Car Insurance For Old Cars

Insuring an old car is a crucial yet often overlooked aspect of vehicle ownership, especially for enthusiasts who cherish their classic rides. In this comprehensive guide, we'll delve into the world of car insurance for old cars, exploring the unique challenges, considerations, and opportunities that come with safeguarding your vintage or classic vehicle. Whether you're a seasoned collector or a novice enthusiast, understanding the intricacies of insuring an old car is essential to ensure your peace of mind and the protection of your beloved automobile.

Understanding the Value of Old Cars

Old cars, often referred to as classics or vintage vehicles, hold a special place in the hearts of automotive enthusiasts. These vehicles, with their unique designs, historical significance, and often-irreplaceable parts, require a different approach when it comes to insurance. Unlike modern cars, which are typically valued based on their make, model, and age, old cars demand a more nuanced evaluation.

The value of an old car can be influenced by various factors, including its rarity, condition, historical importance, and even its performance in automotive competitions. For instance, a meticulously restored 1967 Ford Mustang, with its iconic design and racing pedigree, may command a significantly higher value than a similar model in poorer condition. This complexity in valuation can make insuring old cars a challenging task, as standard insurance policies designed for modern vehicles may not adequately cover the true worth of these vintage gems.

Challenges in Insuring Old Cars

Insuring an old car presents several unique challenges that differ from insuring a newer vehicle. Here are some of the key challenges and considerations you should be aware of:

Valuation and Appraisal

As mentioned earlier, accurately valuing an old car can be a complex task. Standard insurance policies often use algorithms or databases that may not account for the unique factors that contribute to the value of an old car. This can result in an undervalued insurance policy, leaving you exposed to financial risk in the event of a total loss or significant damage.

To address this challenge, many insurance providers offer specialized agreed-value or stated-value policies for old cars. These policies involve a more thorough appraisal process, often requiring an inspection by a qualified appraiser. The appraiser considers various factors, including the car's condition, originality, rarity, and market demand, to determine an agreed-upon value for insurance purposes. This value is then used as the basis for any claims, ensuring that you receive fair compensation should the need arise.

Limited Coverage Options

Not all insurance providers offer comprehensive coverage for old cars. Some may have restrictions on the age, make, or model of vehicles they’re willing to insure. Additionally, certain coverage types, such as gap insurance or new car replacement, may not be available for old cars. It’s essential to research and compare policies from different providers to find one that offers the coverage you need for your specific old car.

Storage and Usage Restrictions

Insurance providers may have specific requirements or restrictions regarding how and where you store your old car. Some policies may require the vehicle to be kept in a locked garage or enclosed storage facility, especially if it’s not driven frequently. Additionally, certain policies may limit the number of miles you can drive per year or restrict the car’s usage to specific types of events, such as car shows or track days.

Finding the Right Insurance Provider

When it comes to insuring your old car, choosing the right insurance provider is crucial. Not all insurance companies specialize in or understand the unique needs of old car owners. Here are some steps to help you find the ideal insurance provider for your vintage or classic vehicle:

Research and Compare Providers

Start by researching insurance companies that cater specifically to old car owners. Look for providers with a reputation for understanding the unique risks and values associated with classic cars. Compare their policies, coverage options, and pricing to find the best fit for your needs.

Seek Recommendations

Tap into the wisdom of the old car community. Reach out to fellow enthusiasts, car clubs, or online forums to gather recommendations for insurance providers who have a track record of successfully insuring old cars. Personal referrals can provide valuable insights into the customer service and claim handling experiences of different providers.

Consider Specialty Insurers

Specialty insurance providers, often referred to as classic car insurers or collector car insurers, are experts in the field of old car insurance. These providers offer policies tailored to the specific needs of classic car owners, including agreed-value coverage, flexible usage options, and specialized repair networks. While they may not be the cheapest option, their expertise and understanding of the unique risks associated with old cars can provide invaluable peace of mind.

Review Policy Details

Before committing to a policy, carefully review the fine print. Pay close attention to the coverage limits, deductibles, and any exclusions or restrictions. Ensure that the policy aligns with your specific needs and expectations. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider’s customer service team for clarification.

