Car Insurance Get Quote

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the globe. With a myriad of options available, finding the right car insurance policy can be a daunting task. This comprehensive guide aims to demystify the process of getting a car insurance quote, offering valuable insights and expert advice to help you make an informed decision.

Understanding Car Insurance: The Fundamentals

Car insurance is a contract between an individual (the policyholder) and an insurance company. It provides financial coverage for various aspects related to vehicle ownership, including damage to the insured vehicle, liability for injuries or property damage caused to others, and, in some cases, theft or other losses.

The primary goal of car insurance is to safeguard policyholders from the potentially devastating financial consequences of an accident or other vehicle-related incidents. It ensures that policyholders have the necessary funds to repair or replace their vehicles, cover medical expenses, and address legal liabilities.

The cost of car insurance, often referred to as the premium, is determined by several factors, including the make and model of the vehicle, the driver's age and driving record, the coverage limits chosen, and the geographical location. Understanding these factors is crucial when seeking a car insurance quote.

Key Components of Car Insurance

Car insurance policies typically consist of several key components, each providing different types of coverage. These include:

- Liability Coverage: This is the most basic form of car insurance and is often mandatory by law. It covers the policyholder's legal responsibility for bodily injury or property damage caused to others in an accident.

- Collision Coverage: This coverage pays for the repair or replacement of the insured vehicle if it's damaged in an accident, regardless of fault.

- Comprehensive Coverage: This type of insurance covers damages to the insured vehicle that are not caused by collisions, such as theft, vandalism, natural disasters, or collisions with animals.

- Personal Injury Protection (PIP): PIP provides coverage for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder if they're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

The Process of Getting a Car Insurance Quote

Obtaining a car insurance quote is the first step towards securing adequate coverage for your vehicle. The process is straightforward and can be completed online, over the phone, or in person at an insurance agency.

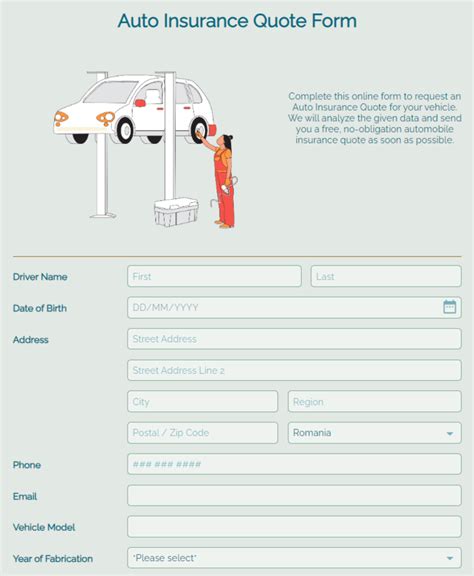

Online Quote Process

Many insurance companies offer the convenience of online quoting, allowing potential customers to obtain a quote quickly and easily. The online process typically involves the following steps:

- Provide Vehicle Information: Start by entering details about your vehicle, including make, model, year, and vehicle identification number (VIN). This information is essential for the insurance company to assess the value and potential risks associated with your vehicle.

- Driver Details: Next, you'll be asked to provide personal information about yourself and any additional drivers on the policy. This includes your age, gender, driving record (including any accidents or traffic violations), and the number of years you've been driving.

- Coverage Selection: At this stage, you'll choose the types and limits of coverage you desire. It's crucial to select coverage that adequately meets your needs, considering factors like the value of your vehicle, your financial situation, and your personal risk tolerance.

- Additional Information: Depending on the insurance company, you may be asked to provide additional details, such as your garage location, annual mileage, or any safety features installed in your vehicle. These factors can influence the accuracy of your quote.

- Review and Purchase: Once you've provided all the necessary information, the insurance company will generate a quote. Review the quote carefully, ensuring that the coverage limits and premium align with your expectations. If you're satisfied, you can proceed with purchasing the policy.

Factors Affecting Car Insurance Quotes

Several factors can influence the cost of your car insurance quote. Understanding these factors can help you make informed decisions and potentially reduce your insurance costs.

- Vehicle Type: The make, model, and year of your vehicle play a significant role in determining your insurance premium. Generally, newer, more expensive vehicles, or those with powerful engines, may have higher insurance costs.

- Driver Profile: Your age, gender, driving record, and years of driving experience are key factors. Younger drivers and those with a history of accidents or traffic violations may face higher insurance costs.

- Coverage Selection: The level of coverage you choose directly impacts your premium. Comprehensive and collision coverage, in particular, can add significantly to your overall insurance cost.

- Location: Where you live and garage your vehicle can affect your insurance premium. Urban areas, for example, often have higher rates due to increased traffic and potential for accidents.

- Claims History: If you've made multiple insurance claims in the past, it can affect your future premiums. Insurance companies view frequent claims as a sign of higher risk, leading to increased costs.

Tips for Reducing Your Car Insurance Quote

While several factors affecting car insurance quotes are beyond your control, there are strategies you can employ to potentially reduce your insurance costs.

