Car Insurance In Usa

Car insurance is a vital aspect of vehicle ownership in the United States, providing financial protection and peace of mind to millions of drivers. With a vast network of roads and a diverse range of vehicles, the US insurance landscape is intricate and varies across states. Understanding the nuances of car insurance is crucial for both new and experienced drivers, as it ensures compliance with legal requirements and offers protection against unforeseen circumstances. This comprehensive guide delves into the world of car insurance in the USA, exploring its key components, coverage options, and the factors that influence premiums.

Understanding Car Insurance Basics

Car insurance in the USA serves as a contractual agreement between an individual (the policyholder) and an insurance provider. This contract, known as an insurance policy, outlines the terms and conditions under which the insurance company agrees to provide financial coverage for specific incidents involving the insured vehicle. The primary purpose of car insurance is to protect drivers and vehicle owners from the financial burden of accidents, theft, or other vehicle-related damages.

Key Coverage Components

Car insurance policies typically consist of several key components, each providing coverage for different scenarios. These components include:

- Liability Coverage: This is the most fundamental aspect of car insurance, covering the policyholder’s legal responsibility for bodily injury or property damage to others caused by the insured vehicle.

- Collision Coverage: This optional coverage pays for damage to the insured vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance protects against damage caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals.

- Medical Payments Coverage: This coverage pays for the medical expenses of the policyholder and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This optional coverage protects the policyholder in case of an accident with a driver who has no insurance or insufficient insurance.

Each of these coverage types can be tailored to the policyholder's needs, with different limits and deductibles, allowing for a customized insurance plan.

Factors Influencing Car Insurance Premiums

The cost of car insurance, known as the premium, can vary significantly depending on several factors. Understanding these factors can help drivers make informed decisions when choosing an insurance policy.

Vehicle Type and Usage

The type of vehicle being insured plays a crucial role in determining premiums. Generally, sports cars, high-performance vehicles, and luxury cars tend to have higher insurance costs due to their higher repair and replacement costs. Additionally, the vehicle’s usage, such as personal or commercial use, and the average annual mileage can also impact premiums.

| Vehicle Type | Average Annual Premium |

|---|---|

| Economy Car | $800 - $1,200 |

| Mid-size Sedan | $1,000 - $1,500 |

| SUV | $1,200 - $1,800 |

| Luxury Car | $1,800 - $3,000 |

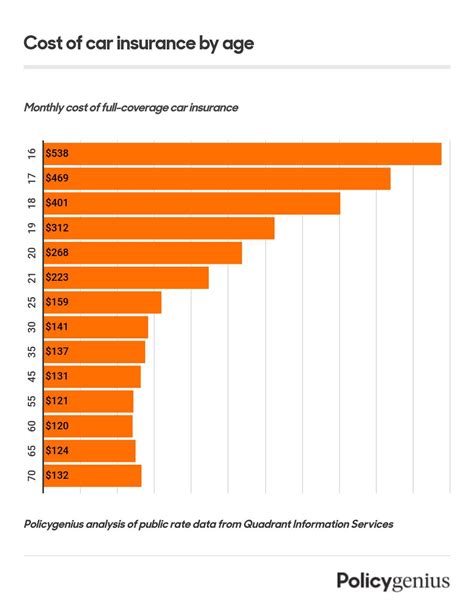

Driver’s Profile

The driver’s profile is a significant factor in insurance premium calculations. Factors such as age, gender, driving record, and credit score can all influence the cost of insurance. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of traffic violations or accidents may also see increased premiums.

| Driver Age | Average Annual Premium |

|---|---|

| 16-20 years | $2,500 - $4,000 |

| 21-25 years | $1,800 - $2,800 |

| 26-35 years | $1,200 - $1,800 |

| 36+ years | $1,000 - $1,500 |

Location and Driving Conditions

The geographic location of the policyholder can significantly impact insurance premiums. Areas with high population density, busy roads, and a higher incidence of accidents or theft may have higher insurance costs. Additionally, factors such as weather conditions, traffic congestion, and local laws can also influence premiums.

| State | Average Annual Premium |

|---|---|

| California | $1,500 - $2,000 |

| New York | $1,800 - $2,500 |

| Texas | $1,200 - $1,600 |

| Florida | $1,600 - $2,200 |

Coverage Options and Deductibles

The level of coverage and the chosen deductibles can greatly affect the cost of insurance. Higher coverage limits and lower deductibles typically result in higher premiums, as the insurance company assumes more financial responsibility. Conversely, opting for lower coverage limits and higher deductibles can reduce premiums, but it’s important to strike a balance between cost and adequate protection.

Tips for Choosing the Right Car Insurance

Selecting the appropriate car insurance policy can be a complex decision, but there are several strategies to help drivers make an informed choice.

Compare Quotes

Obtaining quotes from multiple insurance providers is essential to finding the best coverage at the most competitive price. Online comparison tools and direct quotes from insurance companies can provide a comprehensive view of the market.

Understand Coverage Needs

Assessing individual needs is crucial. Consider the vehicle’s value, the driver’s profile, and the potential risks associated with the location and usage. This assessment will help determine the appropriate coverage limits and deductibles.

Explore Discounts

Insurance companies often offer discounts to policyholders. Common discounts include safe driving discounts, multi-policy discounts (for bundling car insurance with other policies), and loyalty discounts for long-term customers. Additionally, some companies offer discounts for vehicle safety features or membership in certain organizations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that bases premiums on actual driving behavior. This type of insurance can be advantageous for drivers with safe driving records or those who drive infrequently.

Future Trends in Car Insurance

The car insurance industry is evolving, and several trends are shaping its future. The increasing adoption of advanced vehicle technologies, such as autonomous driving features and connected car systems, is expected to influence insurance coverage and premiums. Additionally, the rise of electric vehicles (EVs) and the potential for shared mobility solutions may also impact insurance needs and costs.

The Impact of Autonomous Vehicles

As autonomous vehicles become more prevalent, the liability landscape may shift. Insurance coverage may need to adapt to address the unique risks associated with self-driving cars, including potential cyber risks and system failures.

The Rise of Telematics

Telematics, the technology behind usage-based insurance, is expected to play an even more significant role in the future. Advanced telematics systems can provide real-time data on driving behavior, allowing insurance companies to offer more personalized and accurate coverage.

Data-Driven Insurance

With the increasing availability of data, insurance companies are leveraging advanced analytics to improve risk assessment and pricing. This data-driven approach can lead to more accurate premiums and tailored coverage options.

Conclusion

Car insurance in the USA is a complex but essential aspect of vehicle ownership. Understanding the key coverage components, the factors influencing premiums, and the evolving trends in the industry can empower drivers to make informed decisions about their insurance coverage. By staying informed and exploring various options, drivers can find the right balance between cost and protection, ensuring a safe and secure driving experience.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever you experience significant life changes, such as moving to a new state, purchasing a new vehicle, or getting married. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I switch car insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but be aware of potential cancellation fees or penalties. It’s important to understand the terms of your current policy before making a change.

What should I do if I’m involved in an accident?

+In the event of an accident, remain calm and ensure the safety of all involved. Contact the police to file a report, exchange information with the other party, and notify your insurance company as soon as possible. Following these steps can help ensure a smooth claims process.