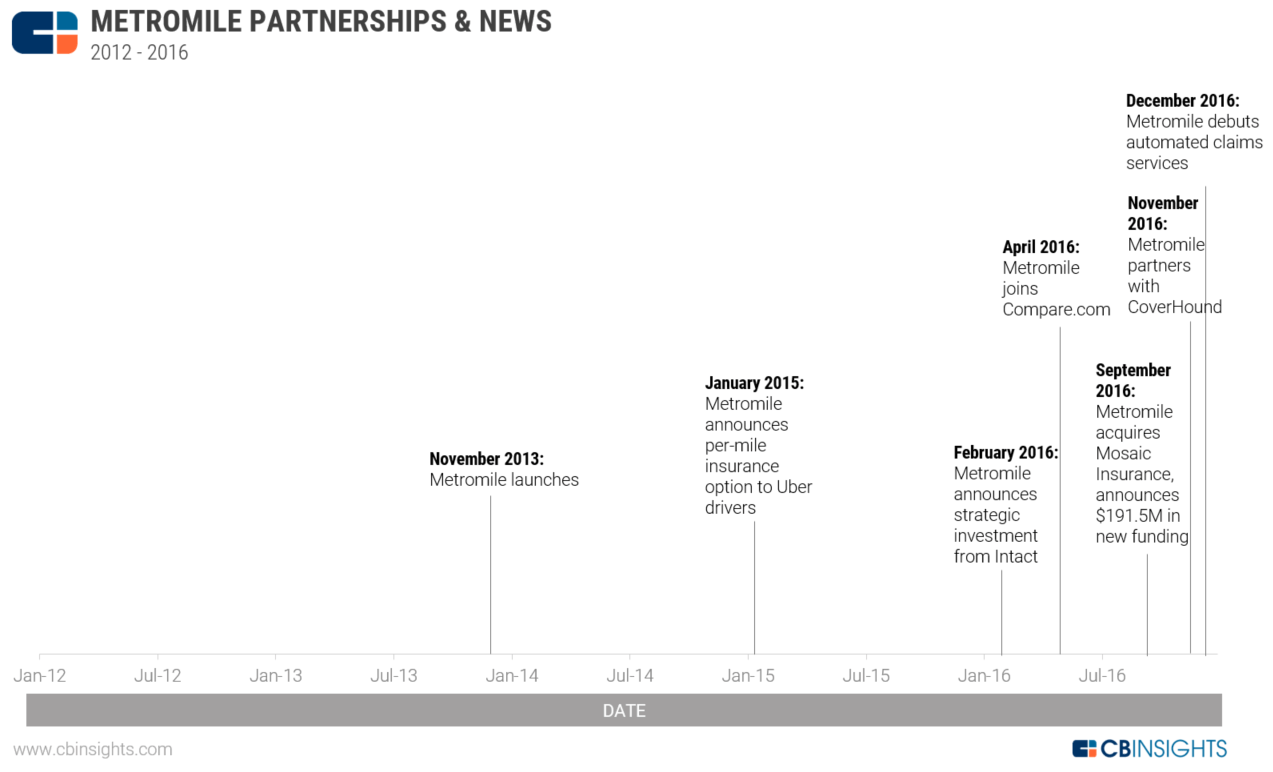

As technology continues to advance and disrupt traditional industries, the world of car insurance is also undergoing significant transformations. From the rise of telematics and usage-based insurance to the increasing popularity of online platforms and digital services, the future of car insurance is shaping up to be more efficient, personalized, and accessible than ever before.

Technological Innovations

Telematics, or the use of technology to monitor and analyze driving behavior, is revolutionizing the car insurance industry. By installing a small device in the vehicle or leveraging smartphone apps, insurance providers can gather real-time data on driving habits, such as mileage, speed, and braking patterns. This data-driven approach allows for more accurate risk assessment and personalized pricing, rewarding safe drivers with lower premiums.

Additionally, the integration of artificial intelligence (AI) and machine learning algorithms is enhancing the claims process. These technologies can automate the assessment and evaluation of claims, reducing processing times and minimizing the need for manual intervention. As a result, policyholders can expect faster and more efficient resolution of their claims, further improving their overall insurance experience.

Digital Transformation

The shift towards digital platforms and online services is also transforming the car insurance landscape. Insurance providers are increasingly investing in user-friendly websites and mobile apps, enabling policyholders to manage their insurance policies, file claims, and access support services with just a few clicks. This digital transformation not only enhances convenience and accessibility but also empowers individuals to take control of their insurance journey.

Furthermore, the use of digital tools and analytics allows insurance providers to offer more personalized and tailored insurance products. By analyzing vast amounts of data, including driving behavior, vehicle usage, and even weather conditions, insurers can develop customized policies that meet the unique needs and circumstances of each policyholder. This level of personalization not only improves customer satisfaction but also contributes to more efficient risk management and pricing.

Conclusion

The Car Insurance Contact Number serves as a vital bridge between policyholders and their insurance providers, offering a dedicated channel of communication for support, guidance, and assistance. By leveraging this resource, individuals can navigate the complex world of car insurance with confidence, understanding their policy, maximizing benefits, and making informed choices. As the industry continues to evolve with technological advancements and digital transformations, the Car Insurance Contact Number remains a reliable and trusted companion throughout the insurance journey.

What information should I have ready when calling the Car Insurance Contact Number?

+When calling the Car Insurance Contact Number, it’s beneficial to have your policy number, vehicle registration details, and any relevant information about the situation you’re inquiring about. This helps the representative assist you more efficiently and accurately.

How can I find the Car Insurance Contact Number for my specific insurance provider?

+You can typically find the Car Insurance Contact Number on your insurance policy documents or on the official website of your insurance provider. Alternatively, you can search for their customer service contact details online, ensuring you reach the correct support line.

What should I do if I need to make a claim using the Car Insurance Contact Number?

+If you need to make a claim, the Car Insurance Contact Number will guide you through the process. Be prepared to provide details about the incident, including the date, location, and any relevant information about the other parties involved. The representative will then assist you in initiating the claims process and provide instructions on the next steps.