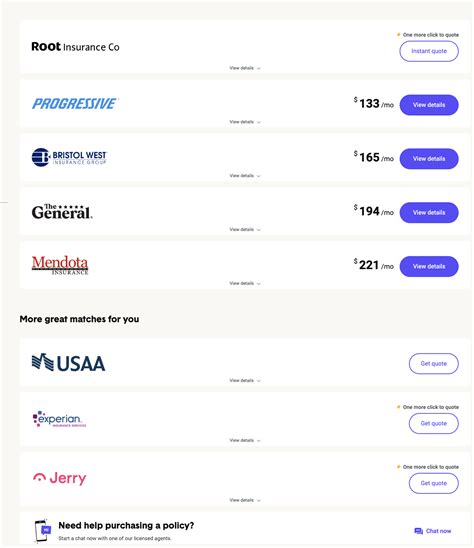

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurance companies to find the best coverage at the most competitive price.

- Increase Your Deductible: A higher deductible (the amount you pay out of pocket before your insurance coverage kicks in) can lead to lower premiums. However, ensure that you can afford the increased deductible in the event of a claim.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents. A clean driving record can result in significant savings on your insurance premium.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, multi-policy discounts, or discounts for vehicles with safety features.

- Consider Bundle Discounts: If you're also shopping for home or other insurance policies, inquire about bundle discounts. Insuring multiple policies with the same company can lead to substantial savings.

Comparing Car Insurance Quotes

When comparing car insurance quotes, it’s crucial to look beyond just the premium. Different insurance companies may offer different coverage options and additional benefits. Here’s what to consider when comparing quotes:

- Coverage Limits: Ensure that the quotes you're comparing offer the same coverage limits. Compare liability limits, collision and comprehensive coverage limits, and any additional coverages you require.

- Deductibles: Compare the deductibles associated with each quote. A lower deductible may be more appealing, but it often comes with a higher premium.

- Additional Benefits: Some insurance companies offer additional benefits or perks, such as roadside assistance, rental car coverage, or accident forgiveness. These benefits can add value to your policy and should be considered when comparing quotes.

- Customer Service and Claims Handling: Research the insurance company's reputation for customer service and claims handling. You want to ensure that the company you choose provides prompt and efficient service when you need it most.

- Financial Stability: Check the financial stability ratings of the insurance companies you're considering. A financially stable company is more likely to be able to pay out claims in the event of an accident.

Using a Broker or Agent

If you prefer personalized assistance when obtaining a car insurance quote, consider working with an insurance broker or agent. These professionals can guide you through the process, explain the intricacies of different policies, and help you find the best coverage for your needs.

Making an Informed Decision

Obtaining a car insurance quote is just the first step. To make an informed decision, consider the following steps:

- Understand Your Needs: Assess your specific insurance needs. Consider the value of your vehicle, your financial situation, and any unique circumstances that may impact your insurance requirements.

- Research and Compare: Research and compare multiple quotes from different insurance companies. Use online tools, speak to brokers or agents, and read reviews to gain a comprehensive understanding of the options available.

- Ask Questions: Don't hesitate to ask questions about the policy, coverage limits, deductibles, and any additional benefits or exclusions. Clarifying these details will ensure you fully understand what you're purchasing.

- Read the Fine Print: Before finalizing your decision, carefully read the policy documents. Pay attention to the coverage limits, exclusions, and any conditions that may impact your coverage.

- Consider Long-Term Savings: While a lower premium may be appealing, consider the long-term savings and benefits. Some policies may offer better value over time, especially if they provide comprehensive coverage and additional benefits.

Conclusion

Getting a car insurance quote is an essential step towards ensuring you have the right coverage for your vehicle. By understanding the fundamentals of car insurance, the quoting process, and the factors that influence your premium, you can make an informed decision that meets your needs and budget.

Remember, car insurance is a crucial investment that provides financial protection and peace of mind. Take the time to research, compare, and ask questions to ensure you're getting the best coverage at the most competitive price.

FAQs

How often should I review my car insurance policy and quotes?

+

It’s recommended to review your car insurance policy and quotes annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for your insurance.

What happens if I don’t have car insurance and get into an accident?

+

In most states, driving without insurance is illegal and can result in fines, license suspension, or other penalties. If you’re at fault in an accident without insurance, you’ll be responsible for paying for all damages and injuries out of pocket.

Can I switch car insurance companies after getting a quote?

+

Absolutely! You’re not obligated to stay with the insurance company that provided your initial quote. Shop around and compare quotes from multiple companies to find the best coverage and price.

What documents do I need to provide when applying for car insurance?

+

Typically, you’ll need to provide proof of identification, such as a driver’s license, as well as your vehicle’s registration and proof of ownership. Additional documents may be required depending on your specific circumstances and the insurance company’s requirements.

Can I customize my car insurance policy to fit my needs?

+

Yes, car insurance policies are highly customizable. You can choose the types and limits of coverage you desire, as well as any additional endorsements or riders to meet your specific needs.