Car Insurance How Much Per Month

Car insurance is an essential financial protection for vehicle owners, offering coverage for various risks and liabilities associated with driving. The cost of car insurance can vary significantly based on numerous factors, making it challenging to provide an exact monthly estimate without considering individual circumstances. However, understanding the key determinants of car insurance rates can help provide a more accurate picture of the financial commitment involved.

Understanding Car Insurance Costs

The price of car insurance is influenced by a multitude of variables, including personal factors, vehicle details, and coverage preferences. Here’s a breakdown of the primary elements that impact the cost of car insurance:

Personal Factors

- Age and Gender: Younger drivers, particularly males, often face higher insurance premiums due to statistical risk factors. However, discounts may be available for experienced drivers and those with a clean driving record.

- Driving History: Insurers consider the number of accidents, claims, and violations on your record. A clean driving history can lead to significant savings.

- Credit Score: In many states, insurers use credit-based insurance scores to assess risk. Maintaining a good credit score can positively impact your insurance rates.

- Marital Status: Married individuals may receive lower rates, as insurers view them as more responsible drivers.

Vehicle Details

- Make and Model: The type of car you drive can impact insurance costs. High-performance vehicles and luxury cars often require more expensive coverage.

- Age of Vehicle: Older cars may have lower insurance premiums, as they generally have a lower replacement cost.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for insurance discounts.

Coverage Preferences

- Coverage Levels: The level of coverage you choose, including liability, collision, comprehensive, and optional add-ons, will impact your monthly premium.

- Deductibles: Opting for a higher deductible can reduce your monthly payments but means you’ll pay more out of pocket if you make a claim.

- Additional Coverages: Endorsements like rental car coverage, roadside assistance, and gap insurance can increase your monthly premium.

| Coverage Type | Description |

|---|---|

| Liability | Covers costs if you're at fault in an accident, including bodily injury and property damage. |

| Collision | Pays for repairs or replacement if your vehicle is damaged in an accident, regardless of fault. |

| Comprehensive | Covers non-accident-related incidents like theft, vandalism, and natural disasters. |

Location and Usage

The area where you live and how you use your vehicle can also affect insurance costs. Here’s how:

- Location: Urban areas with higher population density and traffic often have higher insurance rates due to increased accident risk.

- Usage: If you primarily use your car for commuting or business purposes, your insurance rates may be higher compared to those who drive less frequently.

Sample Monthly Premiums

To provide a more tangible understanding of car insurance costs, here are some sample monthly premiums based on different scenarios. Please note that these are estimates and actual rates may vary based on individual circumstances.

Young Driver with a New Car

A 22-year-old male with a clean driving record who recently purchased a new sports car might expect to pay around 250 to 300 per month for basic liability coverage. Adding collision and comprehensive coverage could increase the premium to 350 to 400 per month.

Experienced Driver with an Older Vehicle

A 40-year-old female with a long-standing clean driving record and an older sedan might pay approximately 150 to 200 per month for liability coverage. With collision and comprehensive coverage, the monthly premium could be 200 to 250.

Family with Multiple Vehicles

A family with two vehicles, a 35-year-old father with a clean record and a 32-year-old mother with one minor violation, might expect to pay 200 to 250 per month for each vehicle with liability coverage. Including collision and comprehensive coverage could increase the premium to 250 to 300 per vehicle per month.

Tips for Reducing Car Insurance Costs

While car insurance is a necessary expense, there are strategies to potentially reduce your monthly premiums. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurers to find the best rates for your situation.

- Increase Deductibles: Opting for a higher deductible can lower your monthly payments, but be prepared to pay more if you make a claim.

- Bundle Policies: Insuring multiple vehicles or combining car insurance with other policies, like homeowners or renters insurance, can lead to discounts.

- Review Coverage: Regularly review your coverage limits and adjust them based on your changing needs and financial situation.

- Safe Driving: Maintain a clean driving record to qualify for safe driver discounts.

- Consider Usage: If you drive less frequently, you may be eligible for low-mileage or usage-based insurance discounts.

The Future of Car Insurance

The car insurance industry is evolving, and new technologies and trends are shaping the future of coverage. Here’s a glimpse into some potential developments:

- Telematics and Usage-Based Insurance: Insurers are increasingly using telematics devices and smartphone apps to monitor driving behavior and offer personalized insurance rates based on actual usage and driving habits.

- Autonomous Vehicles: As self-driving cars become more prevalent, insurance coverage may shift to focus on the vehicle’s manufacturer or operator rather than individual drivers.

- Digital Insurance Platforms: Online and mobile insurance platforms are making it easier for consumers to compare policies, file claims, and manage their insurance needs, potentially reducing administrative costs and passing on savings to customers.

Conclusion

Car insurance is a vital financial safeguard for vehicle owners, providing protection against various risks associated with driving. While the cost of car insurance can vary significantly based on individual circumstances, understanding the key factors that influence rates can help you make more informed decisions and potentially reduce your monthly premiums. By comparing quotes, reviewing coverage regularly, and adopting safe driving practices, you can ensure you have the right coverage at a competitive price.

How often should I review my car insurance policy?

+It’s a good practice to review your policy annually or whenever your circumstances change significantly, such as buying a new car, getting married, or moving to a new location.

Can I get car insurance without a license?

+In most cases, you need a valid driver’s license to obtain car insurance. However, some insurers may offer limited coverage for vehicles owned by individuals without a license, such as for leisure or collector vehicles.

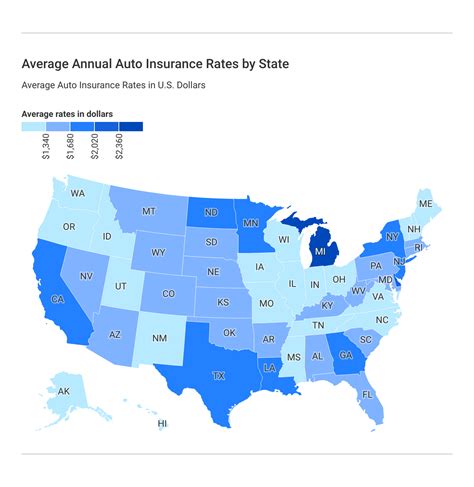

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the US varies by state and can range from around 500 to 1,500 per year, or 42 to 125 per month. However, actual rates can be significantly higher or lower based on individual circumstances.