Coverage Options for Old Cars

Understanding the different coverage options available for old cars is essential to ensure you have the right protection. Here are some common coverage types to consider:

Agreed-Value or Stated-Value Coverage

As mentioned earlier, agreed-value or stated-value coverage is a crucial component of insuring an old car. This type of policy ensures that you receive the agreed-upon value of your car in the event of a total loss or significant damage. The appraisal process, typically conducted by a qualified appraiser, considers various factors to determine this value, providing you with the assurance that you’ll be fairly compensated should the need arise.

Comprehensive Coverage

Comprehensive coverage is an essential component of any old car insurance policy. It provides protection against various non-collision incidents, such as theft, vandalism, fire, and natural disasters. Given the unique risks associated with old cars, having comprehensive coverage is crucial to safeguard your investment.

Liability Coverage

Liability coverage is a fundamental aspect of any car insurance policy, and it’s no different for old cars. This coverage protects you from financial responsibility in the event that you’re found at fault for an accident that causes bodily injury or property damage to others. It’s important to ensure that your liability coverage limits are adequate to protect your assets in the event of a serious accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is another crucial aspect of old car insurance. This coverage protects you in the event that you’re involved in an accident with a driver who doesn’t have sufficient insurance to cover the damages. Given the potential value of your old car, having this coverage is essential to ensure you’re not left financially vulnerable in such a scenario.

Tips for Optimizing Your Old Car Insurance

Here are some additional tips and strategies to help you get the most out of your old car insurance policy:

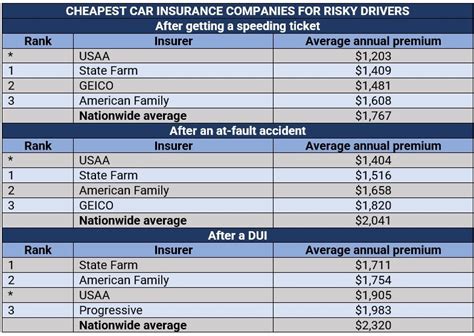

Maintain a Good Driving Record

Insurance providers often offer discounts to drivers with a clean driving record. Maintaining a safe and responsible driving history can not only reduce your insurance premiums but also provide you with a better claim experience should you ever need to file a claim.

Consider Bundling Policies

If you own multiple old cars or have other insurance needs, such as home or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you money on your old car insurance.

Take Advantage of Discounts

Insurance providers often offer various discounts, such as safe driver discounts, loyalty discounts, or even discounts for completing a defensive driving course. Be sure to inquire about these discounts and take advantage of them to reduce your insurance costs.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept that uses technology to track your driving behavior. While this type of insurance may not be suitable for all old car owners, it can provide significant savings for those who drive their classic cars infrequently. By monitoring your mileage and driving habits, usage-based insurance can offer personalized rates based on your actual usage, potentially resulting in lower premiums.

Conclusion: Protecting Your Passion

Insuring an old car is a critical step in protecting your investment and ensuring the longevity of your automotive passion. By understanding the unique challenges and considerations associated with old car insurance, you can make informed decisions to secure the right coverage for your vintage or classic vehicle. Remember, the right insurance policy should provide you with the peace of mind to enjoy your old car without worrying about the financial risks that come with ownership.

Frequently Asked Questions

Can I insure an old car that is not regularly driven or is stored for long periods?

+Yes, many insurance providers offer policies specifically for old cars that are not driven regularly or are stored for extended periods. These policies often have storage or limited-use provisions, ensuring your vehicle is adequately covered even when it’s not in active use.

Are there any discounts available for old car insurance?

+Yes, insurance providers may offer various discounts for old car insurance, such as safe driver discounts, loyalty discounts, or discounts for bundling multiple policies. Additionally, some providers may have specific discounts for classic car clubs or organizations.

Can I insure an old car that is undergoing restoration?

+Yes, it is possible to insure an old car that is in the process of restoration. Many insurance providers offer specialized policies for vehicles in restoration, ensuring they are protected during the restoration process. These policies may have specific coverage limits and conditions, so it’s important to discuss your restoration plans with your insurer.

What happens if my old car is damaged beyond repair or stolen?

+In the event of a total loss or theft, your insurance provider will typically compensate you based on the agreed-upon value of your old car. This value is determined during the appraisal process and is used as the basis for any claims. It’s important to ensure that your agreed-value coverage adequately reflects the true worth of your vehicle.